Key Highlights

U.S. equities pulled back during the week ended December 12, with weakness concentrated in large-cap technology even as the Dow and small caps posted gains.

Market leadership rotated beneath the surface, as domestically oriented and value-sensitive stocks outperformed headline indices.

Treasury yields remained volatile near the mid-4 percent range, continuing to pressure long-duration assets and growth equities.

Economic data sent mixed signals, with historically low jobless claims contrasting sharply with softer payroll estimates and rising layoff announcements.

Investor focus has shifted decisively to the Federal Reserve, with policy guidance expected to determine whether year-end volatility persists or stabilizes.

Markets Step Back From Record Territory

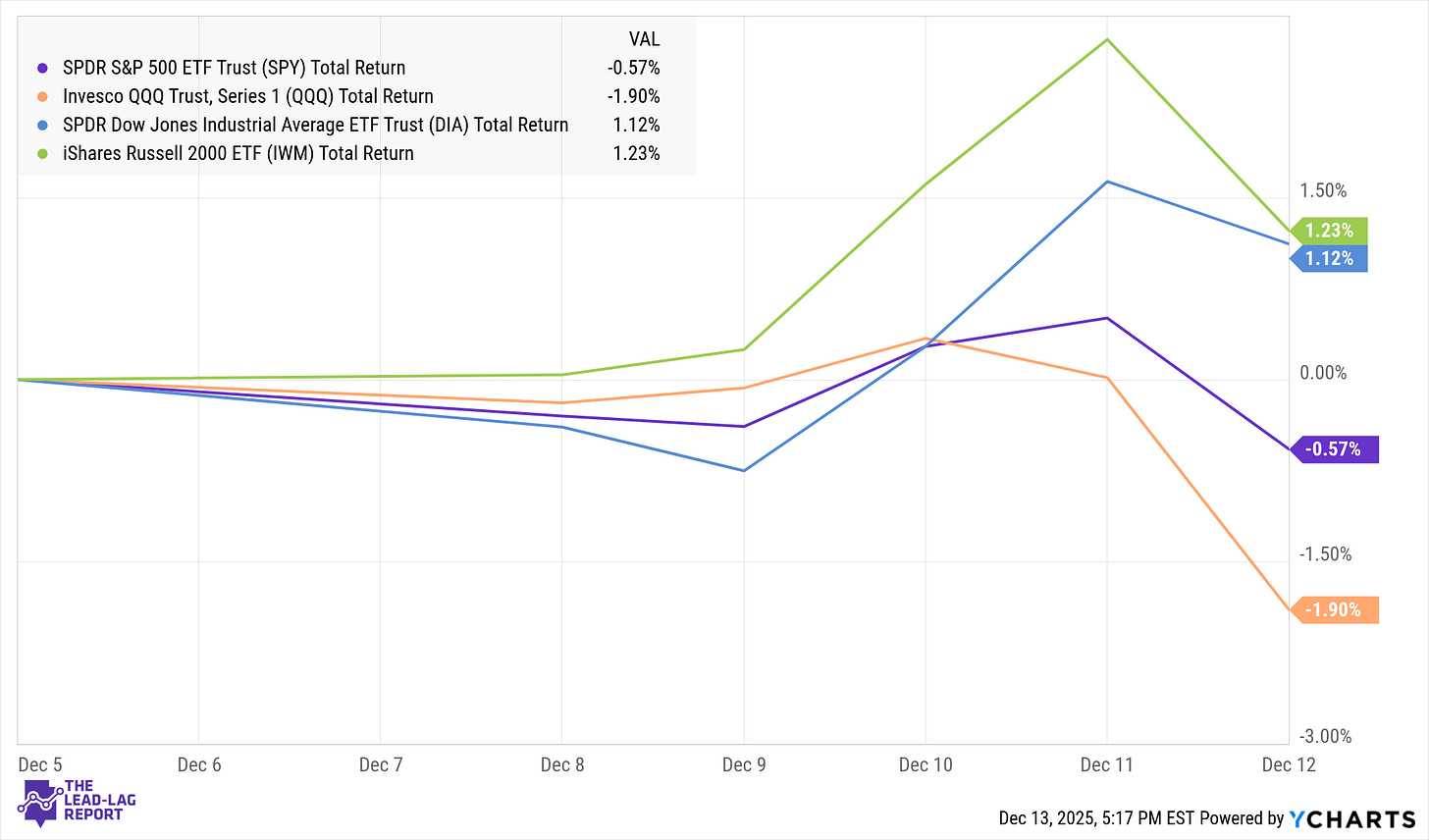

U.S. equities pulled back during the week ended December 12 as investors reassessed risk heading into the Federal Reserve’s final policy meeting of the year. After flirting with record highs earlier in the month, markets lost momentum amid renewed concerns around inflation persistence, stretched technology valuations, and uncertainty over the Fed’s path into 2026. For the week, the S&P 500 declined roughly 0.6 percent, while the Nasdaq Composite fell about 1.6 percent, weighed down by weakness in large-cap technology and AI-linked names.¹ In contrast, the Dow Jones Industrial Average gained over 1 percent, reflecting rotation toward more defensive and value-oriented components of the index. The tone shifted from cautious optimism to selective risk reduction, with investors less willing to chase year-end upside without clearer policy guidance.

Rotation Beneath the Surface

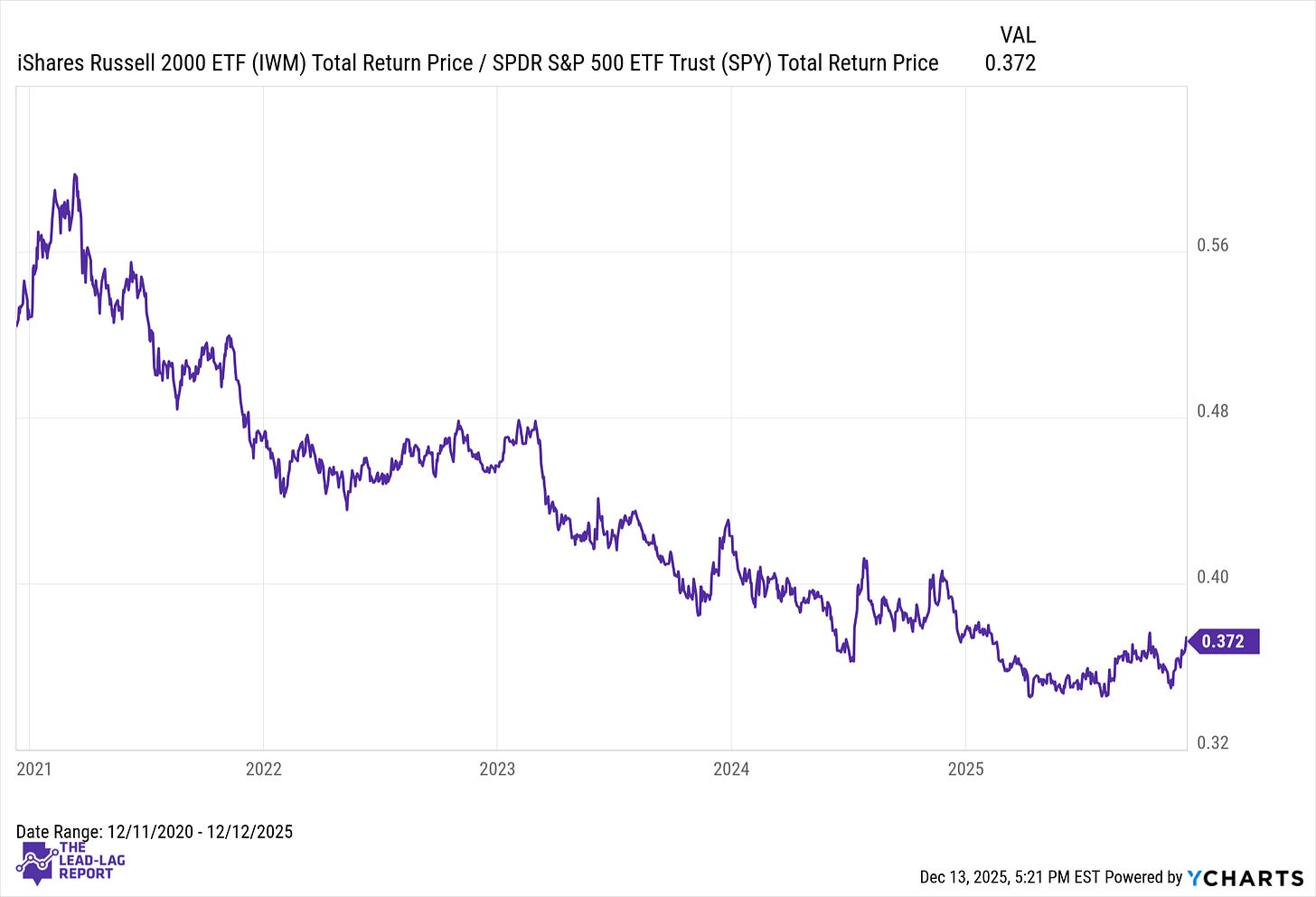

Equity leadership underscored that rotation. Smaller, more domestically oriented stocks outperformed, with the Russell 2000 rising approximately 1.2 percent on the week, extending its recent rebound as investors leaned into the prospect of easier financial conditions ahead.² Market breadth held up better than headline indices suggested, as gains in industrials, financials, and select cyclicals offset pronounced weakness in technology. The divergence highlighted a market that remains active beneath the surface, even as major benchmarks stalled.

Bonds and Volatility Reassert Influence

In fixed income, Treasury yields were volatile but ended the week modestly higher, reflecting lingering uncertainty about the timing and magnitude of policy easing. The 10-year Treasury yield moved back toward the mid‑4 percent range, keeping pressure on long-duration assets and growth equities.³ The U.S. dollar firmed slightly alongside yields, while equity volatility picked up into Friday’s selloff, a reminder that complacency remains fragile ahead of major policy events.

Mixed Data Complicates the Economic Picture

Economic data released during the week offered few clear answers but reinforced the perception that growth is slowing without collapsing. Weekly jobless claims fell sharply to their lowest level in more than three years, a signal of ongoing labor market resilience.⁵ At the same time, private payroll estimates from ADP surprised to the downside, marking the largest decline in over two years and highlighting growing divergence across employment indicators.⁶ Announcements of corporate layoffs continued to mount, with Challenger data showing a substantial year‑to‑date increase compared with last year, even as claims data suggested limited near‑term stress.⁷