Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: EQUITY BULL IS GETTING DANGEROUSLY NARROW

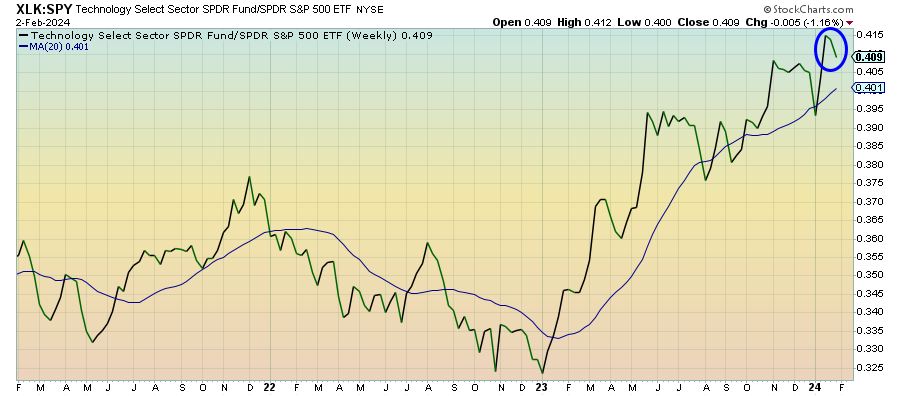

Technology (XLK) – Too Far, Too Fast

The tech rally has taken a pause as investors reconsider cyclicals on the heels of last week’s jobs report. The series of tech sector layoff announcements probably doesn’t impact stocks in the near-term and may even give them a boost as cost cutting is generally viewed positively. Over the long-term, this could be a sign that the sector has tried to grow too far, too fast and now needs to unwind a bit.

Communication Services (XLC) – Cracks In The Dam

This sector got a solid bounce from Facebook’s big earnings and buyback announcement, but in reality, communication stocks have been picking up steam for a few weeks. Unfortunately, it’s still the two magnificent 7 names at the top of the portfolio that are doing all of the heavy lifting. The equal weight version of this sector has been steadily underperforming the S&P 500 for about a year and Alphabet’s questionable earnings report means there are some cracks in the dam.

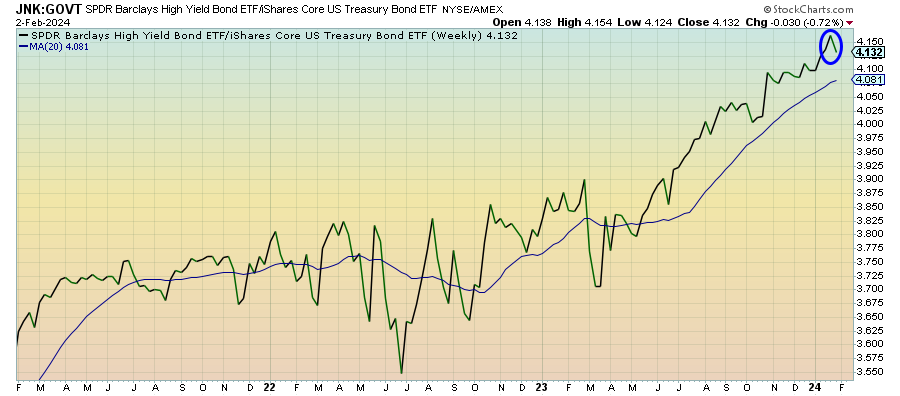

Junk Debt (JNK) – Victim Of Higher For Longer

Junk bonds finally took a step back of their own last week in another rate-driven narrative. If the Fed does remain hawkish on policy longer than the market expects, it’s lower-grade debt that will disproportionately feel the impact. Higher rates are the bane of junk bonds because it makes it less likely the issuer of questionable financial health will be able to pony up when needed.

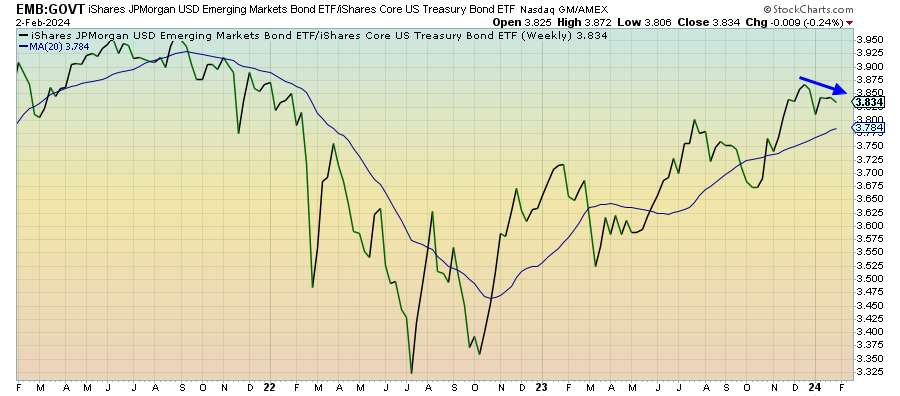

Emerging Markets Debt (EMB) – Potential Is There Even If Performance Isn’t

Emerging markets bonds have lost a lot of their momentum following an extended period that rewarded lower-rated debt. With U.S. Treasuries failing to make a sustainable rally since last year, EM debt’s lagging performance is a sign that investors are passing on fixed income, in general, at the moment in favor of riskier equities. I still think there’s still a fair amount of potential in this group.

Lumber (LUMBER) – Is Housing Optimism Misplaced?