Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: THE MARKET READIES ITSELF FOR TRUMP’S LIBERATION DAY

Communication Services (XLC) – Benefiting From Tariff Volatility

Even as growth and high beta stocks continue to struggle, this tech-adjacent sector has been steadily outperforming. Alphabet has been an anchor for this sector’s performance, but Facebook has actually held up well and the telecom/media segment of the fund continues to lead on the way higher. Tariff volatility has been a major story in Q1 and it’s likely going to keep helping this group outperform.

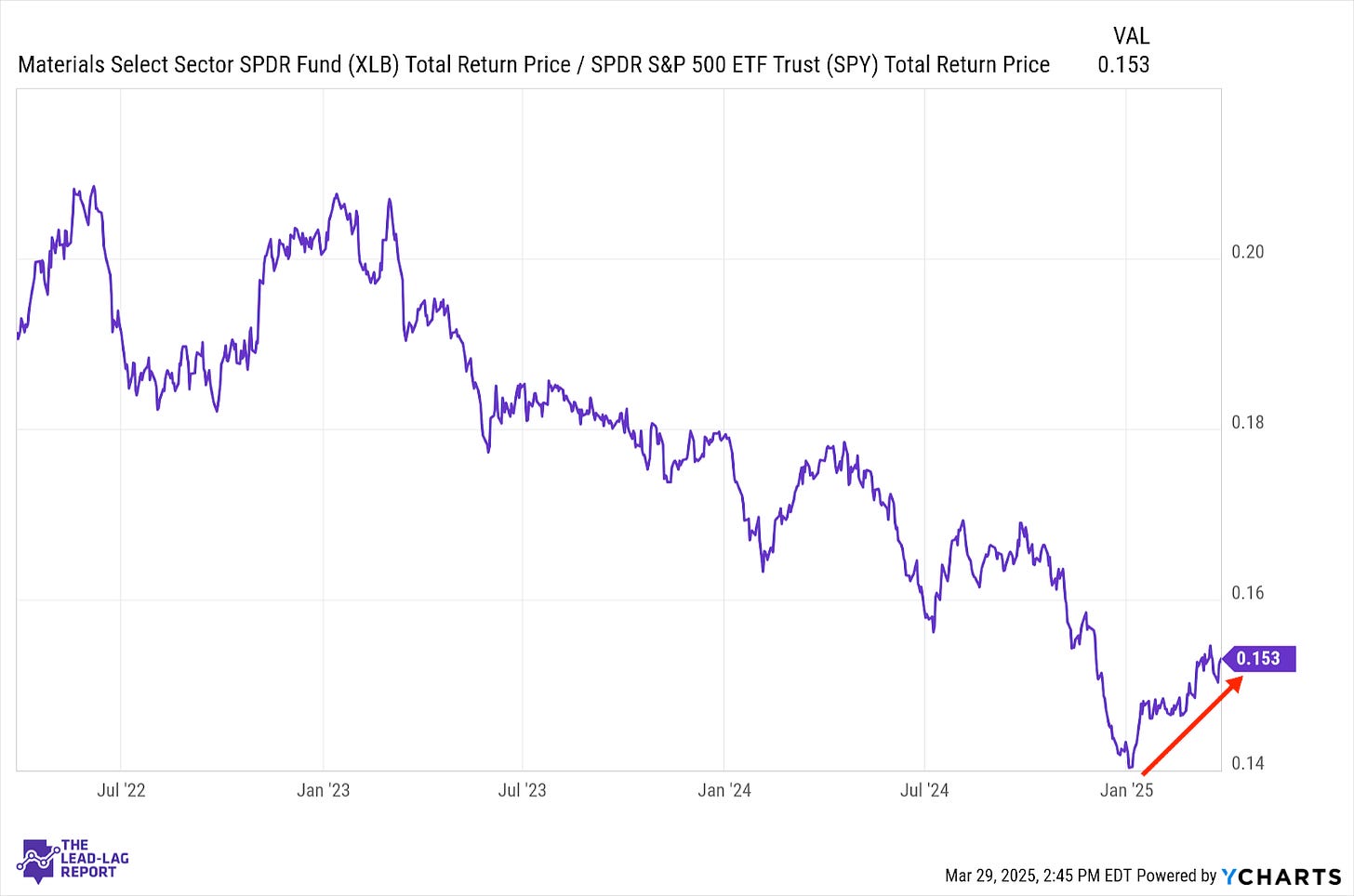

Materials (XLB) – Volatile Road Ahead

The materials sector is still one of the better performers of Q1, although it’s possible we see a more volatile road ahead. Trump’s trade war escalation this week (and the potential for the reciprocal tariffs that could come with them) may further dampen the economic outlook. While cyclicals have been among the best performers this year, the possibility of a rapidly slowing economy could eventually take a toll.

Industrials (XLI) – Time To Jump Ship?

After months of wild swings, industrials have finally calmed a bit. I believe it might only be temporary though. Tariffs have almost universally resulted in additional volatility and downside for equities. If this week’s “liberation day” tariffs come in aggressive, as expected, investors may begin to jump ship on cyclicals if they feel a steeper economic slowdown is imminent.

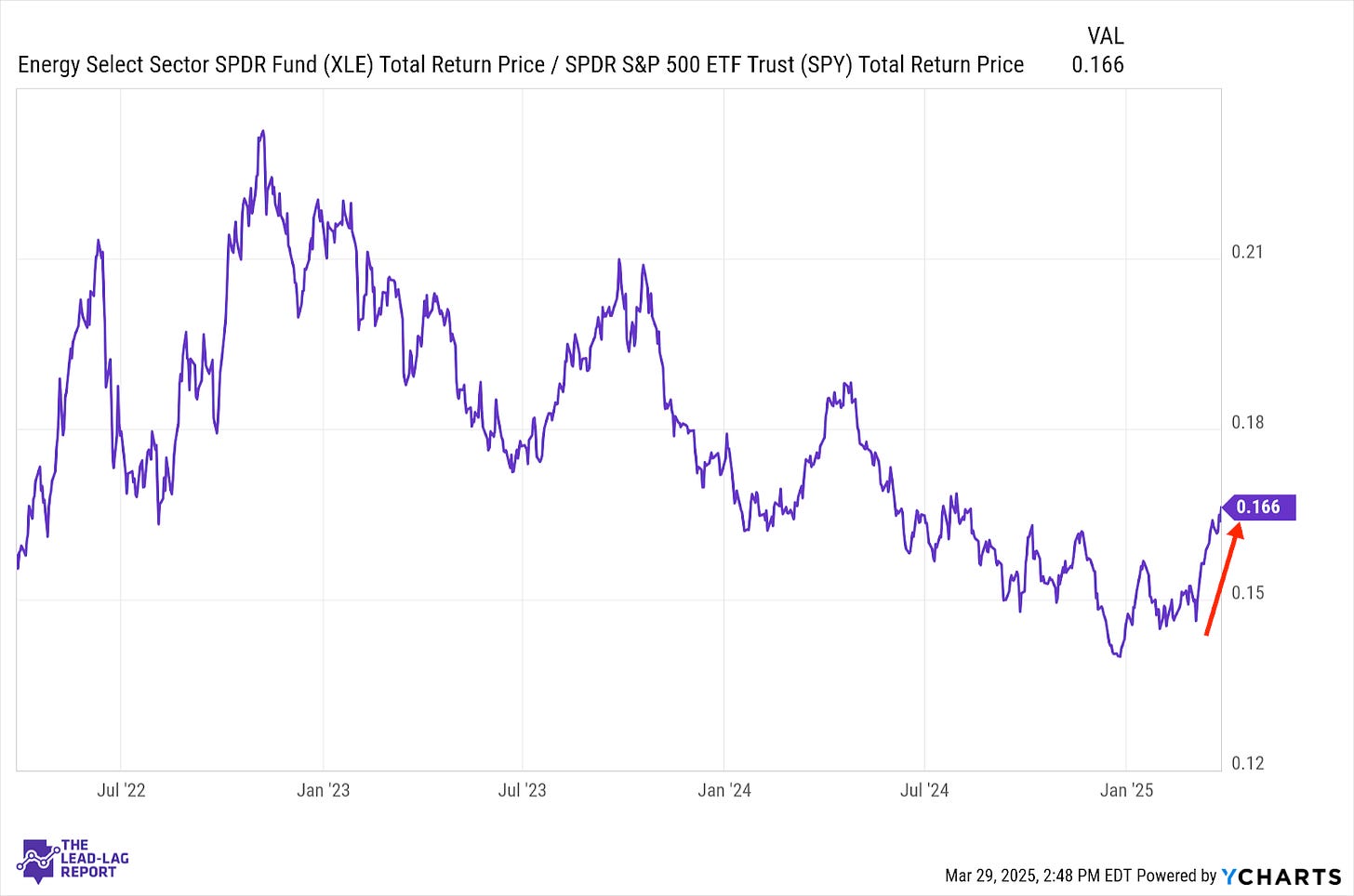

Energy (XLE) – Shrinking Supplies vs. Lower Demand

Geopolitics and potential supply constraints are dominating the discussion in the energy space. Tariffs and potential sanctions have pushed crude oil prices to their highest level since mid-February. Taken in conjunction with the hyper-rally in natural gas and it becomes clearer why this sector has done well recently. The larger, longer-term question becomes how will the potential supply shortage balance with the potential demand shrinkage.

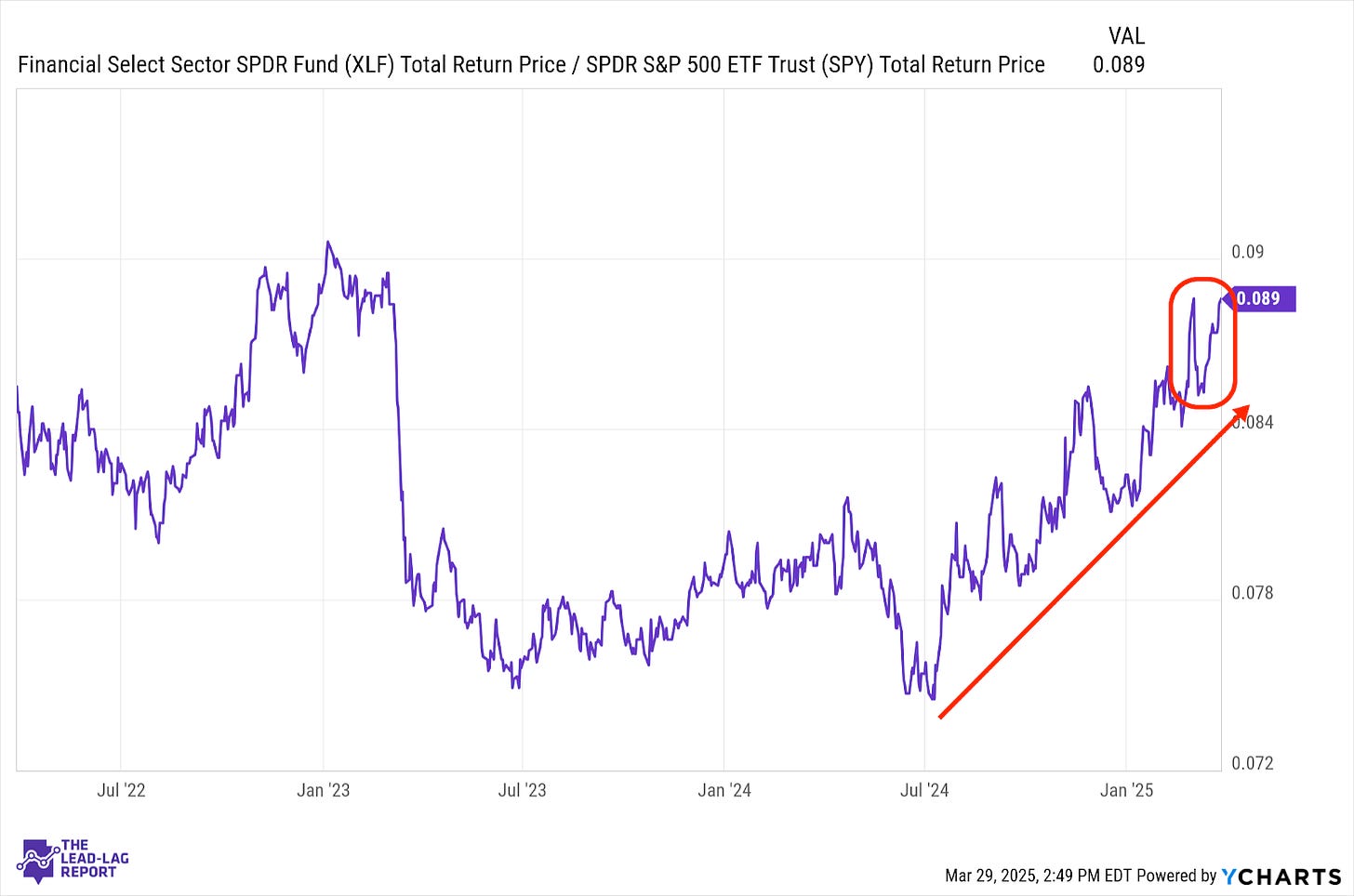

Financials (XLF) – Deregulation Tailwind

The 9-month uptrend in financial stocks relative to the S&P 500 looks to be back on track, nearly wiping out all of the underperformance from the regional bank shock in 2023. The Senate’s recent vote to remove the $5 cap on overdraft fees (along with other recent rollbacks to consumer protections) is another example of how the deregulation theme will likely continue benefiting this sector in the 2nd Trump era.

Utilities (XLU) – Choppy, But Still In Control

Defensive equities have had a choppy few weeks, but utilities are still outperforming the S&P 500. We’ve seen similar behavior from other traditionally defensive sectors & themes, but I still believe that risk-off is firmly in control here. The market clearly thinks that the anticipated Trump tariff announcements will be negative for stocks and the economy, which is why this sector still feels like a good bet.

Consumer Staples (XLP) – A Sharp Comeback