Deregulation in Action: Real-World Case Studies of FMKT Holdings

Key Highlights

Regulatory shifts can materially alter competitive dynamics, creating opportunities for companies believed to benefit from reduced compliance burdens, faster approvals, or clearer operating frameworks.

Financial institutions such as Citizens Financial Group illustrate how targeted regulatory relief can free capital, lower costs, and support expansion without undermining systemic stability.

Energy and industrial firms like Peabody Energy show how policy recalibration can generate cyclical upside even in industries facing long-term structural debate.

Innovation-driven sectors, including biotechnology and advanced transportation, demonstrate that regulatory flexibility and modernization can accelerate commercialization and unlock entirely new markets.

By investing across multiple sectors influenced by regulatory change, FMKT seeks to capture deregulation-driven tailwinds while diversifying the risks associated with unpredictable policy cycles.

When Washington loosens the rules, the effects can ripple quickly through entire industries. A single regulatory shift can save companies millions in compliance costs, accelerate product development, or open markets that were previously constrained by bureaucracy. These changes are not theoretical. They have shaped real corporate outcomes over the past decade, particularly in sectors where regulation plays an outsized role.

The Free Markets ETF (FMKT) is built around this premise. Rather than making broad macro bets, the strategy focuses on companies that stand to benefit when regulatory burdens ease. By investing across industries such as financial services, energy, healthcare, and transportation, the fund seeks to capture opportunities created when policy shifts alter the competitive landscape. The following case studies highlight how deregulation has already influenced several FMKT holdings, offering a practical view of how regulatory change can translate into business momentum.

Banking on Regulatory Relief: Citizens Financial Group

For years after the global financial crisis, mid-sized regional banks were regulated much like the largest Wall Street institutions. Citizens Financial Group, with assets exceeding $200 billion, was subject to extensive stress testing, capital requirements, and compliance obligations designed for systemically important banks. While these safeguards strengthened the financial system, they also imposed significant costs on banks that were not engaged in the complex risk-taking associated with global investment firms.

That dynamic shifted in 2018, when Congress passed the Economic Growth, Regulatory Relief, and Consumer Protection Act. The legislation raised the threshold for enhanced regulatory oversight from $50 billion to $250 billion in assets, effectively easing the burden on many regional banks. Citizens was no longer required to conduct annual Federal Reserve stress tests or maintain the same level of regulatory reporting. The result was immediate relief from compliance expenses and greater operational flexibility.¹

Freed from some of these constraints, Citizens was able to focus more aggressively on growth initiatives, including branch expansion and acquisitions. Industry observers noted that regulatory relief contributed to renewed consolidation among regional banks, as institutions found it easier to deploy capital and pursue strategic opportunities.¹ For investors, Citizens became a clear example of how regulatory recalibration can improve efficiency without fundamentally altering a company’s business model.

The experience also underscores a broader point. Deregulation does not necessarily mean abandoning oversight. Instead, it can involve tailoring rules more appropriately to the scale and risk profile of institutions, allowing well-run firms to compete and grow without excessive friction.

Energy Policy Shifts and Peabody Energy

Few industries are as sensitive to regulation as energy. Environmental standards, permitting processes, and emissions rules directly influence production costs and long-term viability. Peabody Energy, the largest coal producer in the United States, has operated at the center of this tension for more than a decade.

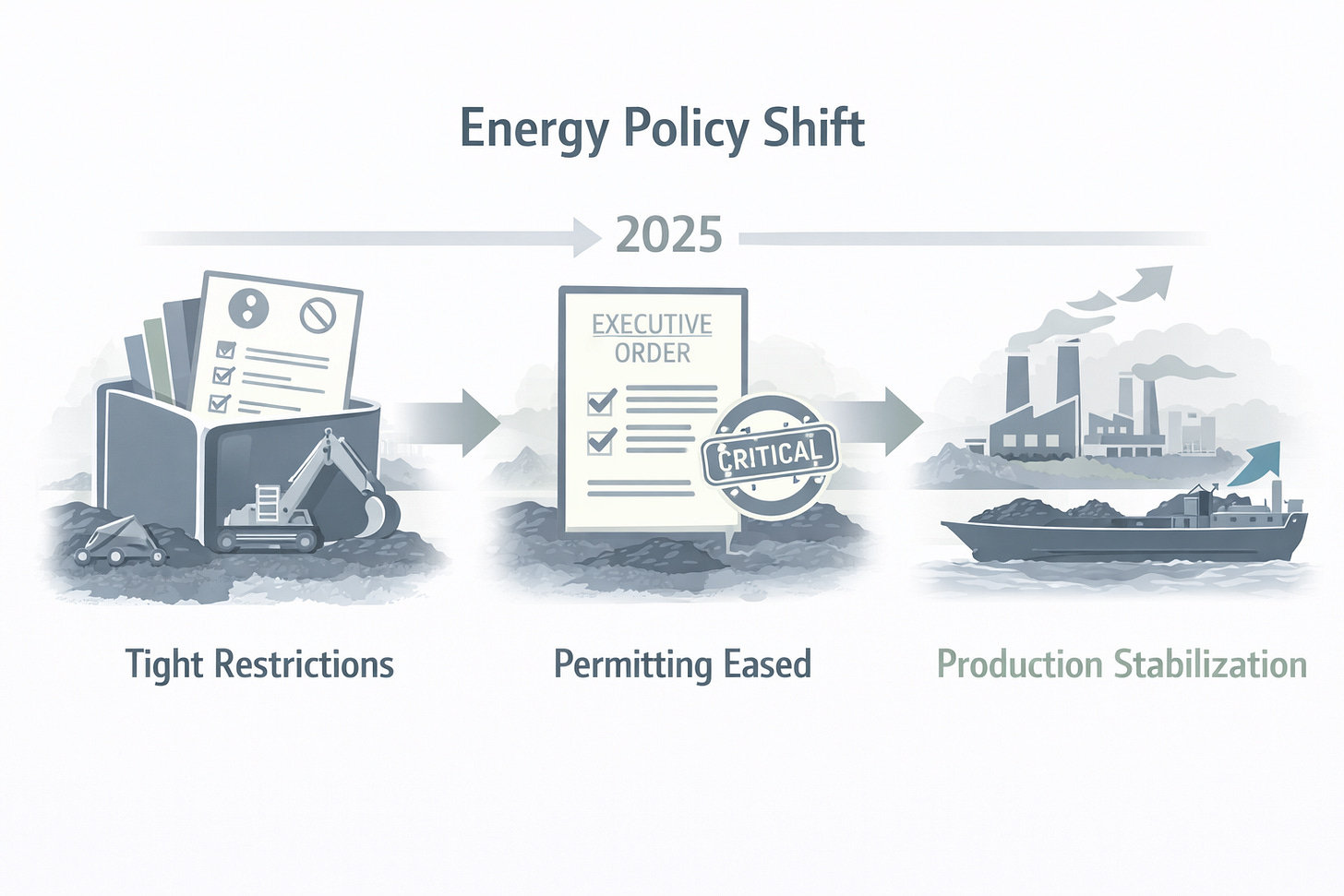

During the 2010s, increasingly strict environmental regulations accelerated the retirement of coal-fired power plants and reduced domestic demand. Many investors viewed coal as a structurally declining industry. That narrative shifted in early 2025, when federal policymakers moved to ease certain restrictions and emphasized energy security. An executive order designated coal, particularly metallurgical coal used in steelmaking, as a critical resource and fast-tracked federal permitting for mining operations.²

These changes did not reverse long-term trends overnight, but they did create a near-term inflection point. Utilities delayed some plant closures, domestic production stabilized, and coal exports increased. Peabody, with a portfolio of low-cost mines, was positioned to benefit from the improved policy environment. The company cited stronger demand and improved visibility for its U.S. operations as regulatory headwinds eased.³

The Peabody example illustrates how deregulation can create cyclical opportunities even in industries facing secular challenges. While coal’s long-term outlook remains debated, regulatory relief altered the short-to-medium-term economics enough to matter for investors willing to recognize the shift.

Streamlining Drug Approvals: Biogen and Regulatory Flexibility

Healthcare regulation is designed to protect patients, but it can also slow innovation. Over the past decade, the Food and Drug Administration has experimented with mechanisms to accelerate access to therapies for serious diseases. One of the most prominent examples was Biogen’s Alzheimer’s drug Aduhelm.

In 2021, the FDA granted Aduhelm accelerated approval, allowing the drug to reach the market based on its effect on a surrogate biomarker rather than definitive clinical outcomes. The agency argued that the pathway could bring treatments to patients sooner while encouraging further research.⁴ For Biogen, this regulatory flexibility significantly shortened the timeline from development to commercialization.

The approval initially sparked optimism among investors, as Alzheimer’s represents one of the largest unmet needs in medicine. However, controversy followed. Questions about clinical efficacy led Medicare to limit coverage, sharply reducing the drug’s commercial uptake.⁵ While Aduhelm ultimately fell short of expectations, the episode highlighted both the opportunity and risk inherent in regulatory flexibility.

The broader takeaway is not limited to one drug. Accelerated approval pathways remain an important tool for biotech companies pursuing treatments in complex disease areas. Biogen later secured approval for a follow-on Alzheimer’s therapy with clearer data, reinforcing the idea that regulatory agility can still unlock value when paired with robust clinical evidence.

Clearing the Skies: Joby Aviation and Advanced Air Mobility

In emerging industries, deregulation can be less about removing rules and more about updating them. Joby Aviation operates in a category that did not meaningfully exist a decade ago: electric vertical takeoff and landing aircraft designed for urban transportation.

From the outset, Joby’s challenge was not only technological but regulatory. Existing aviation rules were written for airplanes and helicopters, not electric air taxis. In response, the Federal Aviation Administration began modernizing its framework, creating a new “powered-lift” category and establishing certification and pilot training standards tailored to eVTOL aircraft.⁶

By late 2024, the FAA had completed key regulatory updates, clearing a path for commercial operations. Joby subsequently completed milestone test flights between public airports, demonstrating that its aircraft could safely integrate into existing airspace.⁷ Each regulatory step reduced uncertainty around commercialization timelines and improved investor confidence.

Unlike traditional deregulation, this process involved building a new regulatory architecture that enabled innovation rather than blocking it. For Joby, regulatory clarity transformed a futuristic concept into a viable business trajectory.

Investing in the Deregulation Theme

These case studies highlight different ways regulatory change can influence corporate outcomes. In some cases, deregulation reduces costs and frees capital. In others, it accelerates innovation or enables entirely new markets. The Free Markets ETF is designed to identify and invest in companies believed to benefit from these shifts across multiple sectors.

That approach carries risks. Regulatory trends can reverse, and policy outcomes are inherently unpredictable. The fund’s strategy acknowledges this uncertainty by diversifying across industries and avoiding reliance on any single regulatory outcome.⁸

For investors, the appeal lies in exposure to a powerful but often overlooked driver of returns. Regulations shape competitive dynamics just as surely as technology or consumer demand. When those rules change, markets do not always adjust immediately.

Deregulation in action is not an abstract concept. It is visible in bank balance sheets, energy output, drug development timelines, and new transportation networks. FMKT offers a structured way to participate in these developments, emphasizing careful analysis rather than ideological assumptions. As history shows, when regulatory barriers ease thoughtfully, companies with strong fundamentals are often the first to move ahead.

Consider FMKT. I believe in it. I wouldn’t have launched the fund if I didn’t.

Footnotes

Holland & Knight, “Regulatory Relief Act Benefits Community and Regional Banks,” June 2018.

U.S. Department of Energy, “Energy Department Acts to Unleash American Coal,” February 2025.

AInvest, “Peabody Energy’s Strategic Resilience in a Volatile Coal Market,” July 2025.

U.S. Food and Drug Administration, “FDA Grants Accelerated Approval for Alzheimer’s Drug,” June 7, 2021.

Centers for Medicare & Medicaid Services, “National Coverage Determination for Aduhelm,” April 12, 2022.

Federal Aviation Administration, “Advanced Air Mobility and Powered-Lift Aircraft,” December 2024.

Business Insider, “Joby’s Flying Taxi Makes Its First Test Flight Between U.S. Airports,” August 2025.

Tidal Investments LLC, “The Free Markets ETF (FMKT) Prospectus and Strategy Overview,” 2025.

Past performance is no guarantee of future results.

The Fund’s investment objectives, risks, charges, expenses and other information are described in the statutory or summary prospectus, which must be read and considered carefully before investing. You may download the statutory or summary prospectus or obtain a hard copy by calling 855-994-4004 or visiting www.freemarketsetf.com. Please read the Prospectuses carefully before you invest.

Investing involves risk including the possible loss of principal.

FMKT is distributed by Foreside Fund Services, LLC.

Find full holding details and learn more about FMKT at

http://www.freemarketsetf.com.

Holdings are subject to change.

Deregulation Strategy Risks.The Fund’s strategy of investing in companies that may benefit from deregulatory measures entails significant risks, including those stemming from the unpredictable nature of regulatory trends. Deregulation is influenced by political, economic, and social factors, which can shift rapidly and in unforeseen directions. Changes in government priorities, political leadership, or public sentiment may result in the reversal of existing deregulatory policies or the introduction of new regulations that could adversely affect certain industries or companies. Further, while the Fund invests in companies expected to benefit from deregulatory initiatives, not all of these companies may achieve the expected advantages, whether fully, partially, or at all. The actual impact of deregulatory measures may vary widely depending on a company’s specific operational, financial, and competitive circumstances. Companies may also face challenges adapting to new regulatory environments, or their competitive positioning may be undermined by other market factors unrelated to deregulation. These risks could negatively affect the performance of the Fund’s portfolio.

Underlying Digital Assets ETP Risks. The Fund’s investment strategy, involving indirect exposure to Bitcoin, Ether, or any other Digital Assets through one or more Underlying ETPs, is subject to the risks associated with these Digital Assets and their markets. These risks include market volatility, regulatory changes, technological uncertainties, and potential financial losses. As with all investments, there is no assurance of profit, and investors should be cognizant of these specific risks associated with digital asset markets.

● Underlying Bitcoin and Ether ETP Risks: Investing in an Underlying ETP that focuses on Bitcoin, Ether, and/or other Digital Assets, either through direct holdings or indirectly via derivatives like futures contracts, carries significant risks. These include high market volatility influenced by technological advancements, regulatory changes, and broader economic factors. For derivatives, liquidity risks and counterparty risks are substantial. Managing futures contracts tied to either asset may affect an Underlying ETP’s performance. Each Underlying ETP, and consequently the Fund, depends on blockchain technologies that present unique technological and cybersecurity risks, along with custodial challenges in securely storing digital assets. The evolving regulatory landscape further complicates compliance and valuation efforts. Additionally, risks related to market concentration, network issues, and operational complexities in managing Digital Assets can lead to losses. For Ether specifically, risks associated with its transition to a proof-of-stake consensus mechanism, including network upgrades and validator centralization, may add additional uncertainties.

●Bitcoin and Ether Investment Risk: The Fund’s indirect investments in Bitcoin and Ether through holdings in one or more Underlying ETPs expose it to the unique risks of these digital assets. Bitcoin’s price is highly volatile, driven by fluctuating network adoption, acceptance levels, and usage trends. Ether faces similar volatility, compounded by its reliance on decentralized applications (dApps) and smart contract usage, which are subject to innovation cycles and adoption rates. Neither asset operates as legal tender or within central authority systems, exposing them to potential government restrictions. Regulatory actions in various jurisdictions could negatively impact their market values. Both Bitcoin and Ether are susceptible to fraud, theft, market manipulation, and security breaches at trading platforms. Large holders of these assets (”whales”) can influence their prices significantly. Forks in the blockchain networks—such as Ethereum’s earlier split into Ether Classic—can affect demand and performance. Both assets’ prices can be influenced by speculative trading, unrelated to fundamental utility or adoption.

● Digital Assets Risk: Digital Assets like Bitcoin and Ether, designed as mediums of exchange or for utility purposes, are an emerging asset class. Operating independently of any central authority or government backing, they face extreme price volatility and regulatory scrutiny. Trading platforms for Digital Assets remain largely unregulated and prone to fraud and operational failures compared to traditional exchanges. Platform shutdowns, whether due to fraud, technical issues, or security breaches, can significantly impact prices and market stability.

● Digital Asset Markets Risk: The Digital Asset market, particularly for Bitcoin and Ether, has experienced considerable volatility, leading to market disruptions and erosion of confidence among participants. Negative publicity surrounding these disruptions could adversely affect the Fund’s reputation and share trading prices. Ongoing market turbulence could significantly impact the Fund’s value.

● Blockchain Technology Risk: Blockchain technology underpins Bitcoin, Ether, and other digital assets, yet it remains a relatively new and largely untested innovation. Competing platforms, changes in adoption rates, and technological advancements in blockchain infrastructure can affect their functionality and relevance. For Ether, the dependence on its proof-of-stake mechanism and smart contract capabilities introduces risks tied to network performance and scalability. Investments in blockchain-dependent companies or vehicles may experience market volatility and lower trading volumes. Furthermore, regulatory changes, cybersecurity incidents, and intellectual property disputes could undermine the adoption and stability of blockchain technologies.

Recent Market Events Risk. U.S. and international markets have experienced and may continue to experience significant periods of volatility in recent years and months due to a number of economic, political and global macro factors including uncertainty regarding inflation and central banks’ interest rate changes, the possibility of a national or global recession, trade tensions and tariffs, political events, war and geopolitical conflict. These developments, as well as other events, could result in further market volatility and negatively affect financial asset prices, the liquidity of certain securities and the normal operations of securities exchanges and other markets, despite government efforts to address market disruptions.

New Fund Risk. The Fund is a recently organized management investment company with no operating history. As a result, prospective investors do not have a track record or history on which to base their investment decisions.

. Lead-Lag Publishing, LLC is not an affiliate of Tidal/Toroso, Tactical Rotation Management, LLC, SYKON Asset Management, Point Bridge Capital, or ACA/Foreside.