Disinflation Relief, Disruption Fear

When Falling Yields Do Not Translate Into Rising Risk Appetite

Key Highlights

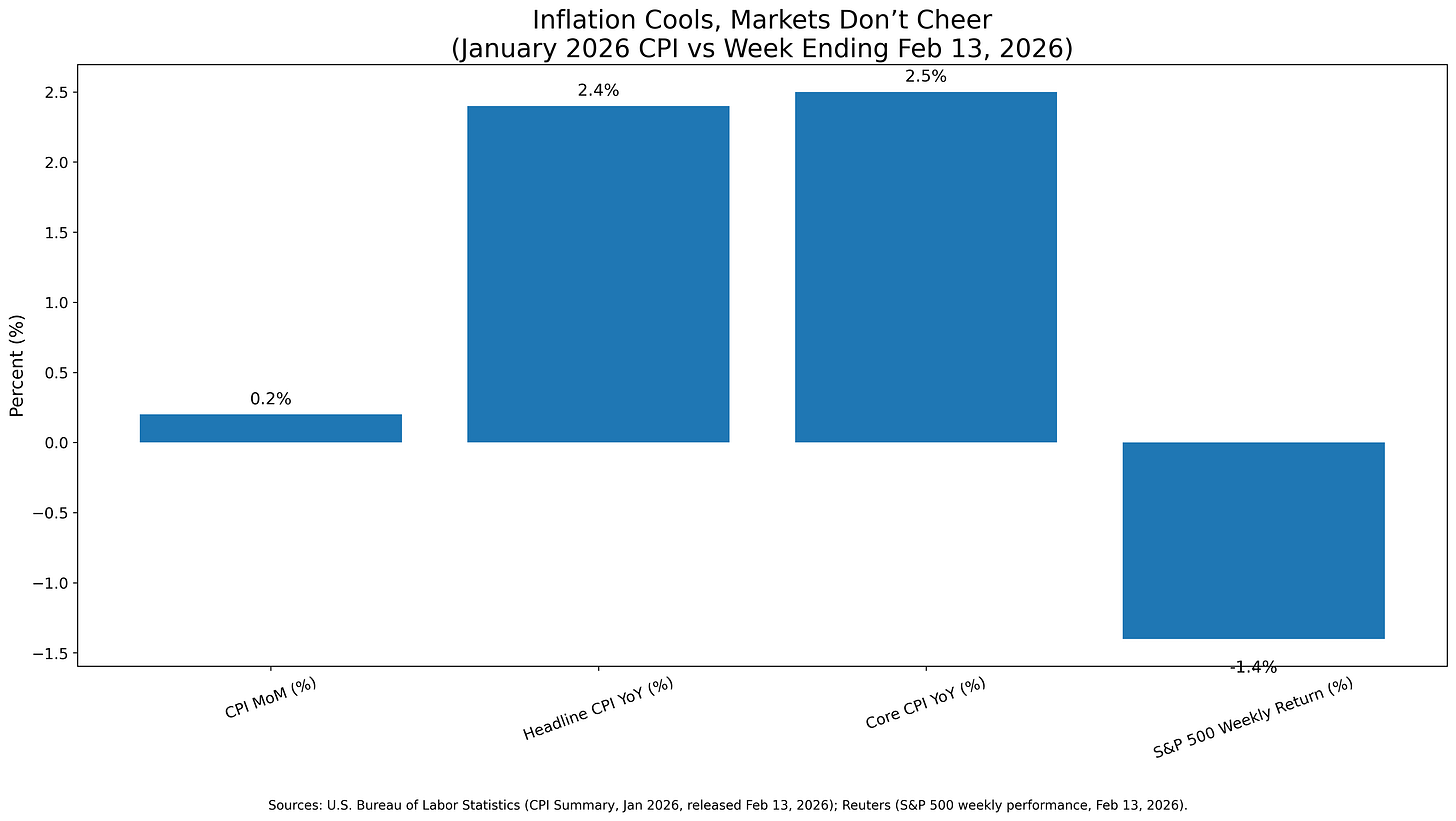

January CPI rose 0.2% month over month, with headline inflation at 2.4% year over year and core at 2.5%, reinforcing that disinflation remains intact even if uneven.¹

U.S. Treasury yields declined across the curve, led by the long end, producing a bull flattening that signaled skepticism about longer-term growth momentum.²

Equities posted their largest weekly loss since November even as bonds rallied, reflecting a repricing of earnings durability rather than a rates shock.³⁴

Volatility surged sharply midweek and the dollar weakened on net, suggesting hedging activity and uncertainty rather than a clean re-risking backdrop.⁷⁸

The dominant narrative shifted from inflation relief to AI-driven disruption risk, widening the gap between discount-rate mechanics and cash-flow confidence.⁴

Inflation Eases, Markets Do Not

The week closed with what should have been constructive macro news. January’s Consumer Price Index rose 0.2% on a seasonally adjusted basis. Headline inflation decelerated to 2.4% year over year, while core stood at 2.5%.¹ In isolation, that combination supports the “soft landing plus eventual easing” framework that has underpinned much of the market’s optimism.

Treasury markets responded accordingly. The 10-year yield declined roughly 18 basis points from the prior Friday to about 4.04%.² The move was more pronounced at the long end than the front end, producing a bull flattening that reflected cooling inflation pressures alongside questions about medium-term growth.

Ordinarily, that setup would be supportive for equities, particularly growth and technology shares that are sensitive to discount-rate changes. Yet the S&P 500 fell approximately 1.4% on the week, its steepest decline since November.³ The divergence between bonds and stocks was stark: yields eased, but risk appetite did not recover.

Volatility confirmed the tension. The VIX surged nearly 18% on Thursday before moderating slightly into Friday.⁸ That type of spike is not typical in a straightforward “good inflation equals higher stocks” regime. It reflects hedging behavior and defensive repositioning.

The dollar index proxy weakened modestly over the week despite intermittent strength around labor data.⁷ Commodities, as measured by the CRB index, also softened.⁹ Instead of the usual cross-asset alignment, markets exhibited broad caution. Falling yields did not translate into enthusiasm.

Midweek labor data complicated the path. January payrolls exceeded expectations, reinforcing the view that the Federal Reserve remains in a steady posture rather than on the brink of immediate easing.⁵ Yields initially moved higher in response. By week’s end, however, the inflation print pulled them back down.

The macro arc was textbook. The tape was not.

The AI Shock to Earnings Confidence

If CPI set the headline, AI set the tone.

Reuters reported widening concern that rapid advances in generative AI tools were beginning to pressure assumptions about business-model durability across sectors.⁴ What began as a technology story broadened into software, brokerage, legal services, data providers, and real estate-adjacent businesses.⁴

Anthropic’s unveiling of a legal AI plug-in became a symbolic inflection point.¹⁴ Investors appeared less focused on the specifics of one product and more on the implications for pricing power and labor substitution. When competitive moats look thinner, valuation frameworks adjust quickly.

This dynamic matters because it competes directly with the rate channel. Lower yields reduce the discount rate applied to future cash flows. That mechanical support can buoy long-duration equities. Yet if the market simultaneously questions whether those cash flows are secure, the benefit of falling yields diminishes.

Technology and growth exposures underperformed during a week in which the 10-year yield fell meaningfully.²³¹¹ That disconnect signals a rising equity risk premium. Investors were not debating where the Fed funds rate might land. They were debating which earnings streams remain defensible.

Credit markets offered an important counterpoint. High-yield credit, proxied by a widely followed ETF, posted a modest gain for the week.¹⁰ Spreads remained contained and did not signal broad recession pricing. The repricing was equity-specific, not systemic in the credit complex.

That distinction is critical. Equity volatility spiked as investors reassessed competitive threats. Credit markets, which focus on solvency and default risk, did not confirm a macro downturn.

In other words, the fear was about disruption, not collapse.

Divergences and Fragilities

Three divergences defined the week.

First, bonds versus equities.

Treasuries rallied while stocks declined.²³ On Thursday, equities fell sharply even as yields moved lower.³⁸ That pattern resembles a growth scare, but the catalyst was not deteriorating macro data. It was an earnings repricing rooted in competitive uncertainty.⁴

Second, defensives versus cyclicals.

Utilities, staples, and real estate proxies outperformed, while technology and financials lagged using ETF benchmarks.¹¹ The rotation suggests investors sought stability rather than leverage to falling rates.