Ever since President Trump’s inauguration a month ago, the term DOGE has been all over the American lexicon (and I’m not talking about the memecoin). You know it as the government agency tasked with improving efficiency and cutting down on wasteful spending. One of its primary initiatives is to reduce the federal workforce by 10%.

Well, it’s happening. Even someone following the news cycle poorly has probably read dozens of stories of people being let go from their jobs with little to no warning. And it’s happening across most federal agencies. It’s been called the St. Valentine’s Day Massacre.

With these mass layoffs have come massive lifestyle adjustments. There are all sorts of studies out there explaining how many Americans have no emergency fund and little, if any, cash savings to cover an unexpected expense. This study says that 37% of those people surveyed would be unable to pay for a $400 expense through traditional means.

That could mean radical lifestyle changes for those affected. Considering what may be going on in the Washington DC real estate market right now, where many of those laid off were located, it could create some seismic shifts in the housing market.

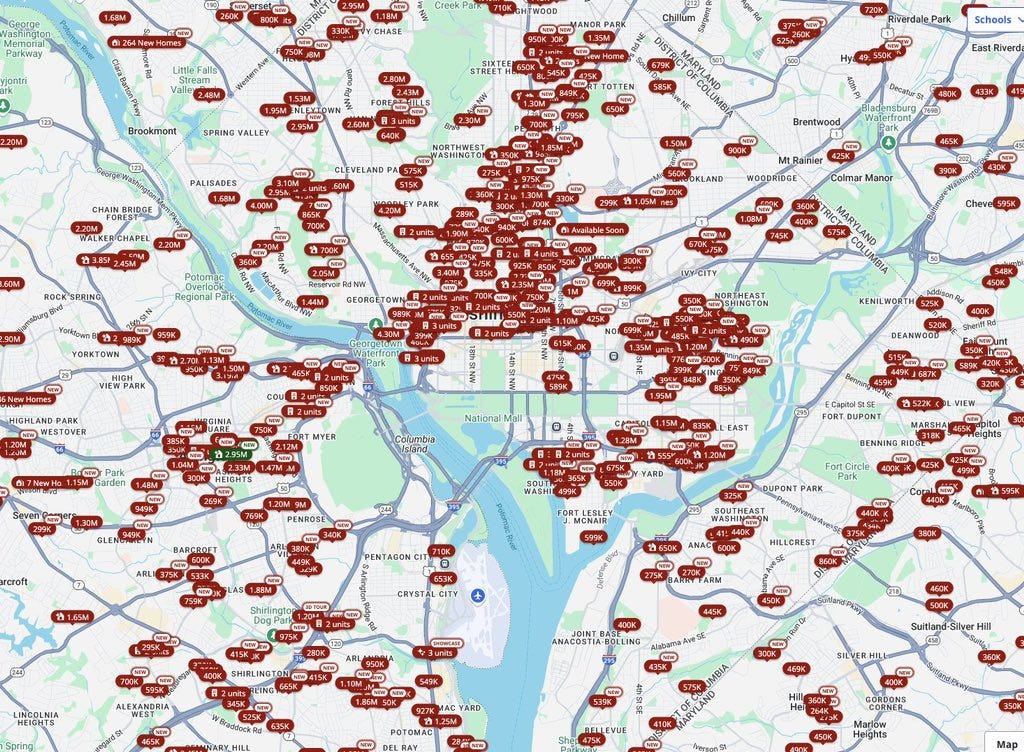

I came across this graphic the other day.

This is a Zillow graphic of new home listings in the Washington DC area over the past 14 days. It’s estimated that around 1-in-5 listings now come from properties up for sale in just the past two weeks. On top of that, about 17% have reduced their asking prices recently. If the U.S. housing market has been essentially frozen because of the gap between current mortgage rates and the rates that many homeowners are locked in at, this could be the catalyst that unsticks it.