Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: DON’T MISTAKE VOLATILITY FOR A REBOUND

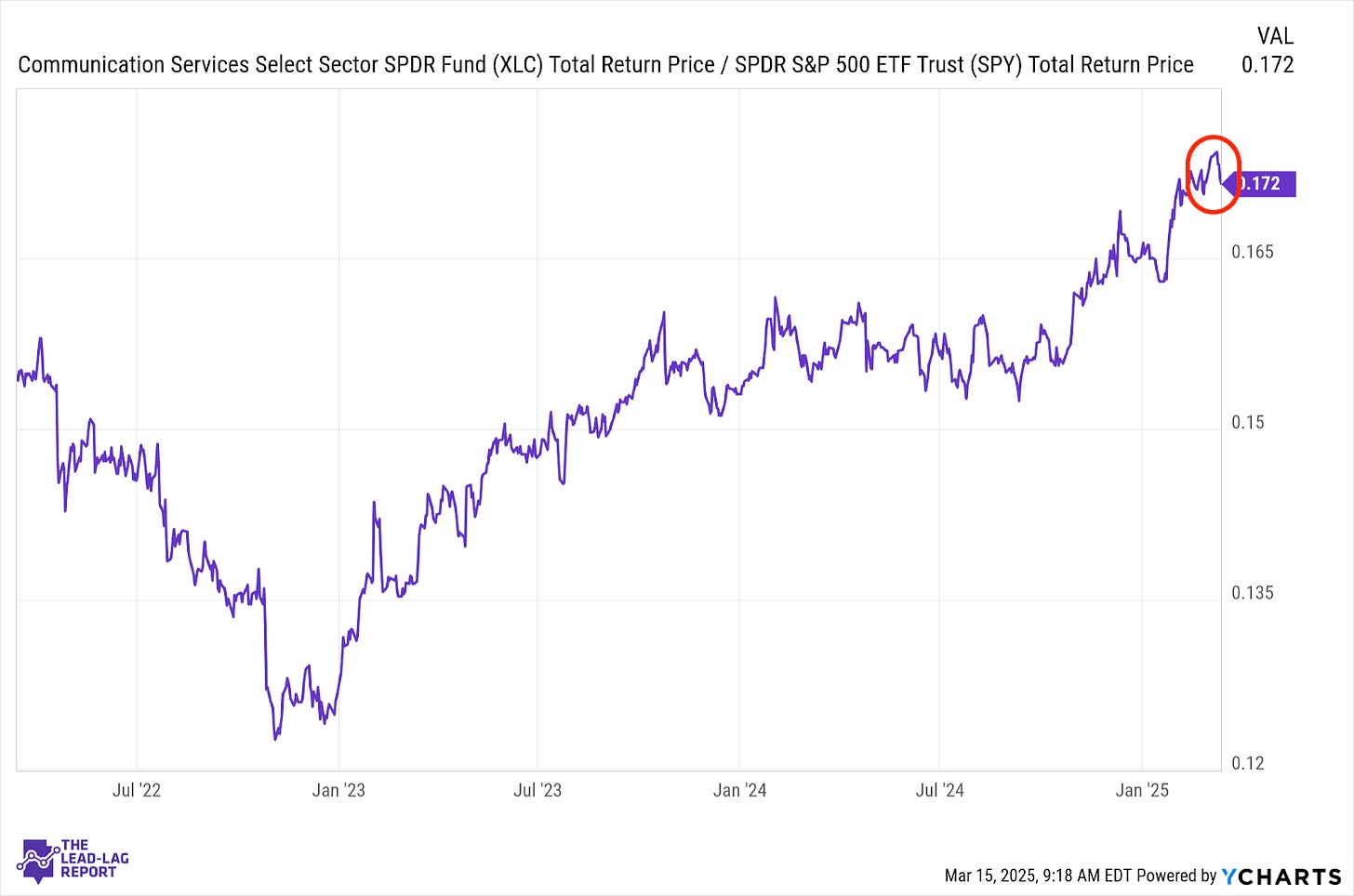

Communication Services (XLC) – The Balance Is Helping

This sector took a bit of a breather last week relative to the S&P 500, but the uptrend appears to still be intact. A nice balance of growth-oriented tech with stodgier telecoms has helped even out some of the risk and steady the ride. With the mag 7 firmly out of favor, it’ll need those telecoms to keep coming through in order to keep the boat afloat.

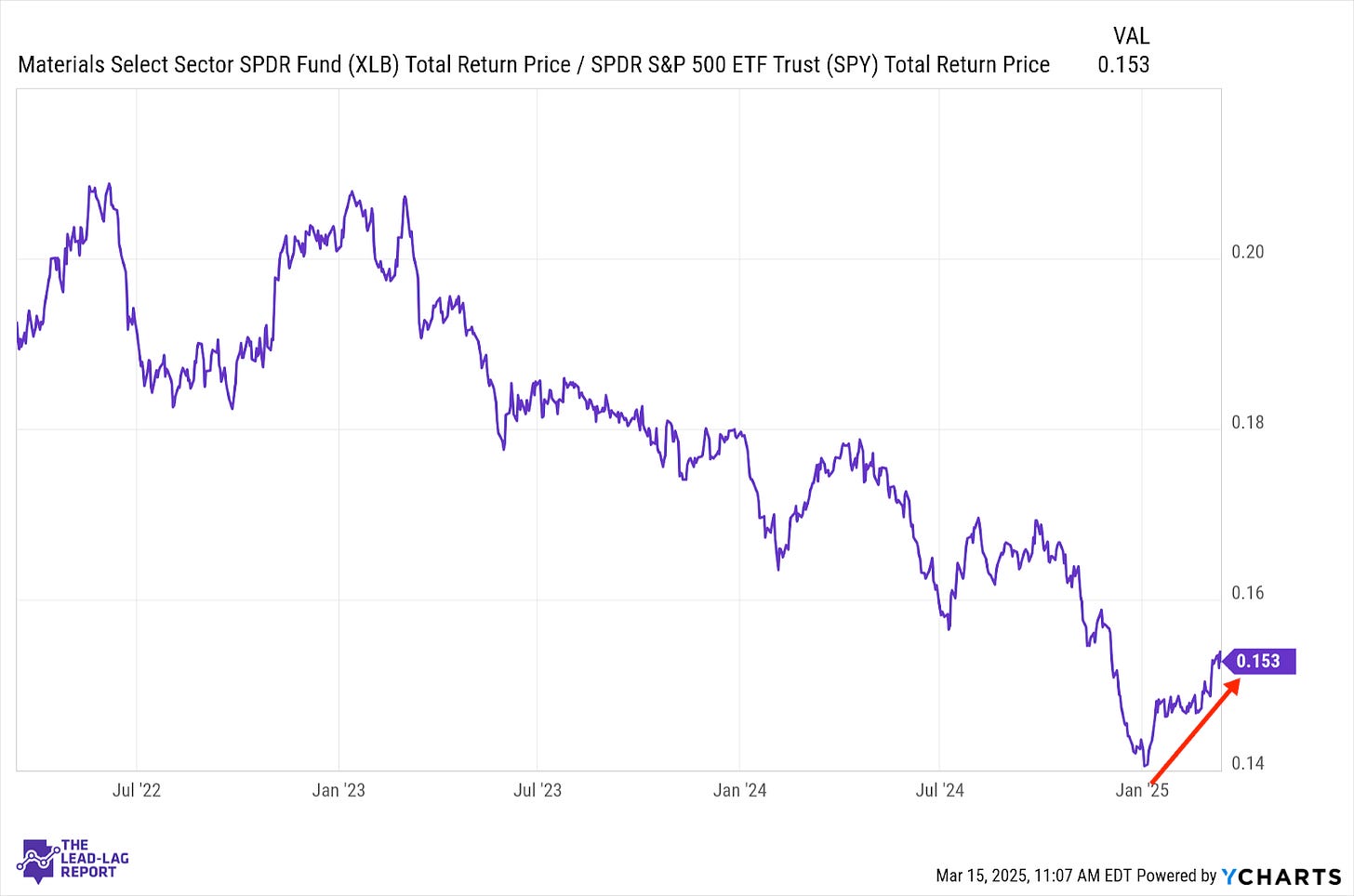

Materials (XLB) – Tariffs & Value

The data would suggest some concern going forward regarding the manufacturing sector and overall economic health, but this sector keeps rallying despite it. Perhaps there’s some tariff effect here if companies begin sourcing their steel and aluminum domestically. There’s almost certainly a tailwind happening due the relative value here. Either way, materials remain one of the better performers this year.

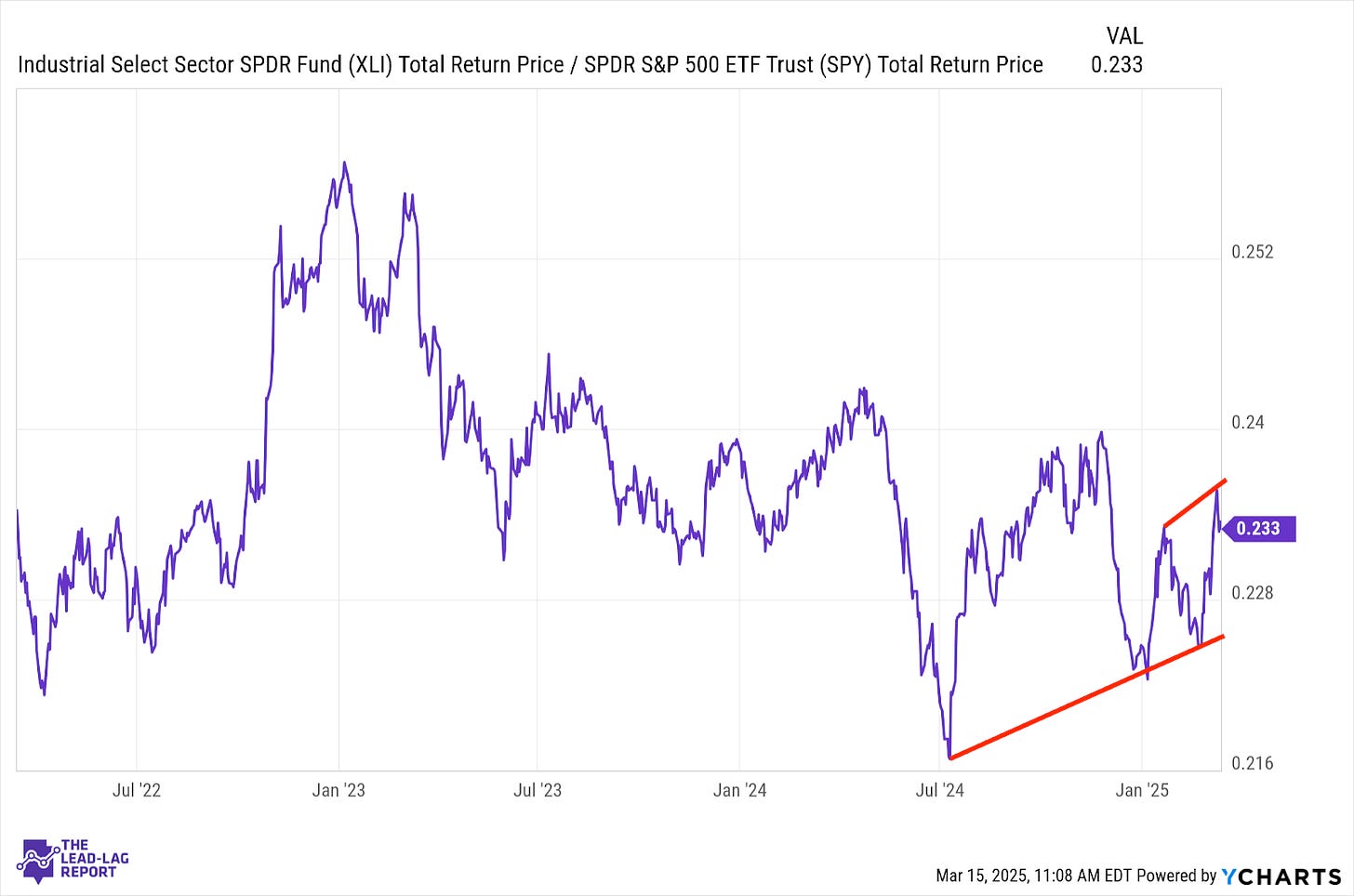

Industrials (XLI) – Violent Ups & Downs

Look closely enough and you’ll see a very broad uptrend in industrials, but it’s been about volatility more than anything. Cyclicals have been enjoying a general boost from their relative value, but performance has been very disparate. The back and forth of the trade war has especially been showing up here in the rather violent ups and downs of this ratio.

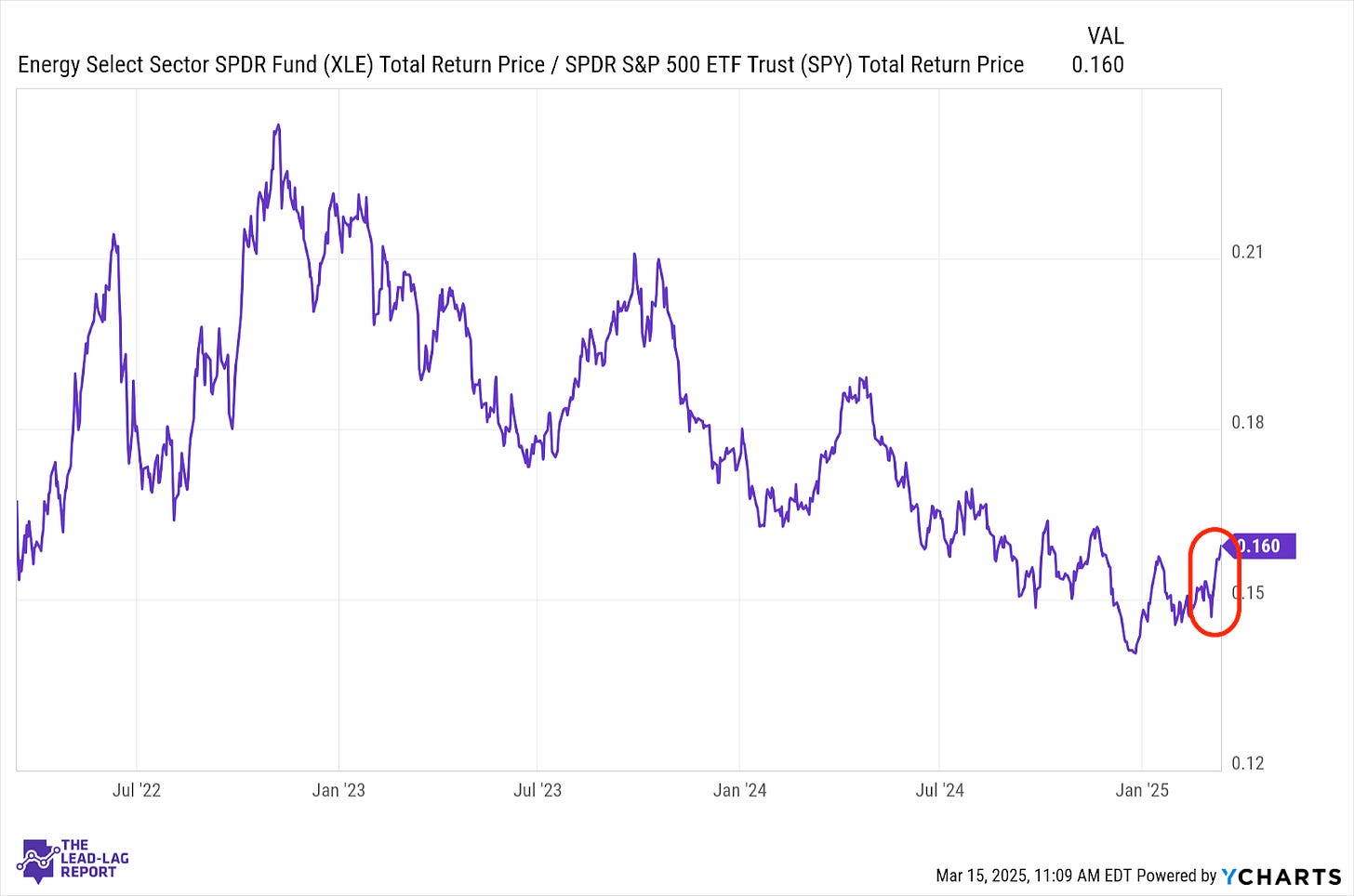

Energy (XLE) – Shrinking Supplies vs. Global Demand

Crude oil prices have stabilized as the U.S. begins imposing geopolitical sanctions that could tighten global supplies, but demand is the real story here. The markets remain very concerned that both U.S. tariffs and retaliatory tariffs are going to slow demand globally. That’s likely to curb energy demand and keep a long-term bearish view on this sector.

Utilities (XLU) – Risk-Off Still In Charge