Engineered Income: The Hidden Mechanics Behind DNP’s Monthly Payout

Beneath the steady cash flow lies leverage, premium risk, and a utilities bet tied to America’s power surge.

Key Highlights

DNP Select Income Fund Inc. is a closed-end fund focused primarily on public utilities, designed to deliver consistent monthly cash distributions.

The fund operates under a managed distribution plan, which may include income, realized gains, and return of capital.

Leverage and premium-to-NAV dynamics can materially influence investor outcomes.

Structural growth in U.S. electricity demand, driven by data centers and electrification, provides a supportive long-term backdrop for utilities.

High yield comes with embedded risks, including premium compression, interest-rate sensitivity, regulatory lag, and capital-base erosion.

Structure Before Story: Understanding the Engine

Most income investors are not trying to outpace an index. They are trying to convert capital into reliable cash flow without being forced to sell assets during market drawdowns. That framing matters when evaluating DNP Select Income Fund Inc. (NYSE: DNP).

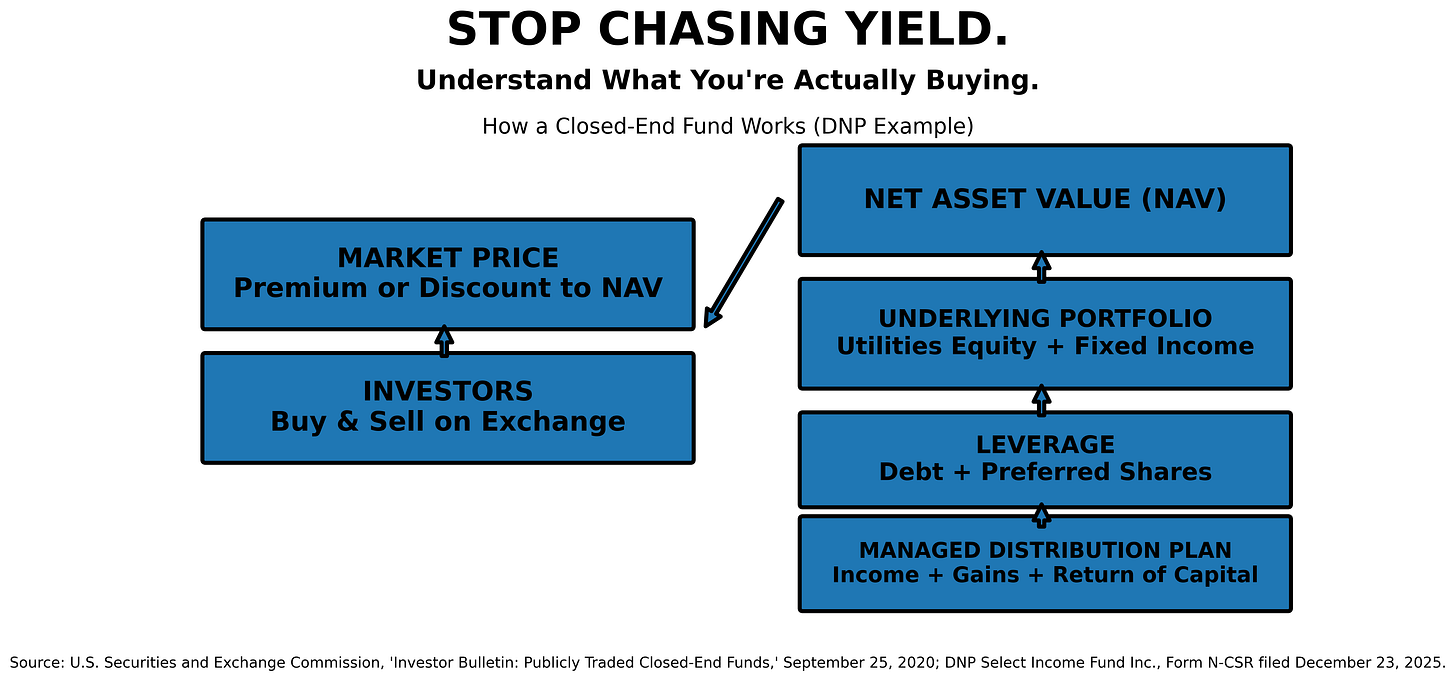

DNP is a registered closed-end fund. Its shares trade on an exchange and can fluctuate above or below the value of the underlying portfolio, known as net asset value, or NAV. The U.S. Securities and Exchange Commission explains that closed-end funds often trade at premiums or discounts and may employ leverage, which can magnify gains and losses.¹

The fund’s stated objective is current income and long-term growth of income, with capital appreciation as a secondary goal.² Under normal market conditions, it invests primarily in equity and fixed-income securities of companies in the public utilities industry.² Electric, gas, and telecommunications utilities form the core exposure.

The defining feature is its managed distribution plan. DNP’s board adopted a policy designed to provide a stable monthly distribution.³ That distribution may be funded by net investment income, realized capital gains, or return of capital. The fund’s shareholder report cautions investors not to equate the distribution amount with investment performance and not to assume that return of capital represents yield in the traditional sense.³

A recent Section 19(a) notice reiterates this structure and discloses estimated sources of distributions.⁴ These notices are not procedural noise. They reveal how the fund maintains distribution consistency even when underlying portfolio income fluctuates.

This is not inherently problematic. It is a design choice. The educational question becomes whether the long-term economics of the portfolio support the managed payout across a full cycle.

The Utilities Backdrop: Demand Is Changing

Utilities were long considered slow-growth defensive holdings. That narrative is evolving.

The U.S. Energy Information Administration recently forecast the strongest multi-year growth in U.S. electricity demand in decades, citing expanding data center capacity and electrification trends.⁵ Reuters similarly reported expectations for record power consumption in coming years, again highlighting AI-driven data center load.⁶

The U.S. Department of Energy released analysis referencing research from Lawrence Berkeley National Laboratory, noting substantial growth in data center electricity use and projecting continued increases.⁷ This growth is not evenly distributed. It clusters geographically, which creates both infrastructure opportunity and grid stress.

The International Energy Agency projects significant global increases in electricity demand from AI-related infrastructure through the end of the decade.⁸ Pew Research Center adds context, noting that data centers already represent a meaningful share of U.S. electricity use and that rapid growth may strain certain regional grids.⁹

For utilities, this translates into expanding capital expenditure pipelines. Transmission upgrades, generation investments, and interconnection improvements are not optional when load rises. The revenue model for regulated utilities often allows cost recovery plus an approved return, though timing matters.

That structural demand tailwind provides a fundamental argument for utility-focused funds such as DNP. However, higher capital spending also requires financing. In a higher-rate environment, the cost of capital becomes central to the thesis.

Deloitte has noted that rising interest rates and regulatory lag can pressure utilities by increasing borrowing costs before rate cases adjust allowed returns.¹⁰ That tension underscores the interest-rate sensitivity embedded in the sector.

DNP’s own filings acknowledge that higher rates can negatively affect fixed-income holdings and that leverage can amplify volatility in NAV and market price.³

Utilities may be defensive relative to cyclical sectors, yet they are not immune to capital-market realities.

The Distribution Mechanism: Stability With Tradeoffs

The managed distribution plan is the feature that attracts income investors. It is also where misunderstanding frequently begins.