Every week, we’ll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

Even though the U.S. equity market continues to mostly hold on to recent gains, it’s the more aggressive strategies that have been garnering the most interest. In particular, single stock leveraged or ultra-high yield products have been drawing in billions of dollars and may not let up anytime soon. As a result, dividend strategies haven’t been in favor for months. Defensive equities? Forget about it. Even traditional covered call strategies, designed to improve yield but keep volatility/reward parameters within range, seem to be forgotten at this point. Is there room left for “boring” income strategies in your portfolio?

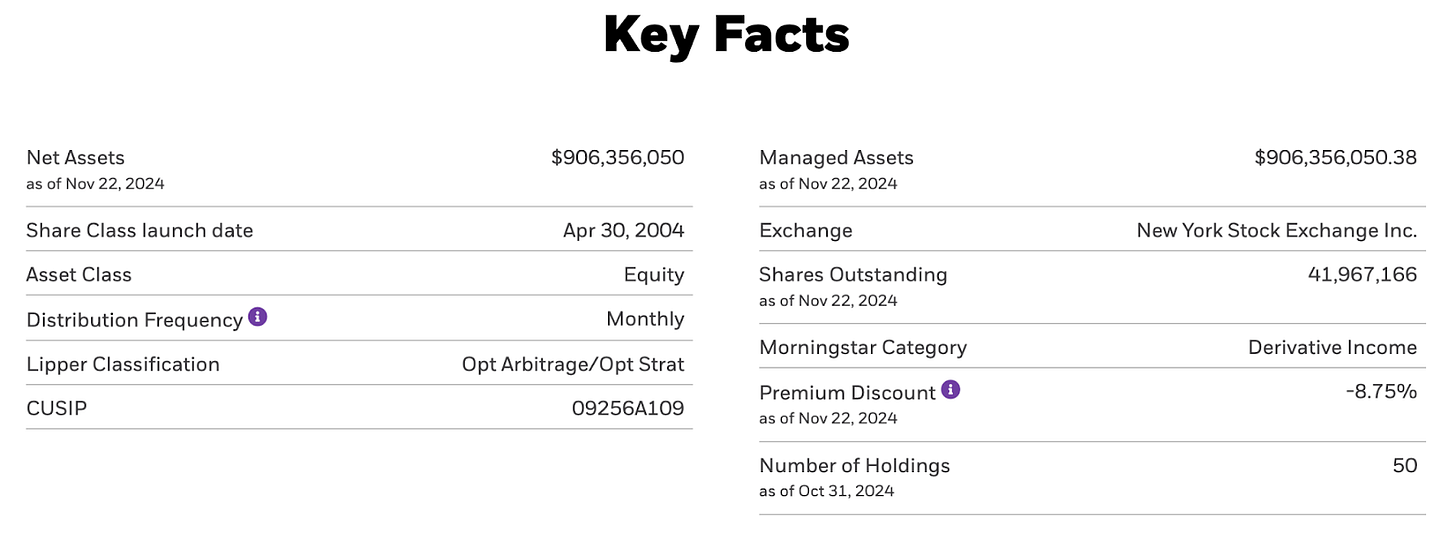

The answer is unequivocally yes. In fact, it might be the most straightforward ones that simply focus on quality stock picks and steady income generation that might be better suited for the environment ahead. The BlackRock Enhanced Capital & Income Fund (CII) could be one of those funds. Its combination of large-cap equities with covered call options is traditional and without any major frills or risks. Boring by today’s standards, but potentially a great choice for predictable income seekers.

Fund Background

CII seeks to achieve its investment objective by investing in a portfolio of equity securities of U.S. and foreign issuers. It may invest directly in such securities or synthetically through the use of derivatives. It also seeks to achieve its investment objective by employing a strategy of writing call and put options on individual securities within the portfolio.

It’s worth noting right off the bat that around the end of this year CII will be changing its name to the BlackRock Enhanced Large Cap Core Fund. In addition, it will be making the specific stipulation that at least 80% of the fund’s holdings must be in large-cap equities. In practice, there are likely to be no real changes to the fund. BlackRock says that the fund’s objective will not change and the current portfolio composition is already roughly 95% large-caps.

As mentioned above, CII doesn’t really come with any surprises. It has a relatively concentrated portfolio of around 50 names, but looks diverse enough that there’s minimal concentration risk. The covered call strategy currently writes options on about half of the portfolio’s position, giving it a solid distribution yield but maintaining some capital growth upside as well. If you’re looking for a comparatively conservative way of increasing yield, this might be a smart way to do it. Its ETF comp could be the Global X S&P 500 Covered Call & Growth ETF (XYLG), a fund that invests in the S&P 500 and overwrites half of the portfolio.