Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: GLOBAL MARKET BREADTH CONTINUES TO IMPROVE

Communication Services (XLC) – Led By Facebook, But The Rally Is Broad

This sector is riding the wave of a 20-day winning streak for Facebook, which has seen that stock rise 20% in the process. It’s not necessarily driving the sector though. Over this time frame, this sector and the equal-weight version of it have produced nearly the same total return, proving that the outperformance has been broad and multiple areas and companies are contributing.

Financials (XLF) – Fear Factor

The deregulation theme continues to play out for the financial sector, but the fear factor may be emerging for loan demand. As people see government employees getting laid off by the thousands and tariffs threatening to reignite inflation, consumers may 1) think twice about taking on new debt and/or 2) struggle to keep current on their existing loans, including mortgages.

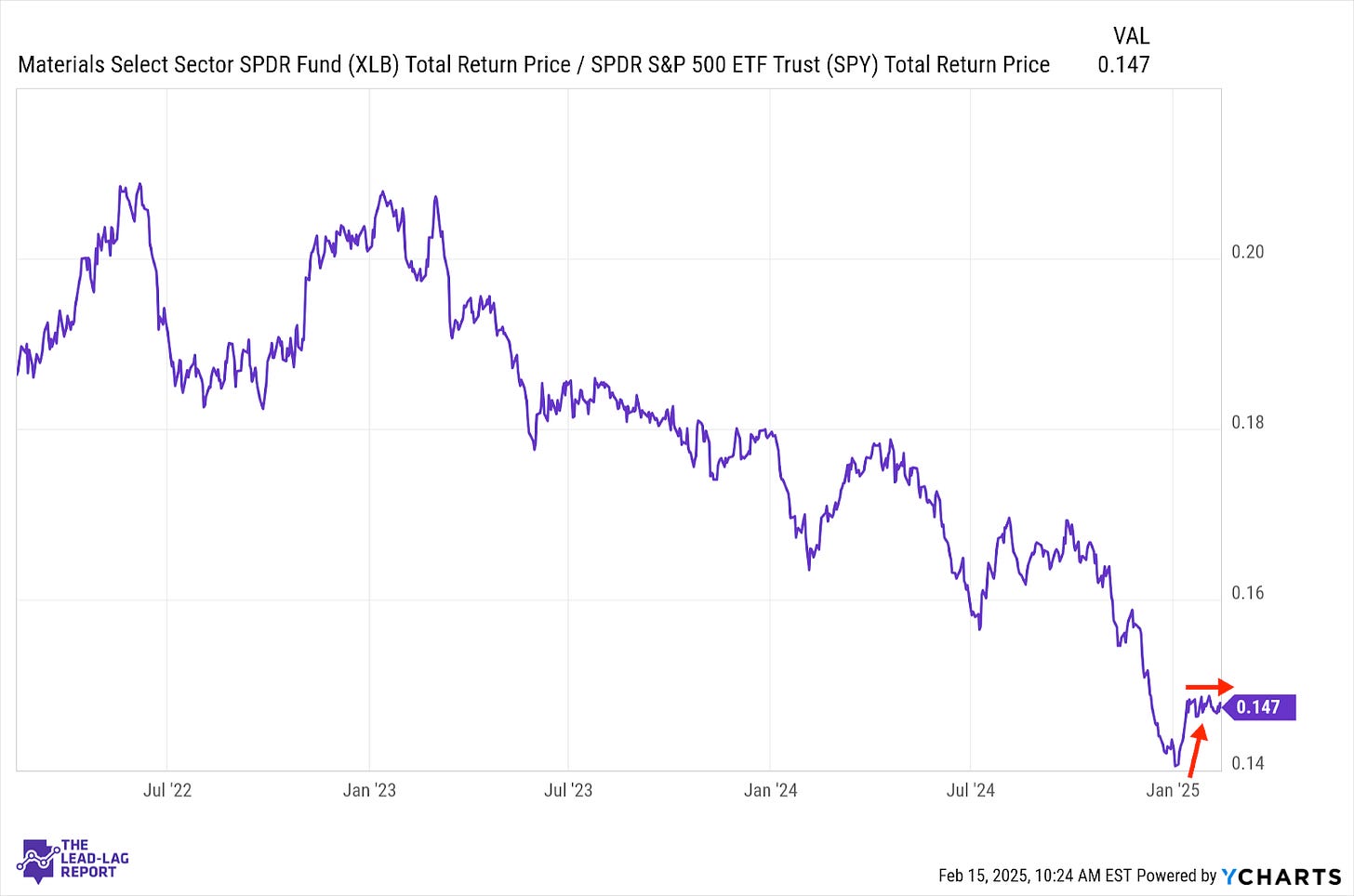

Materials (XLB) – Performance Is Decent, But Tariff Impact Looms

The commodities sector has gotten off to a decent start this year, although the biggest gains are coming from agriculture. A modest pickup in manufacturing activity has provided a boost, but tariffs on steel & aluminum with potentially more on the way will negatively impact sentiment. Materials stocks aren’t giving up though and have been one of the better performers so far this year.

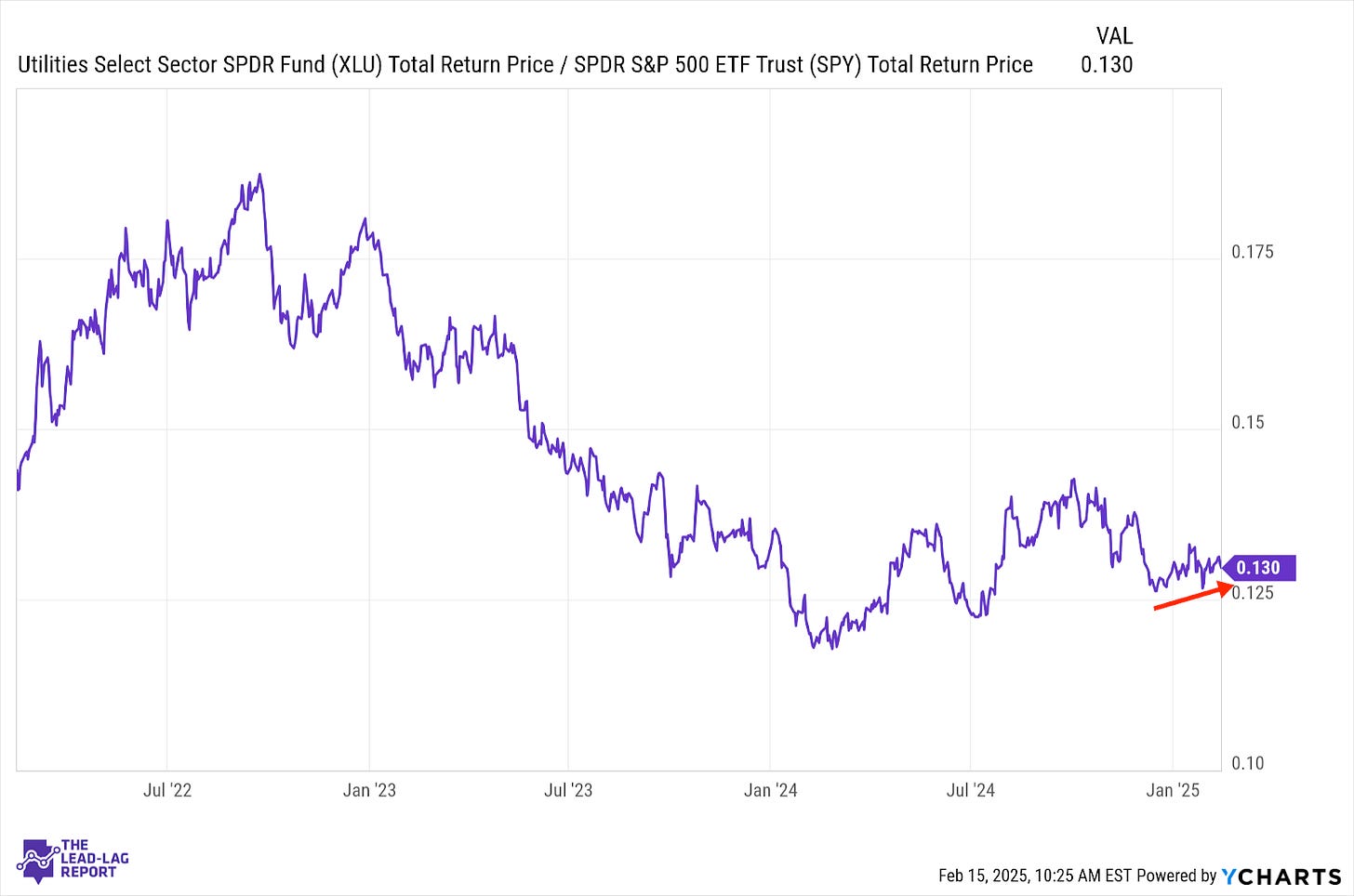

Utilities (XLU) – Market Broadening Creates Opportunity

Even though the S&P 500 and Nasdaq 100 are still at all-time highs, the broadening of the market is still allowing defensive issues an opportunity. Utilities are still outperforming the large-cap averages and it’s beginning to get some consensus from consumer staples and healthcare. Even though the signal hasn’t been bearish up to this point, this trend along with general strength in Treasuries and gold is reason for caution.

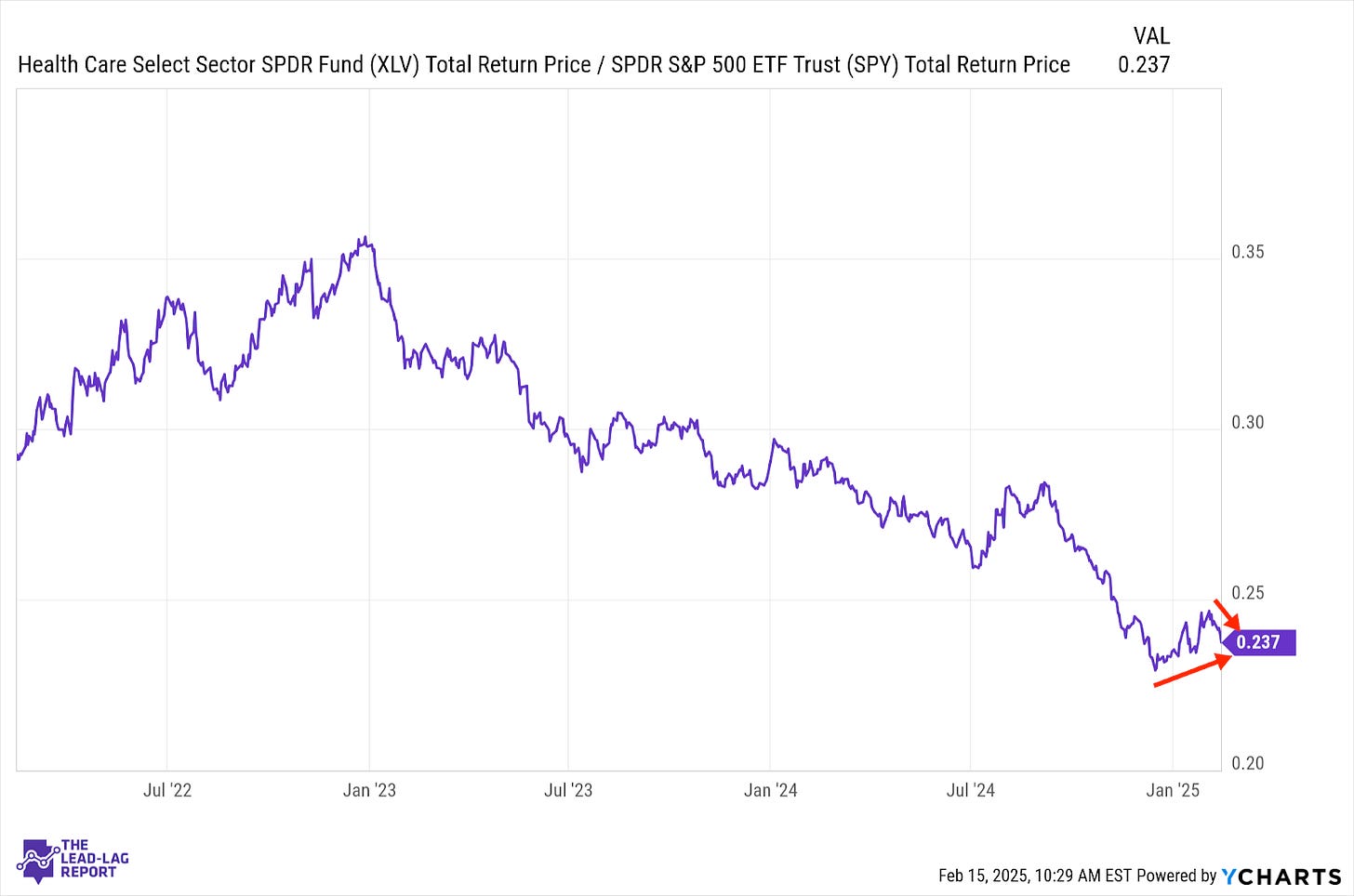

Health Care (XLV) – Leader Status Is Tenuous

Healthcare has gotten off to a solid start to the year, but it’s starting to run into a little resistance. There’s been little consensus thus far as to which style or theme is leading, but defensive sectors are starting to see improvement. The uptrend in this all-important sector is still intact, but the fact that it’s begun to whipsaw up and down relative to the S&P 500 suggests that its status as leader at the moment is tenuous.

Real Estate (XLRE) – The Layoff Perception

After a fair amount of volatility, yields headed lower again last week, yet REITs held up again. While the mass layoffs announced by the government are a small percentage of cases in the grand scheme of things, the perception that a lot of people are suddenly out of a job and could soon struggle to pay their mortgages and rents won’t improve sentiment to continue the current uptrend.

Long Bonds (VLGSX) –Flight To Safety Pulse Developing