Every week, we’ll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

The junk bond market has been a consistent outperformer throughout the past couple years. That trend could be ending as credit spreads remain stuck and inflation becomes a larger concern for many investors. In August, when the reverse yen carry trade was roiling the markets, high yield spreads blew out quickly, leading to significant losses for this category. While junk bonds recovered rather quickly, it’s a sign that the slightest bit of bad news could be quite damaging for low-grade bonds.

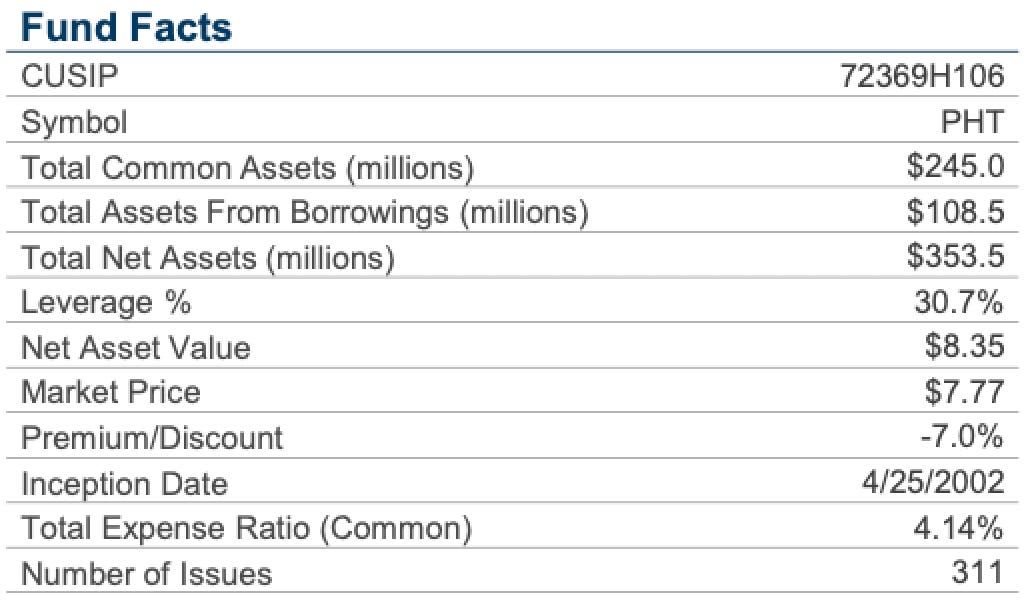

Is re-inflation the next negative catalyst coming soon? The data suggests that it may already be starting and investors might want to consider a targeted approach when investing here. The Pioneer High Income Fund (PHT) has been around for more than 20 years and has seen it all over that time. That could work to its advantage, but the high use of leverage could also exacerbate losses should conditions turn south.

Fund Background

PHT’s primary objective is high current income with a secondary objective of capital appreciation. It does this by investing in a portfolio of below-investment grade bonds and convertible securities. The fund also utilizes leverage in order to enhance yield and total return potential.

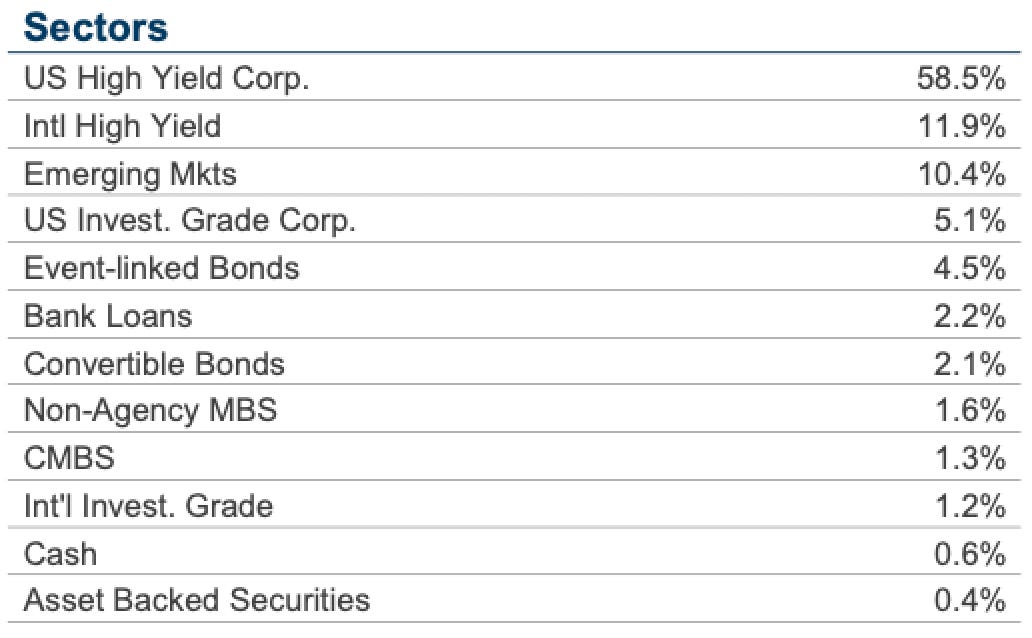

At a high level, this is a fairly straightforward corporate bond fund that uses leverage. The fund’s mandate talks of including convertible bonds as a high yield option, but this is for all intents and purposes a junk bond fund with a few odds and ends sprinkled around the edges.

As is the case with many funds using leverage nowadays, the cost of implementing is prohibitive, as evidenced by the 4% expense ratio. The total expense ratio of just over 1% is relatively common for a high yield fund in this space, but a 3% cost of leverage is going to make benchmark-beating performance that much more difficult to achieve. As long as interest rates remain elevated, which it looks like they could be for the foreseeable future, this could be a big headwind.

The first three categories listed above fall under the general umbrella of a global high yield bond portfolio and comprise the vast majority of the portfolio. The 5% inclusion of event-linked bonds (sometimes referred to as catastrophe bonds because they require some natural disaster or devastating event to trigger) is an interesting addition to the portfolio. They generally have big tail risk, but can be a nice source of yield. The remaining asset classes add a bit of diversification, but aren’t really needle movers.