On the trade front, the markets have been reacting to the threat of new tariffs from the Trump White House, who has floated duties on copper as well as imports from Mexico and the European Union. The copper tariff could be particularly damaging. This obviously raises concerns about how high input costs might rise for manufacturers, especially in homebuilding and infrastructure. There’s also the possibility of supply chain disruptions, which could trigger higher inflation much like it did during the COVID recovery phase and weigh on margins for both industrial and tech companies. If these tariffs actually materialize (which is a big “if”), it could result in retaliatory tariffs that reverses the current positive momentum in investor sentiment. Tariffs, of course, could create some uncertainty for multi-nationals, who would be more heavily exposed to these tariffs, and smaller companies, who don’t necessarily have the flexibility or resources to alter their own supply chain vulnerabilities.

This past week also brought fresh signs that the U.S. labor market might finally be cooling off. Even though the non-farm payroll report for June suggested continued resilience, the ADP report, which measures private sector activity, showed a job contraction. The real tell, however, might be in continuing jobless claims. This figure is approaching 2 million for the first time since 2021 and has risen sharply since Q1 of this year. We’ve also seen job openings steadily declining to 2021 levels and the labor force participation rate well off of its 2023 high. Taken in total, the labor market is definitely showing signs of slowing and could be signaling underlying vulnerabilities for big corporations emerging.

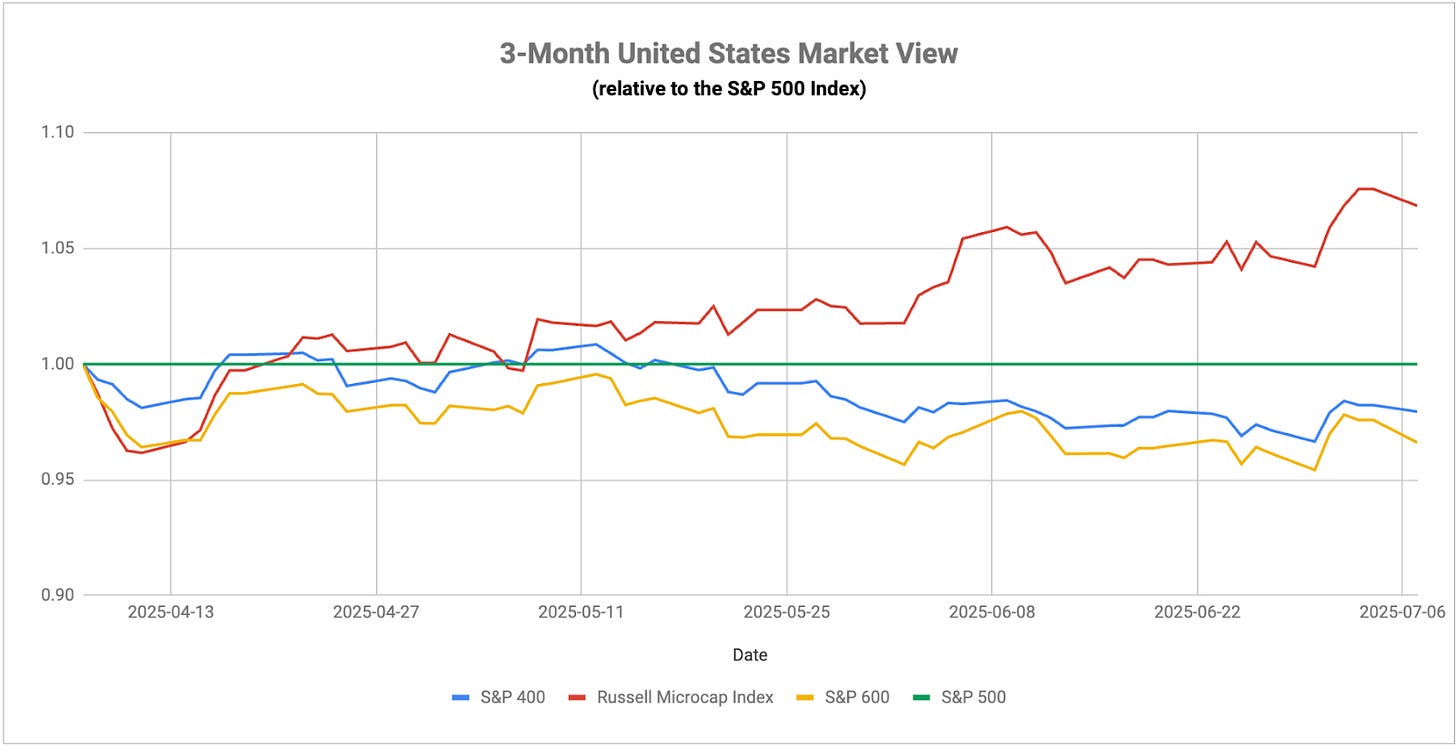

As always, the group I’m watching closely here is small-caps. While they’ve pretty steadily underperformed since the beginning of 2023, we’re seeing signs of a bottom relative to large-caps. The prospect of rate cuts from the Fed and a newfound optimism for a cyclical recovery (small-caps have much larger allocations to cyclicals when compared to the tech-heavy S&P 500) are positioning small-caps relatively well here. Since April, the Russell 2000 has been very gently outperforming the S&P 500, but the Russell Microcap Index has done even better. If these conditions can hang on and they don’t get disrupted by another tariff-induced spike in volatility, small-caps could see a bit of an extended run.

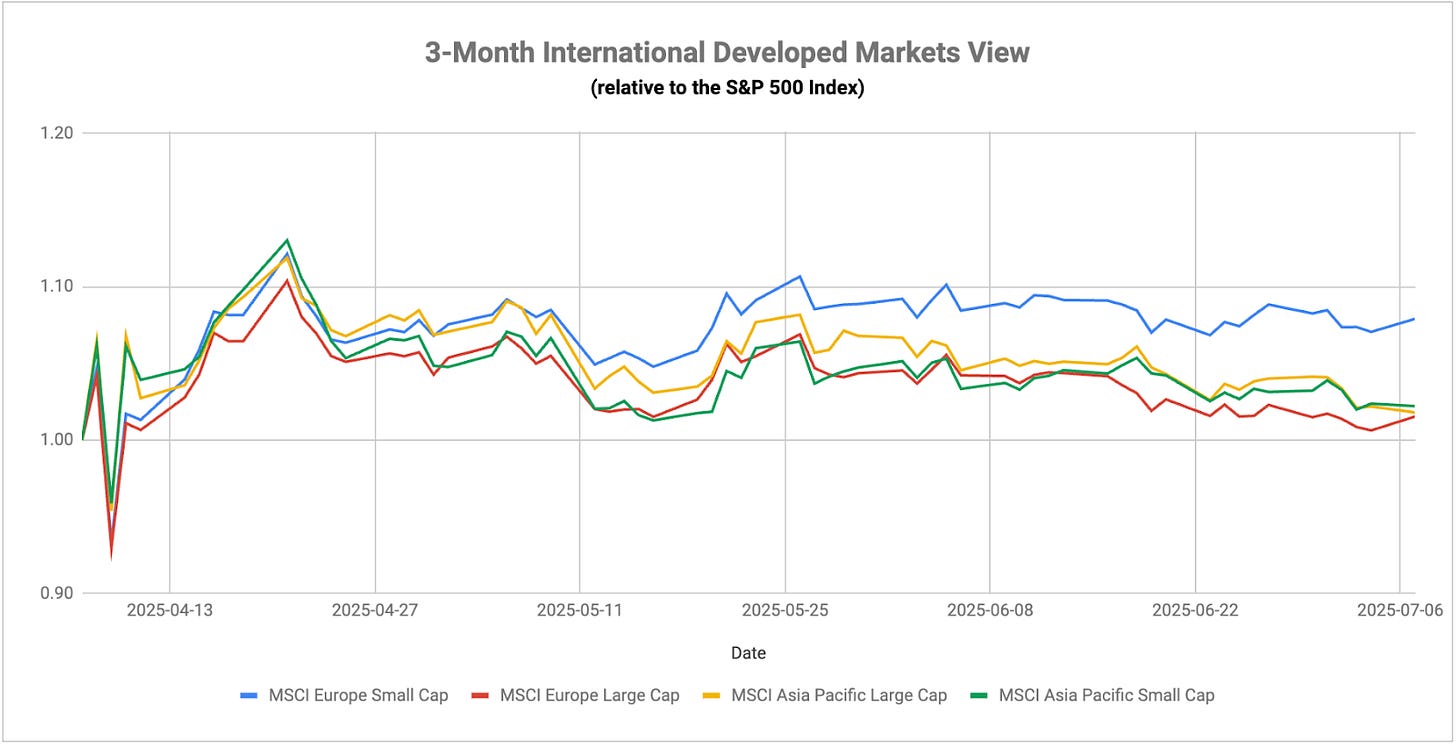

The June inflation rate for the Eurozone is likely to come in right at 2%, marking nearly a year that it’s been at 2.5% or below. That’s given the ECB the flexibility to lower its benchmark rate to 2.15%, but that’s likely where it’s going to remain for the time being. Energy prices have stabilized and services inflation is finally showing signs of easing. Combine that with the fact that the Eurozone GDP growth rate has gone from flat in Q3 2023 and moved steadily higher to 0.6% in Q1 2025 suggests a much healthier economic situation. Q2 GDP, however, is expected to drop, which shows just how delicate the region’s recovery is. It is encouraging though that the biggest support is coming from some of the region’s largest economies. That could be the key to extended growth. The impact of the targeted tariff threat against the EU is sitting in the background, but I’d wait for some follow through before overreacting.