$FMKT: Deregulation as Macro Catalyst

A political leader cutting through a stack of red tape may seem symbolic, yet in a slowing economy it signals something deeper: a policy pivot toward growth through deregulation¹. When interest rates are near historic lows and fiscal tools are constrained by deficits and politics, easing regulations can act as a stealth stimulus². By trimming bureaucratic burdens, policymakers can spur lending, investment, and hiring—extending the expansion when traditional levers falter.

When Traditional Policy Tools Run Dry

Late in an economic cycle, central banks and governments often find themselves boxed in. Rate cuts lose potency, fiscal expansion becomes politically costly, and deficits limit new spending³. In this context, deregulation becomes the “third lever” of macro management—a way to boost activity without writing new checks⁴.

Economists such as Yair Listokin have called for “countercyclical regulation,” meaning looser rules during downturns and tighter ones in booms⁵. By reducing compliance costs or relaxing capital requirements, governments can stimulate credit and job creation when demand softens. Unlike monetary or fiscal interventions, regulatory relief requires no congressional approval, allowing faster deployment⁶.

Recent executive actions reflect this shift. By 2025, the U.S. government had issued sweeping orders to streamline federal rulebooks and accelerate permitting⁷⁸. The appeal is clear: deregulation is fast, inexpensive, and broad in impact—a rising tide rather than a targeted bailout⁹. While not a cure for deep recessions, regulatory relief can help cushion moderate slowdowns, especially when policy tanks run close to empty.

Deregulation: The New Growth Engine

Regulations serve important purposes but often carry hidden costs. Studies estimate that excessive U.S. regulation imposes more than $2 trillion in annual economic drag, roughly $15,000 per household¹⁰. Reducing those frictions can unlock productivity and investment.

History bears this out. The deregulated U.S. economy of the 1990s outpaced its more tightly controlled European peers¹¹. NBER research found that liberalizing entry barriers encourages business formation and capital spending¹². As compliance burdens fall, firms reinvest in capacity, innovation, and hiring. Surveys of American business owners show rising optimism and expansion plans following deregulatory announcements¹³.

The effects are visible across industries. In energy, expedited drilling permits have spurred oil and gas projects that once languished in bureaucratic limbo¹⁴. In banking, regulators are reconsidering post-2008 capital rules, freeing more funds for lending¹⁵¹⁶. Wilmington Trust notes that easing the supplementary leverage ratio could release billions in new credit, effectively a private-sector stimulus¹⁷. Even healthcare stands to gain as streamlined approvals speed new therapies to market.

Yet balance is key. Overzealous deregulation can backfire—environmental rollbacks may impose long-term costs, and excessive financial freedom can rekindle instability. The current wave appears more selective, trimming redundancy rather than gutting safeguards¹⁸. For investors, the implication is clear: moderate, targeted deregulation tends to support growth and sentiment during late-cycle transitions.

Sector Winners and How to Play the Theme

Not all sectors benefit equally. Principal Asset Management identifies energy, industrials, and financials as prime winners from the 2025 deregulation drive¹⁹. Oil drillers and pipeline operators gain from faster approvals; manufacturers save on compliance costs; banks profit from lighter oversight and greater leverage capacity²⁰. Smaller firms, often overwhelmed by one-size-fits-all rules, could also thrive as paperwork thins²¹.

Market pricing suggests the opportunity remains underappreciated. Many deregulation beneficiaries still trade below early-2025 highs, implying upside as investors recognize improving fundamentals²². That sets the stage for thematic exposure through The Free Markets ETF (FMKT)—the first fund designed to capture the deregulation trend²³.

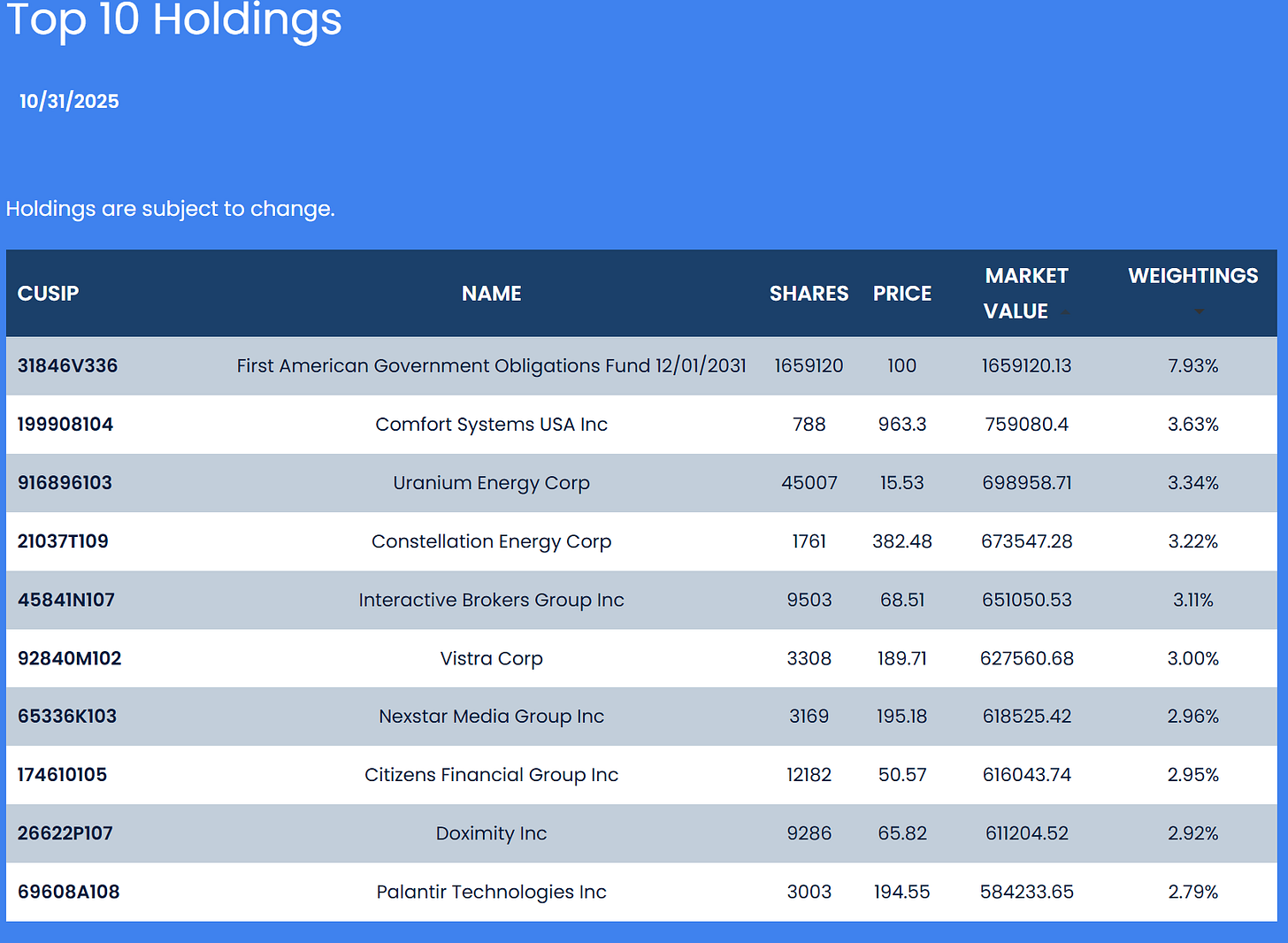

Launched in June 2025, FMKT invests in companies poised to benefit from lighter rules across finance, energy, and healthcare²⁴. Holdings include Robinhood (trading reform), Uranium Energy Corp. (accelerated mining permits), and Constellation Energy (pro-nuclear policy)²⁵. Deregulation, we believe, acts as a “hidden tax refund” for businesses—an underpriced catalyst boosting margins without legislation²⁶. Using a proprietary model, FMKT overweights firms most sensitive to regulatory shifts, offering diversified exposure to a freer economic landscape²⁷.

For late-cycle investors seeking real-economy catalysts rather than speculative fads, FMKT embodies a pragmatic theme: earnings growth driven by structural policy change.

Risks and Rewards in a Deregulation-Fueled Late Cycle

The market’s optimism around deregulation is understandable but requires nuance. A lighter rulebook can extend the cycle and improve productivity, yet it can also invite overconfidence. The danger lies not in deregulation itself, but in assuming it repeals the business cycle²⁸.

Still, the policy’s durability offers comfort. Many of 2025’s reforms are described as “structural, not tactical,” suggesting persistence even under future administrations²⁹. Once industries adapt to leaner oversight, reversals become politically and operationally difficult³⁰. That makes deregulation more than a sugar high—it’s a potential tailwind lasting into the next expansion.

For investors, the playbook is straightforward: lean toward sectors and strategies aligned with efficiency, innovation, and capital flexibility. Watch regulatory trackers and corporate commentary for evidence that lighter rules are translating into tangible output gains. When banks report higher lending or energy firms restart stalled projects, that’s the signal policy is working.

Conclusion

In a world of fiscal fatigue and monetary limits, deregulation has re-emerged as a credible growth lever. It’s not ideological—it’s pragmatic. By cutting red tape rather than printing money, policymakers can unleash latent capacity across the economy. For investors, this shift reframes late-cycle positioning: opportunity may come not from more stimulus, but from fewer constraints.

As with any macro theme, timing and balance matter. Deregulation won’t prevent downturns, yet it can reshape their depth and distribution. For those anticipating change rather than reacting to it, a freer market environment—captured thematically through vehicles like FMKT—offers a disciplined way to turn policy evolution into performance potential. Free markets, after all, tend to reward those who adapt first.

Footnotes

¹ Alex Hino, “Deregulation – A Driving Force for Economic Activity,” Wilmington Trust – Capital Markets Forecast 2025, Oct. 28, 2025.

² Yair Listokin, “Fighting the Next Recession in the United States with Law and Regulation, Not Just Fiscal and Monetary Policies,” Washington Center for Equitable Growth, Feb. 18, 2020.

³ Ibid.

⁴ Nick Sargen, “Assessing the Economic Impact of Deregulation,” Fort Washington Investment Advisors, Aug. 8, 2018.

⁵ Yair Listokin, op. cit.

⁶ Ibid.

⁷ Executive Order 14192 – Unleashing Prosperity Through Deregulation, White House, 2025.

⁸ “Unleashing Prosperity Through Deregulation,” EPA Regulatory Portal, 2025.

⁹ Alex Hino, op. cit.

¹⁰ Wilmington Trust, op. cit.

¹¹ Alberto Alesina et al., “Regulation and Investment,” NBER Working Paper No. 9560, Sept. 2003.

¹² Ibid.

¹³ Mickey Levy, quoted in Nick Sargen, op. cit.

¹⁴ James Bikales and Catherine Allen, “Oil Drilling Permits Surge Under Trump,” E&E News / Politico, Oct. 10, 2025.

¹⁵ Wilmington Trust, op. cit.

¹⁶ Ibid.

¹⁷ Ibid.

¹⁸ Principal Asset Management, “Who Will Benefit from Deregulation?” June 12, 2025.

¹⁹ Ibid.

²⁰ Wilmington Trust, op. cit.

²¹ Principal Asset Management, op. cit.

²² Ibid.

²³ Free Markets ETF (FMKT) – About FMKT, FreeMarketsETF.com, accessed Nov. 1, 2025.

²⁴ Chandrima Sanyal, “Deregulation Is the New Stimulus—And This ETF Is First in Line,” Benzinga, Aug. 5, 2025.

²⁵ Ibid.

²⁶ Ibid.

²⁷ Ibid.

²⁸ Principal Asset Management, op. cit.

²⁹ Chandrima Sanyal, op. cit.

³⁰ Ibid.

Past performance is no guarantee of future results.

The Fund’s investment objectives, risks, charges, expenses and other information are described in the statutory or summary prospectus, which must be read and considered carefully before investing. You may download the statutory or summary prospectus or obtain a hard copy by calling 855-994-4004 or visiting www.freemarketsetf.com. Please read the Prospectuses carefully before you invest.

Investing involves risk including the possible loss of principal.

FMKT is distributed by Foreside Fund Services, LLC.

Find full holding details and learn more about FMKT at

http://www.freemarketsetf.com.

Holdings are subject to change.

Deregulation Strategy Risks.The Fund’s strategy of investing in companies that may benefit from deregulatory measures entails significant risks, including those stemming from the unpredictable nature of regulatory trends. Deregulation is influenced by political, economic, and social factors, which can shift rapidly and in unforeseen directions. Changes in government priorities, political leadership, or public sentiment may result in the reversal of existing deregulatory policies or the introduction of new regulations that could adversely affect certain industries or companies. Further, while the Fund invests in companies expected to benefit from deregulatory initiatives, not all of these companies may achieve the expected advantages, whether fully, partially, or at all. The actual impact of deregulatory measures may vary widely depending on a company’s specific operational, financial, and competitive circumstances. Companies may also face challenges adapting to new regulatory environments, or their competitive positioning may be undermined by other market factors unrelated to deregulation. These risks could negatively affect the performance of the Fund’s portfolio.

Underlying Digital Assets ETP Risks. The Fund’s investment strategy, involving indirect exposure to Bitcoin, Ether, or any other Digital Assets through one or more Underlying ETPs, is subject to the risks associated with these Digital Assets and their markets. These risks include market volatility, regulatory changes, technological uncertainties, and potential financial losses. As with all investments, there is no assurance of profit, and investors should be cognizant of these specific risks associated with digital asset markets.

● Underlying Bitcoin and Ether ETP Risks: Investing in an Underlying ETP that focuses on Bitcoin, Ether, and/or other Digital Assets, either through direct holdings or indirectly via derivatives like futures contracts, carries significant risks. These include high market volatility influenced by technological advancements, regulatory changes, and broader economic factors. For derivatives, liquidity risks and counterparty risks are substantial. Managing futures contracts tied to either asset may affect an Underlying ETP’s performance. Each Underlying ETP, and consequently the Fund, depends on blockchain technologies that present unique technological and cybersecurity risks, along with custodial challenges in securely storing digital assets. The evolving regulatory landscape further complicates compliance and valuation efforts. Additionally, risks related to market concentration, network issues, and operational complexities in managing Digital Assets can lead to losses. For Ether specifically, risks associated with its transition to a proof-of-stake consensus mechanism, including network upgrades and validator centralization, may add additional uncertainties.

●Bitcoin and Ether Investment Risk: The Fund’s indirect investments in Bitcoin and Ether through holdings in one or more Underlying ETPs expose it to the unique risks of these digital assets. Bitcoin’s price is highly volatile, driven by fluctuating network adoption, acceptance levels, and usage trends. Ether faces similar volatility, compounded by its reliance on decentralized applications (dApps) and smart contract usage, which are subject to innovation cycles and adoption rates. Neither asset operates as legal tender or within central authority systems, exposing them to potential government restrictions. Regulatory actions in various jurisdictions could negatively impact their market values. Both Bitcoin and Ether are susceptible to fraud, theft, market manipulation, and security breaches at trading platforms. Large holders of these assets (”whales”) can influence their prices significantly. Forks in the blockchain networks—such as Ethereum’s earlier split into Ether Classic—can affect demand and performance. Both assets’ prices can be influenced by speculative trading, unrelated to fundamental utility or adoption.

● Digital Assets Risk: Digital Assets like Bitcoin and Ether, designed as mediums of exchange or for utility purposes, are an emerging asset class. Operating independently of any central authority or government backing, they face extreme price volatility and regulatory scrutiny. Trading platforms for Digital Assets remain largely unregulated and prone to fraud and operational failures compared to traditional exchanges. Platform shutdowns, whether due to fraud, technical issues, or security breaches, can significantly impact prices and market stability.

● Digital Asset Markets Risk: The Digital Asset market, particularly for Bitcoin and Ether, has experienced considerable volatility, leading to market disruptions and erosion of confidence among participants. Negative publicity surrounding these disruptions could adversely affect the Fund’s reputation and share trading prices. Ongoing market turbulence could significantly impact the Fund’s value.

● Blockchain Technology Risk: Blockchain technology underpins Bitcoin, Ether, and other digital assets, yet it remains a relatively new and largely untested innovation. Competing platforms, changes in adoption rates, and technological advancements in blockchain infrastructure can affect their functionality and relevance. For Ether, the dependence on its proof-of-stake mechanism and smart contract capabilities introduces risks tied to network performance and scalability. Investments in blockchain-dependent companies or vehicles may experience market volatility and lower trading volumes. Furthermore, regulatory changes, cybersecurity incidents, and intellectual property disputes could undermine the adoption and stability of blockchain technologies.

Recent Market Events Risk. U.S. and international markets have experienced and may continue to experience significant periods of volatility in recent years and months due to a number of economic, political and global macro factors including uncertainty regarding inflation and central banks’ interest rate changes, the possibility of a national or global recession, trade tensions and tariffs, political events, war and geopolitical conflict. These developments, as well as other events, could result in further market volatility and negatively affect financial asset prices, the liquidity of certain securities and the normal operations of securities exchanges and other markets, despite government efforts to address market disruptions.

New Fund Risk. The Fund is a recently organized management investment company with no operating history. As a result, prospective investors do not have a track record or history on which to base their investment decisions.

. Lead-Lag Publishing, LLC is not an affiliate of Tidal/Toroso, Tactical Rotation Management, LLC, SYKON Asset Management, Point Bridge Capital, or ACA/Foreside.