$FMKT: Industrial Cyclicals and the Deregulation Optionality Trade

Key Highlights

Industrials have historically outperformed early in deregulation cycles, as expectations for lower compliance costs and faster permitting drive earnings re-rating before policy changes are fully implemented.

Regulatory relief creates operating leverage, particularly for industrial and mid-cap companies where compliance costs weigh more heavily on margins and capital allocation decisions.

Deregulation is often priced by markets as an option, offering asymmetric upside if policy momentum materializes while downside risk remains tied largely to the normal business cycle.

Cyclical sectors such as industrials, energy, and transportation tend to respond first, reflecting their direct exposure to permitting, environmental rules, and capital investment constraints.

The Free Markets ETF (FMKT) is designed to provide targeted exposure to companies with higher sensitivity to regulatory change, offering a way to express a deregulation theme within a diversified portfolio structure.

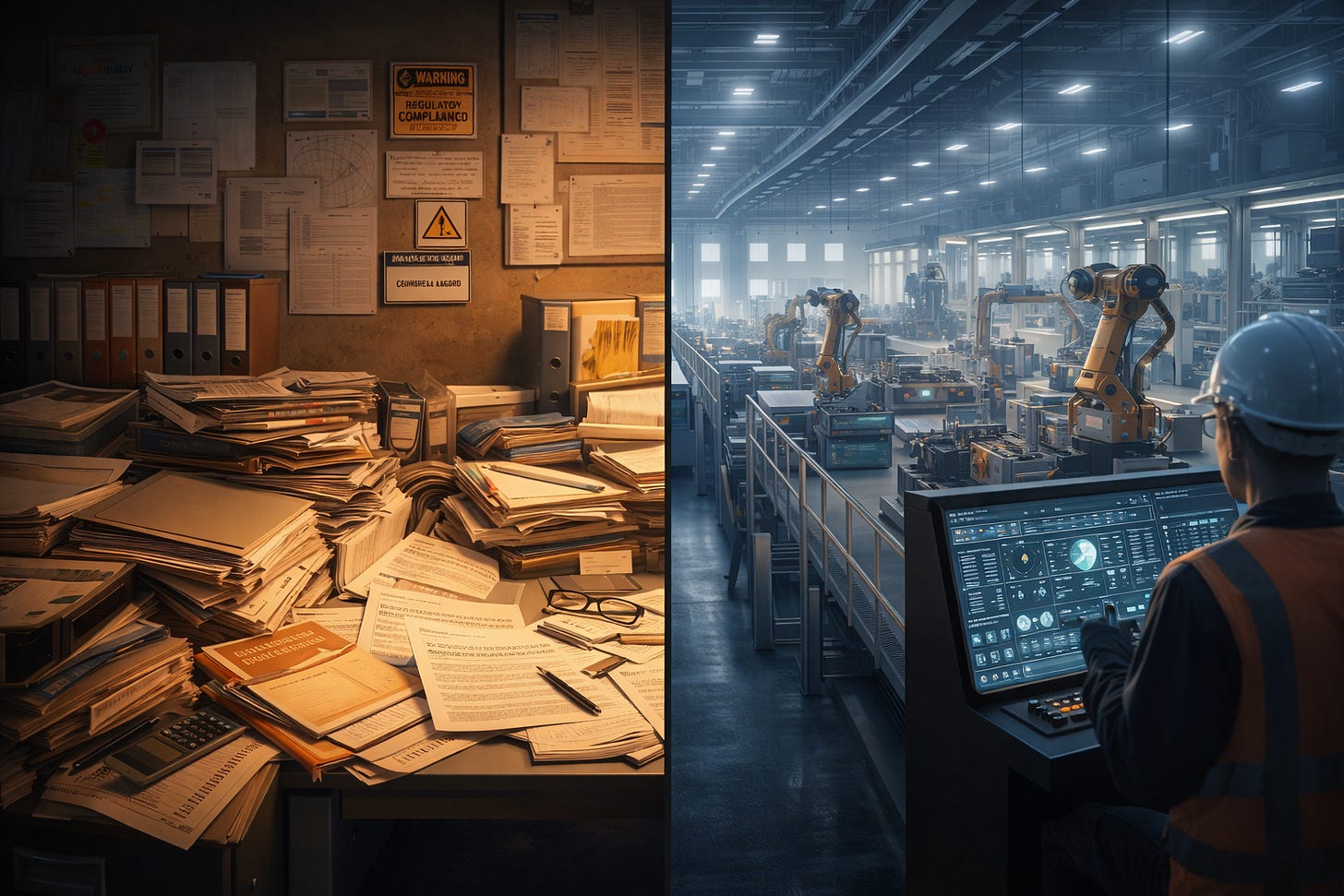

When governments begin signaling a rollback of regulation, markets tend to respond quickly, particularly in economically sensitive sectors. Industrial companies, which sit at the center of production, logistics, and capital investment, have historically been among the earliest beneficiaries. The reason is straightforward. Regulation often imposes fixed costs that weigh most heavily on businesses tied to physical assets, permitting, labor rules, and environmental compliance. When those constraints are expected to ease, investors tend to reprice the earnings power of industrial firms well before policy changes are fully implemented.¹

This pattern has repeated across multiple election cycles and policy regimes. Following U.S. elections associated with pro-growth or pro-business agendas, equity rallies have frequently been led by cyclical sectors such as industrials, energy, and small-capitalization stocks.¹² In early 2025, investors once again rotated toward cyclicals on the expectation that regulatory pressure would moderate, bidding up shares across manufacturing, transportation, and energy-linked industries.²

Mid-cap industrial companies often play a particularly important role in this dynamic. Industrials represent a much larger share of U.S. mid-cap indices than they do of the large-cap S&P 500, making that segment especially sensitive to changes in the policy environment.³ These firms are typically large enough to scale production quickly, yet small enough that compliance costs meaningfully affect margins. When regulatory friction declines, the earnings leverage can be substantial.

Why Deregulation Matters More for Industrials

The economic logic behind this relationship is rooted in operating leverage and optionality. Over time, layers of regulation accumulate costs that are not always visible in headline financial statements. Estimates suggest that U.S. businesses collectively spend trillions of dollars each year complying with federal regulations, an implicit cost borne by households and consumers as well.⁴ When even a modest portion of that burden is reduced, the impact on profitability can be significant.

Lower compliance costs free up capital for investment in equipment, hiring, and expansion. Research consistently shows that operating margins tend to improve when regulatory intensity declines, particularly in industries where compliance expenses are ongoing rather than one-time.⁵ Smaller and mid-sized firms often experience this effect more acutely, since compliance costs per employee are typically higher for them than for large multinational corporations.⁶⁷

History offers several clear examples. After the 2016 U.S. election, small-business confidence surged and manufacturing survey data rose to multi-year highs as expectations for deregulation and tax reform took hold.⁸ Markets responded well before policy outcomes were finalized. Energy producers, capital goods manufacturers, and transportation firms outperformed as investors anticipated faster permitting, lower administrative costs, and a rebound in capital spending.¹

Deregulation as an Optionality Trade

From an investment perspective, this environment creates what can be described as a deregulation optionality trade. Industrial cyclicals embed a form of asymmetric payoff. If deregulation is enacted or meaningfully pursued, earnings upside can be substantial as cost structures improve and investment accelerates. If deregulation stalls or proves less impactful, the downside is often limited to the normal ebb and flow of the business cycle rather than a structural impairment of the business.

Importantly, markets do not always fully price in this optionality. Even after elections that signal a shift toward lighter regulation, sectors expected to benefit have sometimes lagged broader indices once the initial enthusiasm fades.⁹¹⁰ That gap between expectations and realized policy outcomes can create opportunities for patient investors willing to focus on companies with the highest sensitivity to regulatory relief.

This is where targeted strategies come into play. Rather than relying on broad market exposure, some investors seek to isolate companies and sectors most exposed to changes in regulatory intensity. The Free Markets ETF (FMKT) is designed with that goal in mind, emphasizing industries such as industrials, energy, transportation, and financials that historically benefit from deregulation.¹¹ The premise is not that deregulation alone drives returns, but that regulatory relief can amplify existing competitive advantages and accelerate earnings growth when economic conditions are supportive.

In sectors like industrials, deregulation can also reshape competitive dynamics. Companies that were previously constrained by permitting delays or compliance bottlenecks may gain market share as projects move forward more quickly. Pricing power can improve as capacity utilization rises and capital investment resumes. These effects tend to emerge early in the cycle, often before macroeconomic data fully reflect the shift.¹²

Risks and Constraints

Deregulation is not a guaranteed or singular driver of returns. Policy changes take time, and political realities can dilute or delay reform. Other macro forces, including inflation, interest rates, and trade policy, can overshadow regulatory effects in the short term. Industrials remain cyclical businesses, and downturns in demand can negate cost savings if economic growth slows materially.

That said, the historical record shows that early phases of deregulation cycles have often rewarded investors who positioned ahead of confirmed policy outcomes. The benefits tend to be front-loaded as expectations reset and capital spending plans revive. For diversified portfolios, a measured allocation to industrial cyclicals can serve as a way to participate in that potential upside without relying on a single policy outcome.

Estimates of the broader economic impact underscore why investors pay attention to these signals. Analyses of prior U.S. deregulation efforts, particularly during the late 2010s, suggest meaningful contributions to economic output and business investment over time.¹³ While such estimates are inherently uncertain, they reinforce the idea that regulatory policy can influence real economic behavior, not just market sentiment.

Putting the Theme in Context

The deregulation optionality trade is ultimately about recognizing where latent demand and suppressed profitability exist. Industrial companies often operate with projects, capacity, and hiring plans that are deferred rather than canceled when regulation tightens. When those constraints ease, activity can resume quickly. Markets, anticipating that shift, tend to respond early.

For investors inclined to express a view on freer markets and pro-growth policy, industrial cyclicals remain a natural focal point. Vehicles like FMKT offer one way to concentrate exposure to sectors most likely to benefit from regulatory relief, while still operating within a diversified framework.¹¹ As with any thematic allocation, position sizing and risk management matter, particularly given the cyclical nature of the underlying businesses.

In sum, industrials have historically outperformed at the outset of deregulation cycles because they combine high regulatory sensitivity with meaningful operating leverage. That combination creates optionality that markets often reprice ahead of confirmed policy changes. If political and regulatory winds continue to shift toward lighter oversight, the theme remains relevant even as investors balance optimism with realism.

Consider FMKT. I believe in it. I wouldn’t have launched the fund if I didn’t.

Footnotes

Morningstar Indexes, “Which ‘Trump Trades’ Paid Off—and Which Ones Missed the Mark,” November 21, 2017.

Franklin Templeton, “Global Equity Pulse,” January 2025.

Franklin Templeton, “The U.S. Mid-Cap Opportunity: Looking Beyond Mega-Cap Momentum,” February 2025.

Free Markets ETF, “Fund Overview,” January 2025.

Free Markets ETF, “Investment Rationale,” January 2025.

Principal Asset Management, “Who Will Benefit from Deregulation?” October 2024.

Wellington Management, “Deregulation and the U.S. Economy,” September 2024.

Desjardins, “Will We See a Burst of Post-Election Optimism?” November 29, 2024.

Principal Asset Management, “Who Will Benefit from Deregulation?” October 2024.

Principal Asset Management, “Sector Implications of Regulatory Change,” December 2024.

Free Markets ETF, “Strategy and Sector Exposure,” January 2025.

Principal Asset Management, “Deregulation and Equity Markets,” October 2024.

Principal Asset Management, “Economic Impact of Deregulation,” October 2024.

Past performance is no guarantee of future results.

The Fund’s investment objectives, risks, charges, expenses and other information are described in the statutory or summary prospectus, which must be read and considered carefully before investing. You may download the statutory or summary prospectus or obtain a hard copy by calling 855-994-4004 or visiting www.freemarketsetf.com. Please read the Prospectuses carefully before you invest.

Investing involves risk including the possible loss of principal.

FMKT is distributed by Foreside Fund Services, LLC.

Find full holding details and learn more about FMKT at

http://www.freemarketsetf.com.

Holdings are subject to change.

Deregulation Strategy Risks.The Fund’s strategy of investing in companies that may benefit from deregulatory measures entails significant risks, including those stemming from the unpredictable nature of regulatory trends. Deregulation is influenced by political, economic, and social factors, which can shift rapidly and in unforeseen directions. Changes in government priorities, political leadership, or public sentiment may result in the reversal of existing deregulatory policies or the introduction of new regulations that could adversely affect certain industries or companies. Further, while the Fund invests in companies expected to benefit from deregulatory initiatives, not all of these companies may achieve the expected advantages, whether fully, partially, or at all. The actual impact of deregulatory measures may vary widely depending on a company’s specific operational, financial, and competitive circumstances. Companies may also face challenges adapting to new regulatory environments, or their competitive positioning may be undermined by other market factors unrelated to deregulation. These risks could negatively affect the performance of the Fund’s portfolio.

Underlying Digital Assets ETP Risks. The Fund’s investment strategy, involving indirect exposure to Bitcoin, Ether, or any other Digital Assets through one or more Underlying ETPs, is subject to the risks associated with these Digital Assets and their markets. These risks include market volatility, regulatory changes, technological uncertainties, and potential financial losses. As with all investments, there is no assurance of profit, and investors should be cognizant of these specific risks associated with digital asset markets.

● Underlying Bitcoin and Ether ETP Risks: Investing in an Underlying ETP that focuses on Bitcoin, Ether, and/or other Digital Assets, either through direct holdings or indirectly via derivatives like futures contracts, carries significant risks. These include high market volatility influenced by technological advancements, regulatory changes, and broader economic factors. For derivatives, liquidity risks and counterparty risks are substantial. Managing futures contracts tied to either asset may affect an Underlying ETP’s performance. Each Underlying ETP, and consequently the Fund, depends on blockchain technologies that present unique technological and cybersecurity risks, along with custodial challenges in securely storing digital assets. The evolving regulatory landscape further complicates compliance and valuation efforts. Additionally, risks related to market concentration, network issues, and operational complexities in managing Digital Assets can lead to losses. For Ether specifically, risks associated with its transition to a proof-of-stake consensus mechanism, including network upgrades and validator centralization, may add additional uncertainties.

●Bitcoin and Ether Investment Risk: The Fund’s indirect investments in Bitcoin and Ether through holdings in one or more Underlying ETPs expose it to the unique risks of these digital assets. Bitcoin’s price is highly volatile, driven by fluctuating network adoption, acceptance levels, and usage trends. Ether faces similar volatility, compounded by its reliance on decentralized applications (dApps) and smart contract usage, which are subject to innovation cycles and adoption rates. Neither asset operates as legal tender or within central authority systems, exposing them to potential government restrictions. Regulatory actions in various jurisdictions could negatively impact their market values. Both Bitcoin and Ether are susceptible to fraud, theft, market manipulation, and security breaches at trading platforms. Large holders of these assets (”whales”) can influence their prices significantly. Forks in the blockchain networks—such as Ethereum’s earlier split into Ether Classic—can affect demand and performance. Both assets’ prices can be influenced by speculative trading, unrelated to fundamental utility or adoption.

● Digital Assets Risk: Digital Assets like Bitcoin and Ether, designed as mediums of exchange or for utility purposes, are an emerging asset class. Operating independently of any central authority or government backing, they face extreme price volatility and regulatory scrutiny. Trading platforms for Digital Assets remain largely unregulated and prone to fraud and operational failures compared to traditional exchanges. Platform shutdowns, whether due to fraud, technical issues, or security breaches, can significantly impact prices and market stability.

● Digital Asset Markets Risk: The Digital Asset market, particularly for Bitcoin and Ether, has experienced considerable volatility, leading to market disruptions and erosion of confidence among participants. Negative publicity surrounding these disruptions could adversely affect the Fund’s reputation and share trading prices. Ongoing market turbulence could significantly impact the Fund’s value.

● Blockchain Technology Risk: Blockchain technology underpins Bitcoin, Ether, and other digital assets, yet it remains a relatively new and largely untested innovation. Competing platforms, changes in adoption rates, and technological advancements in blockchain infrastructure can affect their functionality and relevance. For Ether, the dependence on its proof-of-stake mechanism and smart contract capabilities introduces risks tied to network performance and scalability. Investments in blockchain-dependent companies or vehicles may experience market volatility and lower trading volumes. Furthermore, regulatory changes, cybersecurity incidents, and intellectual property disputes could undermine the adoption and stability of blockchain technologies.

Recent Market Events Risk. U.S. and international markets have experienced and may continue to experience significant periods of volatility in recent years and months due to a number of economic, political and global macro factors including uncertainty regarding inflation and central banks’ interest rate changes, the possibility of a national or global recession, trade tensions and tariffs, political events, war and geopolitical conflict. These developments, as well as other events, could result in further market volatility and negatively affect financial asset prices, the liquidity of certain securities and the normal operations of securities exchanges and other markets, despite government efforts to address market disruptions.

New Fund Risk. The Fund is a recently organized management investment company with no operating history. As a result, prospective investors do not have a track record or history on which to base their investment decisions.

. Lead-Lag Publishing, LLC is not an affiliate of Tidal/Toroso, Tactical Rotation Management, LLC, SYKON Asset Management, Point Bridge Capital, or ACA/Foreside.