$FMKT: Is Now the Time for Consolidation in Regulated Industries?

Key Takeaways

Washington’s post-2024 policy pivot is setting the stage for a broader deregulatory cycle, easing barriers across banking, energy, and industrial sectors.

Early signals—from FDIC merger-review rollbacks to faster energy-permit approvals—suggest conditions are forming for a potential M&A acceleration.

Investors are increasingly positioning for consolidation, as reduced regulatory friction allows companies to pursue scale, efficiency, and competitiveness more freely.

The Free Markets ETF (FMKT) provides targeted exposure to companies poised to benefit from regulatory relief, offering a single-ticker approach to this macro theme.

While the setup is constructive, investors must balance optimism with discipline, given risks tied to integration challenges, political reversals, and macroeconomic constraints.

After years of tight oversight, Washington’s pendulum is swinging back toward deregulation—and markets have noticed. The morning after the 2024 election, shares of several major asset managers rose nearly 10%, reflecting investor optimism that a lighter regulatory hand would unleash a new wave of deal-making¹. The logic is straightforward: when government barriers fall, mergers and acquisitions (M&A) tend to rise. Investors are now asking whether long-constrained industries are finally poised for a consolidation boom.

Washington’s Green Light for M&A

Early policy signals suggest deregulation is more than campaign rhetoric. By March 2025, the Federal Deposit Insurance Corporation (FDIC)—now under a Republican majority—moved to roll back a 2021 rule that had intensified scrutiny of large bank mergers³. The new standard promises quicker approvals and fewer bureaucratic hurdles, reversing what banks had criticized as an overly “opaque” process⁴.

Executives have taken notice. Warner Music Group’s chairman told CNBC he expects “a big uptick” in M&A thanks to reduced regulatory scrutiny². Stocks of companies like Kroger, Albertsons, and Cleveland-Cliffs all jumped after signals that Washington would be more receptive to domestic tie-ups⁵. Analysts at Mergermarket even predict 2025 could be “a breakout year for M&A,” particularly in sectors long shaped by regulatory uncertainty⁶.

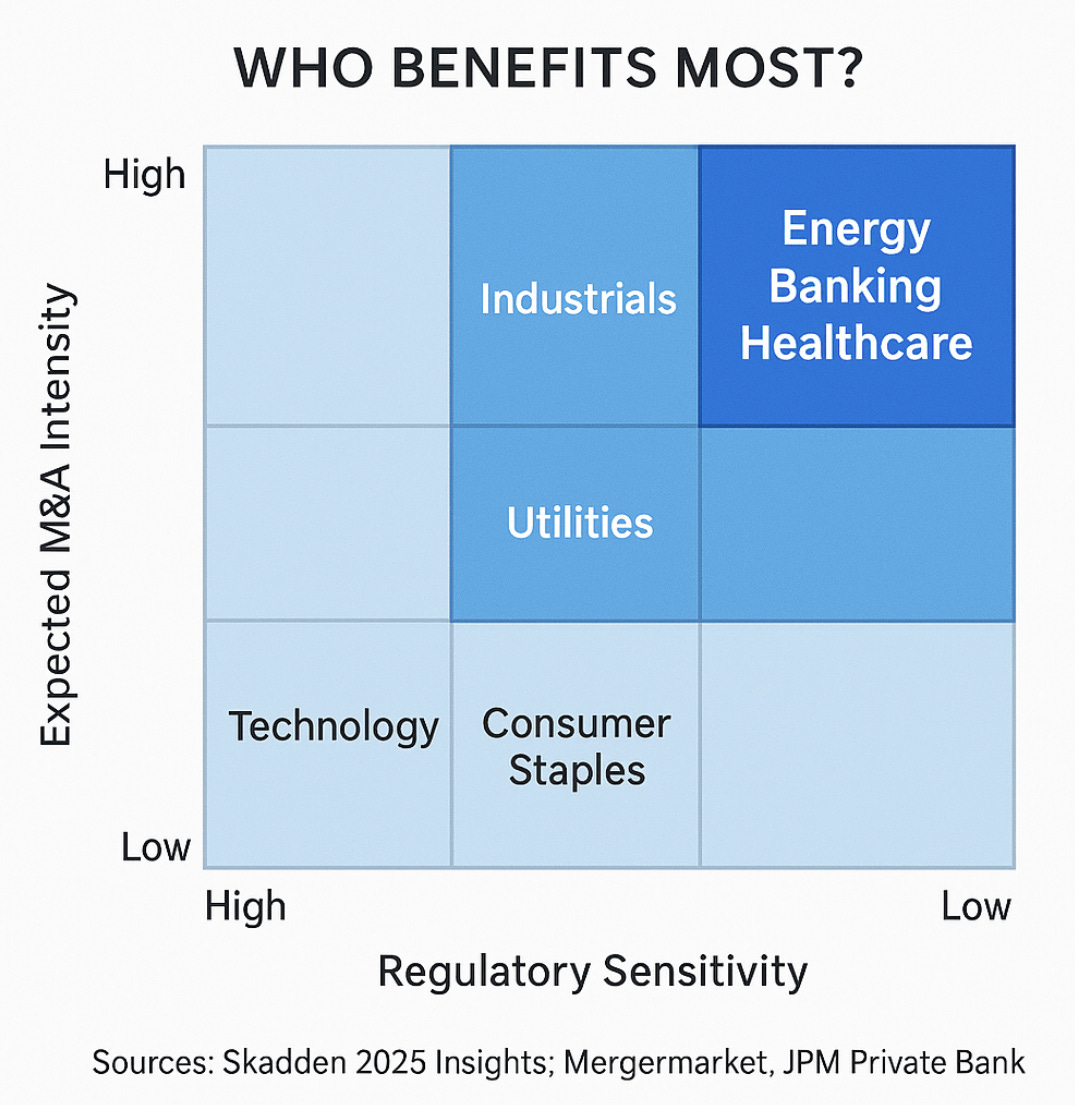

Industries Poised to Benefit

Financials lead the list. America’s largest banks currently hold an estimated $200 billion in excess capital above requirements⁷. With looser merger policies, that dry powder can fund acquisitions rather than sitting idle. For regional banks, especially those weighed down by compliance costs, consolidation offers scale advantages and operational relief. The FDIC’s shift makes such mergers more feasible.

Energy is another area where deregulation could accelerate deals. In mid-2025, the White House issued an executive order to roll back “burdensome” energy rules, while the EPA began expediting power plant permits⁸. Utilities like Southern Company—previously mired in multi-year review cycles—now see faster approvals and fewer rate-case delays⁹. This streamlining boosts not just project execution but also corporate strategy: when building and expansion become easier, consolidation can follow. Utilities, pipelines, and renewable developers may find that scale pays in both cost and influence.

Healthcare, manufacturing, and industrial firms also stand to gain. Relaxed hospital merger rules or streamlined FDA approvals could set off new deal-making. Manufacturing firms, which collectively spend billions annually on compliance, would benefit from cost savings and cross-sector synergies¹². Analysts expect deregulation to most favor energy, finance, industrials, and healthcare—industries historically slowed by regulation¹³.

Why Consolidation Appeals

The case for M&A amid deregulation rests on efficiency and competitiveness. When regulatory drag subsides, companies can merge more easily, cut redundant operations, and gain bargaining power. The T-Mobile and Sprint merger offers a case study: after clearing prolonged antitrust hurdles, the combined firm delivered lower consumer prices and stronger 5G competition⁹. In that sense, consolidation can sharpen—not dull—market rivalry.

Scale also enhances global competitiveness. A larger industrial or financial entity can absorb innovation costs and compete internationally. Deregulation effectively removes what some executives call the “merger tax” imposed by prolonged reviews¹⁶. When oversight relaxes, companies can act decisively, realizing synergies faster. That dynamic can lift corporate earnings and market valuations alike. Historically, M&A waves have coincided with bullish markets as investors anticipate value creation from consolidation¹⁷.

Risks and Realities

Still, deregulation-driven M&A carries risks. Overconsolidation may stifle competition, inviting political backlash or later re-regulation. Even pro-business administrations may intervene if mergers approach monopoly scale. Job losses following large mergers remain a social flashpoint, potentially souring public sentiment. The experience of the 2017–2018 period—when even Trump’s DOJ challenged AT&T’s merger with Time Warner—shows that political goodwill has limits¹⁸.

Economic headwinds also matter. Elevated interest rates increase financing costs, making leveraged buyouts harder to justify. Geopolitical tensions or protectionist trade policies could further restrict cross-border transactions²⁰. A deregulated landscape can encourage deal-making, but macro conditions still dictate whether buyers step up.

Investors should also temper expectations. Not every “deregulation winner” will execute effectively. Some firms may struggle to integrate acquisitions or overpay for targets. Others could face new state or international rules that offset federal relief. As The Free Markets ETF prospectus notes, “political winds can shift abruptly,” making deregulation both an opportunity and a risk¹⁰.

Positioning for Opportunity: The Free Markets ETF (FMKT)

For those looking to invest in the theme, we believe The Free Markets ETF (FMKT) offers an efficient entry point. Launched in mid-2025, FMKT holds roughly 30-50 U.S. companies across energy, healthcare, and financials—sectors where easing regulation could significantly expand margins¹¹. Its managers seek firms with high “regulatory cost sensitivity,” betting that reduced compliance burdens can help boost profitability. This approach aims to stay ahead of market reaction, identifying where relief is material rather than theoretical. While active management introduces costs and execution risk, FMKT gives investors a single-ticker exposure to a structural shift in U.S. policy.

Conclusion – Balancing Optimism with Discipline

Deregulation has historically acted as a growth lever during late-cycle phases, when fiscal and monetary tools are exhausted. Today’s policy environment resembles prior periods of unleashed capital formation—from the 1980s financial boom to the late-1990s merger wave. With regulators stepping back, pent-up consolidation may finally unfold across banking, energy, and healthcare.

Yet prudence remains essential. The same freedom that accelerates M&A can also breed excess. Investors should track tangible policy actions, monitor interest rates, and maintain diversified exposure. For those seeking targeted participation, FMKT provides a disciplined way to engage the theme without trying to pick individual winners.

Being bullish on deregulation doesn’t mean betting blindly. It means recognizing how shifting rules alter corporate behavior and market structure—and positioning intelligently for that change. If policy momentum continues, 2025–2026 could mark the start of a significant U.S. consolidation cycle. For investors, that makes understanding deregulation not just a political interest, but an actionable investment thesis.

Footnotes

¹ Sean Craig, “Trump’s Deregulation Promises Could Spell M&A Glory, Or Not,” The Daily Upside, November 6, 2024.

² Thomas W. Greenberg et al., “Resilient Economy and Promises of Lessened Regulation, Lower Taxes Raise Hopes for a Surge in M&A,” Skadden 2025 Insights, January 14, 2025.

³ Pete Schroeder, “FDIC Moves to Roll Back Merger Policy That Scrutinized Larger Deals,” Reuters, March 4, 2025.

⁴ Ibid.

⁵ The Daily Upside, “Trump’s Deregulation Promises Could Spell M&A Glory, Or Not.”

⁶ Lucinda Guthrie, “2025 Outlook: Breakout Year for M&A,” Mergermarket Report, April 2025.

⁷ J.P. Morgan Private Bank, “Get Ready: Bank Deregulation Now Has Washington’s Support,” November 2018 (archived).

⁸ Michael A. Gayed, “$FMKT: How Deregulation Could Supercharge Southern Company,” The Lead-Lag Report, October 16, 2025.

⁹ Will Hansen, “Deregulation and the Future of M&A,” Wesleyan Business Review, May 14, 2025.

¹⁰ The Free Markets ETF (FMKT) Summary Prospectus, 2025.

¹¹ DJ Shaw, “New ETF Targets Companies Poised for Deregulation Relief,” ETF.com, June 11, 2025.

²⁶ Tidal Investments LLC, “Launches The Free Markets ETF (FMKT), First-of-Its-Kind Fund Targeting Companies Benefiting from Deregulation,” Business Wire, June 10, 2025.

Past performance is no guarantee of future results.

The Fund’s investment objectives, risks, charges, expenses and other information are described in the statutory or summary prospectus, which must be read and considered carefully before investing. You may download the statutory or summary prospectus or obtain a hard copy by calling 855-994-4004 or visiting www.freemarketsetf.com. Please read the Prospectuses carefully before you invest.

Investing involves risk including the possible loss of principal.

FMKT is distributed by Foreside Fund Services, LLC.

Find full holding details and learn more about FMKT at

http://www.freemarketsetf.com.

Holdings are subject to change.

Deregulation Strategy Risks.The Fund’s strategy of investing in companies that may benefit from deregulatory measures entails significant risks, including those stemming from the unpredictable nature of regulatory trends. Deregulation is influenced by political, economic, and social factors, which can shift rapidly and in unforeseen directions. Changes in government priorities, political leadership, or public sentiment may result in the reversal of existing deregulatory policies or the introduction of new regulations that could adversely affect certain industries or companies. Further, while the Fund invests in companies expected to benefit from deregulatory initiatives, not all of these companies may achieve the expected advantages, whether fully, partially, or at all. The actual impact of deregulatory measures may vary widely depending on a company’s specific operational, financial, and competitive circumstances. Companies may also face challenges adapting to new regulatory environments, or their competitive positioning may be undermined by other market factors unrelated to deregulation. These risks could negatively affect the performance of the Fund’s portfolio.

Underlying Digital Assets ETP Risks. The Fund’s investment strategy, involving indirect exposure to Bitcoin, Ether, or any other Digital Assets through one or more Underlying ETPs, is subject to the risks associated with these Digital Assets and their markets. These risks include market volatility, regulatory changes, technological uncertainties, and potential financial losses. As with all investments, there is no assurance of profit, and investors should be cognizant of these specific risks associated with digital asset markets.

● Underlying Bitcoin and Ether ETP Risks: Investing in an Underlying ETP that focuses on Bitcoin, Ether, and/or other Digital Assets, either through direct holdings or indirectly via derivatives like futures contracts, carries significant risks. These include high market volatility influenced by technological advancements, regulatory changes, and broader economic factors. For derivatives, liquidity risks and counterparty risks are substantial. Managing futures contracts tied to either asset may affect an Underlying ETP’s performance. Each Underlying ETP, and consequently the Fund, depends on blockchain technologies that present unique technological and cybersecurity risks, along with custodial challenges in securely storing digital assets. The evolving regulatory landscape further complicates compliance and valuation efforts. Additionally, risks related to market concentration, network issues, and operational complexities in managing Digital Assets can lead to losses. For Ether specifically, risks associated with its transition to a proof-of-stake consensus mechanism, including network upgrades and validator centralization, may add additional uncertainties.

●Bitcoin and Ether Investment Risk: The Fund’s indirect investments in Bitcoin and Ether through holdings in one or more Underlying ETPs expose it to the unique risks of these digital assets. Bitcoin’s price is highly volatile, driven by fluctuating network adoption, acceptance levels, and usage trends. Ether faces similar volatility, compounded by its reliance on decentralized applications (dApps) and smart contract usage, which are subject to innovation cycles and adoption rates. Neither asset operates as legal tender or within central authority systems, exposing them to potential government restrictions. Regulatory actions in various jurisdictions could negatively impact their market values. Both Bitcoin and Ether are susceptible to fraud, theft, market manipulation, and security breaches at trading platforms. Large holders of these assets (”whales”) can influence their prices significantly. Forks in the blockchain networks—such as Ethereum’s earlier split into Ether Classic—can affect demand and performance. Both assets’ prices can be influenced by speculative trading, unrelated to fundamental utility or adoption.

● Digital Assets Risk: Digital Assets like Bitcoin and Ether, designed as mediums of exchange or for utility purposes, are an emerging asset class. Operating independently of any central authority or government backing, they face extreme price volatility and regulatory scrutiny. Trading platforms for Digital Assets remain largely unregulated and prone to fraud and operational failures compared to traditional exchanges. Platform shutdowns, whether due to fraud, technical issues, or security breaches, can significantly impact prices and market stability.

● Digital Asset Markets Risk: The Digital Asset market, particularly for Bitcoin and Ether, has experienced considerable volatility, leading to market disruptions and erosion of confidence among participants. Negative publicity surrounding these disruptions could adversely affect the Fund’s reputation and share trading prices. Ongoing market turbulence could significantly impact the Fund’s value.

● Blockchain Technology Risk: Blockchain technology underpins Bitcoin, Ether, and other digital assets, yet it remains a relatively new and largely untested innovation. Competing platforms, changes in adoption rates, and technological advancements in blockchain infrastructure can affect their functionality and relevance. For Ether, the dependence on its proof-of-stake mechanism and smart contract capabilities introduces risks tied to network performance and scalability. Investments in blockchain-dependent companies or vehicles may experience market volatility and lower trading volumes. Furthermore, regulatory changes, cybersecurity incidents, and intellectual property disputes could undermine the adoption and stability of blockchain technologies.

Recent Market Events Risk. U.S. and international markets have experienced and may continue to experience significant periods of volatility in recent years and months due to a number of economic, political and global macro factors including uncertainty regarding inflation and central banks’ interest rate changes, the possibility of a national or global recession, trade tensions and tariffs, political events, war and geopolitical conflict. These developments, as well as other events, could result in further market volatility and negatively affect financial asset prices, the liquidity of certain securities and the normal operations of securities exchanges and other markets, despite government efforts to address market disruptions.

New Fund Risk. The Fund is a recently organized management investment company with no operating history. As a result, prospective investors do not have a track record or history on which to base their investment decisions.

. Lead-Lag Publishing, LLC is not an affiliate of Tidal/Toroso, Tactical Rotation Management, LLC, SYKON Asset Management, Point Bridge Capital, or ACA/Foreside.