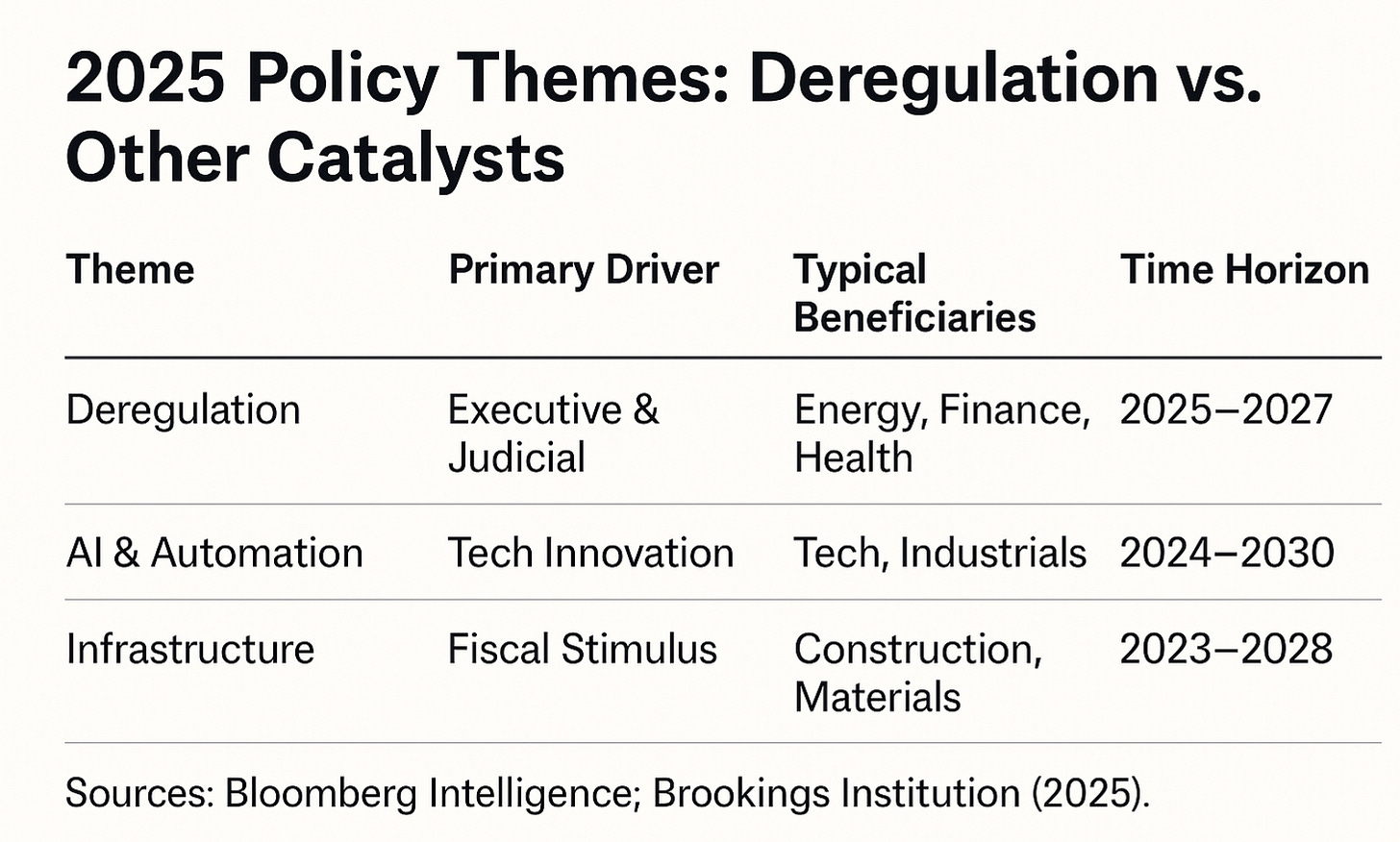

$FMKT: What 2025 Deregulation Signals Tell Us About 2026 and Beyond

In early 2025, Washington reversed course after years of expanding regulation. The White House’s new executive order—dubbed the “10-for-1 Rule”—requires agencies to repeal ten regulations for every new one introduced¹. The intent is explicit: shrink the regulatory state and drive compliance costs below zero². For businesses, that means leaner oversight; for investors, it raises a crucial question: how do you position for a freer-market economy?

A New Deregulatory Regime

The 2025 campaign is not symbolic. The “10-for-1” rule, titled Unleashing Prosperity Through Deregulation, forces agencies to remove deeply entrenched rules before proposing new ones¹³. The design is self-limiting—finding ten offsets for each new rule slows the regulatory churn, which policymakers consider a virtue. From the Oval Office’s perspective, restraint is the goal, not a side effect.

Adding to this is a system of regulatory cost caps. Beginning in fiscal 2026, each agency will receive a regulatory budget—an annual ceiling on the aggregate cost of its rules⁴⁵. Any proposal that exceeds that threshold will be rejected by the Office of Management and Budget. The near-term target is even stricter: all new rules in FY 2025 must collectively reduce total compliance costs². Considering that regulations have been estimated to cost U.S. businesses roughly $2.1 trillion a year⁶, even a modest cut could have material economic impact.

The Environmental Protection Agency offered the most visible early example. In March 2025, it unveiled thirty-one deregulatory actions billed as the largest rollback in its history, with projected savings “in the trillions”⁷⁸. Whether that projection proves accurate, the message is unmistakable: regulators are in retreat, and capital formation is being prioritized over compliance expansion.

Structural Shifts Behind the Headlines

The shift goes deeper than headline policy. The “10-for-1” mechanism alone discourages new rulemaking; identifying ten repeals is nearly as complex as drafting one regulation⁹. Agencies now weigh whether pursuing new standards is worth the administrative effort. That calculus is already visible: the Securities and Exchange Commission paused its long-awaited climate-disclosure rule, signaling a recognition that the winds have changed¹⁰.

Judicial dynamics reinforce this restraint. A series of Supreme Court rulings in 2024–2025, including a landmark decision curbing the Chevron deference doctrine, made it easier to challenge broad agency action¹⁰. Regulations that once passed untested now face closer scrutiny unless Congress has granted explicit authority. The Congressional Review Act further empowers legislators to overturn rules on an expedited basis. Together, these forces—executive, judicial, and legislative—have tilted the balance toward regulatory rollback.

For companies, that environment offers both opportunity and obligation. Lower compliance costs and faster approvals can lift profits, but firms must remain nimble; a new administration or court interpretation could quickly shift the landscape. As one analyst observed, deregulation can feel like “borrowing from the future”—a near-term stimulus that may carry long-term risk¹¹.

History underscores that cyclical pattern. Airline and trucking deregulation in the late 1970s ignited competition and innovation¹². The deregulatory waves of the 1980s and late 2010s spurred bursts of investment and market performance¹³. Yet each cycle eventually yielded to re-regulation when excesses appeared. The lesson: capitalize on the tailwinds, but prepare for the next turn.

Sector Implications

Energy has emerged as the leading beneficiary. The Bureau of Land Management is fast-tracking mining and drilling approvals, cutting multi-year reviews to months¹⁴. Oil, gas, and infrastructure projects once mired in environmental red tape are proceeding apace. In Finance, regulators are easing select Dodd-Frank-era capital and reporting constraints, encouraging lending while maintaining core safeguards¹⁰. Healthcare and pharmaceutical firms anticipate quicker FDA timelines and simplified billing. Transportation and labor-intensive industries welcome greater flexibility in staffing rules. Even technology companies—especially in artificial intelligence—are finding regulators more consultative than punitive¹⁰.

These shifts collectively signal a new business climate: one where “permissionless” growth again becomes the default posture. Still, investors must remember that freer entry can heighten competition; deregulation expands opportunity but also raises the bar for efficiency.

Positioning for a Freer Market

For investors, the 2025-26 deregulation wave presents a broad thematic play. Reduced compliance costs can translate into higher margins, faster expansion, and re-rated valuations in affected sectors. Energy and Industrials stand to gain from accelerated projects; Financials and Healthcare from lighter administrative burdens; and Tech from regulatory patience toward emerging fields.

A practical expression of that thesis arrived with The Free Markets ETF (FMKT), launched in 2025 to capture companies poised to benefit from regulatory relief¹⁵. The fund’s strategy identifies U.S. firms with measurable “deregulation upside,” blending policy analysis with conventional financial screening¹⁶. Holdings span financial services, energy, healthcare, technology, and transportation—industries where reduced oversight could materially enhance profitability⁶. The ETF format also offers diversification across multiple beneficiaries rather than concentrating risk in any single firm.

The logic is straightforward: when the cost of compliance falls, productive capital can redeploy toward innovation, expansion, and shareholder returns. Prior episodes suggest this can be powerful. Small-cap and energy stocks notably surged after deregulatory measures in 2017-2018¹³. FMKT extends that logic to today’s environment, positioning investors for similar potential tailwinds.

Weighing the Risks

Still, optimism must be tempered. Politics is cyclical; a shift in Congress or the 2028 presidential race could slow or reverse the rollback. Over-aggressive deregulation in banking or environmental policy might invite future crises. FINRA guidelines rightly emphasize balanced presentation—acknowledging that while the macro trajectory favors freer markets, outcomes are never assured.

Economic crosscurrents also matter. If growth falters or global shocks tighten financial conditions, even deregulation beneficiaries could see volatility. The prudent approach is to treat deregulation as a structural tailwind, not a guarantee. As with any policy trend, the possible benefits accrue unevenly and evolve over time.

Outlook: Riding the Next Wave

Looking into 2026 and beyond, the structural implications of 2025’s initiatives are clear. The combination of the “10-for-1” rule and regulatory cost caps represents a durable recalibration of government scope²⁴⁵. Court precedents reinforce the trend, effectively raising the bar for new rulemaking¹⁰. That suggests a multi-year window in which business dynamism could strengthen and compliance headwinds recede.

For companies, this is a chance to reallocate resources from paperwork to productivity. For investors, it is an opportunity to align portfolios with sectors positioned to gain from regulatory relief. Being bullish on deregulation does not mean embracing recklessness—it means recognizing that policy friction is easing and growth optionality expanding.

After years of accumulating red tape, the thaw has begun. Those who understand the signals of 2025—and act before the next wave fully crests—may find themselves surfing ahead of the pack.

Footnotes

Scott Abeles, “10-for-1 Rule: EO Mandates Agencies Repeal 10 Regulations for Every New One,” Carlton Fields – JDSupra, Feb 12 2025.

Executive Order 14192 – Unleashing Prosperity Through Deregulation, Jan 31 2025.

Ibid.

FinregE, “Inside the U.S. Deregulation Agenda: What Does It Mean for Firms?”, Oct 28 2025.

Office of Management and Budget Guidance on Regulatory Cost Caps, FY 2026.

Wayne Crews, “Ten Thousand Commandments 2023,” Competitive Enterprise Institute.

“EPA Announces 31 Sweeping Regulatory Reforms,” McGuireWoods Legal Alert, Mar 13 2025.

Ibid.

JDSupra, op. cit.

FinregE, op. cit.

FinregE, op. cit.

Reason Magazine, “Regulations’ Enormous Costs Give DOGE an Enormous Opportunity,” Dec 19 2024.

Advisorpedia, “Before the Calm: Why This Market Storm Could Change Everything,” Mar 25 2025.

“BLM Rushes Review of Jindalee Lithium Project,” MiningConnection News, Mar 31 2025.

Free Markets ETF (FMKT) – Fund Website, 2025.

Ibid.

Past performance is no guarantee of future results.

The Fund’s investment objectives, risks, charges, expenses and other information are described in the statutory or summary prospectus, which must be read and considered carefully before investing. You may download the statutory or summary prospectus or obtain a hard copy by calling 855-994-4004 or visiting www.freemarketsetf.com. Please read the Prospectuses carefully before you invest.

Investing involves risk including the possible loss of principal.

FMKT is distributed by Foreside Fund Services, LLC.

Find full holding details and learn more about FMKT at

http://www.freemarketsetf.com.

Holdings are subject to change.

Deregulation Strategy Risks.The Fund’s strategy of investing in companies that may benefit from deregulatory measures entails significant risks, including those stemming from the unpredictable nature of regulatory trends. Deregulation is influenced by political, economic, and social factors, which can shift rapidly and in unforeseen directions. Changes in government priorities, political leadership, or public sentiment may result in the reversal of existing deregulatory policies or the introduction of new regulations that could adversely affect certain industries or companies. Further, while the Fund invests in companies expected to benefit from deregulatory initiatives, not all of these companies may achieve the expected advantages, whether fully, partially, or at all. The actual impact of deregulatory measures may vary widely depending on a company’s specific operational, financial, and competitive circumstances. Companies may also face challenges adapting to new regulatory environments, or their competitive positioning may be undermined by other market factors unrelated to deregulation. These risks could negatively affect the performance of the Fund’s portfolio.

Underlying Digital Assets ETP Risks. The Fund’s investment strategy, involving indirect exposure to Bitcoin, Ether, or any other Digital Assets through one or more Underlying ETPs, is subject to the risks associated with these Digital Assets and their markets. These risks include market volatility, regulatory changes, technological uncertainties, and potential financial losses. As with all investments, there is no assurance of profit, and investors should be cognizant of these specific risks associated with digital asset markets.

● Underlying Bitcoin and Ether ETP Risks: Investing in an Underlying ETP that focuses on Bitcoin, Ether, and/or other Digital Assets, either through direct holdings or indirectly via derivatives like futures contracts, carries significant risks. These include high market volatility influenced by technological advancements, regulatory changes, and broader economic factors. For derivatives, liquidity risks and counterparty risks are substantial. Managing futures contracts tied to either asset may affect an Underlying ETP’s performance. Each Underlying ETP, and consequently the Fund, depends on blockchain technologies that present unique technological and cybersecurity risks, along with custodial challenges in securely storing digital assets. The evolving regulatory landscape further complicates compliance and valuation efforts. Additionally, risks related to market concentration, network issues, and operational complexities in managing Digital Assets can lead to losses. For Ether specifically, risks associated with its transition to a proof-of-stake consensus mechanism, including network upgrades and validator centralization, may add additional uncertainties.

●Bitcoin and Ether Investment Risk: The Fund’s indirect investments in Bitcoin and Ether through holdings in one or more Underlying ETPs expose it to the unique risks of these digital assets. Bitcoin’s price is highly volatile, driven by fluctuating network adoption, acceptance levels, and usage trends. Ether faces similar volatility, compounded by its reliance on decentralized applications (dApps) and smart contract usage, which are subject to innovation cycles and adoption rates. Neither asset operates as legal tender or within central authority systems, exposing them to potential government restrictions. Regulatory actions in various jurisdictions could negatively impact their market values. Both Bitcoin and Ether are susceptible to fraud, theft, market manipulation, and security breaches at trading platforms. Large holders of these assets (”whales”) can influence their prices significantly. Forks in the blockchain networks—such as Ethereum’s earlier split into Ether Classic—can affect demand and performance. Both assets’ prices can be influenced by speculative trading, unrelated to fundamental utility or adoption.

● Digital Assets Risk: Digital Assets like Bitcoin and Ether, designed as mediums of exchange or for utility purposes, are an emerging asset class. Operating independently of any central authority or government backing, they face extreme price volatility and regulatory scrutiny. Trading platforms for Digital Assets remain largely unregulated and prone to fraud and operational failures compared to traditional exchanges. Platform shutdowns, whether due to fraud, technical issues, or security breaches, can significantly impact prices and market stability.

● Digital Asset Markets Risk: The Digital Asset market, particularly for Bitcoin and Ether, has experienced considerable volatility, leading to market disruptions and erosion of confidence among participants. Negative publicity surrounding these disruptions could adversely affect the Fund’s reputation and share trading prices. Ongoing market turbulence could significantly impact the Fund’s value.

● Blockchain Technology Risk: Blockchain technology underpins Bitcoin, Ether, and other digital assets, yet it remains a relatively new and largely untested innovation. Competing platforms, changes in adoption rates, and technological advancements in blockchain infrastructure can affect their functionality and relevance. For Ether, the dependence on its proof-of-stake mechanism and smart contract capabilities introduces risks tied to network performance and scalability. Investments in blockchain-dependent companies or vehicles may experience market volatility and lower trading volumes. Furthermore, regulatory changes, cybersecurity incidents, and intellectual property disputes could undermine the adoption and stability of blockchain technologies.

Recent Market Events Risk. U.S. and international markets have experienced and may continue to experience significant periods of volatility in recent years and months due to a number of economic, political and global macro factors including uncertainty regarding inflation and central banks’ interest rate changes, the possibility of a national or global recession, trade tensions and tariffs, political events, war and geopolitical conflict. These developments, as well as other events, could result in further market volatility and negatively affect financial asset prices, the liquidity of certain securities and the normal operations of securities exchanges and other markets, despite government efforts to address market disruptions.

New Fund Risk. The Fund is a recently organized management investment company with no operating history. As a result, prospective investors do not have a track record or history on which to base their investment decisions.

. Lead-Lag Publishing, LLC is not an affiliate of Tidal/Toroso, Tactical Rotation Management, LLC, SYKON Asset Management, Point Bridge Capital, or ACA/Foreside.