Food Inflation Could Be A Strong Signal For Where The Bond Market Heads Next

Fasting Solves This

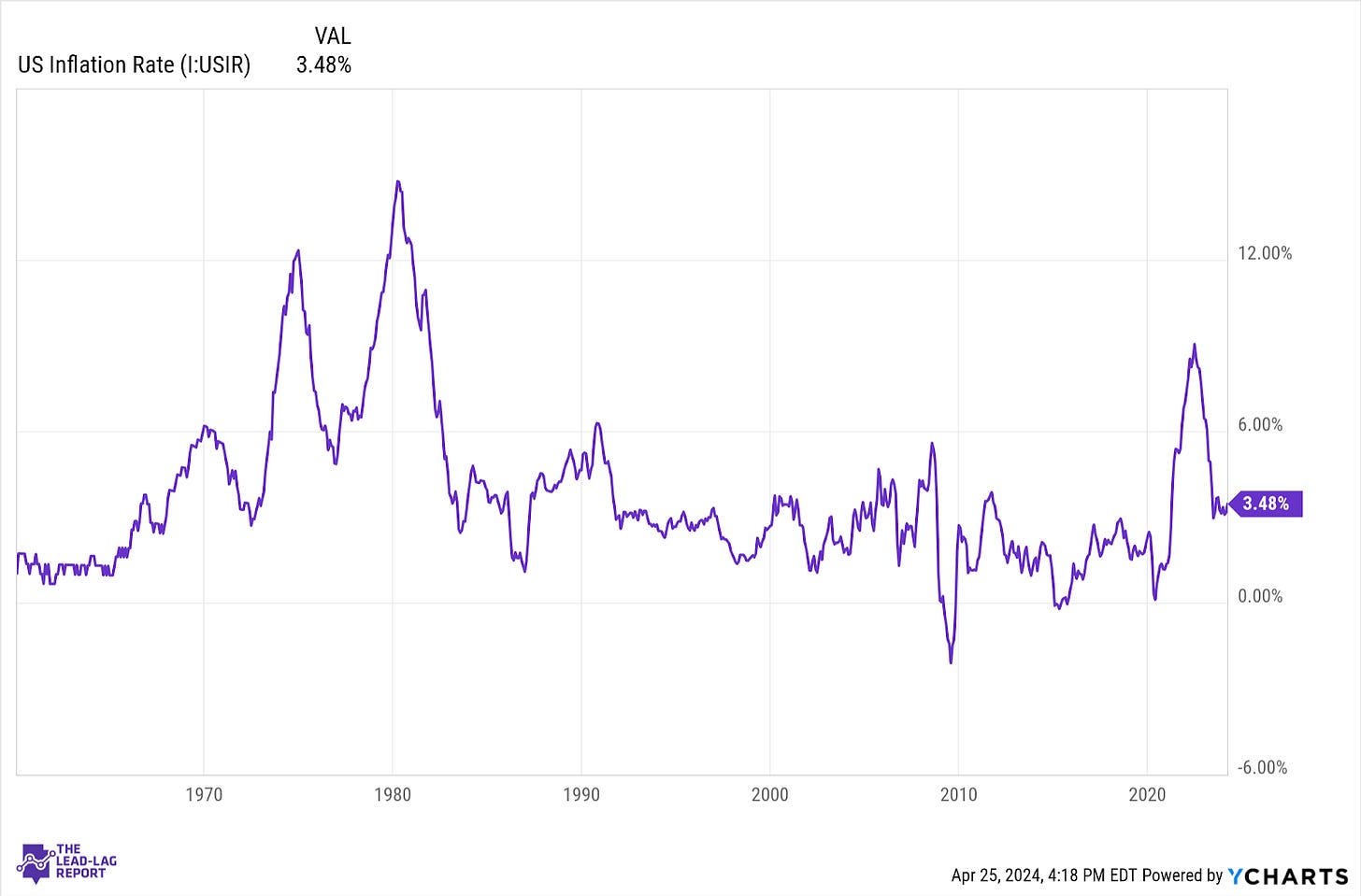

I want to make one thing abundantly clear if it isn’t already. Inflation is a problem. Some folks over the past year pointed out the double inflation peak of the 1970s as a potential blueprint for what could happen again this time around, but most people believed that the Fed’s aggressive rate hiking cycle and disinflationary trend would hold and get the U.S. back to the 2% target.

Now, we may be in the early stages of seeing that come to fruition.

Obviously, we’re probably not getting back to double digit inflation again, but the disinflationary trend appears to be over. Core inflation is ticking higher again. The PCE inflation number released this past week shows the Fed’s favorite measure coming in way above expectations. The events in both the Gaza region and the Red Sea are keeping the pressure on oil prices to remain higher for longer. The main measures of inflation in the U.S. at least seem to be stuck in the 3-4% range and there’s no immediate indication that they’re coming back down soon.

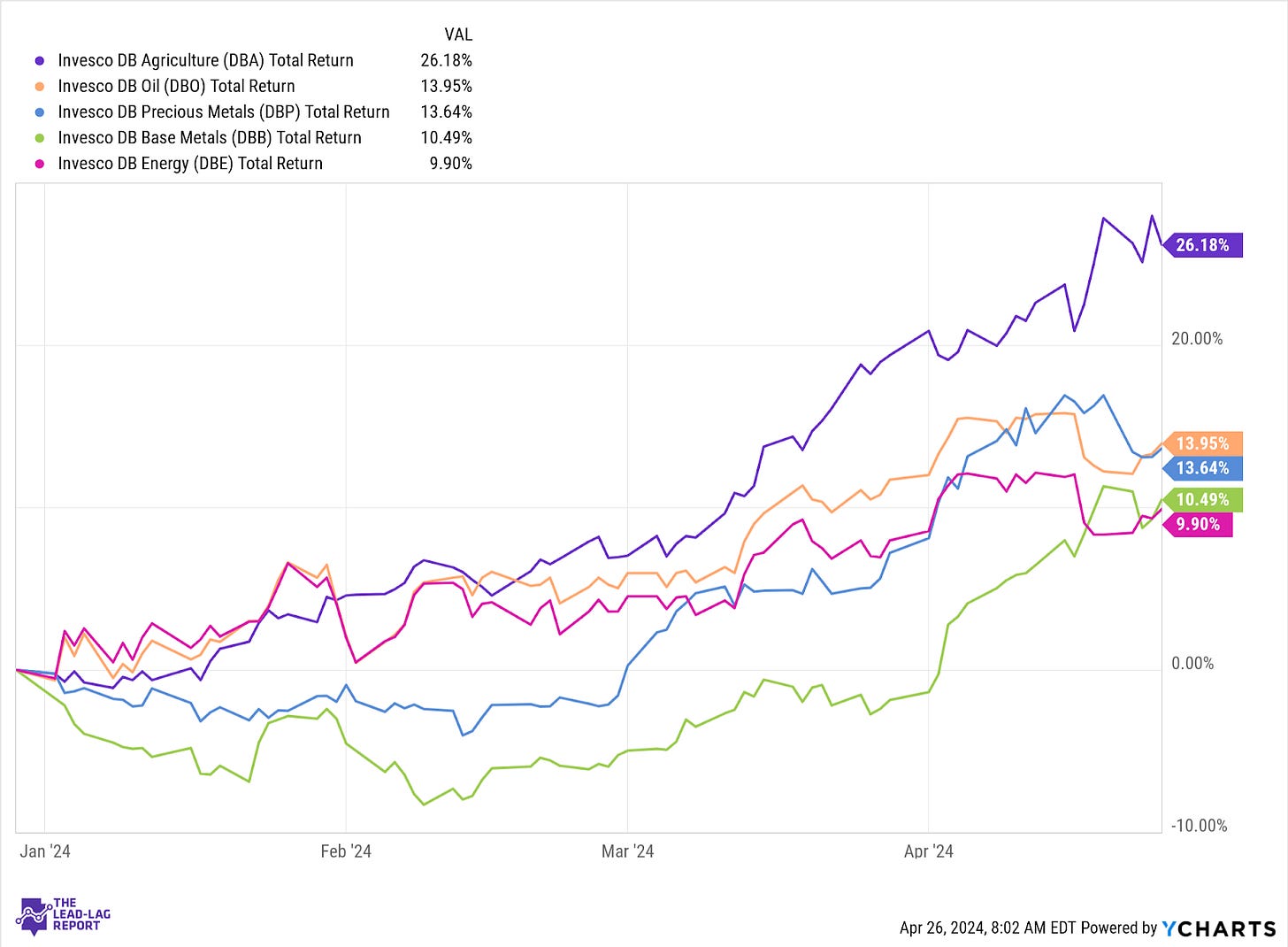

While most of the market’s attention is focused on metals and oil and industrial goods, there's an area that’s contributing just as much to the problem - agricultural commodities.

Of all of the major commodity baskets, it’s seen the biggest year-to-date increases, doubling the next closest baskets - oil and precious metals.

This is a problem for obvious reasons. Food is one of the biggest components of the typical household’s monthly budget. If the prices for things, such as corn, wheat, sugar, cocoa, coffee and meat, rise significantly and quickly, that puts a real financial strain on a large class of people. With the costs of many core materials that go into goods & products going higher, that increases inflation and, by extension, what the Fed might need to do in order to rein inflation back in.