Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: THE OBLIGATORY BOUNCE BEFORE THE CREDIT EVENT

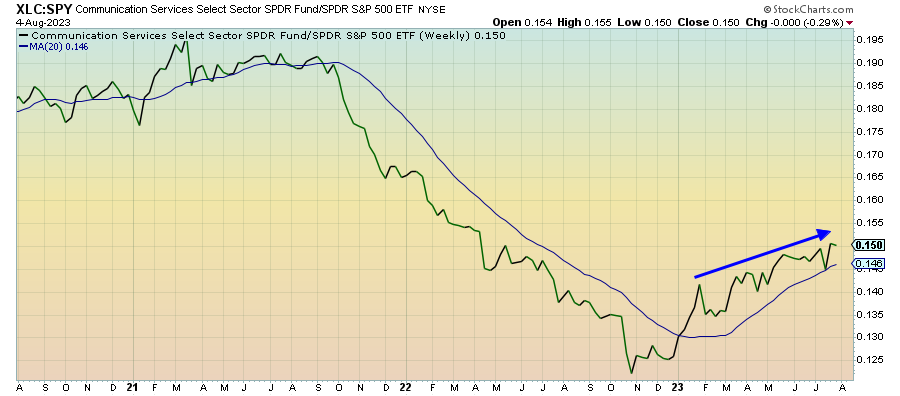

Communication Services (XLC) – A Matter Of Time

Growth and high beta stocks have begun underperforming again, but this sector is still holding up here. The mega-cap growth trade is already unwinding and it may just be a matter of time before it drags this top-heavy sector down with it. The telecoms within this group could hold up comparatively well should the Fitch downgrade or the yen carry trade depress sentiment further, but the overall growth tilt would very likely win out.

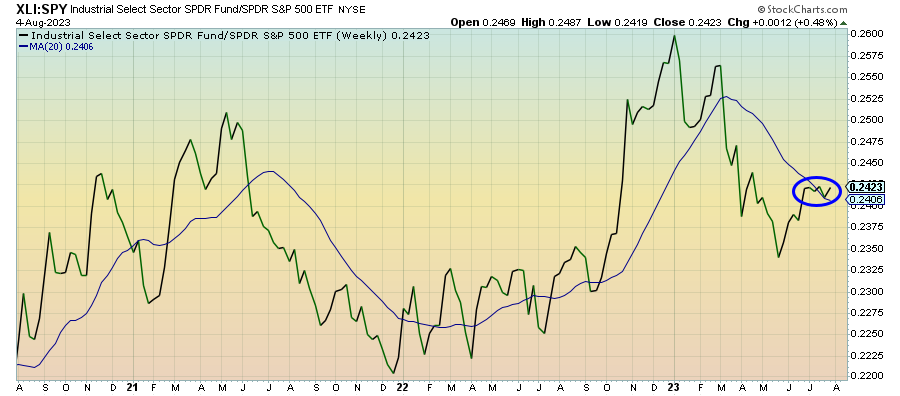

Industrials (XLI) – An Interest Rate Play

Cyclicals have been leading the market over the past month, but the biggest gains have begun moving beyond just industrials and towards previous laggards, financials and energy. The move higher in yields over the past week could trigger a move away from interest rate sensitive sectors and cyclicals and other more defensive plays, an event which would likely give industrials another lift.

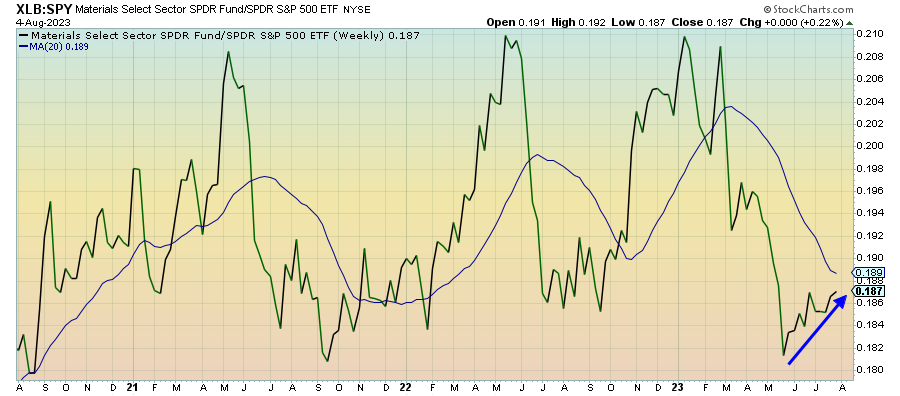

Materials (XLB) – Bearish Long-Term View

Materials stocks continue to outperform here as they have consistently since early this summer as the resilient U.S. economy gives new strength to cyclical investments. The backdrop, however, is still mixed. Even though manufacturing is starting to pick up a little bit, industrial metal prices look weak and lumber prices have declined rapidly, indicating a potentially more long-term bearish view.