The closing stretch of 2025 has been defined by record equity prices, broadening market participation, and an easing inflation backdrop that few anticipated a year ago. Central banks across developed markets have either paused or begun reversing tightening cycles, while investors have embraced a risk-on posture that has pushed valuations higher and volatility lower. The result has been a year of exceptional asset-price performance, paired with growing debate about how durable these conditions may be as 2026 approaches.

U.S. Macro and Markets

U.S. equities ended the year at fresh highs, with the S&P 500 and Dow Jones Industrial Average both closing at records after gaining solidly in 2025. The Federal Reserve cut rates for a third consecutive meeting in December, lowering the policy range to 3.50–3.75 percent. The decision exposed growing internal divisions, with dissenters split between holding rates steady and pushing for a larger cut. Chair Powell acknowledged the tension between moderating inflation and a labor market that is beginning to soften.¹

Inflation data supported the Fed’s more cautious tone. November consumer prices rose at a slower pace, while unemployment edged higher. Treasury markets responded with a notable decline in short-term yields and a re-steepening of the yield curve as two-year yields fell below long-term rates.² This shift has been interpreted less as a recession signal and more as confirmation that the peak in monetary restriction is likely behind us.

Equities embraced that interpretation. The Nasdaq outperformed on enthusiasm around artificial intelligence and continued earnings resilience among mega-cap firms, while broader benchmarks posted their third consecutive annual gain. Investor confidence has been reinforced by the absence of a clear recession despite aggressive tightening earlier in the cycle. At the same time, the combination of easing policy and still-elevated valuations has narrowed the margin for error going forward.³

Sector and Style Rotation

While mega-cap growth dominated much of the year, the final quarter saw a meaningful broadening of leadership. Small-cap stocks broke out to new highs after years of underperformance, aided by falling borrowing costs and renewed interest in domestically oriented businesses. Cyclical sectors such as industrials and regional banks benefited from this shift, while value-oriented names narrowed the performance gap with growth.⁴

Sector leadership also diversified. Technology and communication services remained strong beneficiaries of the AI cycle, while financials delivered outsized gains as credit conditions improved and the yield curve steepened. Materials stocks advanced sharply on the back of soaring precious-metal prices, while energy lagged as oil prices declined over the year. Defensive sectors such as utilities underperformed amid persistent risk appetite.⁵

This late-year rotation suggests investors are increasingly looking beyond a narrow set of winners. Whether it marks a durable change in leadership or simply a year-end adjustment remains an open question as markets enter 2026.

Developed Markets

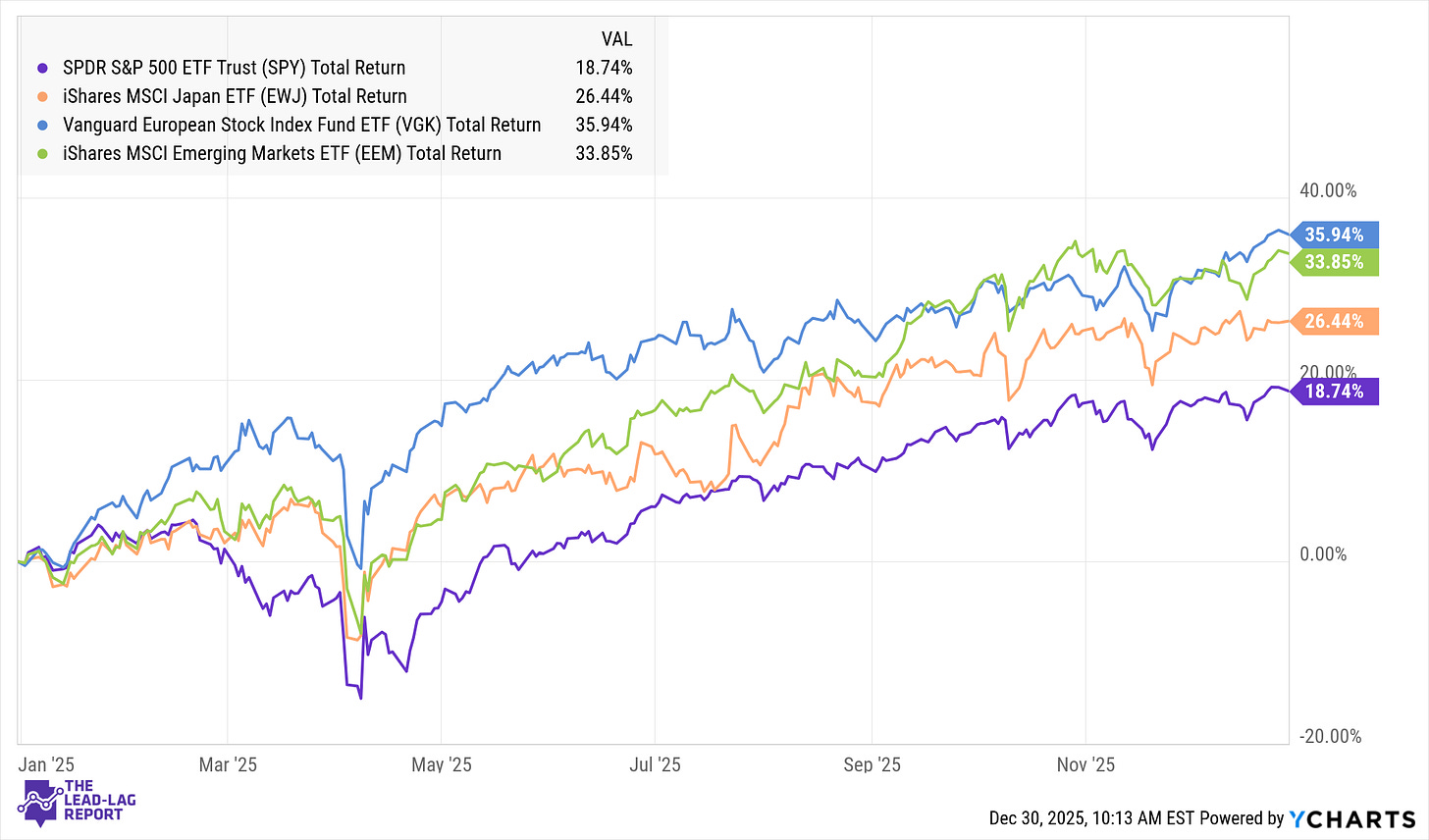

Outside the United States, developed markets also posted robust gains. In Europe, the European Central Bank held rates steady in December after earlier cuts, citing improved growth resilience and inflation near its target. Officials emphasized uncertainty around services inflation and geopolitics, signaling a prolonged pause rather than a rapid return to easing. European equity markets responded favorably, with major indices hovering near record levels.⁶

The United Kingdom followed a similar path. The Bank of England cut rates again in December as inflation cooled, though policymakers warned that price pressures are likely to remain above target for some time. Despite these constraints, UK equities rallied strongly, supported by global risk appetite and rebounds in financial and commodity-linked stocks.⁷

Japan marked one of the most significant policy shifts of the year. The Bank of Japan raised rates again in December, continuing its gradual exit from decades of ultra-loose policy. Officials debated the need for further hikes to contain inflation and support the yen, which remained weak despite tighter policy. Japanese equities surged to multi-decade highs, driven by earnings growth, shareholder reforms, and renewed global interest in the market.⁸

Emerging Markets

Emerging markets presented a more mixed picture. China’s economy slowed into year-end as industrial output and retail sales weakened, reflecting persistent property-sector stress and soft domestic demand. Policymakers signaled a preference for targeted fiscal measures and structural reform rather than large-scale stimulus, even as trade surpluses hit record levels. Chinese equities rallied in the second half on policy optimism, but investor confidence remains fragile.⁹

India stood out as a relative bright spot. Inflation fell sharply, giving the Reserve Bank of India room to cut rates multiple times during the year. Domestic demand remained resilient, and growth expectations were revised higher. Equity markets reached record levels, though gains moderated toward year-end amid global capital flows.¹⁰

Latin America reflected divergent paths. Brazil’s central bank held rates at elevated levels to anchor inflation expectations despite slowing growth, while Mexico and Chile continued easing cycles as inflation cooled. Across emerging markets, a weaker U.S. dollar and global disinflation provided support, even as commodity price volatility created uneven outcomes.¹¹

Currencies and Cross-Market Signals

Currency markets reinforced the year’s broader themes. The U.S. dollar suffered its worst annual decline in years as interest-rate differentials narrowed and investors rotated away from dollar-centric trades. Most major currencies appreciated, led by the euro and Swiss franc, while the yen lagged amid cautious Bank of Japan tightening.¹²