Global Utilities Present An Intriguing Income Play For This Market

And Now For Something Different

Every week, we’ll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

With the equities markets pivoting more defensive in the United States, the focus moves squarely back towards utilities. It certainly helps in this environment that consumer staples, healthcare, value, low volatility, Treasuries and gold are all doing relatively well, but it’s utilities which research has shown often acts as the measuring stick for market sentiment. If utilities are outperforming for an extended stretch, as they have been over the past couple months, it’s often a sign of an imminent market shift to risk-off investing.

That’s why I want to take a look at the Gabelli Global Utility & Income Trust (GLU). Not only does it focus heavily on utilities and telecommunication stocks, it also includes a heavy dose of international stocks, an area of the market that’s been on a strong run over the past two months. If the U.S. economy is slowing down as multiple recent datasets suggest might be happening, this could be an ideal place to look for bargains.

Fund Background

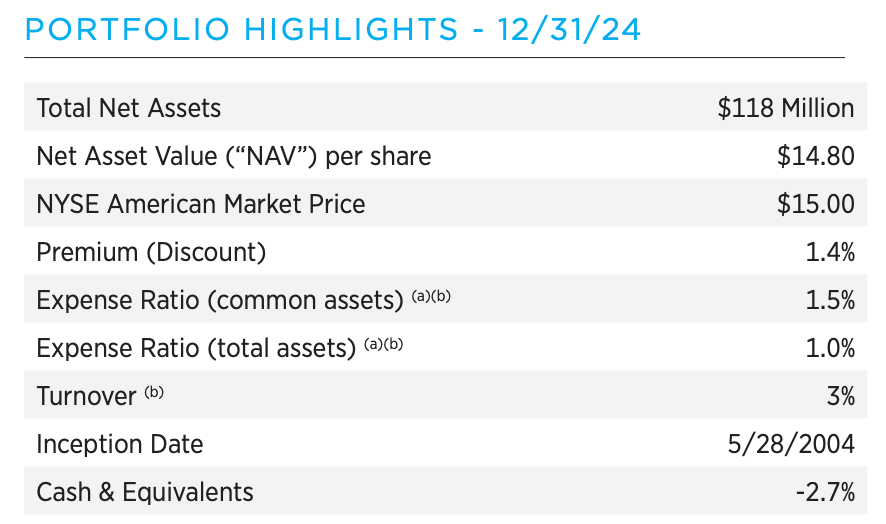

GLU is a non-diversified, closed-end fund whose investment objective is to seek a consistent level of after-tax total return for its investors with an emphasis on tax-advantaged dividend income. It typically invests in equity and income producing securities of global companies involved in the utilities industry and other industries that are expected to pay dividends periodically. The fund also utilizes leverage in order to enhance yield and total return potential.

It’s important to note that this isn’t a pure utilities fund. It also invests in “income-producing securities”, which could literally be from any sector (although it focuses on utilities and telecoms). The fund’s 25% use of leverage is high, but not that high, and is enough to boost the yield into the 7-8% range. The one thing that stands out to me is the 3% annual turnover. That means, in essence, that you’re paying active management fees for an index fund. This is one of the things I hate about funds like this - premium fees for little to no activity.

About 40% of the fund is in the top two categories, although you can see plenty of adjacent groups all throughout this sector list. The inclusion of things, such as financial services and food & beverage companies also near the top make sense because many of them are steady income producers and keep with the more defensive theme. This fund is spread fairly evenly between large-, mid- and small-cap companies, adding an additional layer of risk. It also has about 60% invested in North America, 34% in Europe and 6% in Asia Pacific.

Among the top holdings, you’ve got some traditional American names, such as American Electric Power and Portland General Electric, along with a number of international names. Most of the biggest names are focused on utilities and telecoms with no particular idiosyncratic risk that’s obvious.

GLU was launched in May 2004. Since its inception, the fund has returned a total of 216%, which translates to just under 6% annually.

This return isn’t bad considering that the market largely favored U.S. large-cap growth throughout the past two decades. The fund debuted just before the financial crisis, which damaged total returns early out of the gate, but the fact that the fund rode out this period and the COVID pandemic, yet has seen relatively little deterioration in its NAV, is a positive in terms of distribution sustainability and long-term growth.

Despite the use of leverage, GLU isn’t substantially more volatile than the U.S. utilities sector. That’s not a perfect comp, especially given that GLU is 40% international, but in a lot of cases we see leverage really ramp up volatility regardless of what the underlying fund is invested in. This is a positive in terms of having a better shot of matching the index’s risk-adjusted returns, but GLU still trails this ETF and a global utilities index by a fairly wide margin over the past decade.