Global X MLP & Energy Income ETF (MLPA): Income From the Backbone of America’s Energy System

Key Highlights

Pipeline and midstream assets generate fee-based cash flows largely independent of commodity price swings

Record U.S. oil and gas production has reinforced the strategic importance of existing energy infrastructure

MLPA offers diversified exposure to major midstream MLPs while simplifying tax considerations for investors

Structural barriers to new pipeline construction enhance the long-term value of incumbent assets

The strategy carries risks tied to regulation, interest rates, and long-term energy demand trends

Every time energy is consumed, whether filling a gas tank or heating a home, an unseen network of pipelines is at work. These systems form the circulatory system of the U.S. energy economy, transporting oil, natural gas, and refined products across vast distances. While rarely discussed outside industry circles, this infrastructure generates consistent, contract-driven cash flows by charging fees based on volume rather than price. In an environment marked by elevated interest rates and heightened market uncertainty, those characteristics have renewed relevance.¹

The Global X MLP & Energy Income ETF (MLPA) provides access to this overlooked corner of the market by bundling major midstream Master Limited Partnerships into a single vehicle. Rather than chasing growth narratives or commodity price forecasts, the fund focuses on assets whose value is rooted in throughput, contracts, and scale. As U.S. energy production has reached record levels, these pipelines have remained indispensable.²

High Rates, Skepticism, and the Case for Midstream Stability

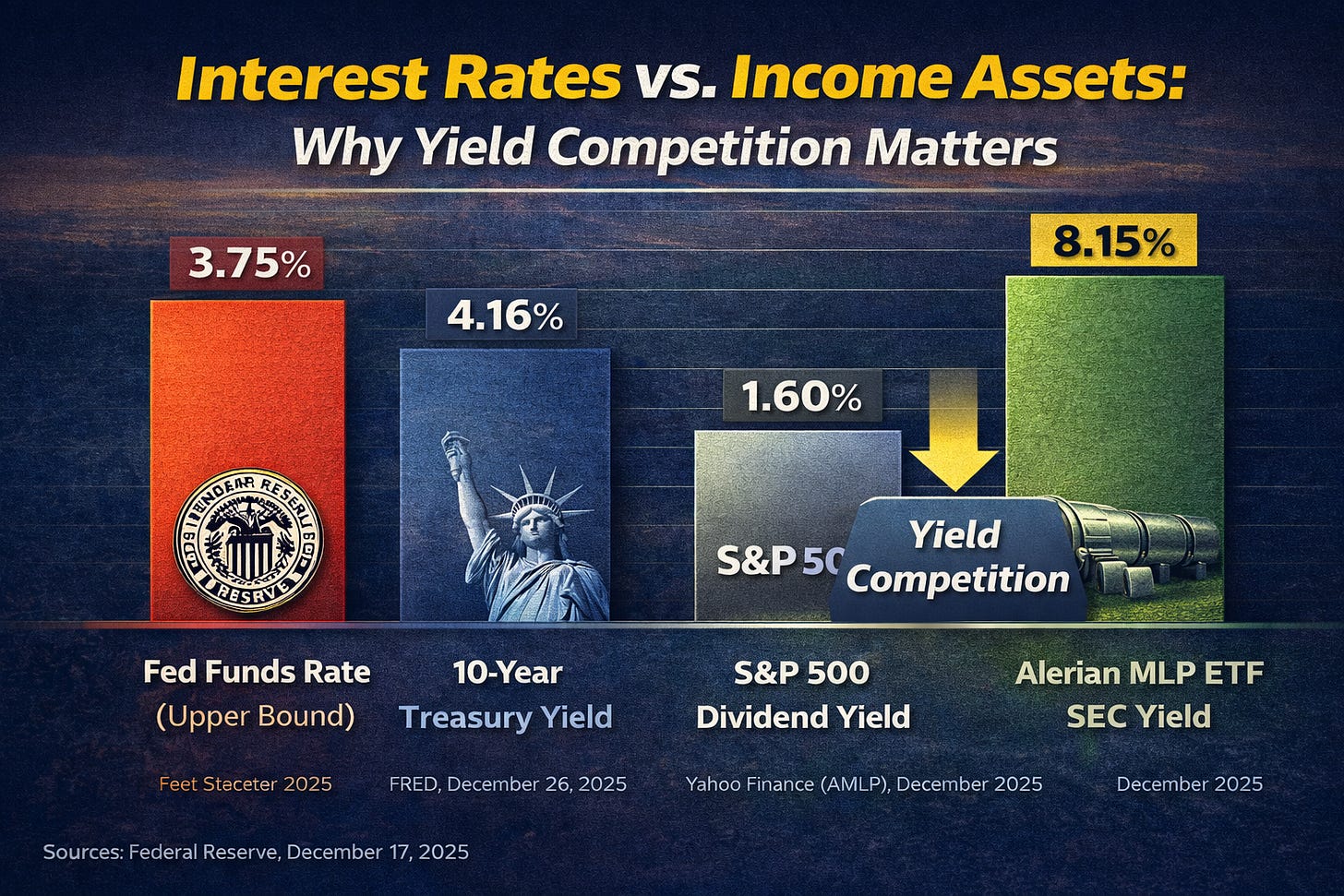

The past several years have been challenging for income-oriented investors. Benchmark interest rates climbed to levels not seen in more than a decade, fundamentally reshaping the opportunity set for yield.³ When Treasury securities and money-market funds began offering meaningful income, traditionally defensive equity sectors such as utilities and real estate investment trusts lost some of their relative appeal. Any equity-based strategy offering materially higher income was met with skepticism.

Midstream energy infrastructure occupies a distinct position in this landscape. Unlike upstream producers or refiners, pipeline operators are not primarily exposed to commodity prices. Their revenues are generated through long-term agreements that charge for transportation, storage, and processing. As long as energy volumes continue to move through the system, cash flows remain comparatively stable. That distinction matters.

During periods of commodity volatility driven by geopolitical events or production decisions, midstream operators have historically demonstrated resilience. Contracts often include minimum volume commitments and inflation-linked escalators, which help stabilize revenue even when market conditions fluctuate. In recent years, this model has allowed pipeline-focused assets to weather turbulence more effectively than other segments of the energy sector.

Record U.S. oil and natural gas output has further reinforced the relevance of these assets. Production growth increases throughput across existing networks, benefiting operators without requiring additional capital investment.² For income-focused investors wary of relying solely on fixed income in an inflation-sensitive environment, midstream infrastructure offers an alternative source of cash flow tied to real economic activity rather than monetary policy alone.

How MLPA Works: Toll Roads, Not Commodity Bets

MLPA holds a portfolio of large, established midstream MLPs that own pipelines, storage facilities, and processing infrastructure critical to the energy supply chain. These partnerships are structured to distribute the majority of their available cash to investors while avoiding corporate-level income taxation.⁴ In many ways, the structure resembles real estate investment trusts, substituting energy infrastructure for property assets.