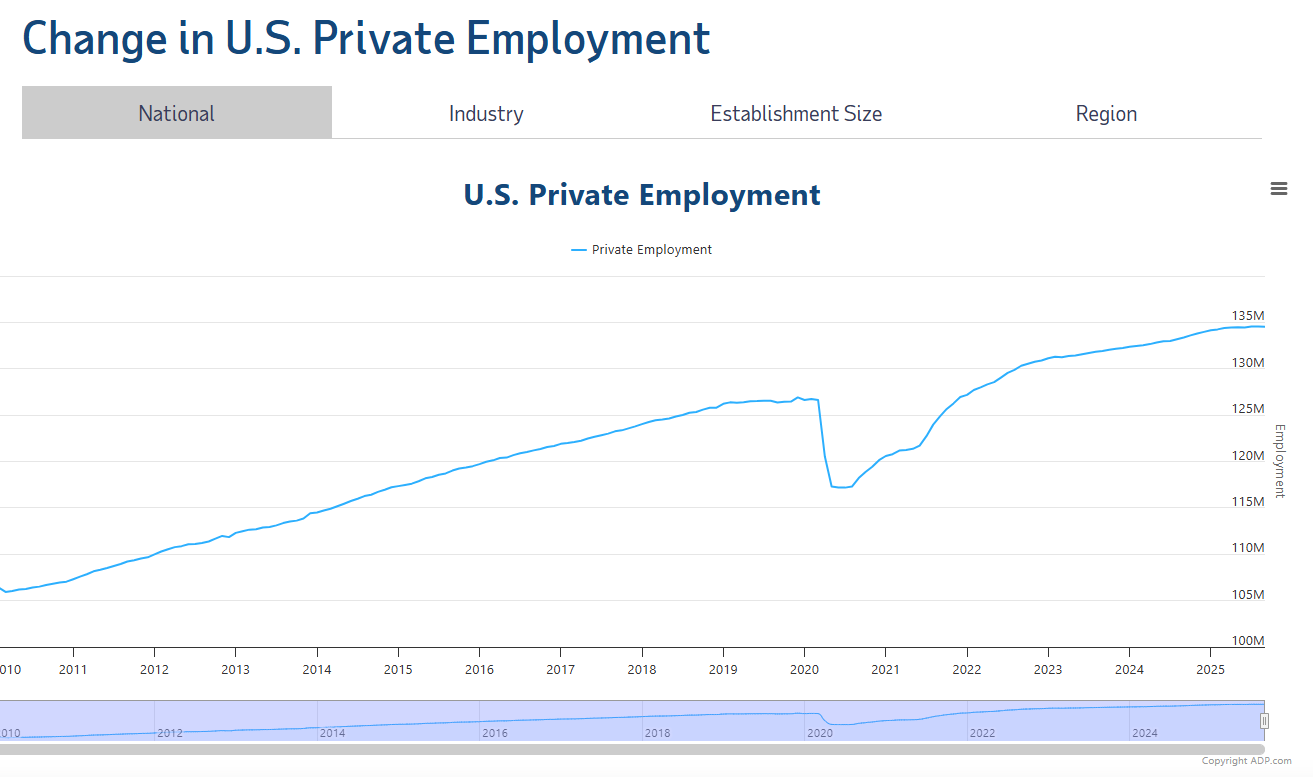

Economic data were muted by the partial government shutdown, but enough leaked to shape markets. Private payrolls (ADP) unexpectedly fell by 31,000 in September, far below forecasts, and consumer confidence slid to a five-month low¹. The labor market remains historically tight (U-3 unemployment ~4.3%) but hiring has clearly slowed. Federal Reserve speakers struck a dovish tone: Powell said the economy may be on a “firmer trajectory than expected,” but with hiring and inflation roughly unchanged since September, Fed policy will be decided on a meeting-by-meeting basis². Governor Bowman signaled as many as two more cuts this year, expecting softer data to permit easing³.

Yields fell modestly and the curve steepened on these “Fed can cut” bets. The 10-year Treasury yield dipped toward 4.1% by Friday, roughly 6 basis points lower on the week⁴. Investment-grade spreads remained near multi-year lows. Tech megacaps led the advance (with chip and software firms surging on AI news), but even small-caps rallied after weak ADP data added to the “bad is good” narrative. Healthcare and pharma stocks jumped ~7% on a U.S.-Pfizer drug pricing deal easing tariff threats⁵. Investor sentiment remains complacent – the VIX is very low – reflecting confidence that policy easing lies ahead.

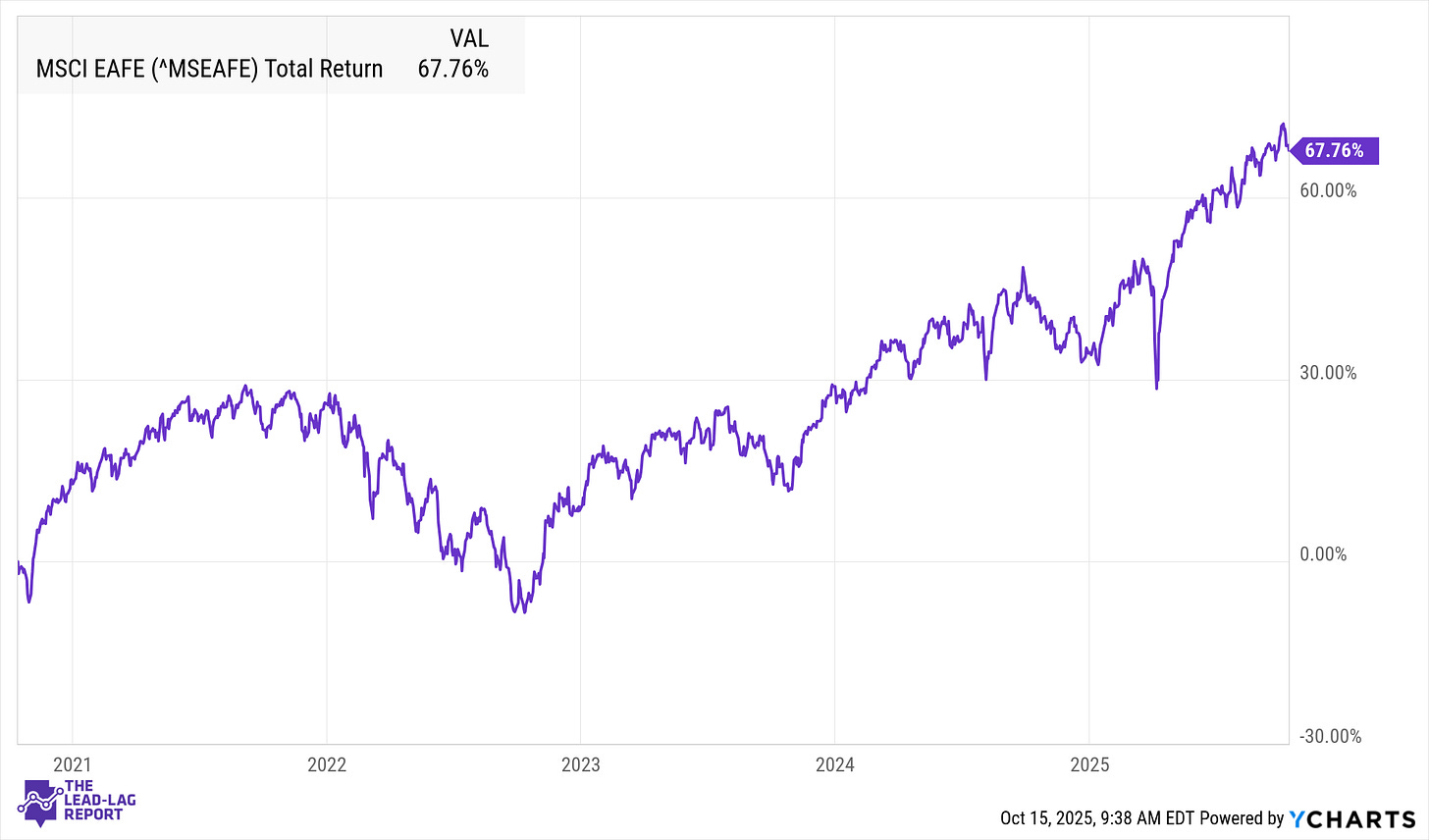

International Developed Markets

Global central banks mostly stayed on hold. In Europe, the ECB reiterated that policy is “sufficiently restrictive” with inflation near target (2.2–2.3%)⁶. Minutes highlighted that German industry is stalled and U.S. trade tensions are pressuring exports, but with core inflation entrenched, the ECB maintained its policy stance. Markets now expect no rate cuts this year; analysts see easing only if growth slows sharply.