Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: IF THE S&P 500 IS AT A RECORD HIGH, WHY ARE HALF OF THE SECTORS STILL IN CORRECTION?

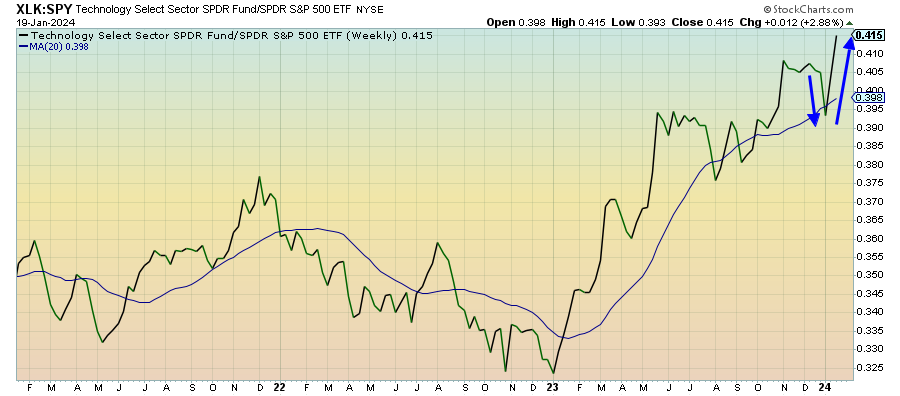

Technology (XLK) – Falling Back Into Old Habits

And just like that, tech stocks’ relative performance is back at new highs after looking quite vulnerable just a few weeks ago. Unfortunately for the market, it’s the only sector setting new highs here. This is very reminiscent of what we saw throughout 2023 and the continued lack of market breadth suggests that 1) other sectors, such as small-caps, are demonstrating the real risks of this economy and 2) investors realize that they overdid it on rate cut hopium and are now falling back into old habits.

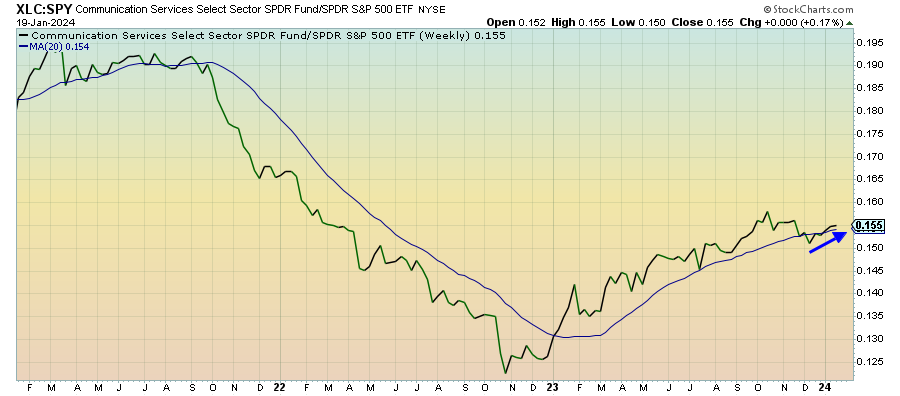

Communication Services (XLC) – Actually Looking Quite Weak

This sector has slowly and steadily been outperforming the S&P 500, but that’s all thanks to the power of Facebook and Alphabet. If you look at the equal weight version of this sector relative to the S&P 500, it’s been steadily underperforming further and further for more than a year. The “magnificent 7” exposure will inextricably link this sector to tech, but it’s actually looking quite weak here.

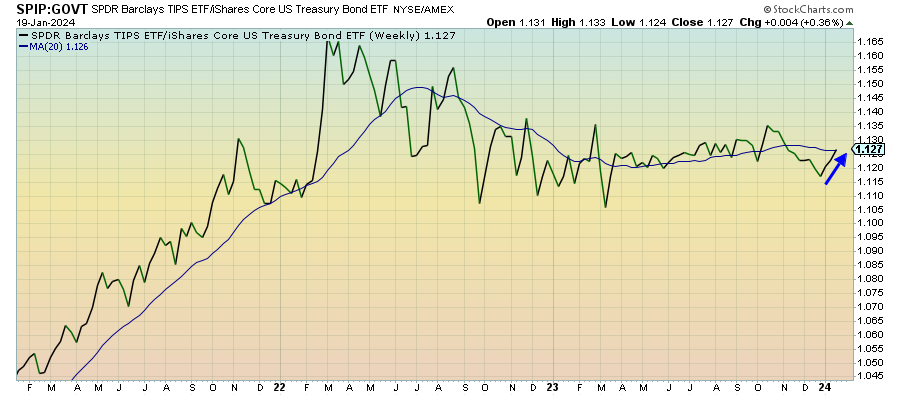

Treasury Inflation Protected Securities (SPIP) – Risk Is Far From Over

It’s interesting that the interest in TIPS is starting to pick up here despite the outward appearance of confidence from investors that inflation is trending back to the Fed’s 2% target. In reality, core inflation is still running at a short-term annualized 3-4% rate and we have no idea when it’s going to sustainably decrease. The decline in rental rate growth will help, but we’re far from out of the woods on this yet.

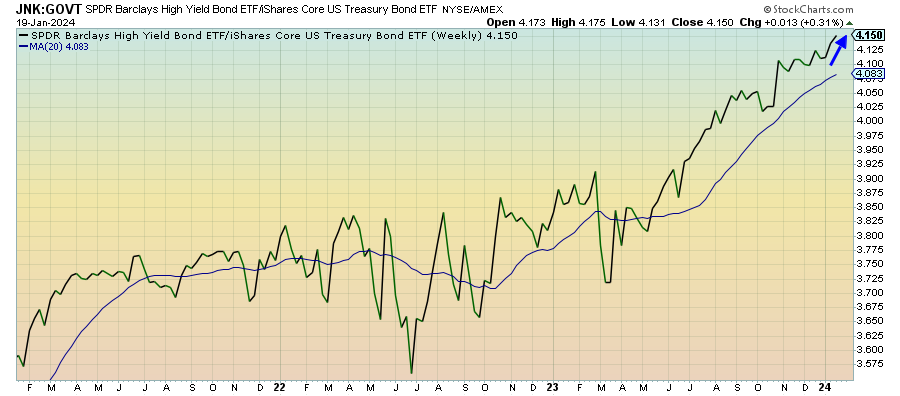

Junk Debt (JNK) – The Time Is Still Coming

As long as investors are confident the economy is growing, consumers are spending and unemployment is low, there may be little motivation for junk bonds to pull back in the near-term. Credit spreads are still near two-year lows and there’s little indication of concerns about credit quality. I’m not sure that’s the right take on the situation since the upcoming refinance boom is going to expose a lot of companies and their real financial situations.

Emerging Markets Debt (EMB) – Global Credit Event Is Still Coming