Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: IT’S MAGNIFICENT 7 DOMINANCE ALL OVER AGAIN

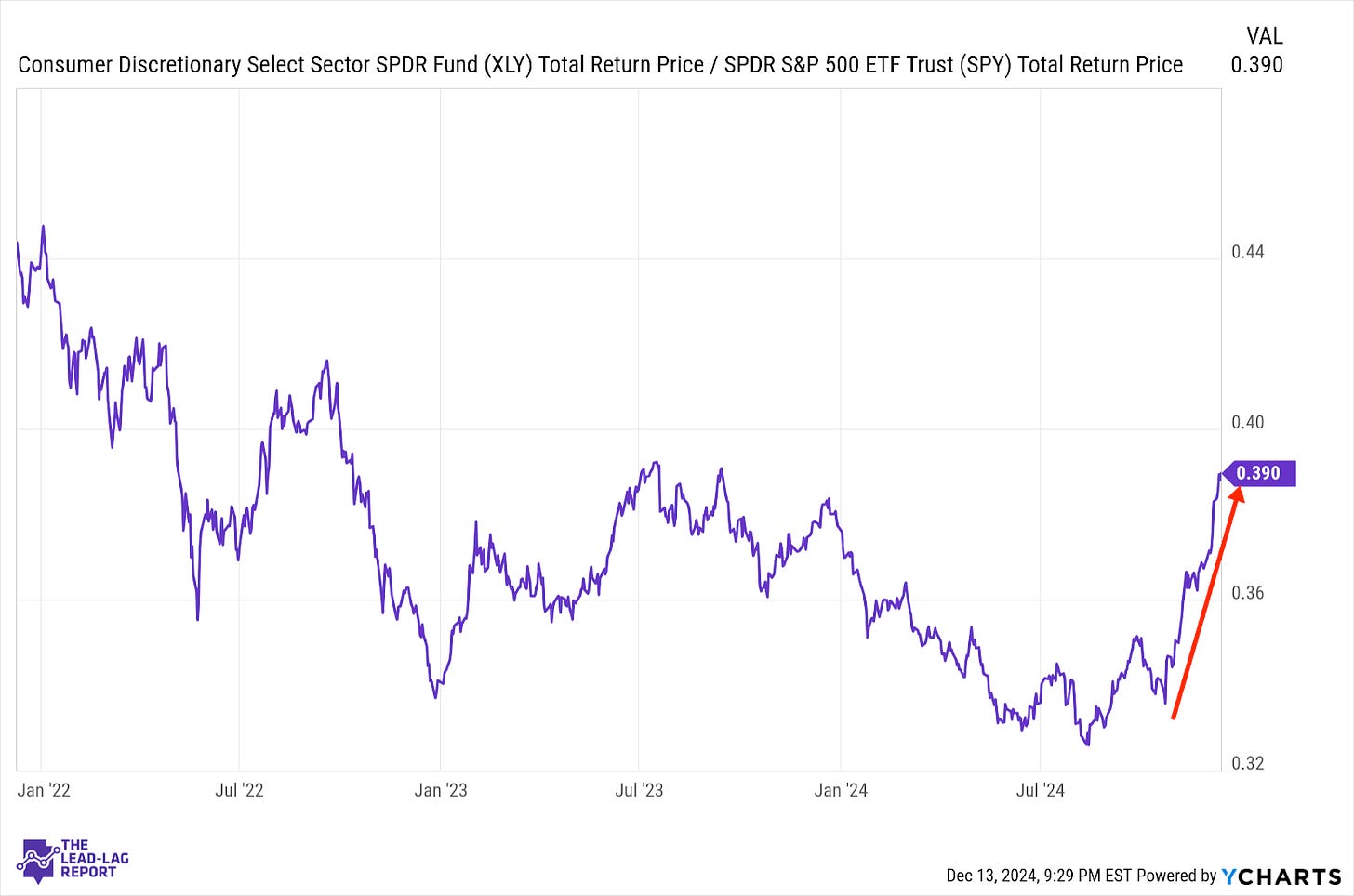

Consumer Discretionary (XLY) – Not Quite As Strong As It Appears

This sector continues its powerful rally, but it’s worth clarifying that this is largely Tesla-driven. The equal weight version of this sector has been outperforming this sector since July, but not nearly to the degree that the chart above would suggest. For now, retail sales and consumer sentiment seem to be strong enough to support the sector as it is today, but the return of inflation would be a killer.

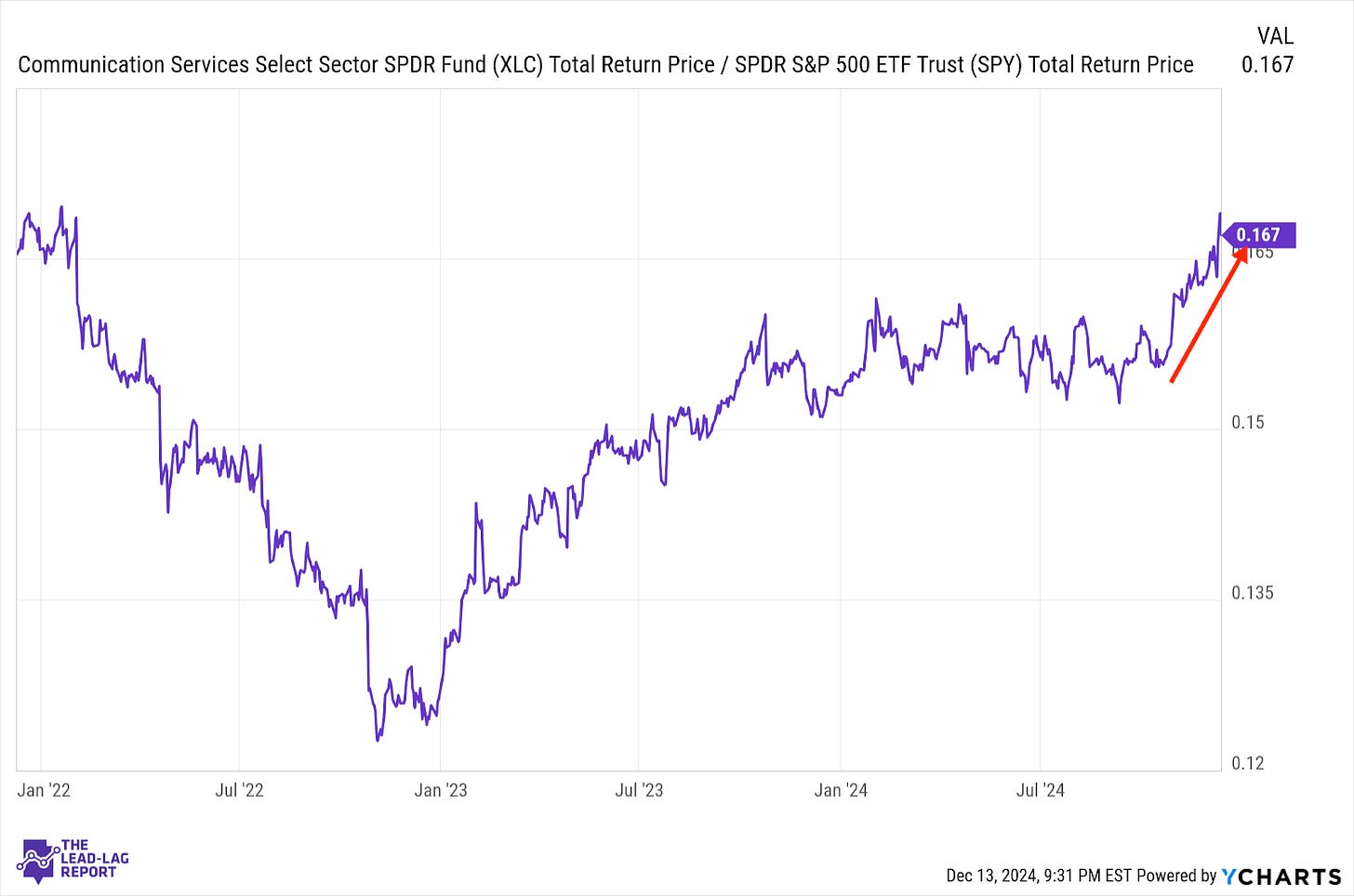

Communication Services (XLC) – The Magnificent 7 Effect

We’ve been seeing the return of the magnificent 7 stocks over the past several weeks and it’s showing up in this ratio (as it often does). This could actually end up being an intriguing short-term play. Alphabet accounts for a 20% position in this sector and if the company’s Willow chip turns out to be a game changer, it could lead to another AI-adjacent rally in this stock that pulls the sector higher.

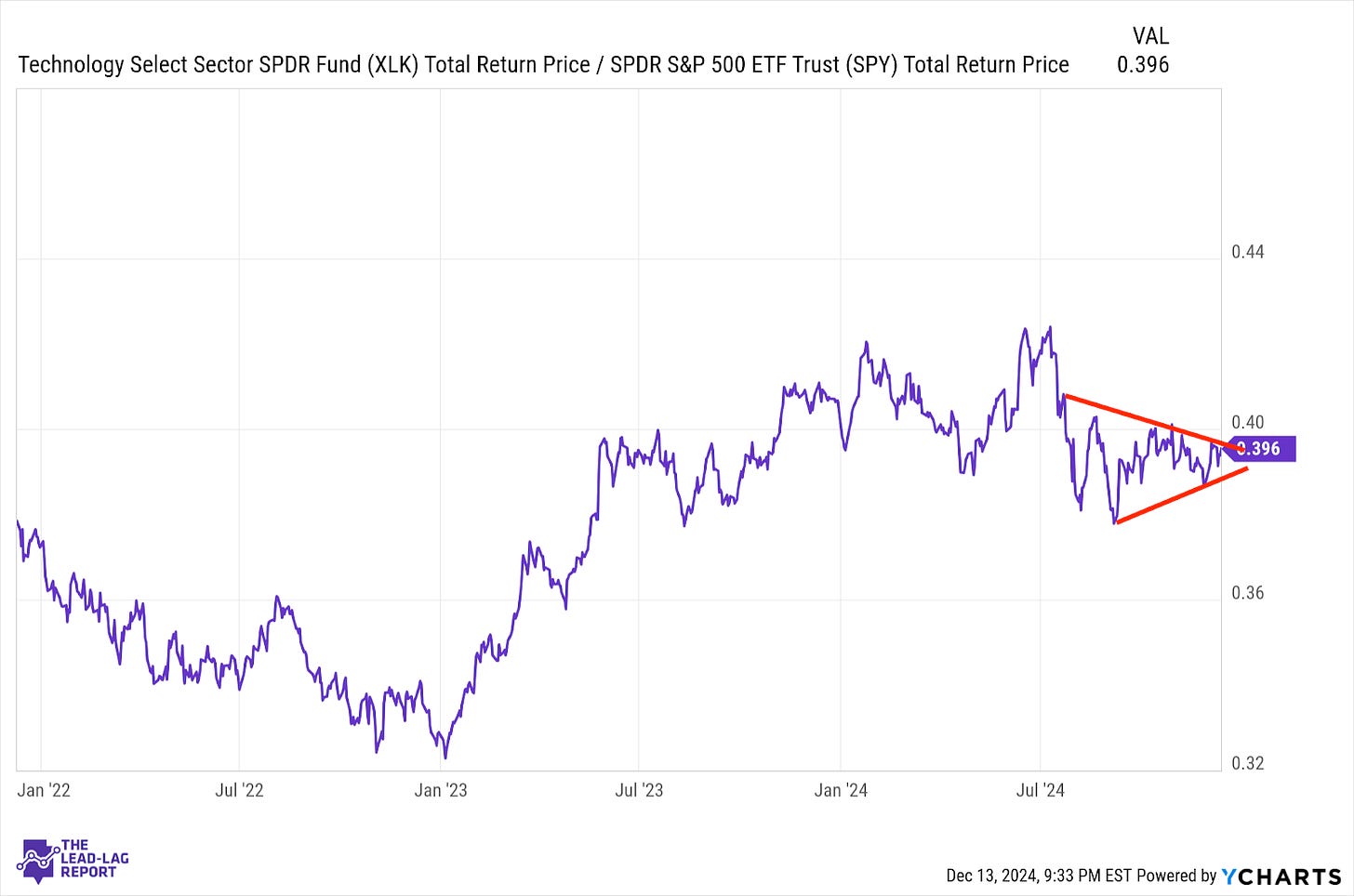

Technology (XLK) – Is The Quantum Computing Rally Coming?

Even though the growth-over-value trade is starting to pick up, the tech sector as a whole hasn’t really participated (although the magnificent 7 continue to set new highs collectively). The chart pattern suggests that a breakout in one direction or the other might be near, but I’m interested in seeing how the quantum computing theme starts to play out. This could lead to another leg higher for the AI trade.

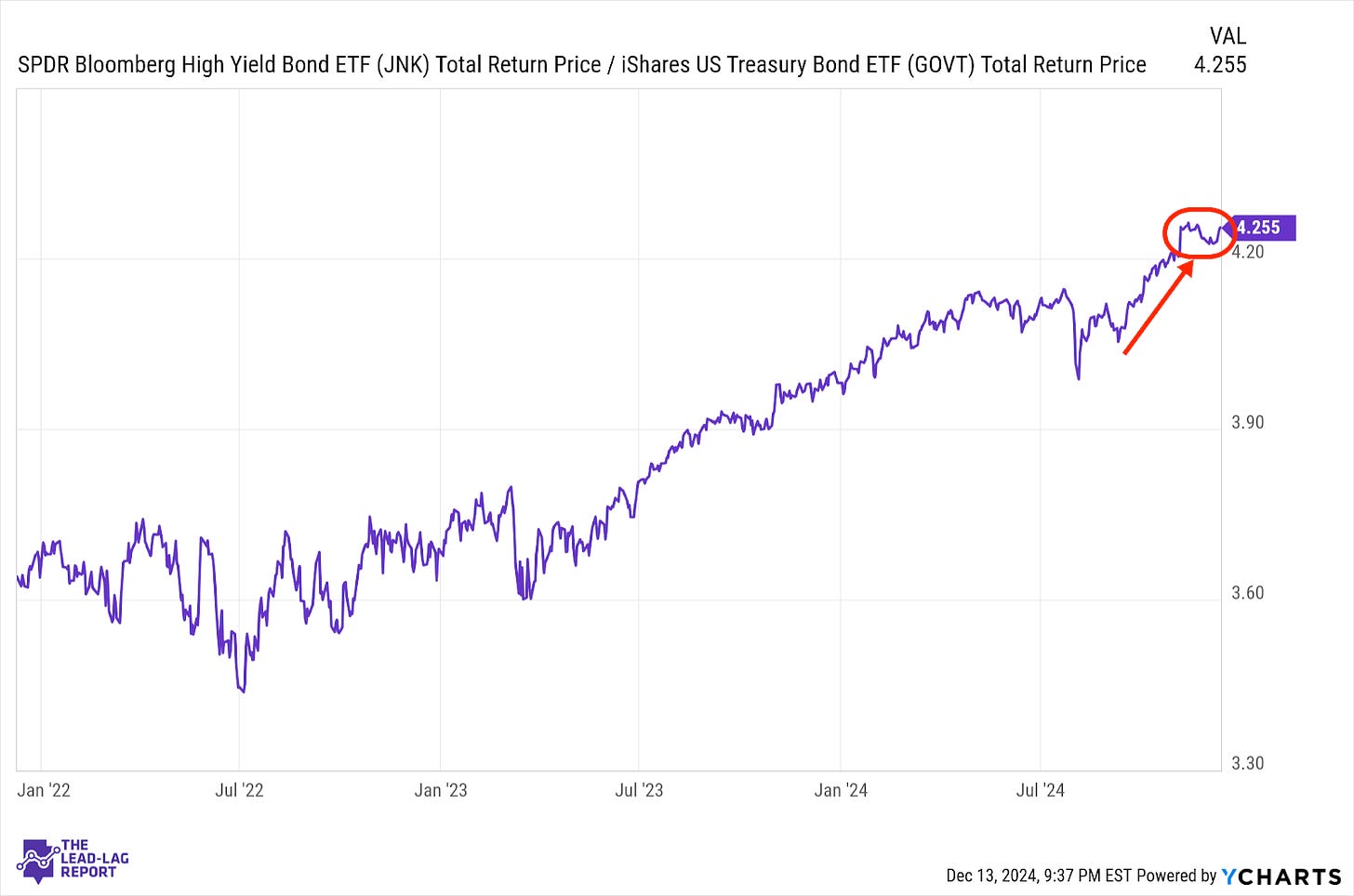

Junk Debt (JNK) – Finally Starting To Top?

We’re starting to see the first signs since this past summer of junk bonds perhaps starting to top out. Even though credit spreads remain near historic lows, there’s a sense that inflationary worries could mean this is the bottom for them. Spreads could very well stay in this range if GDP growth holds up and the labor market remains tight, but I still think there are a lot of potential hazards that could blow this group up.

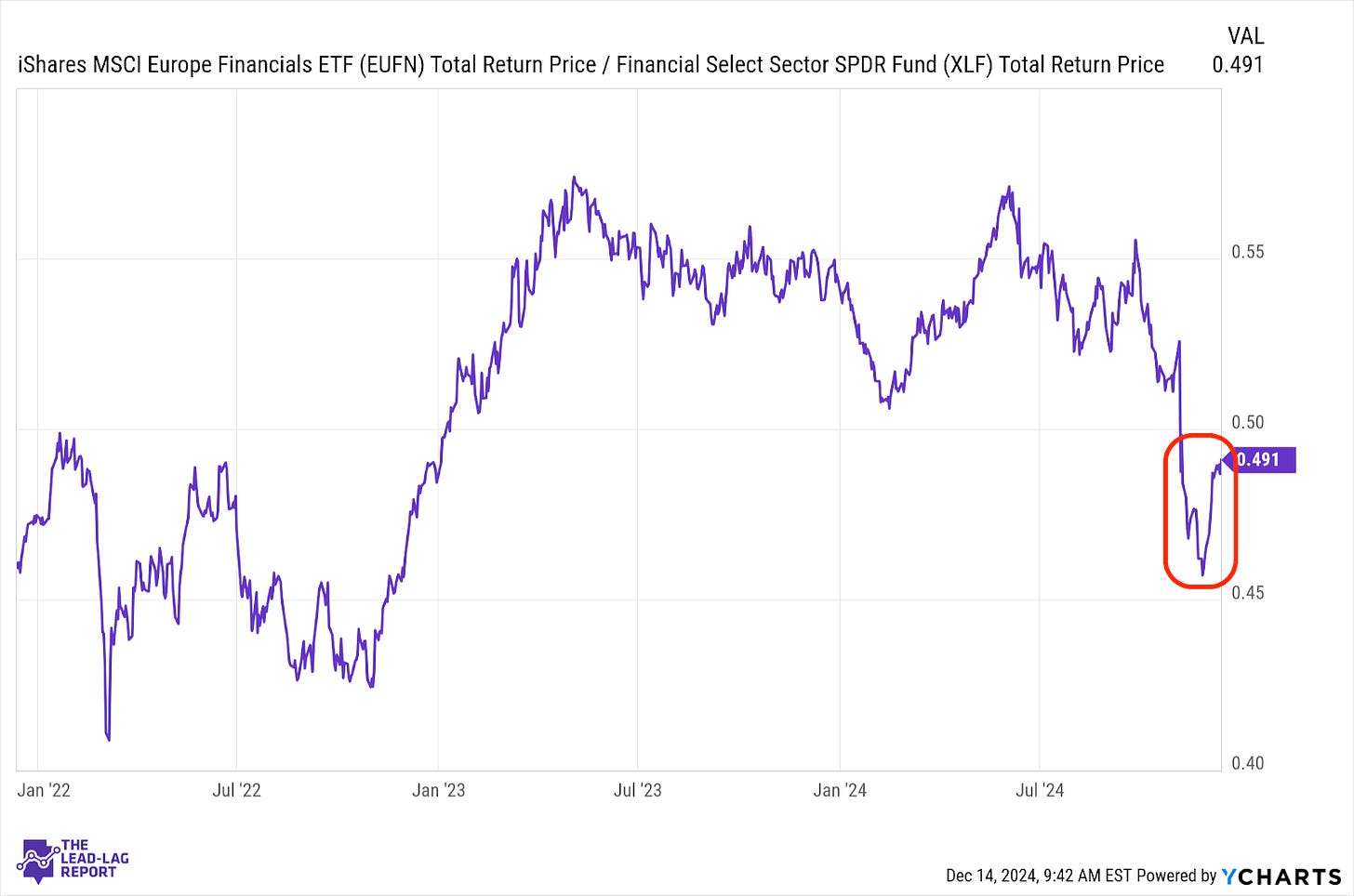

European Banks (EUFN) – It Looks Better Than It Is

The Trump trade for banks in the U.S. has completely faded, which makes this ratio look far more positive than it really is for Euro financials. Lower rates are, at the margins, negative for banks and it’s likely that the ECB will begin stepping up its efforts in the new year despite declarations that they’ll take a measured approach. Inflation appears under control now, which should allow central banks to focus on restarting growth.

Emerging Markets Debt (EMB) – Good Signs For Sustainability