Every week, we'll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

The multi-sector bond market continues to offer compelling opportunities for income-focused investors navigating today's challenging yield environment. Fixed income markets have shown resilience despite ongoing concerns about inflation and central bank policy shifts. While some traditional bond segments have struggled with rate volatility, multi-sector approaches have gained traction by offering managers flexibility to allocate across various credit categories. This tactical advantage has proven particularly valuable as correlations between fixed income segments have fluctuated, allowing nimble managers to capitalize on relative value opportunities.

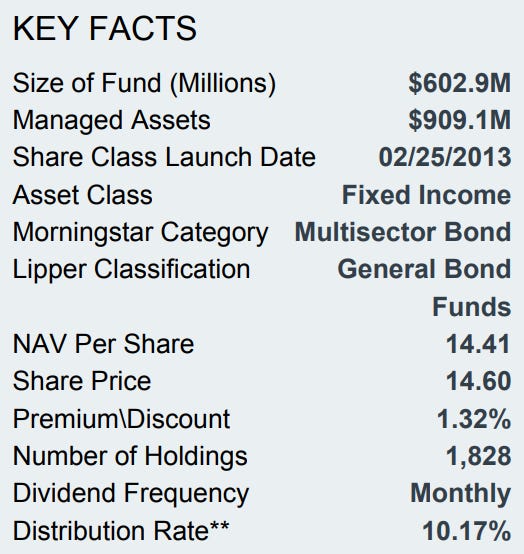

The BlackRock Multi-Sector Income Trust (BIT) represents an intriguing option in this space, offering investors exposure to a diverse range of fixed income sectors. With a double-digit distribution rate and the flexibility to adjust allocations as market conditions evolve, BIT aims to deliver substantial income without sacrificing diversification. This may be an option for yield-focused investors looking to enhance portfolio income while managing risk in today's complex market environment.

Fund Background

BIT seeks high current income with secondary objectives of capital appreciation and reduced portfolio volatility. The fund invests in a diversified portfolio of loan and debt instruments and other income-producing securities of U.S. and non-U.S. issuers, including corporate loans, mortgage-backed securities and other debt instruments, with active management of credit, interest rate and geographic exposures. The fund also utilizes leverage to enhance yield and total return potential.

BIT's multi-sector approach provides investors with several advantages, primarily diversification across various fixed income categories and the flexibility to adjust allocations as market conditions change. I like that the management team can pivot between sectors as relative values shift and capture yield opportunities that more concentrated funds might not be able to. Its use of leverage, however, amplifies risks and makes it more volatile than some might like. The expense ratio of 1.05% is reasonable given the active management.

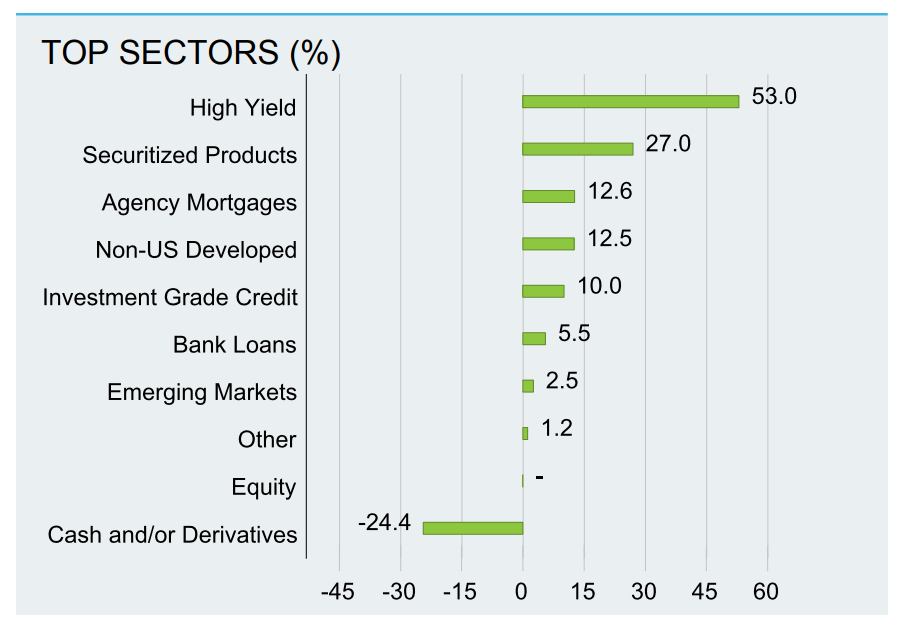

BIT's portfolio spans multiple fixed income sectors with significant allocations to high yield corporate bonds, securitized products and agency notes. This diversified approach allows investors to gain exposure to various income-generating segments, potentially benefiting from both attractive yields and reduced concentration risk. The fund's ability to adjust allocations tactically may prove valuable during periods of market dislocation or when opportunities arise in specific sectors.

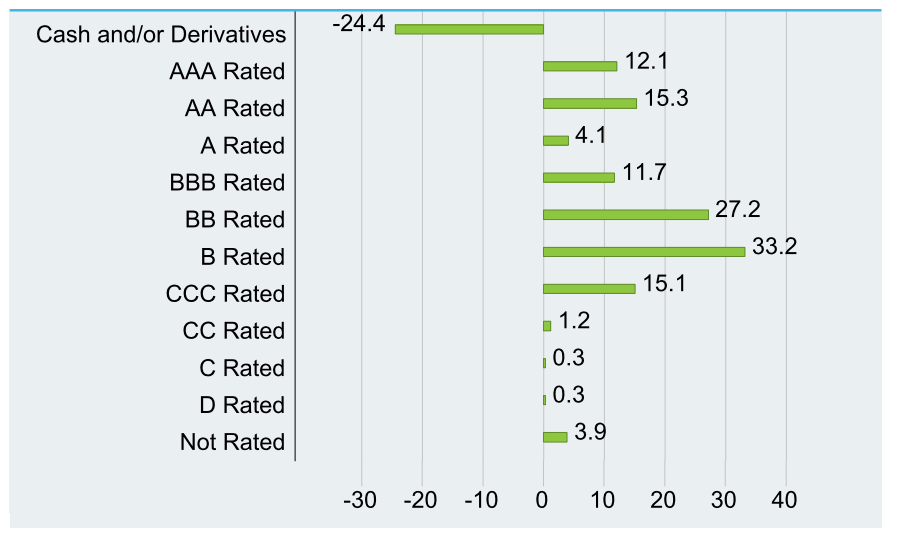

Looking at credit quality, BIT maintains a substantial allocation to below investment-grade securities, with approximately 75% of the portfolio’s assets rated BB or lower. This combination of some investment-grade exposure and higher-yielding securities is a nice all-in-one kind of mix.

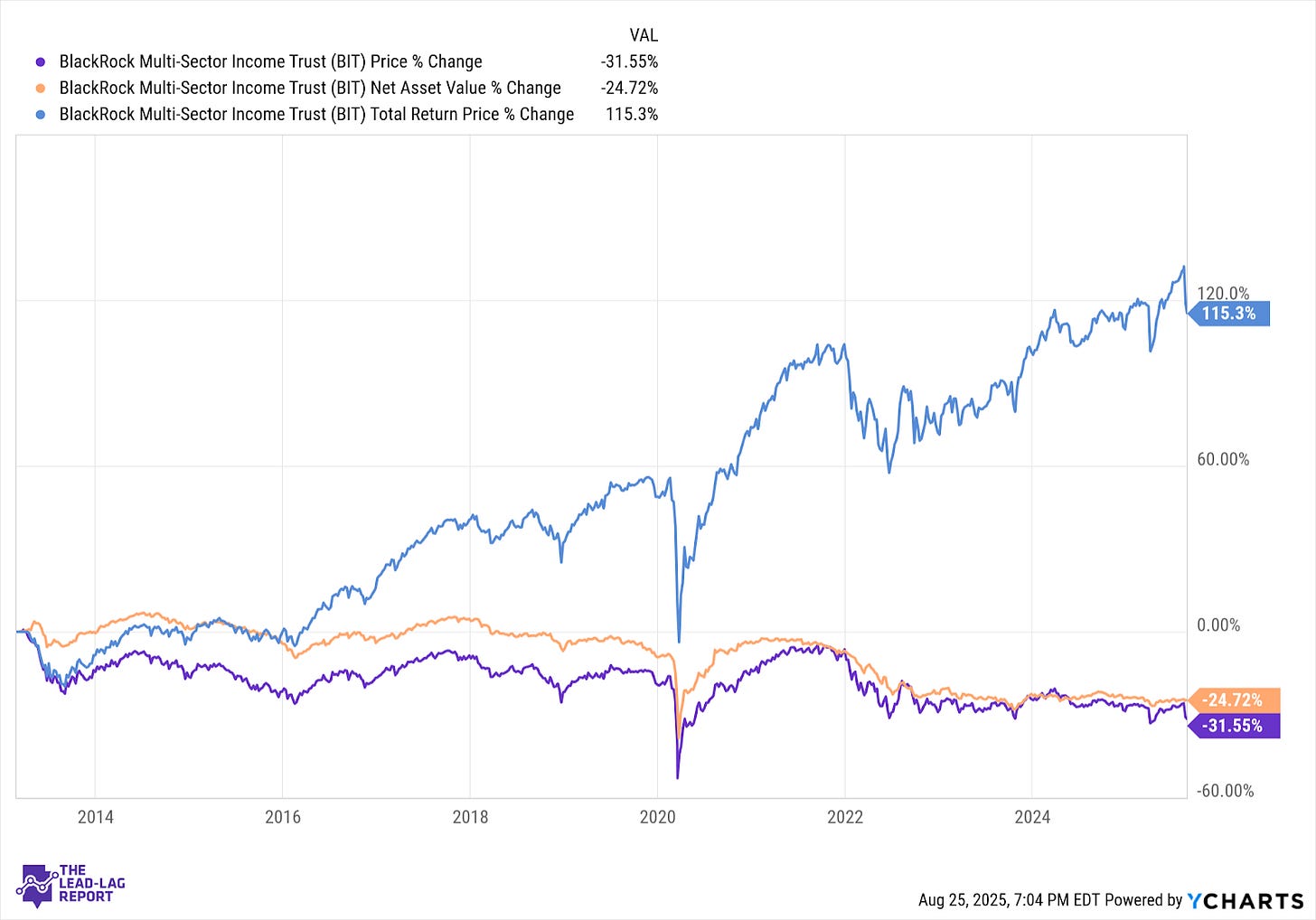

Since its inception back in February 2013, BIT has generated a total return of approximately 115%. That translates to an average annual return of around 7%.