Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: INVESTORS HAVE GOTTEN OVERCONFIDENT ABOUT CONSUMER STRENGTH AND RATE CUTS

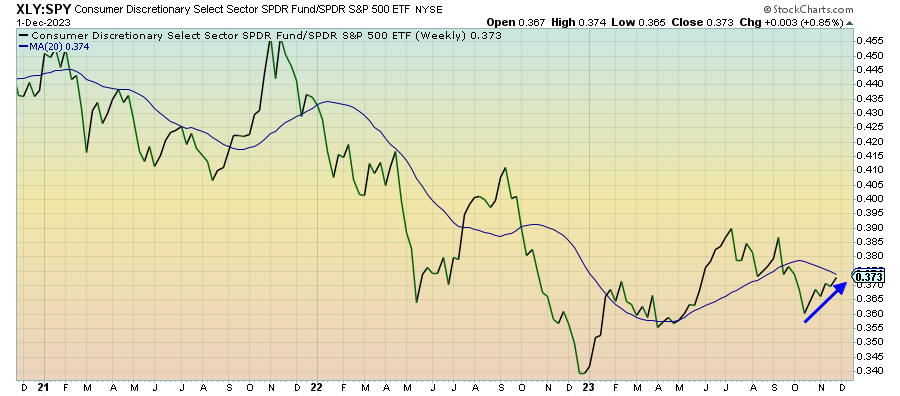

Consumer Discretionary (XLY) – An Unsustainable Trend

Early holiday sales numbers suggest that the consumer is holding up yet again (whether they’ve got the money to fund that spending remains to be seen). I still believe that investors are overconfident that ongoing consumer strength in spending, along with a tight labor market, are going to be the core factors that will help pull off the soft landing. To that end, high levels of debt and high interest rates are likely to make that unsustainable.

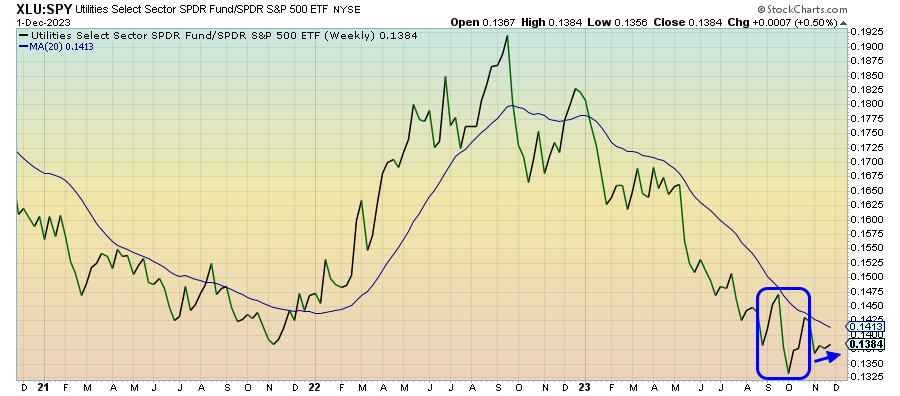

Utilities (XLU) – Making The December Pullback Argument

It looks like volatility in the utilities sector relative to the broader market is finally settling. Like gold, recent outperformance has been partially derived from falling interest rates, but also from a flight to safety pulse that’s not apparent in the major averages. If the trio of utilities, Treasuries and gold continues to move higher, I believe that the argument for a December pullback will keep building.

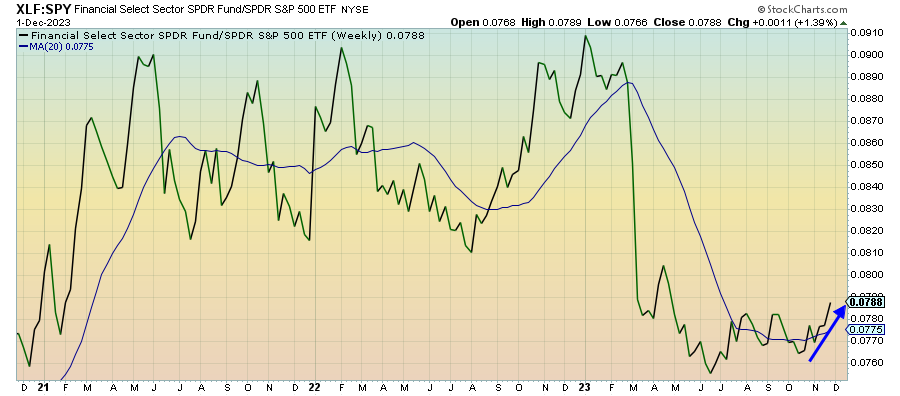

Financials (XLF) – Falling Rates Become A Lifeboat

Bank stocks have been one of the cyclical recovery’s biggest beneficiaries as the decline in long-term rates eases some margin pressure. The bigger challenges, of course, are in the longer-term view. The commercial loan market looks like it could be in really rough shape, but the retail side may have been thrown a lifeboat with rates starting to come back down again.

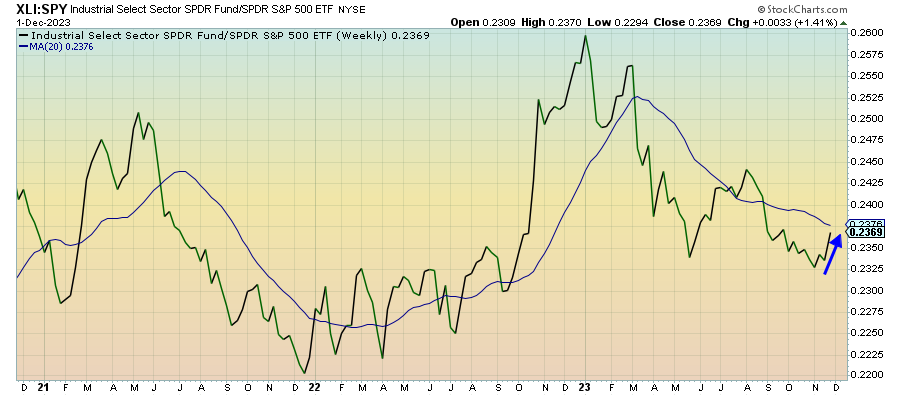

Industrials (XLI) – Rate Cut Expectations Getting Pulled Forward Too Far

Cyclicals are enjoying a real run here amid optimism that an anticipated Fed rate cutting cycle might help pull off the soft landing after all. Cyclicals tend to outperform during these economic turnaround scenarios and it looks like that’s exactly what’s happening here. My problem is that the market seems to have pulled forward about 6 month’s worth of rate expectations into Q1 2024 and investors have gotten a little overconfident.

Materials (XLB) – Good Rebound, But It’s Not Quite Strong Enough