Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: IT’S BEEN A MASSIVE REVERSAL, BUT LET’S PUMP THE BRAKES

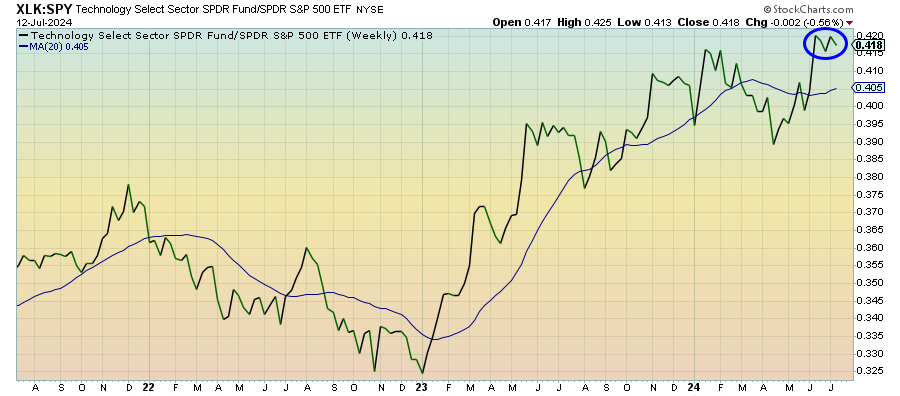

Technology (XLK) – Not An Imminent Correction

For as much as has been made about last week’s reversal in the magnificent 7 stocks, it still looks like a relatively modest move overall when you pull back to look at it. The markets clearly didn’t like the implication for expensive mega-cap names based on the data and the path of rates, but we’re not necessarily looking at an imminent correction yet. Small-caps may have another run in them before this is said and done, but investors haven’t strayed from tech for too long lately.

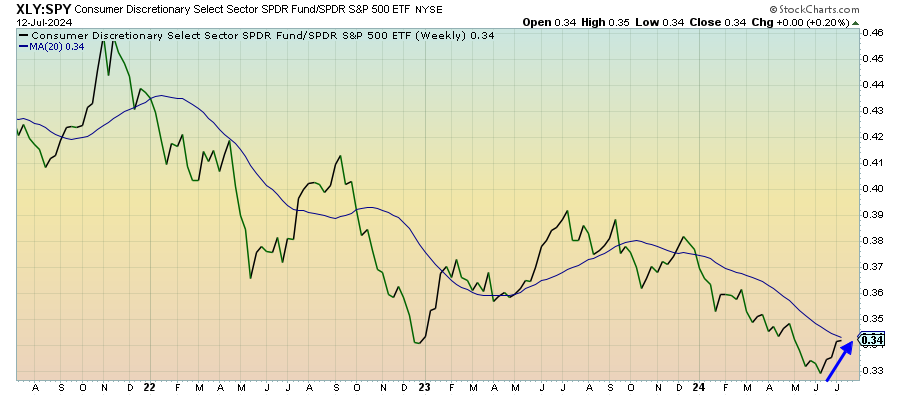

Consumer Discretionary (XLY) – Misleading Trend

Even though the markets widely rejected growth stocks last week, discretionary stocks are still managing to drive higher. Part of this is the ratio bouncing off of recent lows, but I’m not sure there’s much strength in this move. All of the signs are pointing to stress in consumer behavior and that’s a trend I see unlikely to reverse in the near future.

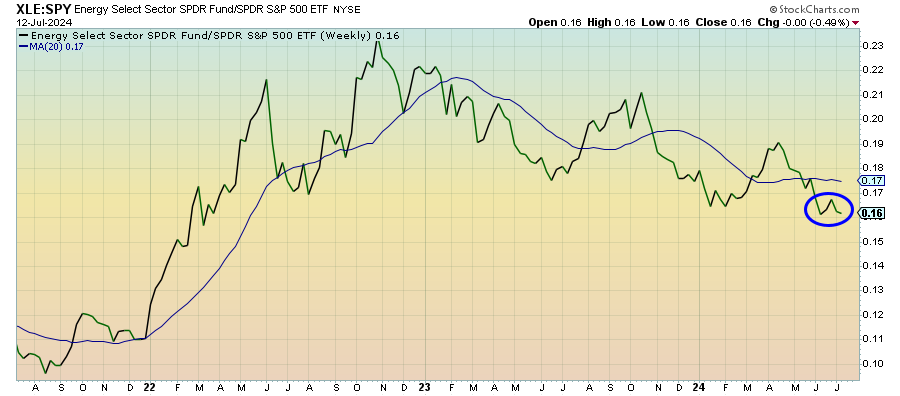

Energy (XLE) – Where Is Demand Headed?

Crude oil prices are taking a pause as are energy stocks for the time being. This group didn’t participate in the cyclical renaissance last week, which may be more of a statement on where markets think consumer behavior is headed. Energy demand usually peaks in the summer travel season and cools later in the year, but we could see that happen sooner and more swiftly this year if current economic trends continue.

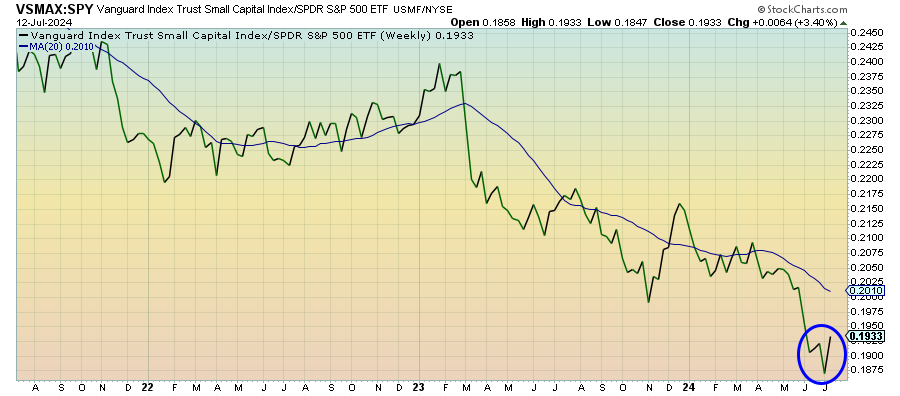

Small-Caps (VSMAX) – Huge Potential

If last week did mark a turning point for U.S. stocks, the potential for small-caps relative to large-caps is HUGE. Maybe not because they’ll outperform in a falling rate/slowing economy environment, but because they fall less. It would be a similar pattern to what we saw in 2022 when small-caps outperformed the S&P 500 even though stocks, in general, were dropping by 20%. The value factor made a big difference in holding this group up.

Long Bonds (VLGSX) – Is Disinflation Threatening To Become Deflation?