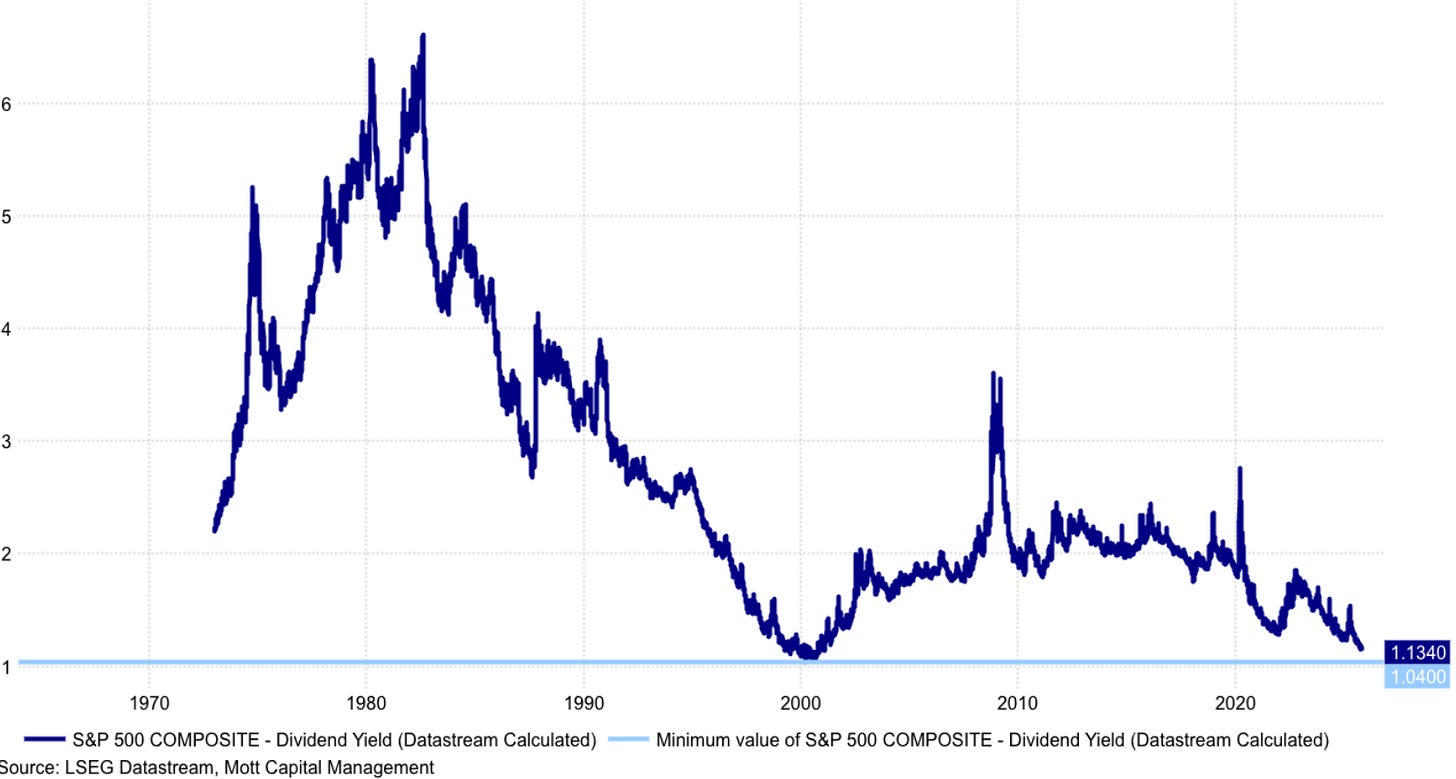

After a long bull run, many investors sense we’re in the late innings of the market cycle. Stocks notched record highs in 2025, yet equity income remains scarce. The S&P 500’s dividend yield sits below 2%, hardly satisfying retirees or income seekers.² Meanwhile, traditional bonds, though offering higher yields, still carry rate and inflation risks. Valuations are stretched, upside appears limited, and cash on the sidelines risks erosion from inflation. This leaves investors searching for income strategies that retain equity exposure—a gap that covered-call strategies aim to fill.¹

How Covered Calls Generate Income

A covered-call strategy enhances portfolio income by holding stocks (or an index) and selling call options against them. The investor collects option premiums upfront, generating immediate cash flow. If stocks remain flat or fall modestly, the options expire worthless and the premiums are retained—effectively earning “extra income” from owned positions.³ This structure shines when markets are range-bound or overvalued, where rapid gains seem unlikely.

The trade-off is capped upside. Should stocks rally beyond the strike price, gains above that level are forfeited. In strong bull markets, covered-call strategies lag traditional equity portfolios. Yet in late-cycle or volatile phases, that trade-off can make sense: investors exchange uncertain future gains for steady, realized income. Premiums also tend to rise with volatility, often surpassing normal dividend yields.³ Properly timed, covered calls can turn a low-yield stock portfolio into a more robust income engine—exactly what many investors crave in a slowing market.

Inside GPIX: Goldman’s Covered-Call Solution

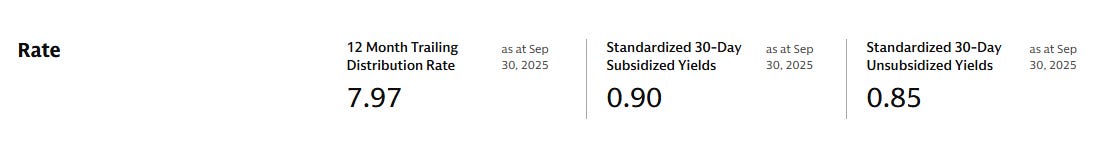

Wall Street has taken note. The Goldman Sachs S&P 500 Premium Income ETF (GPIX) packages a covered-call strategy for mainstream investors. The ETF maintains broad exposure to the S&P 500 while dynamically selling call options on portions of its holdings to generate monthly income.⁴ The fund’s goal is straightforward: deliver consistent cash flow while retaining some participation in rising markets.⁵

Unlike static overwrite peers, GPIX adjusts how much of its portfolio is covered at any given time. Goldman’s managers may sell calls on half—or more—of the portfolio depending on volatility and market outlook.⁶ This partial, flexible approach helps preserve upside potential. During flat or declining markets, higher overwrite levels aim to boost income; in rising markets, reduced coverage helps capture more equity gains.⁴