Income Investing Beyond Dividends: Incorporating Options Into Your 2026 Yield Plan

Key Highlights

Income investing has evolved as dividends alone no longer meet the needs of many portfolios in today’s market structure.¹

Options strategies allow investors to convert volatility and market demand into cash flow, even from non-dividend-paying assets.²

Covered calls and cash-secured puts can supplement traditional income but involve clear trade-offs between yield, upside, and downside risk.⁶

Options-based ETFs have expanded access to these strategies, packaging them into professionally managed, rules-based vehicles.¹¹

A resilient 2026 income plan blends traditional dividends with options-driven strategies, emphasizing diversification and risk management.¹³

For decades, income investing followed a familiar script. Investors bought dividend-paying stocks, clipped quarterly checks, and relied on bonds to smooth volatility. That approach still plays an important role in portfolio construction. Yet in 2026, it is no longer sufficient on its own. Structural changes in markets, corporate behavior, and investor needs have reshaped what “income” really means.¹

Many of today’s most influential companies pay little or no dividends. Investors can accumulate substantial wealth through capital appreciation while generating minimal cash flow along the way. At the same time, market volatility has become more persistent, creating both challenges and opportunities. These forces have pushed investors to rethink how income is generated and to explore tools beyond traditional dividends. One of the most significant developments has been the growing use of options as an income-producing mechanism.²

Why Dividends Alone Fall Short

Dividend strategies remain valuable, but they face practical limitations. Broad equity yields are lower than they were in prior decades, and many growth-oriented sectors reinvest cash rather than distribute it. This creates a disconnect for investors who need ongoing income but want exposure to innovation-driven companies.³

Selling shares to fund spending introduces sequence-of-returns risk, particularly during market drawdowns. That reality has encouraged investors and advisors to look for ways to monetize existing holdings without relying solely on price appreciation. Options provide one such avenue, allowing investors to convert volatility and market demand into cash flow.⁴ Options may not be suitable for all investors.

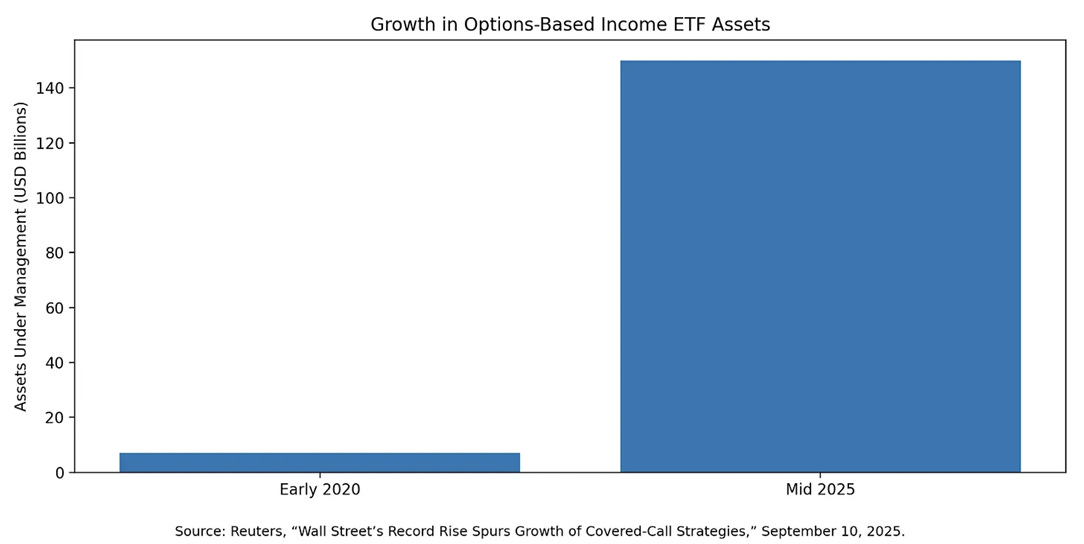

The shift has been substantial. Assets in options-based income products have expanded dramatically over the past several years, reflecting demand from retirees, advisors, and investors with concentrated equity positions.⁵ The appeal lies in flexibility. Options allow income generation regardless of whether a stock pays a dividend, and they can be tailored to different market environments.

How Options Generate Income

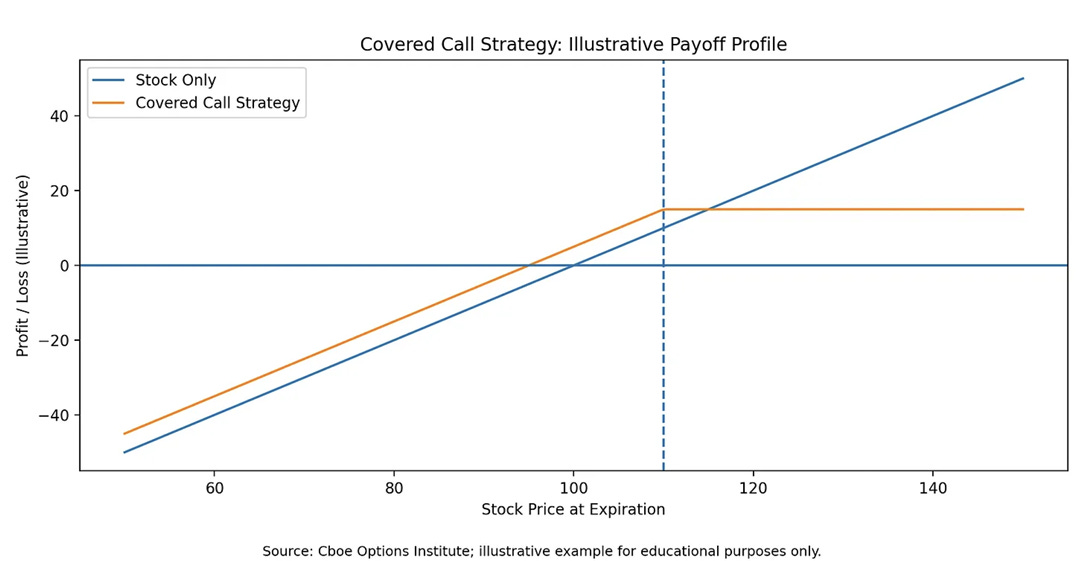

At their core, options income strategies involve collecting premiums in exchange for taking on defined obligations. Covered calls are the most widely recognized example. An investor who owns shares can sell call options against those holdings, receiving upfront income. If the stock remains below the strike price, the option expires worthless and the investor keeps both the premium and the shares. If the stock rises sharply, the investor may have to sell at the strike price, giving up some upside in exchange for the income received.⁶

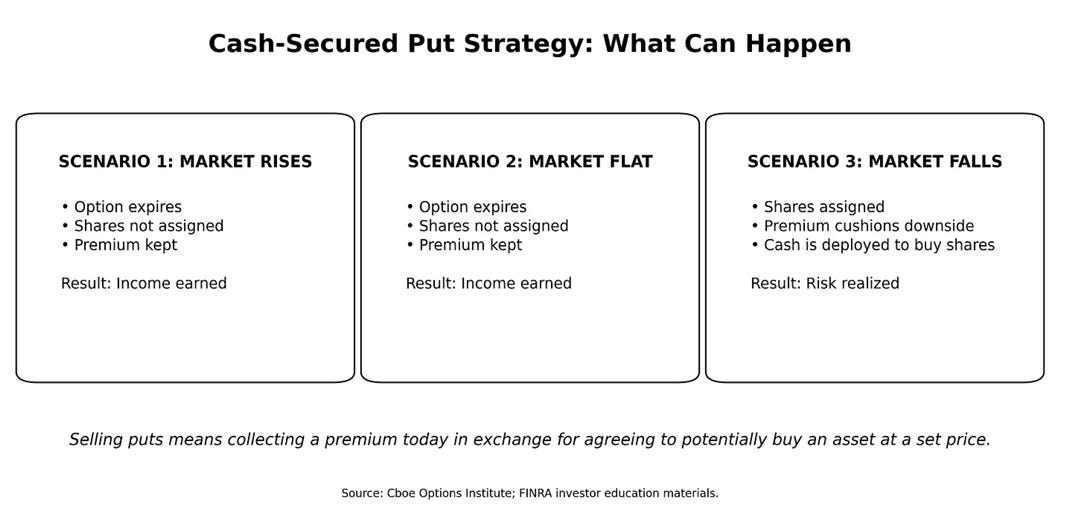

Cash-secured put strategies work in the opposite direction. Investors sell put options on assets they would be willing to own, collecting premium while agreeing to buy shares if prices fall to a predetermined level. When markets remain stable, the income is retained without ownership changing hands. When markets decline, the premium received can help offset losses on the acquired shares.⁷

Unlike dividends, option income is not tied to corporate profitability. It is driven by volatility, demand for protection, and expectations about future price movements. Higher volatility generally translates into richer premiums, which can enhance income but also signal increased risk.⁸ This makes options income inherently dynamic rather than fixed, requiring active management and risk awareness.

Trade-Offs and Limitations

Options are not a substitute for risk-free income. Every premium collected represents compensation for accepting a constraint or obligation. Covered call strategies tend to lag during strong bull markets because upside participation is capped. Long-term data shows that while covered call approaches can reduce volatility, they often capture only a fraction of total market gains during extended rallies.⁹

Put-selling strategies carry downside risk if markets fall sharply. Premiums provide a buffer, not protection against severe drawdowns. In stressed environments, losses can exceed income collected, particularly if volatility spikes after positions are established. These realities underscore that options income is best viewed as a risk-managed enhancement, not a guaranteed yield source.

The Rise of Options-Based Funds

As demand has grown, asset managers have packaged options strategies into exchange-traded funds, making them accessible to a broader audience. These vehicles handle execution, position sizing, and contract management, allowing investors to participate without trading options directly.¹⁰

Some funds focus on writing calls on broad indexes. Others take more targeted approaches, applying options strategies to individual equities or themes. The GraniteShares YieldBOOST suite represents a newer evolution within this space. Rather than selling calls on traditional stocks, these funds employ put spread strategies linked to leveraged single-stock ETFs.¹¹

The strategy seeks to capture elevated option premiums during periods of higher volatility while using defined-risk structures that aim to reduce, but do not eliminate, exposure to extreme downside risk. Importantly, the funds themselves do not employ leverage. Instead, they access volatility indirectly through the underlying instruments. This distinction matters from a risk-management standpoint. YieldBOOST funds are tied to growth-oriented companies and sectors that historically provided little natural income. By systematically harvesting option premiums, they attempt to convert volatility into regular cash distributions. Weekly payout schedules reinforce the income-centric design, though distributions can vary based on market conditions and not guaranteed.¹²

Risk Management Still Matters

High income potential often coincides with higher risk. Options-based funds can experience losses during sharp market declines, and there is no assurance that premium income will offset those losses. Fund disclosures emphasize that strategies may underperform in certain environments and that investors can lose principal.¹³

For this reason, options income strategies are generally most effective when used as part of a diversified income framework. Traditional dividends, fixed income, and real assets can provide stability, while options-based funds add a differentiated income stream that responds to volatility rather than earnings.

Position sizing is critical. Allocations should reflect both income needs and risk tolerance. Chasing the highest possible yield without regard for underlying exposure can undermine long-term objectives.

Building a Modern Income Portfolio

Income investing in 2026 is no longer a single-lane road. Dividends still matter, but they are only one component of a broader toolkit. Options have introduced new ways to extract cash flow from markets that previously offered little income, particularly within growth-oriented segments.

When incorporated carefully, options strategies can complement traditional approaches, helping investors bridge income gaps without relying solely on asset sales. The key is understanding how income is generated, what risks are involved, and how each strategy behaves across market cycles.

A resilient income plan blends predictability with flexibility, stability with opportunity. Options can play a role in that balance, provided they are used deliberately and within a diversified framework.

Footnotes

Reuters, “Wall Street’s Record Rise Spurs Growth of Covered-Call Strategies,” September 10, 2025.

Financial Industry Regulatory Authority, “Options Trading: Characteristics and Risks,” last modified March 18, 2024.

Reuters, “Retail Investors Embrace Options-Based Income Products,” June 21, 2025.

IncomeShares, “Dividend Income vs. Options ETP Income: What’s the Difference?,” published February 6, 2025.

Reuters, “Volatility Drives Options Premiums as Income Demand Grows,” August 14, 2024.

ProShares, “Balancing Yield and Total Return in Covered Call Strategies,” January 17, 2024.

Cboe Global Markets, “Put Writing and Risk Management,” updated December 12, 2024.

Reuters, “Options Premiums Rise as Market Uncertainty Persists,” May 3, 2024.

ProShares, “Covered Call Strategy Performance Over Market Cycles,” January 17, 2024.

Financial Industry Regulatory Authority, “Complex Products and Income Strategies,” last modified April 9, 2024.

GraniteShares, “YieldBOOST ETF Strategy Overview,” published April 3, 2025.

GraniteShares, “YieldBOOST ETFs Product Summary,” updated May 9, 2025.

Investing News Network, “GraniteShares Expands YieldBOOST Lineup,” July 22, 2025.

A covered call is an options strategy where you own the underlying asset and sell a call option on it to generate income, while capping your upside if the asset rises above the strike price.

A cash-secured put is an options strategy where you sell a put option while holding enough cash to buy the underlying asset if assigned, generating income in exchange for the obligation to purchase it at the strike price.

Writing calls is an options strategy where you sell call options to collect premium, taking on the obligation to sell the underlying asset at the strike price if exercised.

RISK FACTORS AND IMPORTANT INFORMATION

This material must be preceded or accompanied by a Prospectus. expenses before investing. Please read the prospectus before investing.

There is no guarantee that the Fund’s investment strategy will be properly implemented, and an investor may lose some or all of its investment.

An Investment in the Fund is not an investment in the Underlying ETFs.

The Fund’s strategy will cap its potential gain if the Underlying ETFs’ share increases in value.

The Fund’s strategy is subject to all potential losses if the Underlying ETFs’ share decline, which may not be offset by the income received by the Fund.

The Fund does not invest directly in the Underlying ETF.

Shares are bought and sold at market price (not NAV) and are not individually redeemed from the ETF. There can be no guarantee that an active trading market for ETF shares will develop or be maintained, or that their listing will continue or remain unchanged. Buying or selling ETF shares on an exchange may require the payment of brokerage commissions and frequent trading may incur brokerage costs that detract significantly from investment returns.

An investment in the Fund involves risk, including the possible loss of principal. The Fund is non-diversified and includes risks associated with the Fund concentrating its investments in a particular industry, sector, or geographic region which can result in increased volatility. The use of derivatives such as option contracts and swaps are subject to market risks that may cause their price to fluctuate over time. Risks of the Fund include Risk of the Underlying ETF, Derivatives Risk, Affiliate Fund Risk, Counterparty Risk, Price Participation Risk, Distribution Risk, NAV Erosion Risk, Put Writing Strategy Risk, Option Market Liquidity Risk. These and other risks can be found in the prospectus.

This information is not an offer to sell or a solicitation of an offer to buy shares of any Funds to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. Please consult your tax advisor about the tax consequences of an investment in Fund shares, including the possible application of foreign, state, and local tax laws. You could lose money by investing in the ETFs. There can be no assurance that the investment objective of the Funds will be achieved. None of the Funds should be relied upon as a complete investment program.

The Fund is distributed by ALPS Distributors, Inc, which is not affiliated with GraniteShares or any of its affiliates ©2025 GraniteShares Inc. All rights reserved. GraniteShares, GraniteShares Trusts, and the GraniteShares logo are registered and unregistered trademarks of GraniteShares Inc., in the United States and elsewhere. All other marks are the property of their respective owners.

ETF distributed by ALPS Distributors, Inc. (ADI)

DISCLAIMER – PLEASE READ: This is a sponsored article for which Lead-Lag Publishing, LLC has been paid a fee. Lead-Lag Publishing, LLC does not guarantee the accuracy or completeness of the information provided in the article or make any representation as to its quality. Lead-Lag Publishing, LLC expressly disclaims any responsibility for action taken in connection with the information provided in the discussion. The content in this writing is for informational purposes only. You should not construe any information or other material as investment, financial, tax, or other advice. A participant may have taken or recommended any investment position discussed, but may close such position or alter its recommendation at any time without notice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in any jurisdiction. Please consult your own investment or financial advisor for advice related to all investment decisions.