Key Highlights

An unprecedented confrontation between the White House and the Federal Reserve tested perceptions of central bank independence.¹

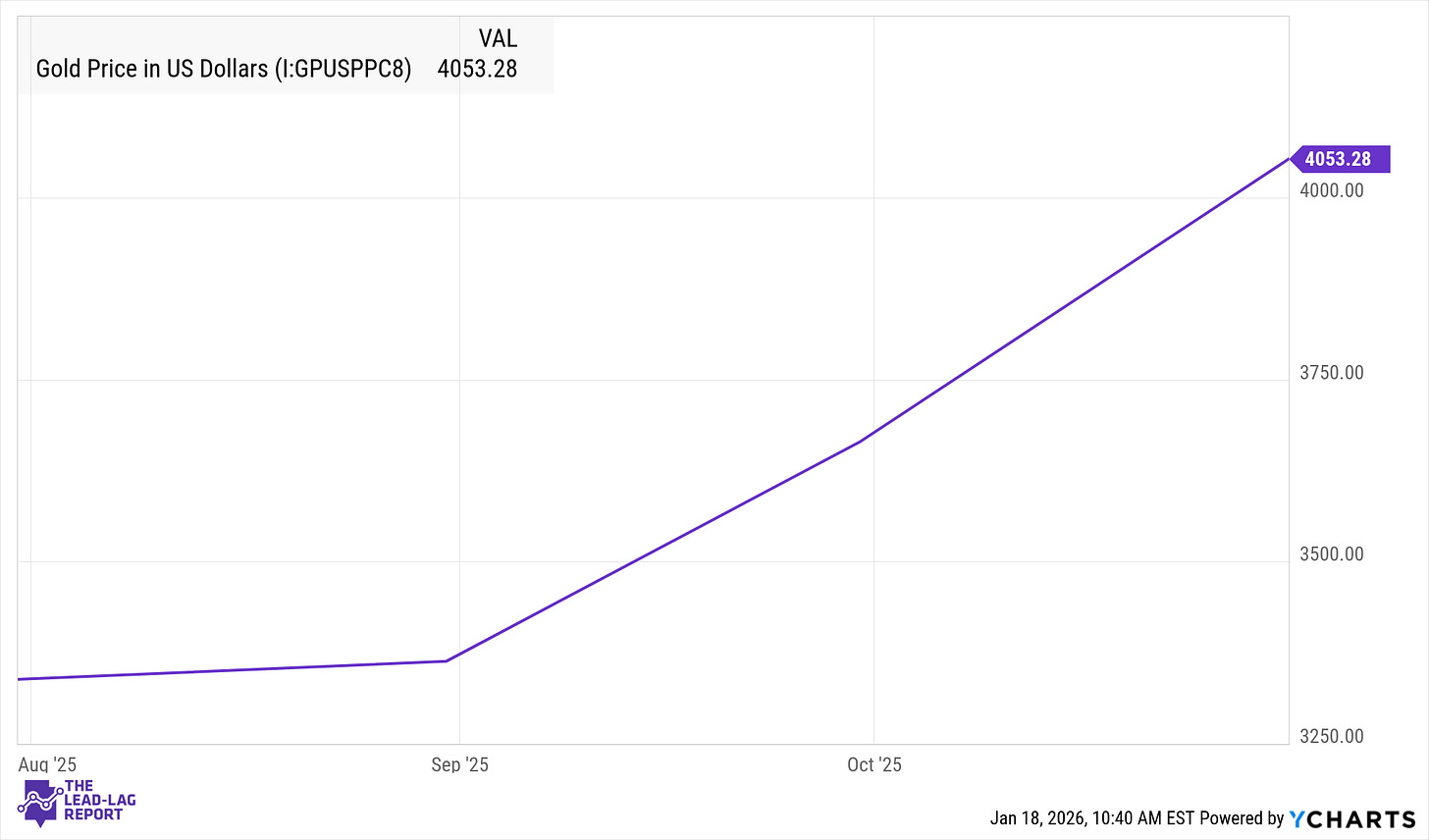

Markets reacted unevenly: gold and Treasury yields surged while equities largely held their ground.²³

Global developments, including China’s record trade surplus and renewed geopolitical tensions, added to cross-asset volatility.¹³¹⁹

Investor calm may mask growing fragilities beneath the surface as policy uncertainty builds.

Markets faced a dense web of political and economic crosscurrents this week, dominated by a confrontation few investors ever expected to see. Reports that the Trump administration had threatened legal action against the Federal Reserve, including subpoenas directed at Chair Jerome Powell, marked a sharp escalation in tensions between Washington and the central bank.¹ The move raised profound questions about institutional independence at a moment when monetary credibility remains central to market stability.

Initial reactions were swift in traditional safe havens. Gold surged to fresh record highs above $4,600 per ounce, reflecting rising concern over political interference in monetary policy.² Treasury yields also climbed, with longer-dated maturities pushing to four-month highs as investors demanded higher compensation for uncertainty.³ Equities, however, told a more restrained story. Major U.S. indexes briefly touched record levels early in the week before retreating modestly, ultimately finishing down less than one percent.⁴ The divergence underscored a market struggling to reconcile political shock with still-supportive economic fundamentals.

Central Bank Independence Under Pressure

For the first time in decades, the Federal Reserve found itself openly resisting legal pressure from the executive branch. Powell forcefully rejected the subpoenas, characterizing them as an unacceptable intrusion into monetary policymaking.⁵ While tensions between presidents and Fed chairs are not new, the threat of criminal proceedings marked a clear departure from historical norms.

Market participants initially responded by trimming dollar exposure. The U.S. currency’s early-January strength faded quickly as confidence in policy continuity wavered.⁶ Gold’s rally gained momentum, rising more than five percent in just two weeks as investors sought insulation from institutional risk.⁷ Despite these moves, broader markets appeared reluctant to extrapolate worst-case scenarios. Several strategists noted that the Fed has historically proven resilient under political strain, and early signs suggested investors were inclined to treat the episode as noise rather than a regime shift.⁸