After nearly three years of fits and starts, it looks like China’s economic engine might finally be showing signs of reigniting. It's not a full-fledged recovery nor even an acceleration. It's still just signs that things could finally be improving. That, however, could be enough to mark a shift in how the market views both China and emerging markets as investments looking forward.

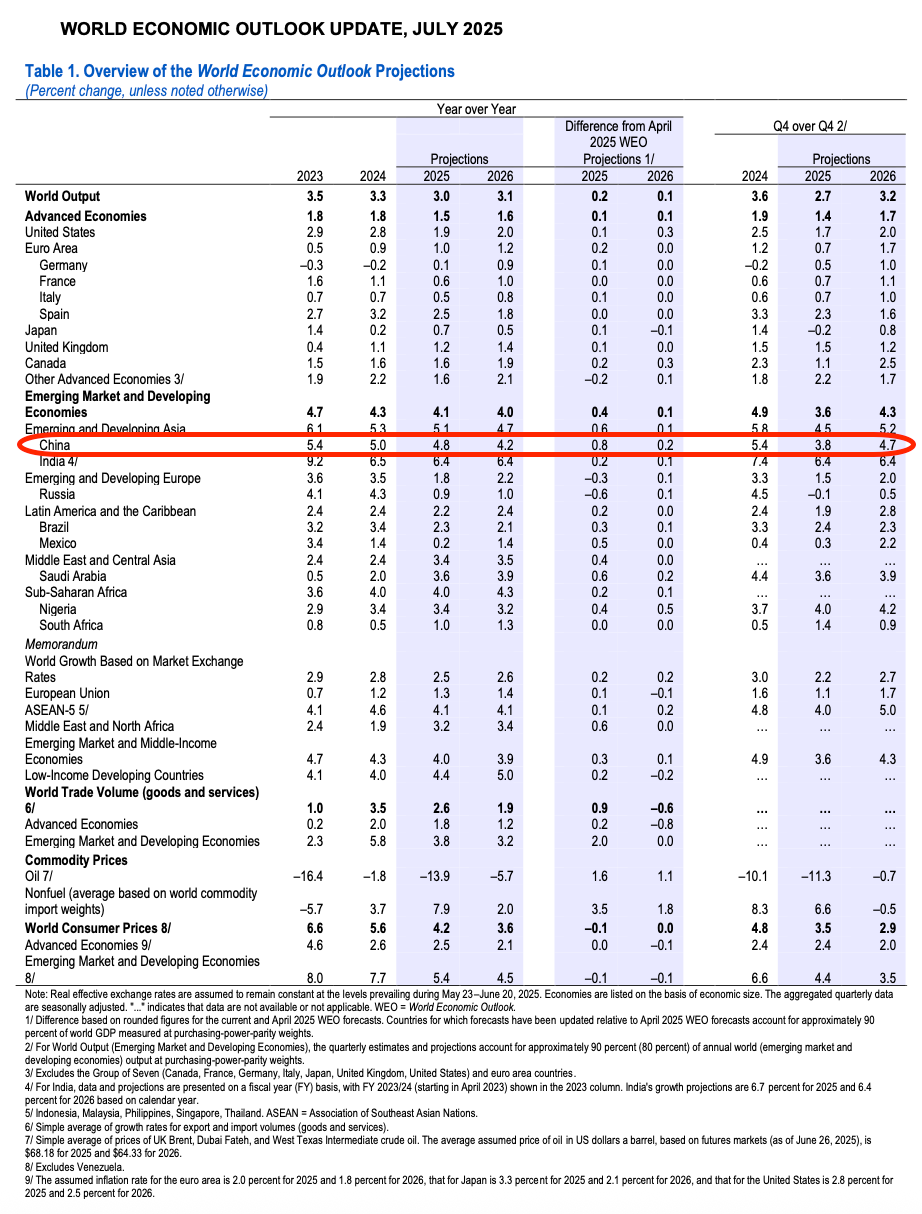

In its July 2025 update, the IMF raised its estimate of 2025 GDP growth for China from 4% to 4.8%, bringing forecasts back closer to the 5% area that the country has been accustomed to.

The catalyst, of course, would be the expectation for lower tariff rates. In the report, the new forecast assumed an overall tariff rate of 17.3% on Chinese imports, down from 24.3% in the prior update. Given how wildly unpopular a 100%+ tariff rate obviously is and Trump's predisposition to extending deadlines over reimposing high tariff rates, it seems likely that the worst of the trade war is over. Long-term tariff rates are still an unknown, but it's likely they'll probably end up being within range of where they are now.

That's one positive development, but the Chinese government has also been taking steps to kickstart the economy. Over the past several months, Chinese policymakers have quietly begun to adjust their approach. After a rate cut in May, the PBoC may be inclined to hold rates here until it gains more clarity on its longer-term trade relationship with the United States. However, there does appear to be a desire by the PBoC to inject further stimulus into the economy, either by additional rate cuts or new private sector investment.

Progress on the economic front, however, has been inconsistent. Manufacturing activity, as measured by the Caixin manufacturing PMI, crept back up to 50.4 in June, indicating a modest expansion but not yet a robust recovery. The government has been trying to focus on a recovery in the services sector and away from an over-reliance on the manufacturing sector, but it has yet to yield much in the way of undeniable results.

There are, however, reasons to be optimistic.