Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: LUMBER/GOLD ROARS BACK TO LIFE, BUT WITH A CAVEAT

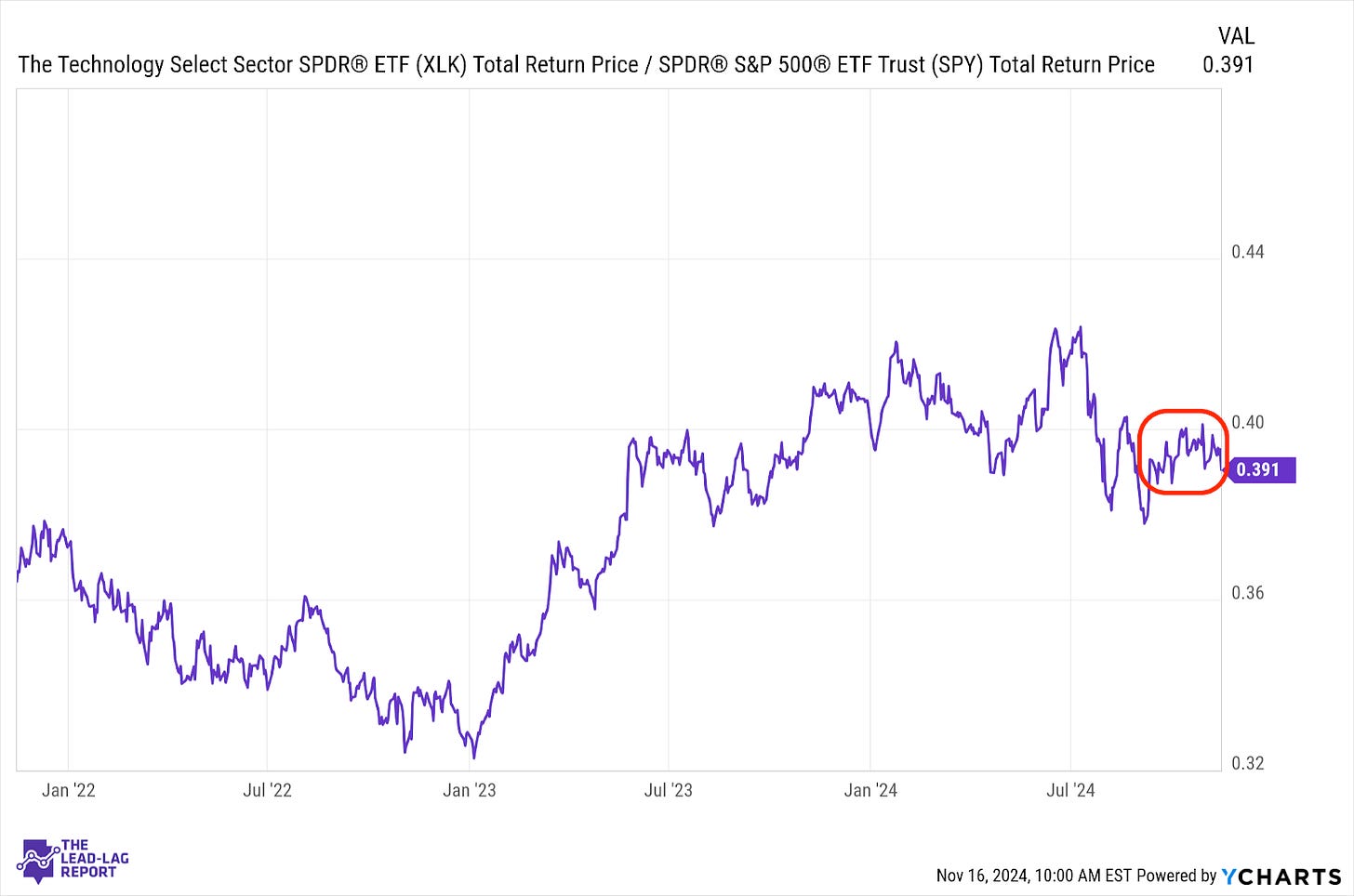

Technology (XLK) – Bitcoin Rally A Bad Thing?

Tech remains a fairly average performer and certainly isn’t the leader that it was back in 2023. The huge positive momentum around crypto right now might actually be a bad thing for this sector. As bitcoin approaches $100,000, investors may see greater opportunity there and choose to rotate out of the traditional tech names.

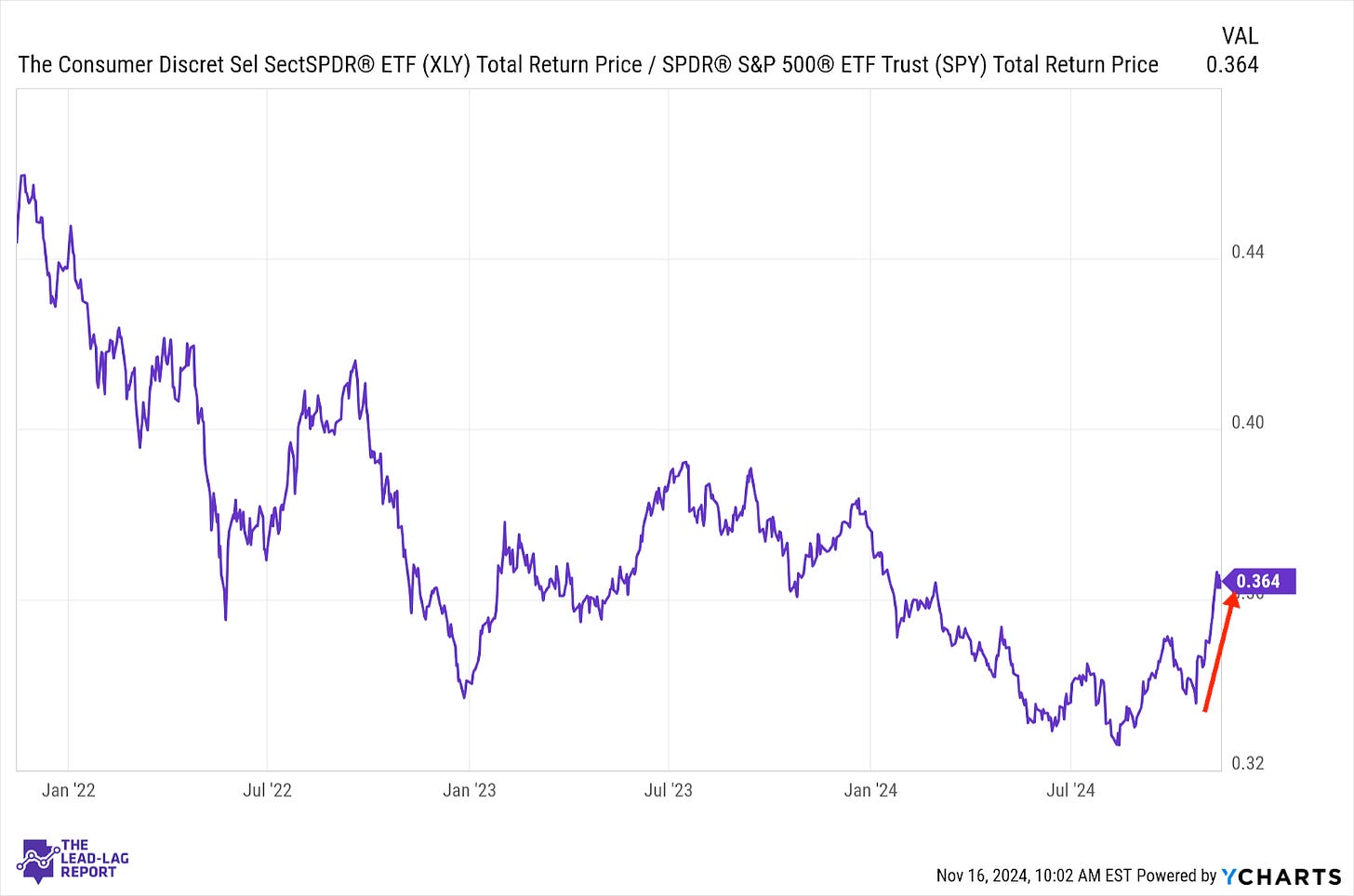

Consumer Discretionary (XLY) – Is The Consumer Strong Or Not?

The retail sector has been something of a dichotomy for a while. On one hand, you’ve got healthy resilience in the personal spending and retail sales figures. On the other hand, several big retailers are warning that consumers actually aren’t in that good of shape and are more vulnerable than the numbers suggest. With Target, Walmart and Lowe’s reporting earnings this week, we’ll get a good idea of whether or not that trend continues.

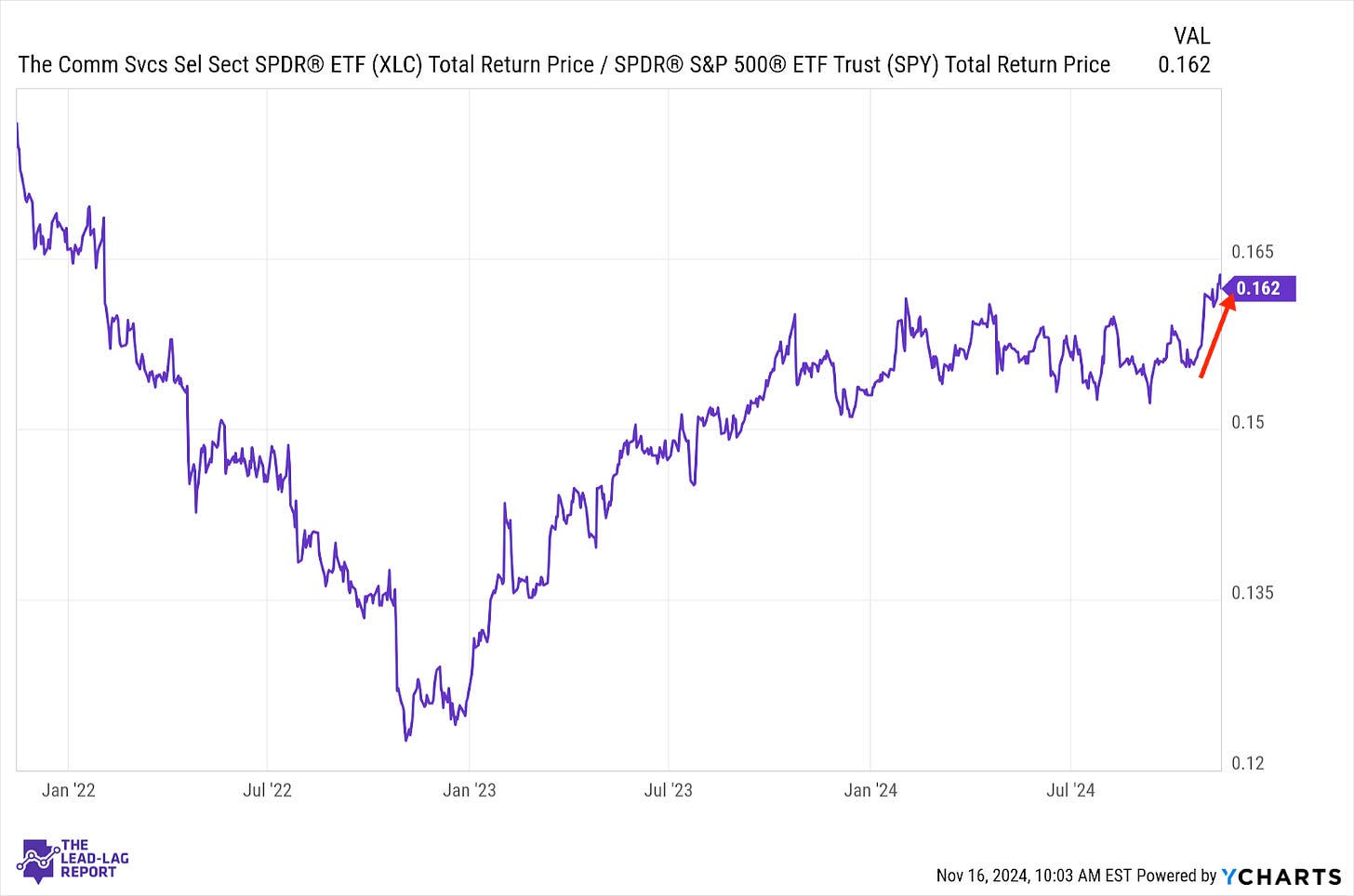

Communication Services (XLC) – Broadening Out

This sector is finally experiencing a big breakout, which quietly pushes this ratio to a 2½ year high. Plus, it’s good to see that the sector is getting contributions beyond just the heavyweight pair of Facebook and Alphabet. While the latter has been a contributor to outperformance, Netflix, Disney, Charter and T-Mobile have all delivered solid gains. Top-heavy concentration has been a concern for this group, so broad participation in gains is a good sign.

Financials (XLF) – Environment Lining Up Nicely

In the Trump administration’s likely push for greater deregulation, no sector may benefit more than the banks. In terms of relative strength, this is one of the hottest groups in the market and is finally starting to get back to its pre-regional banking crisis days. At this point, the rally could probably use a breather, but regulatory easing would line up nicely with the current environment where investment banking activity is picking up and banks are more willing to lend.

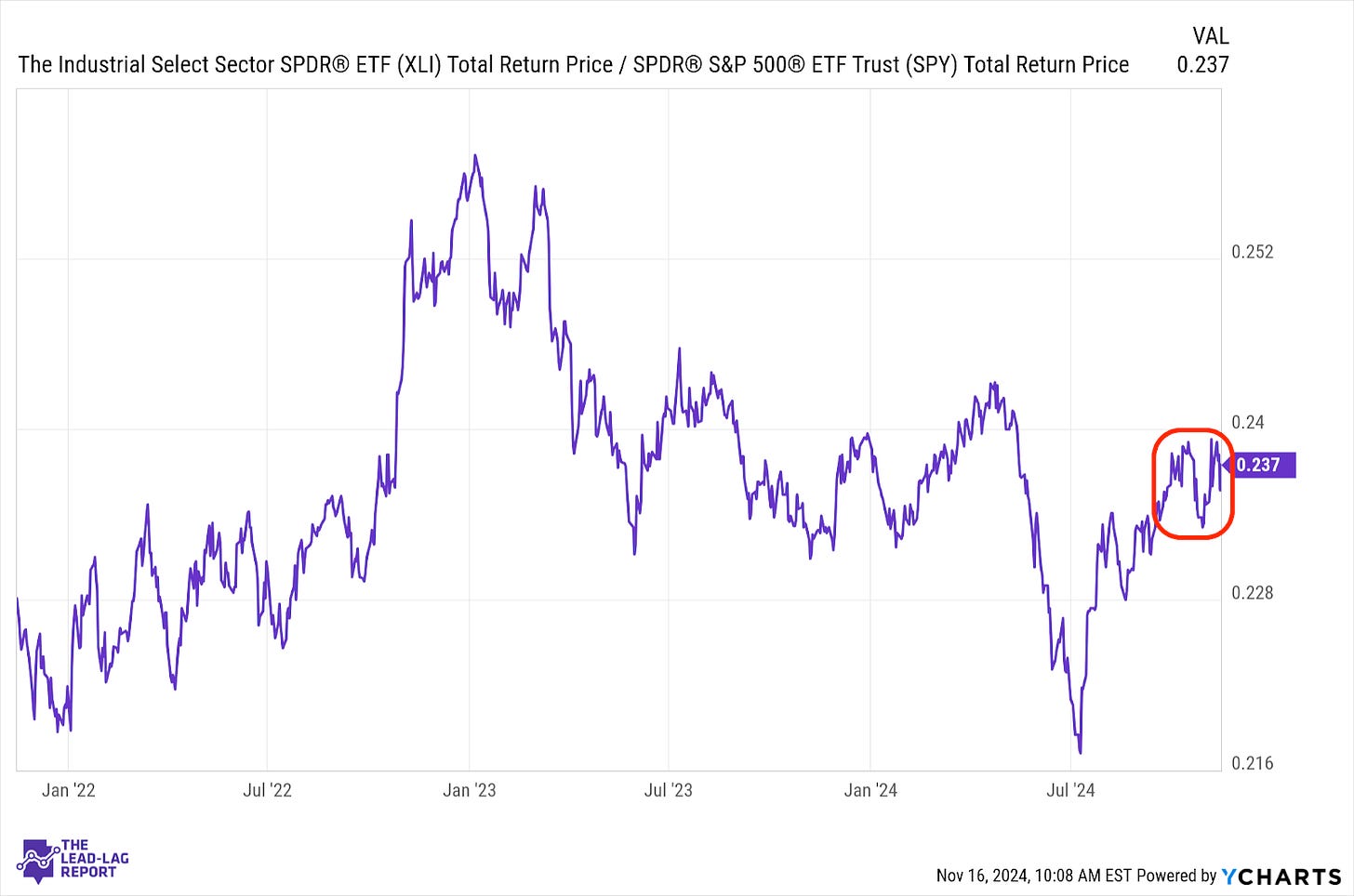

Industrials (XLI) – A Stock Picker’s Market

While cyclicals, generally speaking, are leading the current market rally, it’s becoming more of a stock picker’s market. Industrials, which had been leading the way thanks to anticipation of monetary easing from the Fed, have leveled off in the post-election landscape. This sector should continue to do all right as long as growth remains resilient and there are no blowups in manufacturing sectors overseas, but the direct Trump trade winners seem to be leading for the time being.

Small-Caps (VSMAX) – Negative Impact From Inflation & The Fed