Is the Rotation Into Value Affecting ATACX Signals? Factor Shifts, Tactical Timing, and What 2025 Revealed

Key Highlights

Market leadership in 2025 has shifted away from mega-cap growth stocks toward small-caps, value-oriented sectors, and emerging markets.

The rotation reflects improving risk appetite and broader market participation rather than a move toward defensive positioning.

Small-cap and emerging-market strength has historically aligned with risk-on environments, reinforcing signals used by tactical strategies.

ATACX’s positioning has adapted to the changing leadership, emphasizing small-cap exposure during favorable risk conditions.

The 2025 experience highlights the importance of flexibility, as tactical approaches seek to respond to evolving market regimes rather than chase past winners.

Market leadership rarely changes quietly. After years dominated by mega-cap growth stocks, late 2025 has brought a noticeable shift in tone. Smaller companies, value-oriented sectors, and emerging markets have moved into the spotlight, while many of the technology stocks that previously led the market have stalled. This change raises an important question for investors who follow tactical allocation strategies: does a rotation into value interfere with the signals used to determine when to take risk, particularly for a fund like ATACX that relies on timing rather than static exposure.¹

This question matters because factor rotations often begin beneath the surface, well before headline indexes reflect them. Tactical strategies that misinterpret these shifts risk reacting too late or drawing incorrect conclusions. At the same time, well-designed signals should be resilient enough to adapt as leadership evolves. The market environment of 2025 provides a useful test of that adaptability.

Value’s Return: Small Caps and Emerging Markets Lead

One of the clearest signs of the current rotation has been the resurgence of small-cap equities. After trailing large-cap benchmarks for several years, small-caps began outperforming decisively in the second half of 2025. The Russell 2000 broke above prior resistance levels and started to outpace the S&P 500, indicating that market participation was broadening beyond a narrow group of large technology firms.¹

This shift has been driven by more than simple mean reversion. Smaller companies tend to be more sensitive to economic expectations and borrowing costs. As inflation pressures eased and confidence grew that the Federal Reserve was nearing the end of its tightening cycle, investors became more willing to assume exposure to economically sensitive areas of the market.² The eventual pivot toward rate cuts reinforced that trend, particularly after a surprise reduction late in the year.³

The rotation has not been limited to domestic equities. Emerging markets, long overlooked during the era of U.S. growth dominance, have also staged a meaningful comeback. In 2025, emerging-market equities outperformed both developed international markets and U.S. stocks, reversing a pattern that had persisted for more than a decade.⁴ A softer U.S. dollar, easing inflation abroad, and supportive policy measures in several key economies helped revive investor interest.²

Together, these developments point to a shift away from defensive concentration and toward broader risk participation. Capital has flowed into areas historically associated with value exposure, including small-caps, cyclicals, and non-U.S. equities. For tactical strategies, the central issue is whether this behavior reflects constructive risk-on conditions or a fragile late-cycle rally.

How ATACX Interprets Risk

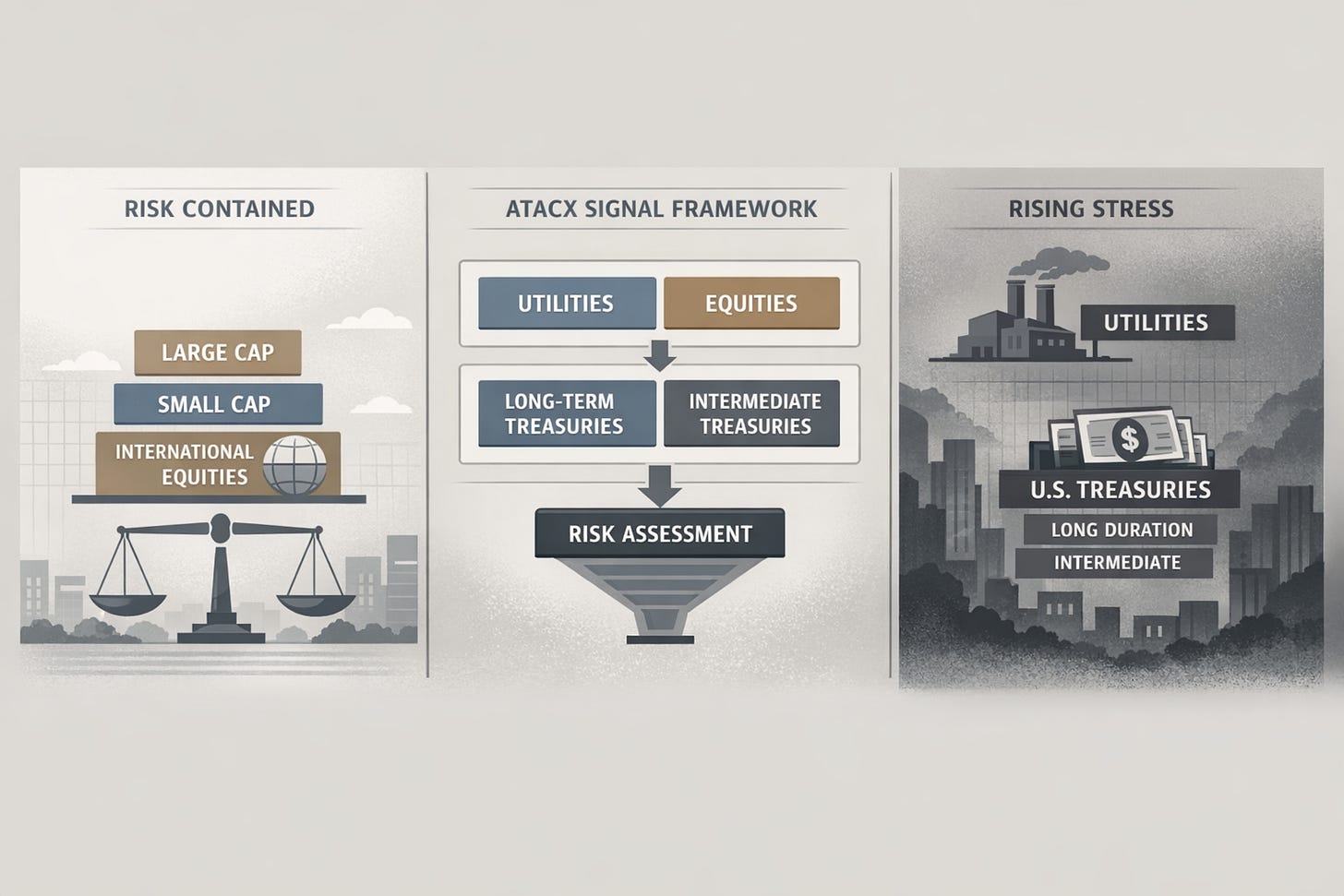

To understand how this rotation affects ATACX, it helps to clarify how the fund determines positioning. ATACX does not attempt to forecast which factor or sector will lead next. Instead, it seeks to identify changes in market conditions that have historically preceded shifts in volatility. When signals point to rising stress, the portfolio moves defensively. When risk appears contained, it allocates to equities.⁵

Two of the fund’s core indicators rely on inter-market relationships. One compares the performance of utilities, a traditionally defensive sector, with the broader equity market. Sustained outperformance by utilities has historically preceded equity drawdowns, reflecting growing investor caution.⁶ Another signal examines relative movements within the Treasury market, particularly the behavior of longer-duration bonds versus intermediate maturities. Sharp rallies in long-duration Treasuries often coincide with rising economic fear and increasing equity volatility.⁷

These indicators are combined with other historically validated measures designed to detect changes in market stress. The objective is not to predict returns, but to assess whether conditions favor risk exposure or capital preservation.⁶

Importantly, ATACX does not limit equity exposure to a single segment of the market. During risk-on periods, the fund may allocate to large-caps, small-caps, or international equities depending on where relative strength and momentum are strongest. During risk-off periods, it shifts predominantly into U.S. Treasury securities.⁶

Tactical Positioning in a Value-Led Market

The rotation into value during 2025 has not conflicted with ATACX’s signals. Instead, it has largely reinforced them. Defensive sectors have lagged, credit conditions have remained stable, and volatility has stayed contained. These conditions are consistent with a risk-on environment rather than a warning phase.

As a result, ATACX has maintained a strong equity posture, with a pronounced tilt toward small-cap equities. By late 2025, the fund’s exposure was heavily concentrated in small-cap ETFs, reflecting both the strength of that segment and the absence of defensive warning signals.⁸ This positioning suggests that the fund’s models interpreted the value rotation as confirmation of improving risk appetite rather than a sign of emerging stress.

This distinction is critical. A rally led by value stocks does not inherently signal trouble. In many cases, it reflects expanding participation and improving confidence. When capital rotates out of defensive leadership and into cyclicals, it often coincides with declining volatility and healthier market breadth.⁹

That said, tactical strategies are not immune to risk. Small-cap and emerging-market equities remain sensitive to interest rates and macro surprises. A resurgence in inflation or an abrupt shift in monetary policy could quickly undermine the current leadership. In such a scenario, the same indicators that currently support equity exposure would be expected to reverse, prompting a defensive reallocation.³

What the Rotation Reveals About Tactical Discipline

The experience of 2025 highlights an important principle: successful tactical strategies are not about chasing yesterday’s winners. They are about responding systematically to changes in market conditions. ATACX did not need to predict that value would outperform. It simply responded to improving risk signals and allocated toward the areas exhibiting strength during that regime.

History shows that extended periods of concentrated leadership often give way to broader participation. After long stretches dominated by large-cap growth, rotations into value and international markets are not unusual.¹⁰ The challenge for investors is adapting without abandoning discipline.

For those relying on static portfolios, such transitions can be uncomfortable. Tactical strategies, by design, seek to adjust as leadership changes. Whether the current value-led cycle persists or eventually reverses, the advantage lies in having a process that evolves with conditions rather than reacting emotionally after the fact.

Conclusion

The rotation into value has not distorted ATACX’s signals. Instead, it has validated them. Strength in small-caps and emerging markets reflects improving risk appetite, stable volatility, and broadening participation—conditions consistent with a risk-on environment. The fund’s positioning has adapted accordingly, illustrating how tactical allocation can respond to evolving leadership without relying on fixed assumptions.

Markets will continue to rotate, and no leadership regime lasts indefinitely. The lesson of 2025 is not that value will always outperform, but that flexibility matters. Investors who recognize shifts in market character and align exposure accordingly are better positioned to navigate uncertainty. Tactical strategies like ATACX offer one framework for doing so, emphasizing discipline over prediction and adaptation over attachment.

Consider ATACX. I believe in it. I wouldn’t have launched the fund if I didn’t.

Footnotes

Equiti Trading, “Russell 2000 Breaks Out as Investors Rotate into Risk Assets,” December 15, 2025.

VanEck, “Turning Tides: EM Equities Are Surging in 2025,” July 7, 2025.

Cape Cod 5, Market Review Q3 2025, October 2025.

Nasdaq, “Rare Signal Says Emerging Markets Could Be Entering a Multi-Year Outperformance Cycle,” December 21, 2025.

ATAC Funds, ATAC Rotation Fund Overview, accessed December 2025.

ATAC Funds, ATAC Rotation Fund Prospectus, April 7, 2025.

Michael A. Gayed, “Clearing the Way,” Lead-Lag Report, August 25, 2025.

Financial Times, “ATAC Rotation Fund (ATACX) Holdings,” December 2025.

Michael A. Gayed, “They Sucked Everyone Back In,” Lead-Lag Report, August 13, 2024.

The Acquirer’s Multiple, “VALUE: After Hours—Michael Gayed on Small Caps, Inflation, and Market Cycles,” February 2025.

The Russell 2000 Index is a stock market index that tracks the performance of 2,000 small-cap US companies, serving as a key benchmark for small-cap stocks and a barometer for the US economy

The Nasdaq 100 is a stock market index comprising the 100 largest non-financial companies listed on the Nasdaq stock exchange, weighted by modified market capitalization

The Standard and Poor’s 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States.

Past performance is no guarantee of future results.

The Fund’s investment objectives, risks, charges, expenses and other information are described in the statutory or summary prospectus, which must be read and considered carefully before investing. You may download the statutory or summary prospectus or obtain a hard copy by calling 855-ATACFUND or visiting www.atacfunds.com. Please read the Prospectuses carefully before you invest.

Fund Risks: An investment in the Fund is subject to numerous risks including the possible loss of principal. There can be no assurance that the Fund will achieve its investment objective. Equity securities, such as common stocks, are subject to market, economic and business risks that may cause their prices to fluctuate. As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund, and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV. Please see the prospectus and summary prospectus for a complete description of principal risks.

The Fund’s investments will be concentrated in an industry or group of industries to the extent the portfolio manager deems it appropriate to be so concentrated. In such event, the value of Shares may rise and fall more than the value of shares that invest in securities of companies in a broader range of industries.

Investing involves risk including the possible loss of principal.

JOJO is distributed by Foreside Fund Services, LLC.

ATACX is distributed by Quasar Distributors, LLC.