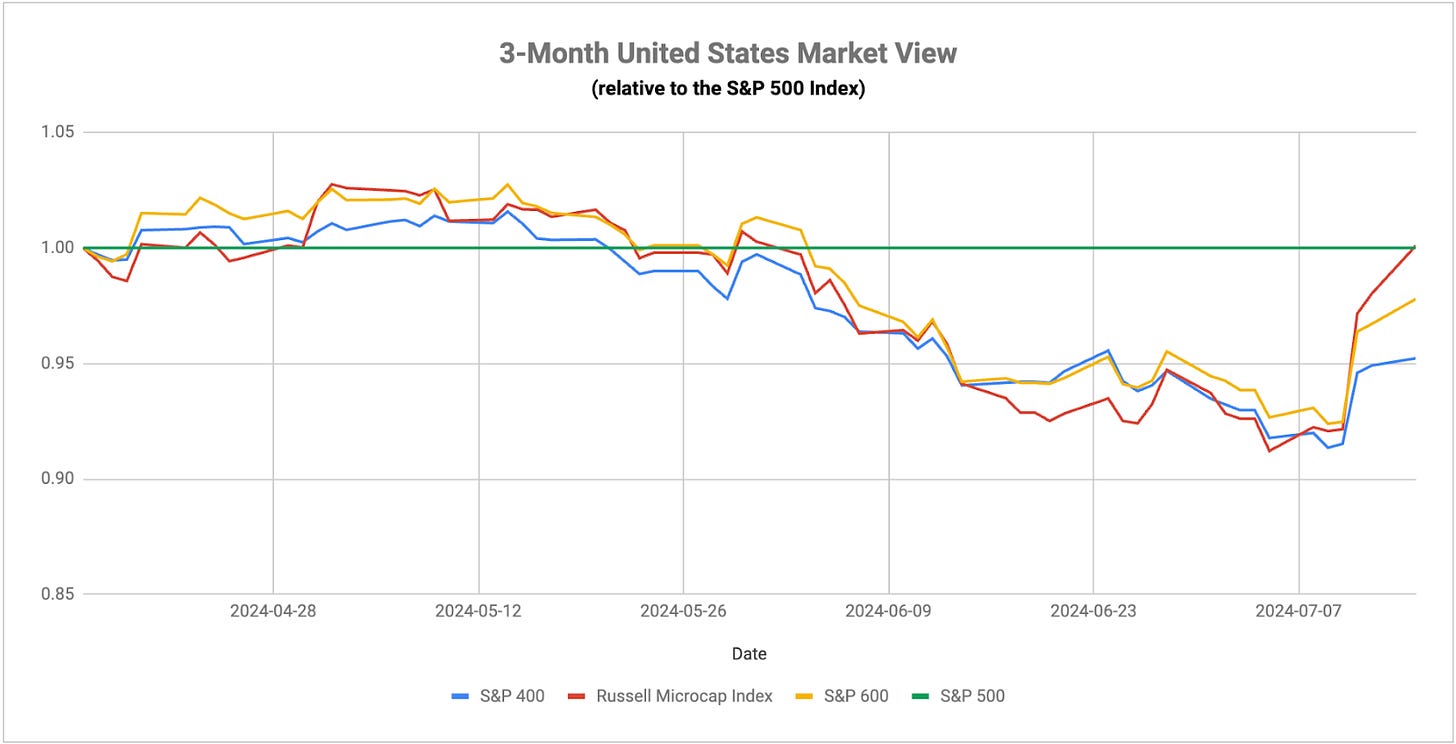

Following the second consecutive monthly inflation report that showed prices moderating, small-caps have overtaken mega-cap growth as the unquestioned market leader. I think there are two ways to interpret this. Very broadly, a rotation from large-caps into small-caps could be viewed as a bullish sign since investors are moving into a traditionally riskier asset class. That could ultimately prove to be the case. After all, long-term Treasuries really aren’t rallying at all and that’s something you’d expect to see if investors are really taking risk off the table. Plus, from a historical perspective, sudden and sharp moves like this where small-caps have outperformed large-caps by a wide margin have coincided with market bottoms, not the beginning of new bear markets.

That being said, I do think this rotation does have a minor flight to safety feel to it, but it’s simply taking the form (for now) of a growth to value move, not a stock to bond move.