Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: THE QUESTION BECOMES WHETHER THE SMALL-CAP RALLY IS SUSTAINABLE

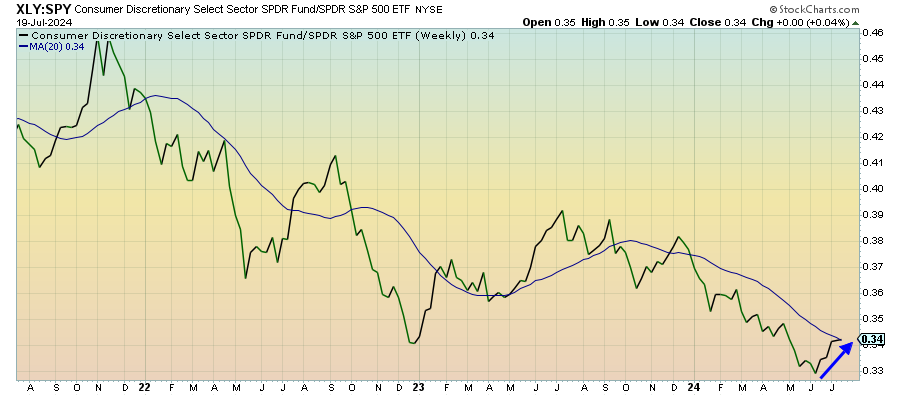

Consumer Discretionary (XLY) – Can Spending Hold Up?

Not all growth sectors are lagging here and this one has actually been having a pretty good run over the past month. This could just be an oversold bounce following a year-long lagging trend because I don’t see much in the macro backdrop to this sector that is encouraging. If consumer spending can hold up, there’s a chance this short-term trend can continue, but it’s looking less likely over the longer-term.

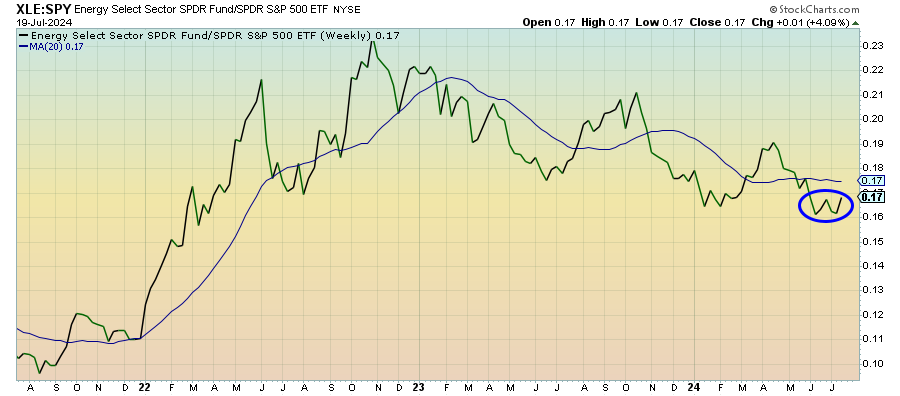

Energy (XLE) – Growth Will Be The Driver

Energy stocks haven’t had quite as strong of a rally as other cyclicals over the past couple weeks, but oil prices have also been trending lower on growth concerns. Japan lowering its 2024 GDP estimate last week didn’t help matters, but this week’s U.S. first GDP reading for Q2 could help correct that. Lower output quotas seem to be stemming some of the bleeding, but growth rates are going to be the big driver.

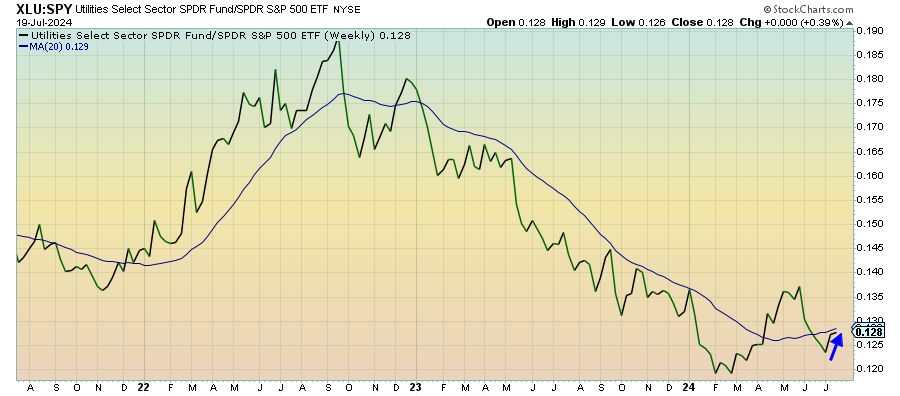

Utilities (XLU) – Why Are Defensives Outperforming As Well?

I think outperformance of the utilities sector might be one of the stronger signals that the small-cap rally will fade in the near-term. If this were a shift where investors were adding exposure for traditional risk-on reasons, you wouldn’t expect to see defensives showing strength as well. This will be one of the more important ratios to watch over the next few weeks.

Industrials (XLI) – Needs Growth To Sustain

Cyclicals maintained their momentum from the prior week. The ability to maintain that momentum will be dependent on the Fed’s ability to cut rates later this year and data showing sustained strength in the economy. This week’s GDP and PCE data could provide a short-term boost if the slowdown narrative could get pushed further into the future.

Materials (XLB) – Lumber Is The Tell