Is There An Investment Case For A Closet S&P 500 Index Fund?

Few understand this.

Every week, we’ll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

If you read the standard disclosure on any investment fund, you’ll see that “past performance is no guarantee of future returns”. It’s a warning that should be heeded as research has shown that performance chasing can lead to below average performance going forward. Still, it’s impossible to look at the historical performance of the Adams Diversified Equity Fund (ADX) and not be at least a little intrigued. After all, it’s beaten the S&P 500 over the past 1-, 3-, 5- and 10-year holding periods. Very few funds can make that claim.

That kind of performance, however, is a good reason to look under the hood of the fund. Sometimes there’s a reason why a fund has performed as well as it has. For ADX, that reason is that it looks just like the S&P 500! It’s the ever-present risk of “closet indexing” that can make investors the unwitting victims of essentially paying high fees for a product they could largely find elsewhere in the form of an ultra-low cost index fund. Let’s take a look at the full investment case of ADX and whether it makes sense to buy it instead of the S&P 500.

Fund Background

ADX seeks to deliver superior returns over time by investing in a broadly-diversified equity portfolio. The fund invests in a blend of high-quality, large-cap companies. It seeks to generate returns that exceed its benchmark as well as consistently distribute dividend income and capital gains to shareholders.

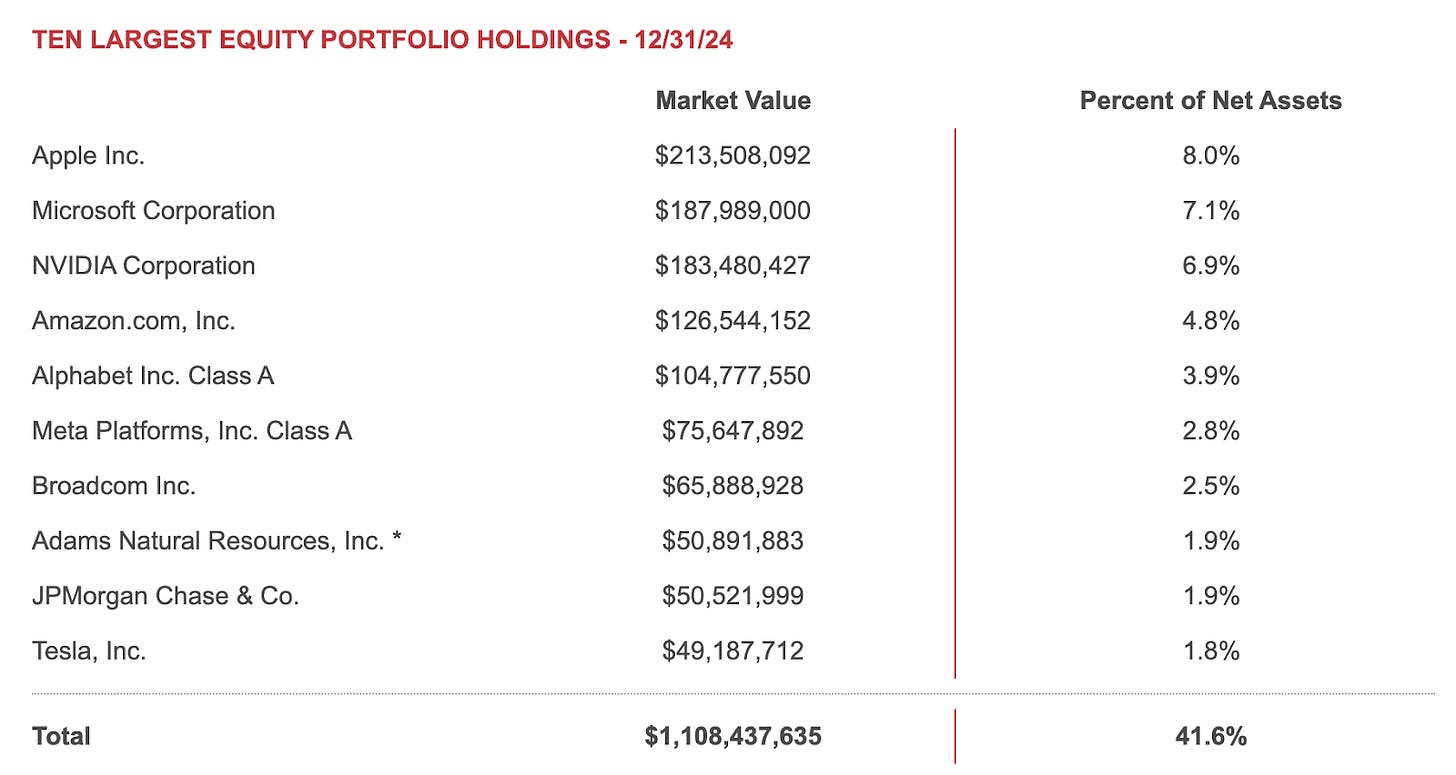

At its roots, ADX offers a very reasonable objective. The focus on high quality large-caps makes sense in almost any portfolio and the 0.56% expense ratio, at least within the closed-end fund universe, is quite low. My concern, as I mentioned up top, is how similar it looks to the current S&P 500. The top 6 holdings are all magnificent 7 names and the 7th also resides in the top 10. There’s no calculation of active share offered by the fund, but a 60% turnover rate suggests that there is trading going on within the fund. The question is whether or not the fund’s managers can generate enough alpha to support an 8% distribution rate and still come out ahead on a total return basis. I have my doubts, but with AUM of $2.7 billion, there are a lot of believers.

Two things stand out about this portfolio. First, these sector allocations are almost identical to those of the S&P 500. Second, the long-term correlation of these two portfolios is 0.98. In other words, they look essentially the same and they act essentially the same. This doesn’t make a strong case at all for why you’d want to own this fund over a standard S&P 500 ETF that charges only 0.03%. You might as well buy that and save yourself an extra 0.50% per year on fees alone.

The only differences in the top 10 holdings of ADX and the S&P 500 is that this fund includes JPMorgan Chase and the Adams Natural Resources Fund (which, of course, also falls under the Adams umbrella), while excluding Berkshire Hathaway and one of the Alphabet share classes. Individual holding allocations aren’t even all that far off. From everything we see here, ADX is effectively a near clone of the S&P 500.

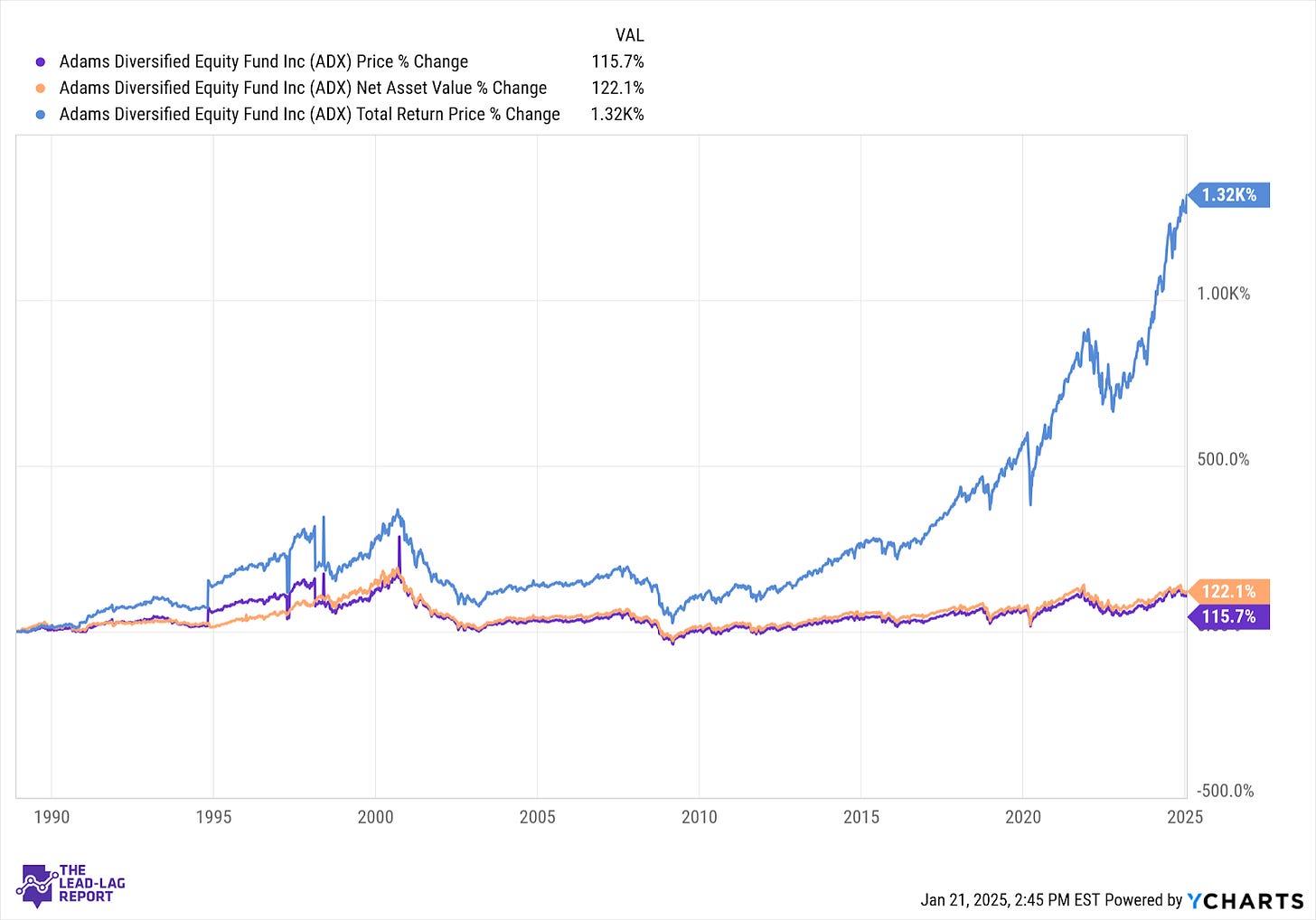

ADX was launched all the way back in 1929. As far back as this chart was able to go (late 1988), the fund has returned a total of 1,320%, which translates to about 7.7% annually.

Over its lifetime, ADX has trailed the S&P 500 by a fairly wide margin. It’s in the last decade that the correlation between the two has approached 1 and ADX has been able to slightly outperform on a total return basis. At this point, I think we have to assume that the high correlation between the fund and the index will remain, especially as long as the magnificent 7 continues to rule the index.

There’s probably not much need to spend a lot of time on this. Given the high overlap, the volatility levels of ADX and the S&P 500 are nearly the same. Historically, the discount to NAV on ADX has stayed within a fairly consistent range. Normally, that adds to volatility, but in ADX’s case, it really hasn’t.