The big news of the week, obviously, is the U.S.-China trade “deal”. I use the word deal in quotes because we still don’t have a lot of details as to what it’s going to look like. We know that reciprocal tariffs have been paused, but that still leaves a 30% tariff on Chinese imports in place. In broad macro terms, that’s still a relatively high number and it could still be enough to push inflation higher in the longer-term.

Still, the market is viewing this as a net positive in the short-term and probably rightly so. We got a fairly broad risk-on move post-announcement that saw U.S. equities moving sharply higher and Treasury bonds & gold moving lower. The dollar pivoted higher as well as sentiment seems to have returned to U.S. assets once again.

Is the trade truce the real deal though? As we’ve seen countless times in the past, the narrative tends to shift rather quickly and what appears as easing tensions one day can do a 180 the next with one comment from the White House. Overall, I think the initial escalation between the U.S. and China was more an effort to bully the other into submission than any form of real economic policy. With the April hard data starting to come in, the White House probably realized that the current 145% tariff was unsustainable and the markets would soon see the damage being done by the trade war. Reversing course now gives them an out to say that conditions will improve in the near future even if the short-term data looks worse.

The April CPI data, however, didn’t show a major worsening in inflationary pressures (although it was still early in the trade war). The below expectation reading was fueled heavily by lower energy prices, but we may be seeing conditions continue to normalize. Core inflation is still up 2.8% year-over-year, but it’s only up around 2% on a 3-month annualized basis. That may change as we understand the longer-lasting effects of the Trump tariff policies, but it may also open the door for the Fed to cut rates sooner than later.

Powell’s comments coming out of the Fed meeting pushed the rate cut calendar back based on the uncertainty surrounding the economic outlook. If the Fed is satisfied that a ~2% core inflation rate is good enough to focus on slowing growth, rate cuts could be back on the table later this summer. Powell has been pretty consistent in his wait-and-see messaging, so nothing may have changed, but I think it’s worth listening closely to his upcoming speeches for clues.

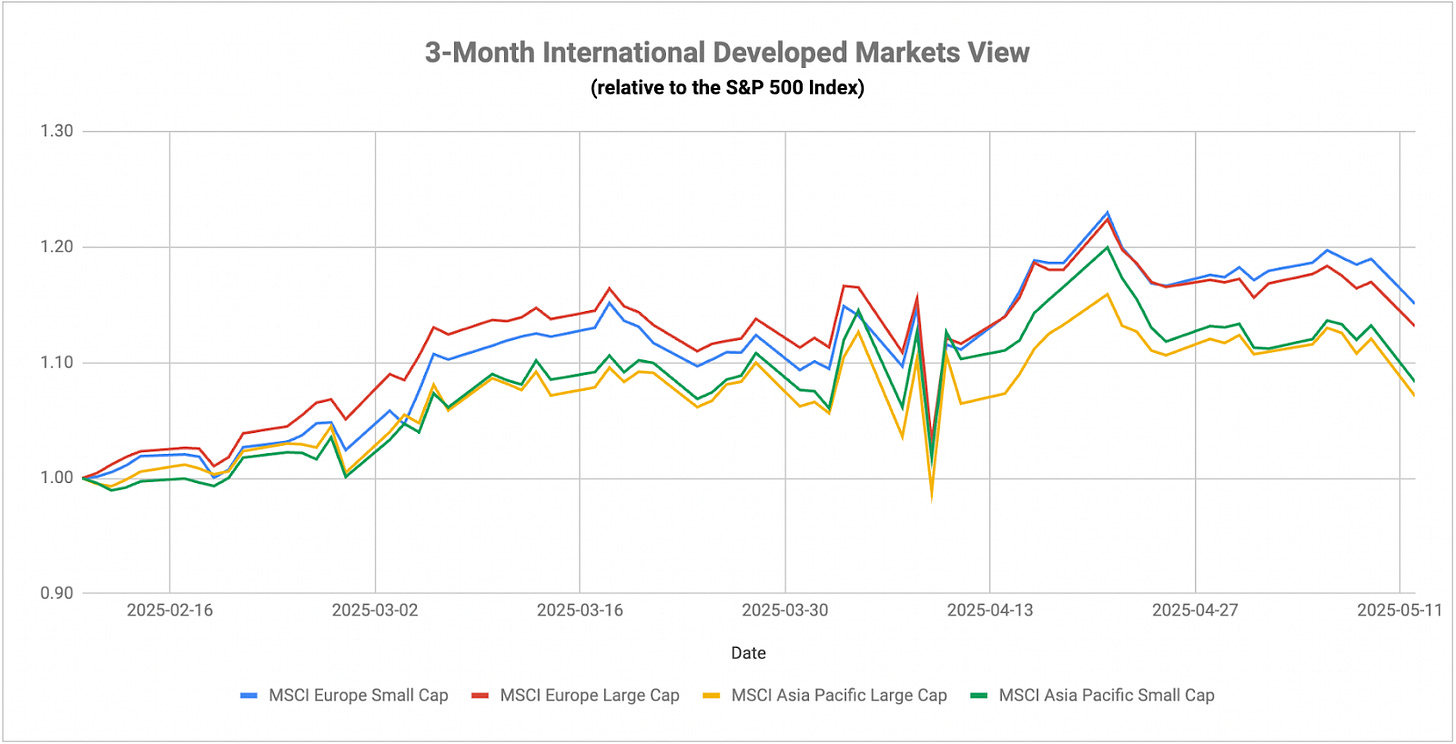

International stocks have been leading the S&P 500 throughout 2025 and it’s been European stocks that have been doing the heavy lifting. Germany and Spain are both up more than 25% year-to-date, while other countries, including Austria, Finland and Italy, are all up more than 20%. The positive progression of economic growth in the region, moving from stagnation to slightly positive, has been a catalyst for the Eurozone’s equity markets, while the easing cycle from the ECB has provided an additional tailwind.

One of the premises of the rally has been the negative sentiment surrounding dollar-denominated assets. The negative growth trajectory combined with the broad disdain worldwide for the Trump tariffs has created an environment for foreign and value stocks to really thrive. The 90-day pause in the trade war between the U.S. and China may be ending that trend. As we saw in the early part of this week, investors pivoted back to U.S. equities in droves and that momentum has been carrying forward since. International developed market stocks have still produced additional gains, but they’ve lagged the S&P 500 badly in recent days.