Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: IT’S GETTING SERIOUS NOW

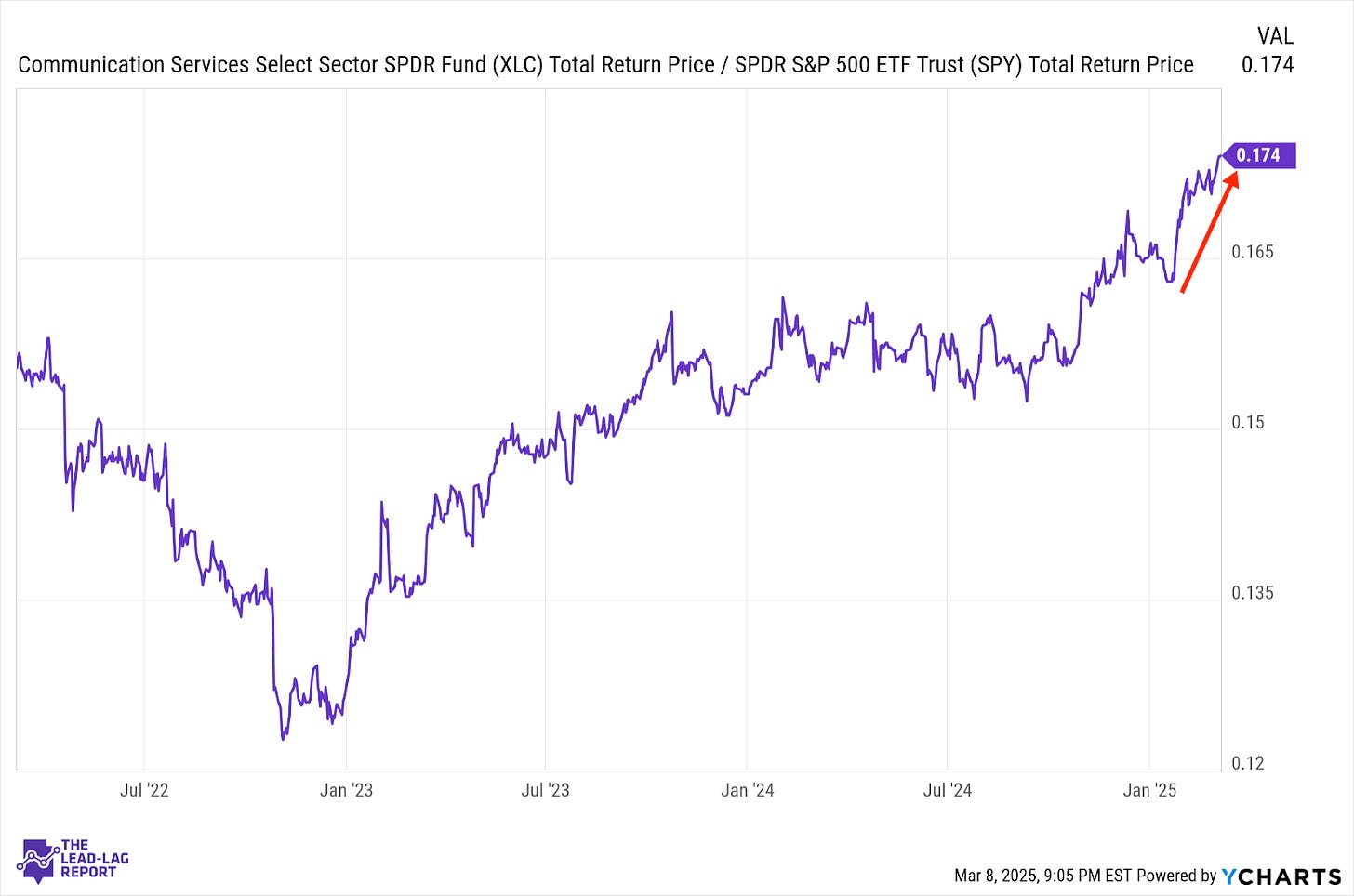

Communication Services (XLC) – Media & Telecom Stepping Up

Despite Facebook’s strong year so far, this is one of the few sectors where the equal weight version is outperforming the traditional cap-weighted version. That means outperformance has, thus far, been strong and sustainable. Even as the magnificent 7 stocks rotate out of favor, the breadth of this sector, which includes more durable media and telecom names, has stepped up big time.

Materials (XLB) – Tariffs Begin To Have An Impact

The materials sector has benefited post-Trump inauguration, even though the prospect of a growth slowdown looms over the entire economy. We’re seeing a tariff-induced rise in lumber prices right now and that could very well spill over into other commodities soon as well. From an equity perspective, the rotation out of tech has benefited cyclicals (although not all of them equally).

Industrials (XLI) – Volatile With Long-Term Risks

Industrials are still pretty all over the place, although they’ve done quite well on a relative basis over the past couple weeks. Even though they’ve outperformed, inflation and growth are likely to be long-term risks as long as the trade war continues. Manufacturing data has shown an uptick in recent months, but nothing that would suggest a definite expansion.

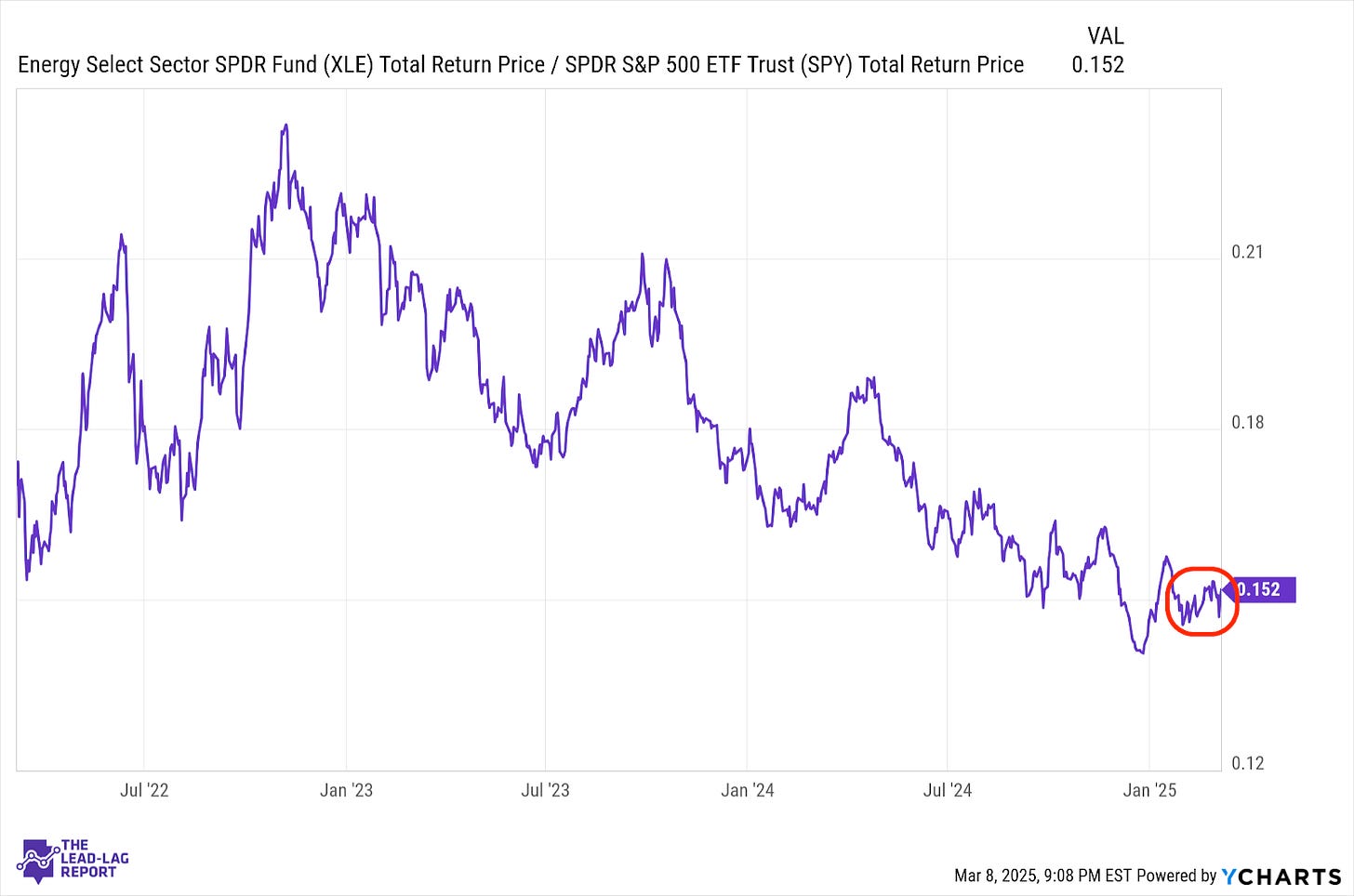

Energy (XLE) – The Dreaded “Period Of Transition”

Energy stocks haven’t been underperformers over the past few weeks, but the outlook for the sector hasn’t improved. President Trump’s “period of transition” comments are being taken as an indication of recession risk and tariffs are likely to temper demand. There are signs that the global demand for energy is beginning to wane and the outlook for energy stocks looks comparatively poor.

Utilities (XLU) – Signaling Weeks Ahead

Utilities continue to signal the risk-off shift in the market, although not as forcefully as staples and dividend stocks at the moment. Regardless, this has been a roughly 3-month stretch where utilities have been leading, several weeks before the current downturn started. The utilities sector remains one of the more successful signals that indicates risk-off conditions ahead.

Consumer Staples (XLP) – Performing Very Strongly