With the Trump inauguration just days away, the focus should be on how quickly and how decisively the new president will adjust its foreign economic policy stances. I’m obviously talking about tariffs. I still believe that Trump uses tariffs as a negotiating and strong-arming tool as much as a potential economic tool to reshore business back to the United States. The latest indications are that the Trump administration is considering a gradual rollout of tariffs, which should mitigate the risk of a more violent market reaction while keeping some dry powder on the sidelines. At this point, we have no idea what the end foreign trade policy will look like, but there’s a good chance that, at a minimum, it increases market volatility during the second half of this month.

On Tuesday, a cooler than expected PPI report seemingly did little to calm investors worries about interest rates or inflation. Instead of dipping on the news, the 10-year Treasury yield held firm around the 4.8% level. While the PPI report isn’t considered nearly as consequential as the CPI report scheduled to drop on Wednesday, it’s a directionally positive bond market signal at the margins. The reason the bond market might not be reacting is because the overall U.S. inflation picture is still troubling. The annualized PPI rate of 3.3% is well above the 2.1% rate printed in September, demonstrating a clear re-acceleration. The December CPI is expected to come in at 2.9%, up from 2.4% in September. Services and rent inflation are still well north of 4%. As long as inflation continues trending in the wrong direction, there’s probably little incentive for bond yields to move lower in the near-term.

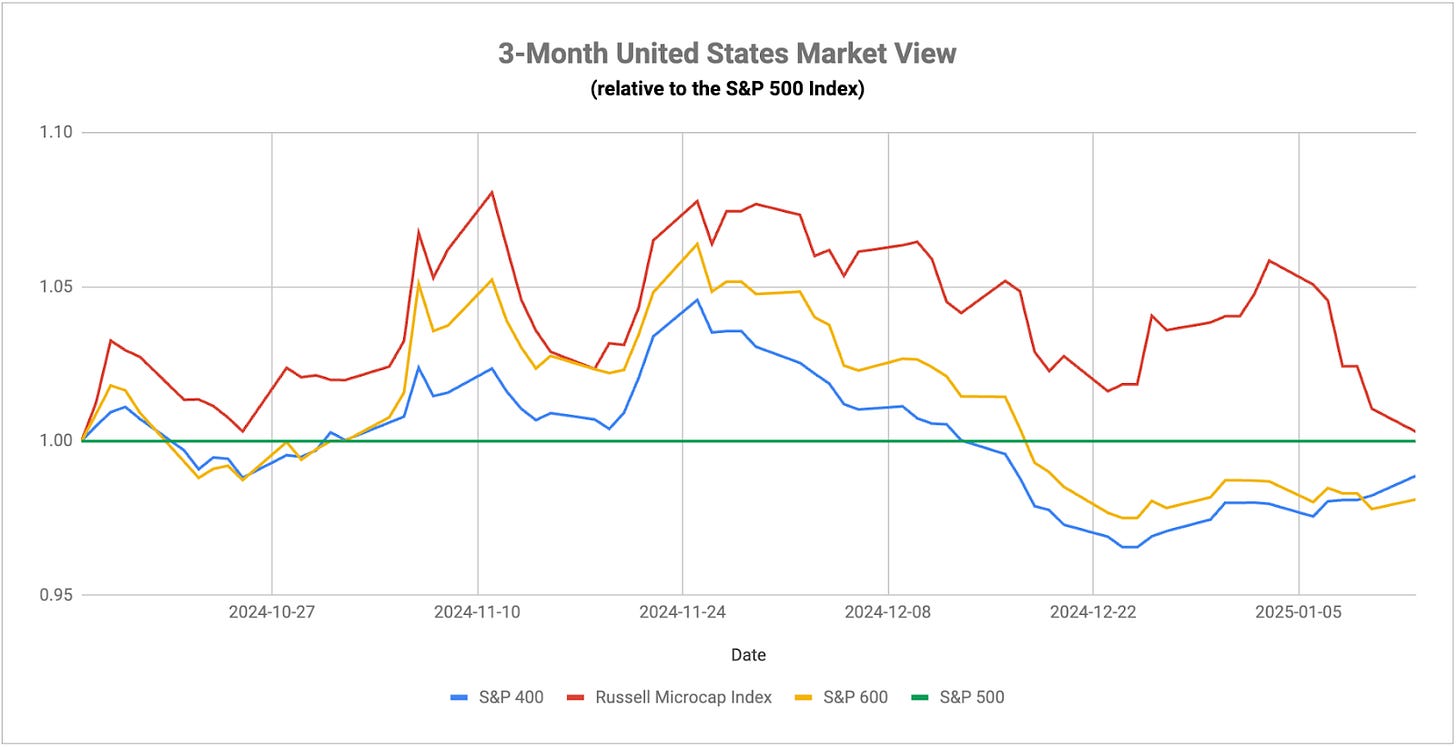

Within U.S. equities, there are signs that investors are getting a little more cautious. Utilities and healthcare have gotten off to relatively strong starts to 2025 and those are two sectors that generally do the best job of indicating investor sentiment. The problem is that they’ve yet to get confirmed broadly (consumer staples, low volatility and dividend stocks have all continued to underperform). While bonds look like they’re doing a fairly good job of reflecting inflation risk here, small-caps have been doing a better job of reflecting default risk. They’ve been making minor improvements relative to large-caps in recent weeks, but the dive in micro-caps from the chart above is telling. This is likely the first group to fall should worsening credit conditions start to get priced in. The fact that they underperformed badly even as small-caps and mid-caps held firm could be a problem.

In a little over a week, the Bank of Japan will meet to set policy rates. It would not be an understatement to say that this meeting, in my opinion, is one of the most consequential of the last several years, if not decades. At stake is the potential catalyst for another reverse yen carry trade similar to the one experienced back in August. The BoJ decided to defer on a rate hike in December citing the uncertainty surrounding the next Trump presidential term and the need for more data on inflation and wage growth. Shortly after the meeting, the annualized Japanese inflation rate jumped from 2.3% to 2.9%, seemingly making a stronger case for a rate hike, while wage growth remains well ahead of inflation. Yet many people believe that the central bank will stand pat yet again and wait until March to reconsider.

We know from the news headlines that Japan is already at least considering an intervention to strengthen the yen. The two they did in 2024 produced almost no results, so I’m surprised that they’re considering one again. On the other hand, the BoJ’s surprise rate hike in July sent the yen soaring versus the dollar and is what triggered the pullback in U.S. stocks. It would seem that the BoJ would opt for another rate hike if their goal really is to save the yen given its past effectiveness, low cost and ability to help fight rising inflation. But it sounds like the Japanese government still favors an overall dovish policy stance despite evidence to the contrary. Either way, the pressures are definitely building in Japan. If they hike this month, they risk triggering a global yen carry trade unwind. If they delay, they probably save themselves some volatility in the near-term, but risk a more adverse event later this year.

Special Announcement

The Cullen Enhanced Equity Income ETF (NYSE Ticker: DIVP)

Historically only available through separately managed account and mutual fund vehicles, the Enhanced Equity Income strategy focuses on income generation by owning large cap value, dividend paying stocks and then selectively writing covered calls on 25-40% of the portfolio for additional income. The strategy has been managed for the past 14 years as an SMA and has about $1.8B in AUM. The Cullen Enhanced Equity Income ETF (DIVP) launched in March 2024 and follows the same investment approach and principles as the SMA version of the strategy.

Key features:

Consistent Income Potential – Approximately half of the income is generated from dividends, while the other half comes from option premiums.

Dynamic Covered Call Overlay - The ETF selectively writes covered call options on a target range of between 25-40% of the underlying equity securities owned in the portfolio. The fund receives premiums from writing covered call options.

Disciplined Value Style – Cullen employs a “value” style investment approach, which means they selects stocks for the portfolio that have lower price-to-earnings ratios and possess above-average earnings and dividend growth potential.

If you are interested in more information click: Cullen Enhanced Equity Income ETF or contact us at info@cullenfunds.com

To determine if the Fund is an appropriate investment for you, carefully consider the fund’s investment objectives, risk, and charges and expenses. This and other information can be found in the fund’s prospectus, which can be obtained by calling 1-833-4CULLEN or by visiting www.cullenfunds.com

Please read the prospectus carefully before investing.

DISCLAIMER – PLEASE READ: This is sponsored advertising content for which Lead-Lag Publishing, LLC has been paid a fee. The information provided in the link is solely the creation of Cullen Capital Management. Lead-Lag Publishing, LLC does not guarantee the accuracy or completeness of the information provided in the link or make any representation as to its quality. All statements and expressions provided in the link are the sole opinion of Cullen Capital Management and Lead-Lag Publishing, LLC expressly disclaims any responsibility for action taken in connection with the information provided in the link.

The biggest news in emerging markets has to be the United States decision to sanction the Russian oil industry, which sent crude oil prices sharply higher. Asian countries, including China and India, are among the biggest importers of Russian oil and figure to be the most impacted. For China, it comes at a time when the country is likely to get more aggressive in enacting stimulus measures to increase consumption. Tighter energy supplies figure to make oil in these regions more expensive and hinder any potential recovery.

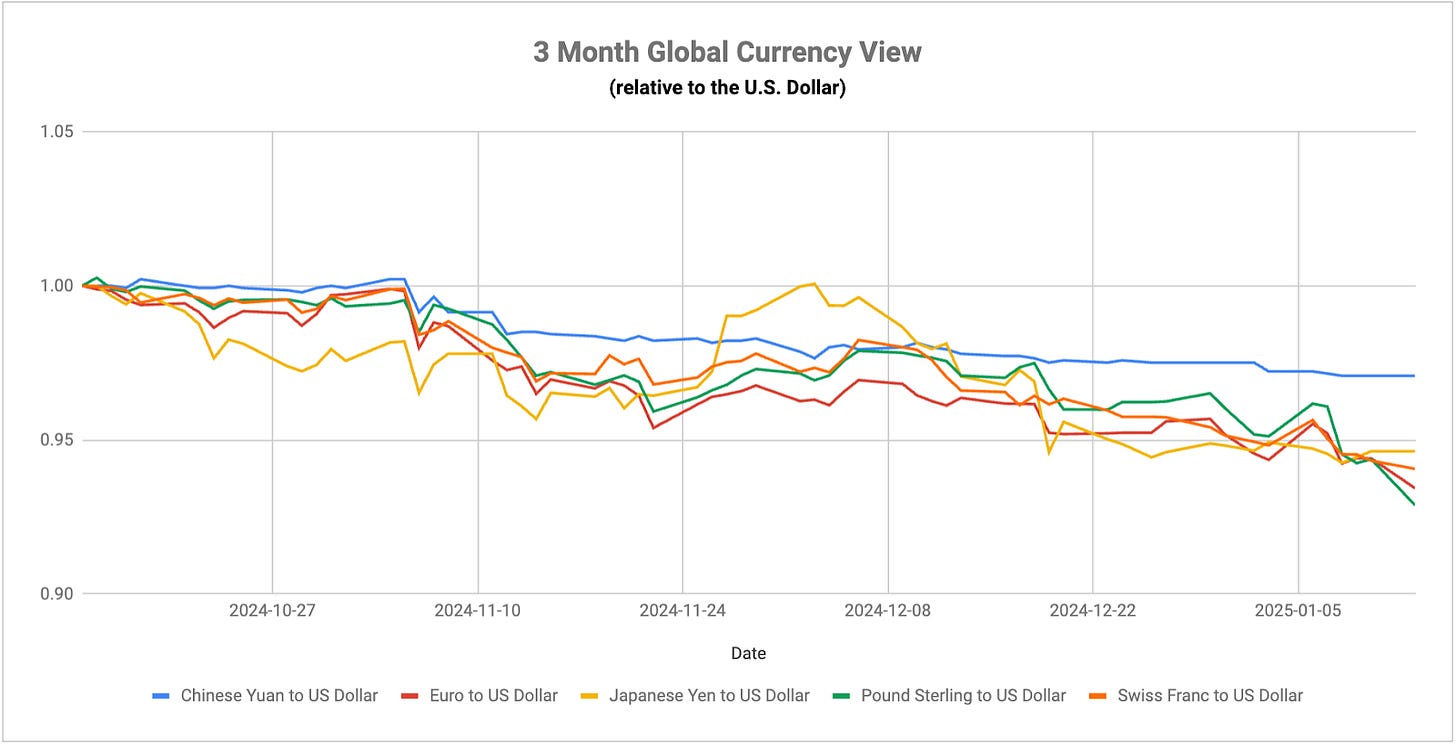

As expected, emerging economies are bracing themselves for the impact of Donald Trump becoming president once again. American corporations have been accelerating their inventory builds ahead of any tariff implementation and that’s pulled the demand calendar forward for many suppliers. Sovereign governments have also been issuing large amounts of debt in order to keep liquidity positions high. News that Trump tariff implementation could be a slow burn over time instead of a day one drop on the economy should add some positive sentiment in the short-term, but it’s clear that conditions will remain tough for emerging markets for a while. The strong dollar is causing multiple governments to step in to support their currencies in the short-term, but with tariffs on the horizon and a mixed bag of growth outlooks across the spectrum, there may not be a catalyst for a longer-term emerging market revival on the horizon.

Speaking of which, China is one of those countries stepping in to support the yuan. It recently pledged its support for the currency by adjusting some capital control measures, but like its support for broader economic stimulus measures, most of this has been talk with little action. The yuan weakened further as its 10-year yield dropped from 2.2% at the end of September to nearly 1.6% today as Chinese investors appear to be heading for safe havens amid the current turbulence. That’s resulted in the Chinese central bank putting a halt on bond purchases to avoid further downward pressure on yields and the yuan. None of this is terribly surprising, but it does a fairly significant amount of risk to market very early on in 2025.

The dollar index continues to plow towards the 110 level for the first time since Q4 2022 and virtually every major world currency is feeling the impact. Almost all of the news coming out right now is supportive of a higher dollar and higher interest rates - a lack of rate cuts from the Fed, upward trending inflation readings, the potential for Trump tariffs, healthy U.S. GDP growth, a strong labor market. The ECB and PBoC, in particular, have confirmed their plans to continue easing monetary and fiscal conditions, which could provide additional incentive for the dollar to strengthen further.

The wild card, of course, is the Bank of Japan and next week’s policy meeting. If they decide to spring a modest surprise on the markets and raise interest rates, the dollar could quickly reverse course even if it isn’t weakening against all major currencies. As we saw back in August, the market reaction would likely be swift and severe. It still might be a coin toss as to whether the BoJ moves or not, but the potential risk in the forex market over the next couple of weeks is quite high.

The Indian rupee just hit an all-time low versus the dollar this week, although the Reserve Bank of India’s own intervention helped to stop the bleeding for now. This is really a continuation of the trend that has developed over decades, but its recent acceleration demonstrates how India is slowly losing its grip on the preferred emerging market status among investors. GDP growth is showing signs of slowing, inflation is at the high end of the central bank’s target range and now the RBI is intervening to save its currency.

The Lead-Lag Report is provided by Lead-Lag Publishing, LLC. All opinions and views mentioned in this report constitute our judgments as of the date of writing and are subject to change at any time. Information within this material is not intended to be used as a primary basis for investment decisions and should also not be construed as advice meeting the particular investment needs of any individual investor. Trading signals produced by the Lead-Lag Report are independent of other services provided by Lead-Lag Publishing, LLC or its affiliates, and positioning of accounts under their management may differ. Please remember that investing involves risk, including loss of principal, and past performance may not be indicative of future results. Lead-Lag Publishing, LLC, its members, officers, directors and employees expressly disclaim all liability in respect to actions taken based on any or all of the information on this writing.