While I like to talk a lot about sectors or themes relative to the broader market, I think it’s time to acknowledge the idea that the Fed may be lining up to make a policy mistake even as the markets dial back their expectations for rate cuts. It wasn’t that long ago that the futures market was pricing in 6-7 cuts by the end of 2025. Now that number is down to 2-3 and even that may still be too much. If GDP growth is running at ~3%, the unemployment rate is just a hair above 4% and inflation has at least stabilized around 2-3% for the time being, there really isn’t much case to be made for cutting rates significantly here. Unless you want to make the argument that a normalization is needed, it’s tough to argue that rate cuts are what’s needed right now when liquidity in the system is still high and credit spreads are near all-time lows. Especially with the likelihood that inflation could start climbing again in the 1st half of 2025, the Fed might be wiser to hold rates steady right here and actually try to remain ahead of the curve for once instead of listening to what the markets want by loosening monetary conditions. By loosening heading into what’s likely to be a more challenging inflationary environment, I think the Fed is setting things up for trouble.

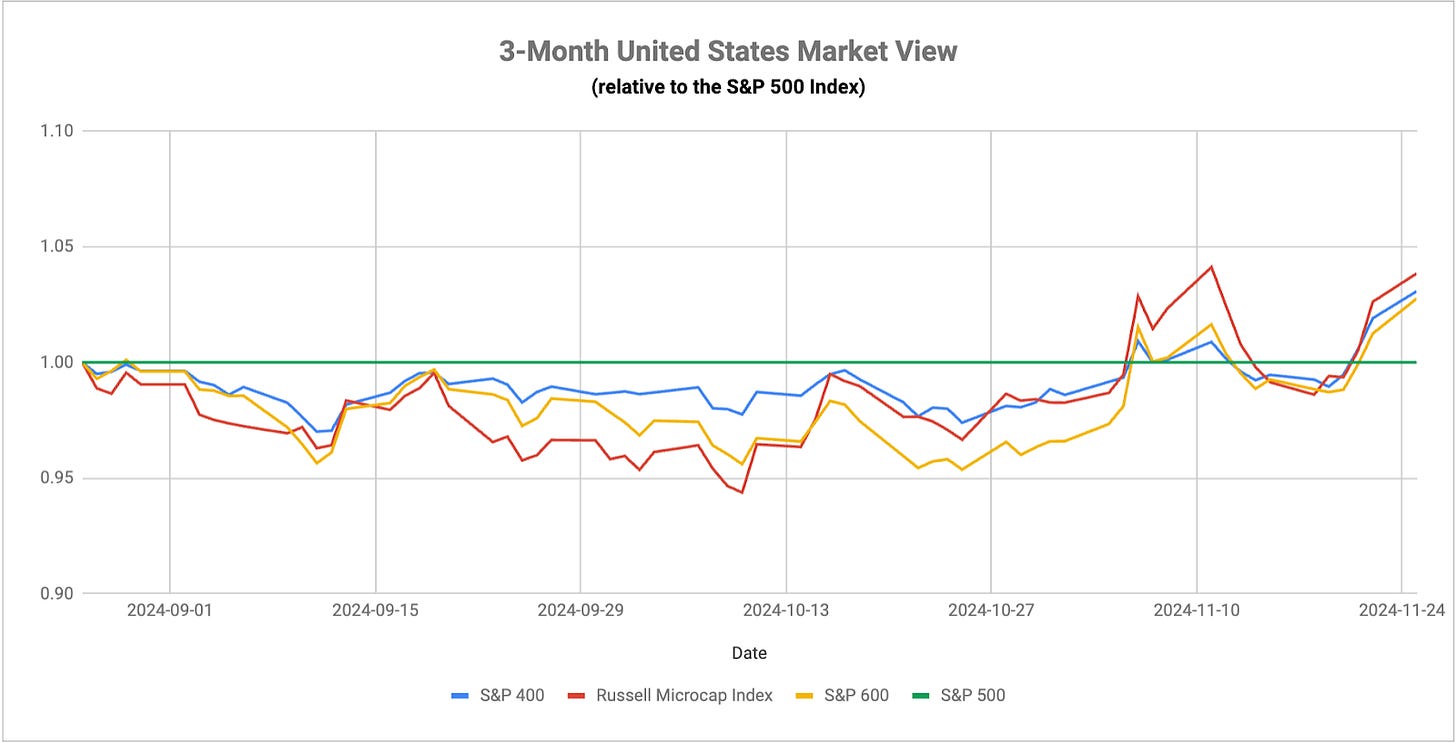

The one undeniable thing we’re seeing right here is a breakout in small-caps. Over the past month, the Russell 2000 has outperformed the S&P 500 by more than 8% and that’s even including the post-election dive in this ratio. Given that we’re seeing this occur alongside leadership from value, financials and energy stocks, the market seems to be expecting an uptick in economic activity in 2025. My biggest concern is that it could come with consequences. The idea of tax cuts and deregulation in the next Trump administration is pro-business at the margins, but that also comes with a higher risk of inflation. That’s what we’re seeing in risk asset prices right now in that the only real leaders in U.S. equities are the sectors that are most likely to explicitly benefit from Trump policy. Most other areas of the market, including tech, have been lagging for a few weeks. When adding in that interest rates are moving higher and gold is rallying again, you have an environment where investors are hopeful about the direction of the economy, but cognizant of the risks that could come with it.

Speaking of risk, the credit markets are starting to fly under the radar given that heightened liquidity seems to have calmed investors’ nerves for the time being. It’s important to keep in mind that the biggest driver of economic activity, the U.S. consumer, is still struggling here. Delinquent auto loan rates are now at 14-year highs. It’s an unappreciated area of the consumer credit market, but it feeds a lot of what happens elsewhere. If consumers lose their car, they’re suddenly going to have difficulty getting to work. If they default on an auto loan, they’re probably going to default on their credit card debt as well. Even if they don’t, the rate on any outstanding revolving debt is going to skyrocket if they’re even able to qualify for credit at all. The markets want to keep focusing on retail sales and personal spending. In isolation, those numbers make the consumer look pretty strong. If you look at other data (the prevalence of “buy now, pay later” schemes to buy basics, such as groceries, is getting much higher than it should as well), consumers are still under considerable pressure. Even within Walmart’s quarterly earnings report, which the markets were quite happy about, it showed that even high income households are starting to pivot towards discount retailers for their purchases. It’s not as pretty of a picture as it might look.

If you’re looking for a catalyst that could rattle the markets within the next month or so, your sights should be set on Japan. On December 19th, the BoJ is going to make its next interest rate decision and it could come with significant implications. The market doesn’t really want to believe that a rate hike is a possibility because 1) rate hikes have been extremely rare over the course of history, 2) stagnant growth doesn’t really warrant rate hikes and 3) the Japanese government has been publicly arguing that conditions should remain loose for the time being. The BoJ, however, has an inflation problem on its hands. Japanese core inflation rose for the 3rd straight month in October moving to 2.3%. That’s the highest reading since April and up from 1.9% in July. Headline inflation over the past six months is running at a 3% annualized rate. Japan could very well be looking at a period of stagflation, which could create stock prices and damage the yen. If the BoJ tries to address the inflation problem and decides to hike, it could catch the global markets off-guard and trigger another reverse yen carry trade. The market is currently putting the odds of a rate hike at less than 50%, but don’t be surprised if this is the December surprise that suddenly turns the markets volatile.