The past week underscored an extraordinary divergence between darkening economic data and buoyant financial markets. A U.S. shutdown, which started on Oct. 1, put the data in a no-man’s land – not even the make-or-break September non-farm payrolls report was available¹. But a private-sector employment survey closed some gaps; ADP said that September saw 31,000 jobs lost versus expectations of a gain north of 50k, all but confirming the labor market’s momentum has cooled¹. These labor market concerns caused consumer confidence to fall to its lowest level in five months¹.

With unmistakable signals of a cooling job market, the Federal Reserve is getting ready to pivot toward easing. Powerful officials like John Williams on the New York Fed and Mary Daly, of San Francisco, indicated comfort with additional cuts in interest rates to offset labor softness². After all, the Fed already slashed rates by 0.25% last month (in a hotly contested 11–1 vote) and futures markets now give us a whopping 95% odds of yet another quarter-point cut at the next October meeting. Unemployment has risen to 4.3% and Fed policymakers envisage at least two further cuts by year-end in order to provide insurance against a hard landing². Still, not everyone at the Fed is completely on board — Governor Michael Barr and some others are counseling caution, concerned that loosening policy too soon might spark a fresh outbreak of inflation². It’s a fine balance, but for now the doves have the upper hand as job market steam has fizzled quickly.

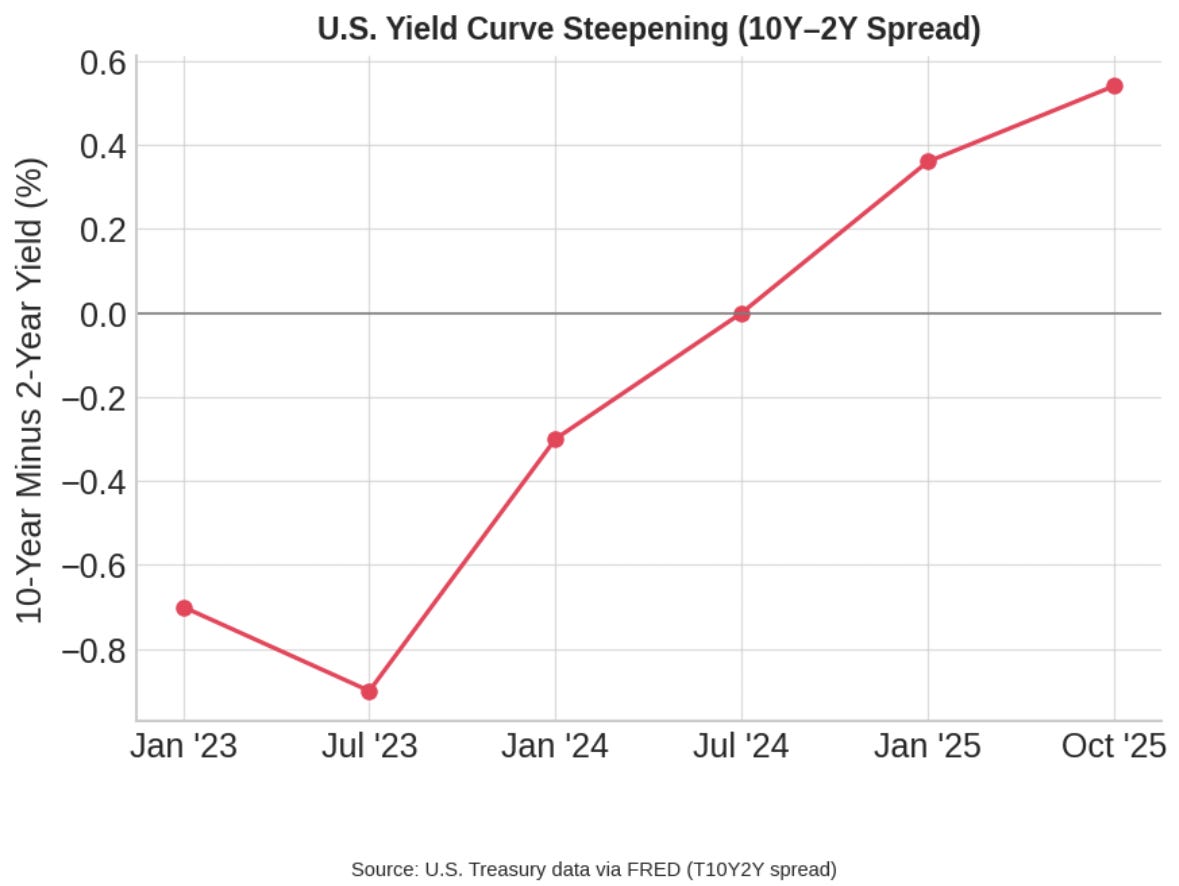

Short-term Treasury rates have dropped as investors price in the Fed easing, but longer-dated yields have held up relatively well. The upshot has been the biggest steepening of the yield curve in years³ and a sign that traders expect rate cuts to stave off a more serious downturn. The U.S. dollar that had been underpinned by high rates has now started giving up its highs as this yield differential narrows.

Equity investors have paradoxically been savoring the deterioration of economic data under a “bad news is good news” framework. As Fed relief loomed, so did a rally in stocks: the S&P 500 was up about 1.1 percent for the week and global equities were up nearly 1.7 percent³ even despite the Washington gridlock. Major indices are not far from record highs, fueled by excitement about artificial intelligence and hopes that easier monetary policy will elongate the economic cycle. It is a story that I have seen play out before — where markets rally on the euphoria of soft data because it raises hopes for stimulus — and the euphoria can be brittle.

Underneath the surface, indications that risk appetite is fading can be seen. Small-cap stocks, which are particularly sensitive to credit conditions have slipped quietly lower in early October following a sharp surge in the third quarter⁴. These sorts of divergences, where small caps lag and large caps grind higher, have often signaled a broader pullback in markets historically. Market breadth is contracting and defensive areas are coming to life. Ironically, one of the classic safe havens (Utilities) is now ramping as Treasuries are showing some signs of life. That odd couple (utilities up, yields down) is exactly what you would have expected during risk-off phases — not rip-roaring bull markets. In other words, it seems as though the old guard “smart money” is positioning defensively even while headline indices party. It’s this rotation inward, toward safety, that serves as an ominous tell of a resurgence in volatility. Seasonality is something to consider as well: October traditionally has the distinction of being the market’s most volatile month, and with so much complacency being bred all summer long, investors might be due for quite a rude awakening.

Europe and U.K. – Persistent Inflation vs. Slowing Growth

Across the Atlantic, mixed messages. The rise in inflation in the Eurozone in September has muddied the waters further. The headline CPI was 2.2% yoy, above the 2.0% in August, and core inflation maintained at 2.3%⁵. After a year of slashing rates, the European Central Bank now seems ready to stay put. This tepid rise in inflation, largely the result of higher service charges and a smaller fall in energy prices, will help to support ECB expectations to hold rates on October 30th. Financial markets concur — they price just a 10 percent chance of any further cut this year. Indeed, some ECB officials are more worried about the opposite issue: inflation could fall too far. The bank’s own forecasts show inflation falling below the 2% target for multiple quarters next year⁵. The latest data indicate, at best, a tentative recovery. Manufacturing and investment remain soft, and consumer spending is holding up poorly⁵. Europe’s industrial powerhouse, Germany, has been suffering deteriorating gauges due in part to mediocre global demand. This all leaves the ECB in a wait-and-see mood. Absent another inflation surprise, more easing in Europe probably remains on hold while there is more clarity on whether growth can stabilize.

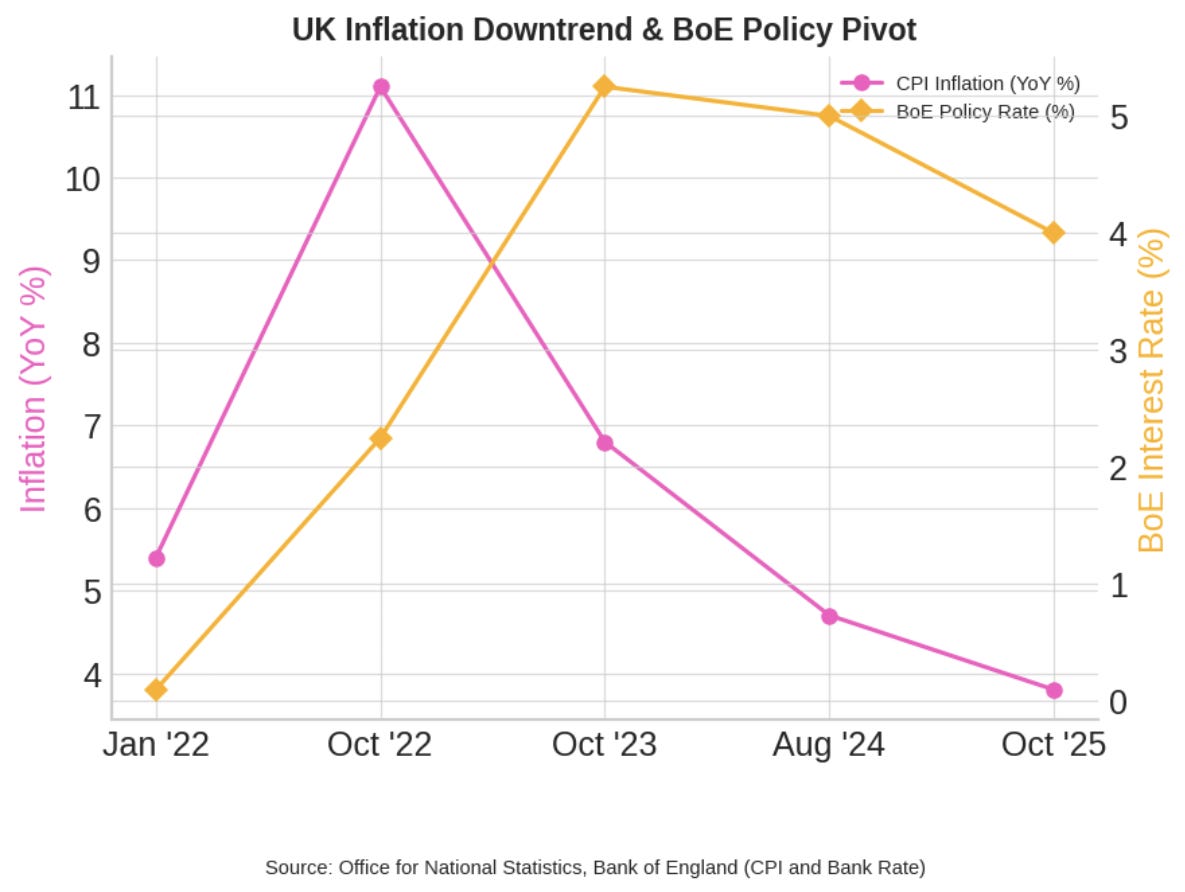

The Bank of England, meanwhile, is dealing with an unhelpful backdrop of stubbornly high inflation and a slowing economy in the United Kingdom. U.K. consumer prices are still up about 4% a year - just under double the BoE’s target — as of September⁶. After at last having slashed rates to 4.0% in August, the BoE held off on September and we now have a more hawkish tone from members of the MPC. At the same time, Britain’s expansion is softening and higher taxes along with previous rate increases are also putting a brake on consumer spending power. It’s a quandary: Inflation is sticky but the economy is fragile. For the moment, though, it seems BoE will stay on hold at 4% for even longer. Policymakers like Catherine Mann have gone so far as to suggest that further rate cuts could be a mistake if price pressures fail to recede. The British pound has been firming, with markets factoring in that U.K. rates will remain relatively high versus a dovish-firming U.S. Fed. How that divergence plays out in the currency and bond markets will be something to watch closely over the coming months.