$JOJO: Stock Market Volatility In August And September Could Widen Credit Spreads

There Are No Gurus, Only Cycles

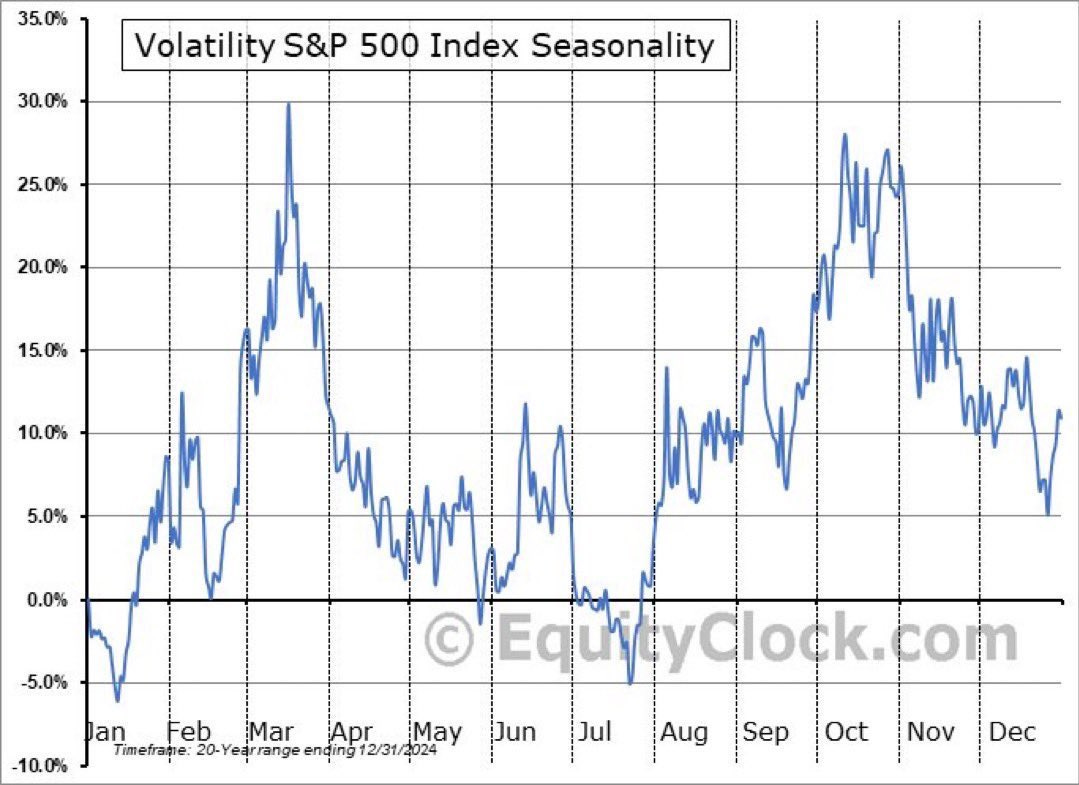

August and September have historically resulted in higher average volatility for the stock market, with September in particularly delivering the lowest average monthly returns over the past 30 years. I think that makes the current setup particularly interesting from a tactical standpoint.

What does any of this have to do with the bond market? Put simply, stock market volatility is the equivalent of credit spread widening.

Investment grade and high-yield corporate bonds have experienced some spread widening in both the United States and Europe, but they remain tight by historical standards. I think that creates an interesting opportunity for tactical investors who understand how market volatility typically ripples through different asset classes. The ATAC Credit Rotation ETF (JOJO) is designed to capitalize on exactly these types of market conditions - rotating between Treasuries and high-yield bonds based on early warning signals of volatility spikes.

The story here is whether credit markets can continue to shrug off equity volatility during what's historically the most challenging period of the year for stocks.

Why August and September Are Historically Volatile

September has delivered the worst performance for stocks going back nearly a century. It's not just a recent phenomenon - this pattern holds across major market averages, all showing September among their weakest months over the past decade.

The question is why this seasonal weakness persists so consistently.

Seasonal patterns in equity markets

Market participants have dubbed it the "September Effect". August carries its own reputation for volatility, largely due to thin summer trading volumes that amplify every market move. When half the Street is on vacation, reduced liquidity can turn routine news into outsized price swings.

What's particularly interesting is how this extends beyond just poor returns. The third quarter consistently witnesses the sharpest volatility spikes since the global financial crisis. It's almost as if the market saves up its nervous energy for late summer.

This seasonal volatility creates ripple effects that go well beyond equities. Credit spreads often widen during these periods - exactly the type of environment where tactical strategies like JOJO can potentially capitalize by rotating between Treasuries and high-yield bonds as volatility signals emerge.

How Volatility Can Lead to Wider Credit Spreads

Image Source: Bloomberg.com

Credit spreads are one of those market indicators that tell you what investors really think about risk. The spread - basically the yield difference between corporate bonds and risk-free Treasuries - reveals how much extra compensation investors demand for taking on corporate default risk.

How the JOJO ETF Responds to Market Stress

The ATAC Credit Rotation ETF (ticker: JOJO) operates on a simple premise: utilities sector performance relative to the broader market tends to signal volatility spikes before they happen. I launched this actively-managed bond ETF to seek current income and long-term capital appreciation by rotating between defensive and offensive positions based on this early warning system.

The Utilities Signal

JOJO's methodology centers on utilities sector performance relative to the broader market as its primary signal. When utilities start outperforming - historically a precursor to market stress - the fund triggers weekly evaluations that determine position allocation. If utilities are showing relative strength, JOJO moves into "Credit-Off" mode, rotating to long-duration Treasury securities. If market conditions appear stable, it shifts to "Credit-On" mode, investing in high-yield bonds.

The logic here makes sense. Utilities typically outperform during risk-off periods when investors flee to lower volatility options. Rather than waiting for volatility to spike, JOJO positions itself ahead of potential trouble.

Tactical Positioning for Volatile Markets

The fund's structure deliberately takes less credit risk precisely when market conditions deteriorate. This becomes particularly relevant during the seasonal periods we're entering, where August and September's historical weakness could trigger exactly the kind of utilities outperformance that would shift JOJO into defensive mode.

Treasury bonds have historically delivered positive returns during volatile periods for risk assets, which means if JOJO's signal works as intended, the fund should be positioned in the right asset class when credit spreads start widening.

Conclusion

August and September volatility looks likely now, especially with complacency through the roof in my opinion. Volatility will likely turn higher in the coming weeks, which historically triggers the credit spread widening that's been notably absent so far.

The relationship between equity stress and credit spreads eventually reasserts itself - it's one of the most reliable patterns in finance. Credit conditions have stayed surprisingly resilient, but that disconnect rarely lasts when volatility persists. With seasonal factors pointing toward continued market stress, tactical positioning becomes more important.

I don't think it's unreasonable to consider JOJO given the seasonal setup. The fund essentially automates the defensive positioning that becomes critical during late summer volatility spikes. Rather than trying to time these moves yourself, JOJO's systematic approach handles the tactical allocation between Treasuries and high-yield bonds.

Consider JOJO as part of your bond allocation strategy. Not because I developed the strategy and I’m the portfolio manager of the fund. Consider it because there are no gurus, only cycles. And the cycle may finally be here for it.

Michael A. Gayed, CFA

Junk debt, also known as high-yield bonds or speculative-grade debt, refers to fixed-income securities issued by companies or governments with lower credit ratings, offering higher interest rates to compensate investors for the elevated risk of default.

The VIX index, often called the "fear gauge" of Wall Street, is a real-time market index that measures the market's expectation of 30-day forward-looking volatility derived from S&P 500 index options prices, serving as a key barometer of investor sentiment and market risk.

The ICE BofA BB US High Yield Index Option-Adjusted Spread measures the yield differential between BB-rated corporate bonds and a spot Treasury curve, quantifying the risk premium for below-investment-grade debt with a BB rating in the US market.

As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is new with a limited operating history. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund, and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV.

Because the Fund invests in Underlying ETFs an investor will indirectly bear the principal risks of the Underlying ETFs, including but not limited to, risks associated with investments in ETFs, equity securities, growth stocks, large and small capitalization companies, non-diversification, fixed income investments, derivatives and leverage. The prices of fixed income securities may be affected by changes in interest rates, the creditworthiness and financial strength of the issuer and other factors. An increase in prevailing interest rates typically causes the value of existing fixed income securities to fall and often has a greater impact on longer duration and/or higher quality fixed income securities. The Fund will bear its share of the fees and expenses of the underlying funds. Shareholders will pay higher expenses than would be the case if making direct investments in the underlying funds.

Because the Fund expects to change its exposure as frequently as each week based on short-term price performance information, (i) the Fund’s exposure may be affected by significant market movements at or near the end of such short-term periods that are not predictive of such asset’s performance for subsequent periods and (ii) changes to the Fund’s exposure may lag a significant change in an asset’s direction (up or down) if such changes first take effect at or near a weekend. Such lags between an asset’s performance and changes to the Fund’s exposure may result in significant underperformance relative to the broader equity or fixed income market. Because the Adviser determines the exposure for the Fund based on the price movements of gold and lumber, the Fund is exposed to the risk that such assets or their relative price movements fail to accurately predict future performance.

Past performance is no guarantee of future results.

The Fund’s investment objectives, risks, charges, expenses and other information are described in the statutory or summary prospectus, which must be read and considered carefully before investing. You may download the statutory or summary prospectus or obtain a hard copy by calling 855-ATACFUND or visiting www.atacfunds.com. Please read the Prospectuses carefully before you invest.

Investing involves risk including the possible loss of principal.

JOJO is distributed by Foreside Fund Services, LLC.

Learn more about $JOJO at https://atacfunds.com/jojo/ Lead-Lag Publishing, LLC is not an affiliate of Tidal/Toroso or ACA/Foreside.