JOJO: The Case For Treasuries As A Risk-Off Asset Again (And How To Benefit From It)

There Are No Gurus, Only Cycles

Treasuries are supposed to rally when markets get nervous. That's been the playbook for decades - stocks sell off, investors flee to safety, bond prices rise. Yet when tariff tensions spiked this spring, something strange happened. Treasuries got crushed alongside everything else (at least during the final weeks of the stock market sell-off).

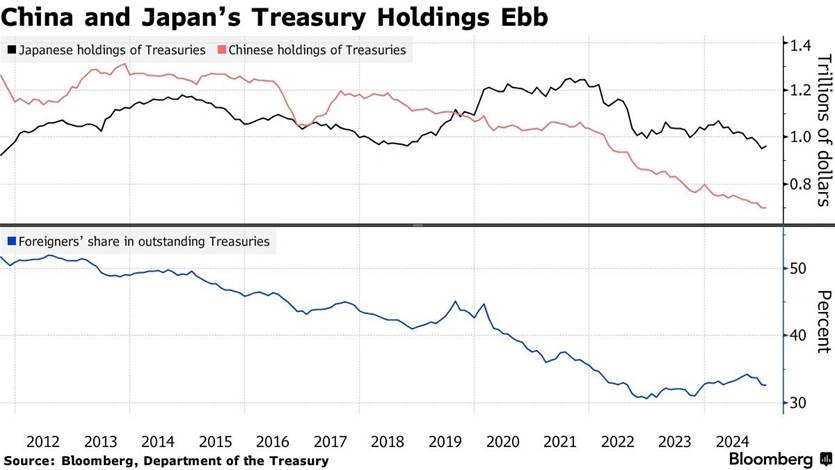

I think the breakdown tells us something important about current market dynamics. Foreign investors, who own roughly 30% of the Treasury market, have been rethinking their allocations. The sharp fall in Treasury prices during trade tensions suggests they're not as willing to hold U.S. government debt at any price. Foreign ownership has already dropped from about 50% in 2015 to 30% now, and that structural shift appears to be accelerating.

The interesting thing is that this unusual behavior might actually create an opportunity. Markets don't stay broken forever, and when Treasuries eventually return to their traditional safe-haven role, there could be significant price appreciation for those positioned correctly. The ATAC Credit Rotation ETF (JOJO) is designed specifically for this scenario - rotating into Treasuries during periods of credit stress when their flight-to-safety characteristics become most valuable.

The question isn't whether Treasuries will regain their safe-haven status. I think they will. The question is how to position for that shift and benefit from Treasury price appreciation when risk-off conditions return. JOJO offers a tactical approach that could turn this market anomaly into an investment opportunity.

Why Treasuries Failed as a Risk-Off Asset in Recent Selloffs

The Treasury market breakdown wasn't random - it reflected three converging factors that temporarily overrode decades of safe-haven behavior. Understanding these dynamics helps explain why bonds sold off when they should have rallied, and more importantly, why this situation probably won't last.

Tariff-Driven Inflation Fears Push Yields Higher

When tariffs hit, bond traders did the math quickly. The 30-year Treasury yield jumped 46 basis points in a single week - the largest increase in nearly four decades. That psychological 5% barrier on the 30-year got breached as markets priced in higher inflation ahead.

The reaction makes sense if you think about it. Tariffs are essentially a tax on imports, and that cost gets passed through to consumers. CPI data confirmed these concerns, coming in at 2.7% year-over-year in June and exceeding expectations. Sectors directly impacted by tariffs - clothing, furniture, electronics - showed notable price increases. When inflation expectations rise, bond prices fall. It's that simple.

But here's what's interesting: inflation driven by tariffs is different from demand-driven inflation. If tariffs eventually moderate or the economy adjusts, this type of price pressure could prove more temporary than markets initially feared.

Hedge Fund Deleveraging Created a Liquidity Spiral

The bigger problem was what happened in the plumbing of the bond market. Hedge funds had been running massive "basis trades" - highly leveraged positions that exploit tiny price differences between cash bonds and futures. When volatility spiked, these trades became untenable fast.

The deleveraging was brutal. During March 2020, we saw something similar when the average Treasury-holding hedge fund cut exposures by roughly 20%. This time around, funds facing redemption pressure prioritized building cash, which meant selling everything - including Treasuries.

This creates a feedback loop where traditional safe havens get caught up in forced selling. The irony is that the assets designed to provide safety during stress become part of the problem when leveraged players need to raise cash quickly.

Foreign Investors Are Rethinking Dollar Dependence

Image Source: Bloomberg

The third factor is more structural and potentially more concerning. Both Japan and China, the two largest Treasury holders, reduced their positions in 2023. While foreign private investors have stepped up purchases somewhat, it hasn't been enough to offset the broader shift. This suggests central banks and sovereign wealth funds are diversifying away from dollar assets - not because of any immediate crisis, but as part of a longer-term rebalancing.

That structural change matters because foreign central banks traditionally provided a stable bid for Treasuries regardless of market conditions. Without that backstop, Treasury prices become more sensitive to technical factors like hedge fund positioning.

The bottom line is that all three factors created a perfect storm where Treasuries couldn't perform their traditional role. But conditions change, and when they do, JOJO's rotation mechanism is designed to capture the Treasury rally that follows.

The Case for Treasuries Regaining Their Safe-Haven Status

The Treasury selloff might look alarming, but I think we're seeing a market correction rather than a permanent breakdown. Several factors suggest the safe-haven trade is likely to reassert itself once current distortions work through the system.

Inflation Peaking

The inflation story is starting to turn. CPI data shows cooling from 3.0% in January to 2.4% in May, and that trend matters more than the headline volatility around tariff announcements. Treasury bonds operate as information-insensitive assets under normal conditions, which means their safe-haven properties should strengthen as inflation pressures continue to ease.

Fed Policy Pivot and Interest Rate Expectations

The Federal Reserve's next moves create another catalyst for Treasury recovery. Yield curve dynamics should favor longer-duration bonds. Short-term yields will likely decline while intermediate rates remain more stable.

This environment could be particularly favorable for JOJO, which rotates into Treasuries precisely when credit risk signals warrant defensive positioning. If the Fed starts cutting rates while credit conditions deteriorate, that's exactly the scenario where Treasury price appreciation tends to be strongest.

Global Demand for USD-Denominated Safe Assets

Despite all the concerns about foreign selling, global demand for Treasuries remains surprisingly robust. The April 2025 Treasury auction attracted demand nearly three times available supply - the strongest auction of the year. That tells me international confidence in U.S. government debt hasn't evaporated, even amid geopolitical tensions.

U.S. Treasuries still offer benefits that no other asset class can match:

· Daily trading volume exceeding $910 billion

· Global benchmark status as the risk-free reference rate

· Historical protection during equity market selloffs

The question isn't whether these advantages will disappear. The question is whether current market conditions will allow them to reassert themselves. JOJO provides a mechanism to capture Treasury price appreciation during risk-off environments.

How the JOJO ETF Rotates into Treasuries During Credit Stress

JOJO operates on a simple premise - utilities tend to outperform the broader market right before credit conditions deteriorate. The fund tracks this relationship systematically, comparing the performance of the Utilities Select Sector SPDR Fund (XLU) against the SPDR S&P 500 ETF Trust (SPY) on a weekly basis.

When utilities start outperforming, JOJO automatically shifts into long-duration Treasury securities. When utilities lag behind, the fund rotates into high-yield corporate bonds. This rotation happens weekly, which means the strategy responds quickly to changing market dynamics without getting caught in lengthy transition periods.

The Logic Behind the Signal

The relationship between utilities and credit risk makes intuitive sense. Utilities are viewed as defensive plays when investors get nervous about credit quality. They tend to move higher relative to the broader market when fear starts creeping into the system. That defensive rotation often precedes wider credit spread expansion and the type of market stress where Treasuries typically shine.

Why Long-Duration Treasuries During Risk-Off Periods

The fund focuses on long duration Treasury exposure during "Credit-Off" periods rather than shorter-duration bonds. This makes sense from a risk/reward perspective. Long-duration Treasuries provide more price sensitivity to yield changes, which means bigger moves when flight-to-safety demand kicks in.

Corporate bonds, even high-quality ones, tend to correlate with equities during market stress. Credit spreads widen, prices fall, and the diversification benefit disappears. Long-duration Treasuries historically move in the opposite direction - falling yields drive prices higher just when investors need that protection most.

The weekly rebalancing schedule keeps JOJO responsive to evolving conditions without overtrading. It's positioned to capture Treasury price appreciation exactly when safe-haven demand should be strongest, potentially turning market volatility into opportunity for those holding the right assets at the right time.

Allocating to JOJO for tactical exposure to Treasuries

JOJO's systematic approach removes the guesswork from Treasury timing. Instead of trying to predict when safe-haven demand will return, the fund dynamically shifts based on utility sector performance relative to the broader market. When utilities start outperforming - often a precursor to credit spread widening - JOJO automatically rotates into long-duration Treasuries.

This tactical positioning allows investors to potentially benefit from Treasury price appreciation exactly when their flight-to-safety characteristics become most valuable. For portfolios that need risk management without sacrificing return potential, JOJO provides targeted Treasury exposure precisely when it's most likely to work.

The beauty of this approach is that you don't need to call the exact timing of when Treasuries regain their safe-haven status. The fund's weekly rebalancing mechanism handles that for you.

Conclusion

The Treasury market breakdown we saw this spring tells us something important about changing market dynamics. Foreign selling, hedge fund deleveraging, and tariff-driven inflation fears created a perfect storm that temporarily broke the traditional relationship between market stress and Treasury performance.

Yet I think this represents an opportunity rather than a permanent shift. Term premiums are normalizing after years of artificial suppression. Inflation appears to be peaking. The Fed will eventually pivot to cuts. Strong auction demand suggests global confidence in U.S. government debt remains intact despite recent volatility.

Markets don't stay broken forever. When Treasuries eventually return to their safe-haven role - and I believe they will - there could be significant price appreciation for those positioned correctly.

JOJO's approach makes sense in this environment. Rather than trying to time the Treasury market recovery, the fund uses a systematic signal based on utilities outperformance to rotate into Treasuries precisely when credit stress conditions suggest defensive positioning is warranted. This removes the guesswork and emotional decision-making that often derail investment strategies during volatile periods.

The weekly rebalancing mechanism ensures JOJO can respond quickly to changing credit conditions. If Treasury bonds are poised to reclaim their traditional role as the premier risk-off asset, JOJO provides a tactical way to benefit from that shift without having to predict exactly when it happens.

Overall, I think it comes down to what you believe about Treasury market dynamics going forward. If you think the recent breakdown is temporary and Treasuries will eventually resume their flight-to-safety function, JOJO offers an intelligent mechanism to capture that potential while managing downside risk through systematic rotation.

Consider JOJO as part of your bond allocation strategy. Not because I developed the strategy and I’m the portfolio manager of the fund. Consider it because there are no gurus, only cycles. And the cycle may finally be here for it.

Michael A. Gayed, CFA

Junk debt, also known as high-yield bonds or speculative-grade debt, refers to fixed-income securities issued by companies or governments with lower credit ratings, offering higher interest rates to compensate investors for the elevated risk of default.

The VIX index, often called the "fear gauge" of Wall Street, is a real-time market index that measures the market's expectation of 30-day forward-looking volatility derived from S&P 500 index options prices, serving as a key barometer of investor sentiment and market risk.

The ICE BofA BB US High Yield Index Option-Adjusted Spread measures the yield differential between BB-rated corporate bonds and a spot Treasury curve, quantifying the risk premium for below-investment-grade debt with a BB rating in the US market.

As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is new with a limited operating history. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund, and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV.

Because the Fund invests in Underlying ETFs an investor will indirectly bear the principal risks of the Underlying ETFs, including but not limited to, risks associated with investments in ETFs, equity securities, growth stocks, large and small capitalization companies, non-diversification, fixed income investments, derivatives and leverage. The prices of fixed income securities may be affected by changes in interest rates, the creditworthiness and financial strength of the issuer and other factors. An increase in prevailing interest rates typically causes the value of existing fixed income securities to fall and often has a greater impact on longer duration and/or higher quality fixed income securities. The Fund will bear its share of the fees and expenses of the underlying funds. Shareholders will pay higher expenses than would be the case if making direct investments in the underlying funds.

Because the Fund expects to change its exposure as frequently as each week based on short-term price performance information, (i) the Fund’s exposure may be affected by significant market movements at or near the end of such short-term periods that are not predictive of such asset’s performance for subsequent periods and (ii) changes to the Fund’s exposure may lag a significant change in an asset’s direction (up or down) if such changes first take effect at or near a weekend. Such lags between an asset’s performance and changes to the Fund’s exposure may result in significant underperformance relative to the broader equity or fixed income market. Because the Adviser determines the exposure for the Fund based on the price movements of gold and lumber, the Fund is exposed to the risk that such assets or their relative price movements fail to accurately predict future performance.

Past performance is no guarantee of future results.

The Fund’s investment objectives, risks, charges, expenses and other information are described in the statutory or summary prospectus, which must be read and considered carefully before investing. You may download the statutory or summary prospectus or obtain a hard copy by calling 855-ATACFUND or visiting www.atacfunds.com. Please read the Prospectuses carefully before you invest.

Investing involves risk including the possible loss of principal.

JOJO is distributed by Foreside Fund Services, LLC.

Learn more about $JOJO at https://atacfunds.com/jojo/ Lead-Lag Publishing, LLC is not an affiliate of Tidal/Toroso or ACA/Foreside.