$JOJO: Why Fed Rate Cuts Can Benefit Treasuries but Stress Junk Bonds

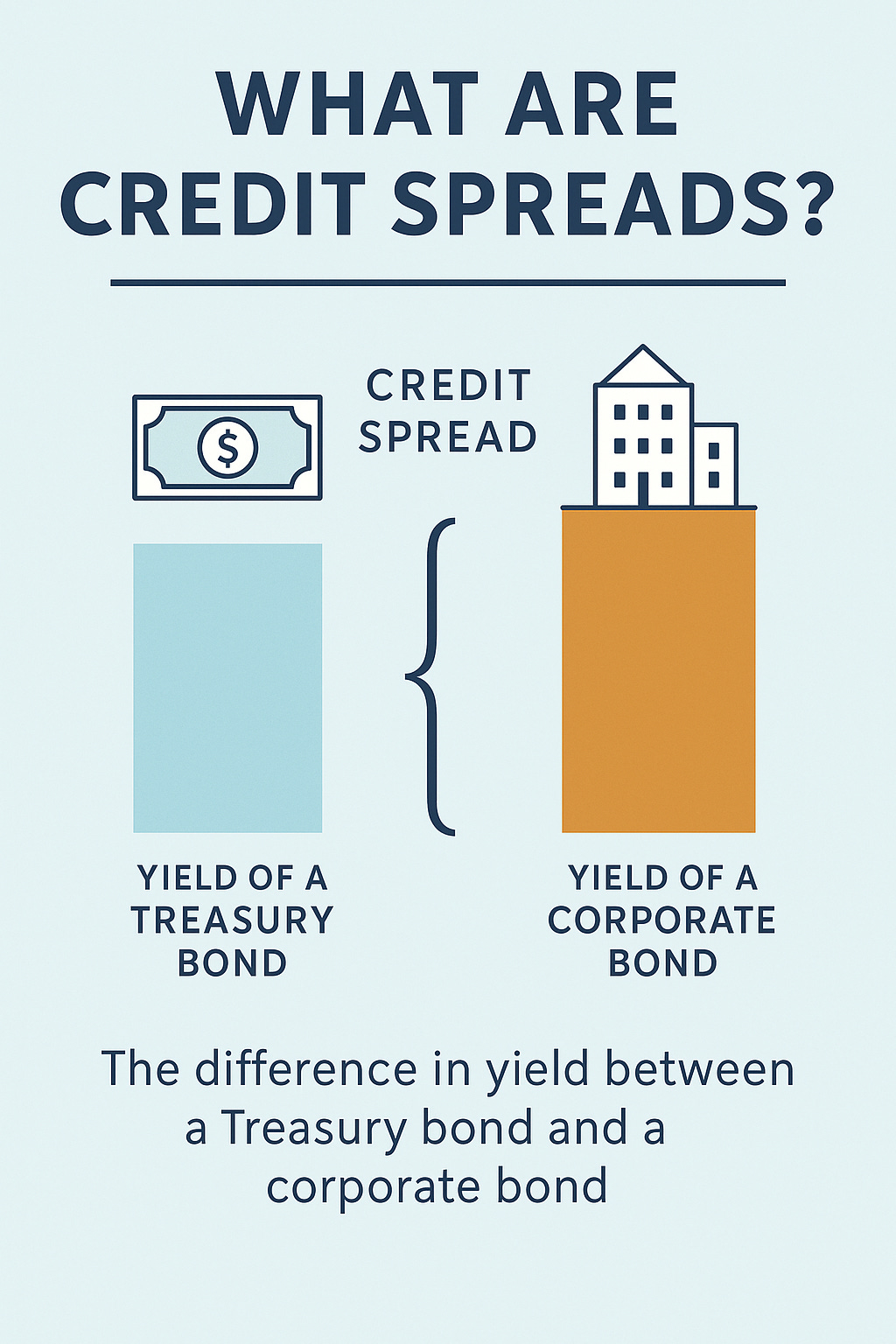

When the Federal Reserve begins cutting interest rates, it often feels like a long-awaited relief. After a tightening cycle, easier money sounds like good news for nearly every corner of the bond market. Yet history shows that a Fed cutting cycle can be a double-edged sword. Historically speaking, U.S. Treasuries tend to thrive as yields fall and investors seek safety, while lower-rated “junk” bonds often stumble—at least in the early innings of easing. Treasury yields typically decline once the Fed starts reducing rates, boosting Treasury prices as investors reposition toward less risky debt.[1] In contrast, high-yield bonds usually see credit spreads widen, reflecting growing fears about the economy’s health.[2]

The reason is simple: the Fed cuts rates not because things are great, but because conditions are deteriorating. When the central bank eases, it’s often responding to slowing growth, rising unemployment, or stress in credit markets. “Leveraged finance” assets like high-yield bonds have historically suffered at these turning points because rate cuts tend to coincide with the start of the credit stress cycle—a phase when defaults rise and investors demand more compensation for risk.[3]

Think back to 2001 or 2007. Both periods began with a Fed pivot toward easing, yet high-yield debt sank as investors braced for recession. Even in milder episodes, the first cut rarely marks the end of volatility. Markets interpret that first move not as a sign of victory over inflation, but as confirmation that something is wrong. Credit spreads tend to widen right around the time of the first rate cut, signaling investor concern about an oncoming downturn.[2]. Only later—when confidence in recovery returns—do high-yield spreads begin to narrow again. That’s why, paradoxically, a Fed pivot often delivers bad news first for junk bonds and good news immediately for Treasuries.

Not all cutting cycles are the same, though. The market reaction depends on whether rate cuts are preemptive or reactive. When the Fed acts early to prevent a slowdown—what economists call a “soft landing”—credit markets often hold up well. In those cases, lower rates boost liquidity and earnings, allowing high-yield bonds to benefit alongside Treasuries. This happened in the mid-1990s and again in 2019, when preemptive easing helped extend the business cycle.[4]

Reactive cuts are different. Those come after the damage is already visible—rising layoffs, declining profits, or a financial shock. In those episodes, spreads typically widen even as Treasury yields fall, punishing high-yield investors despite falling rates.[4] The difference lies in whether rate cuts are cushioning an ongoing expansion or responding to its collapse. Investors ignore that distinction at their peril.

That tension defines the current environment. After one of the fastest hiking cycles in decades, the Fed is widely expected to continue cutting rates. The question is: will those cuts be insurance or triage? Credit markets seem to believe the former. By early autumn 2025, high-yield spreads were among the tightest seen in 25 years, implying confidence that the Fed can steer a soft landing.[5]. Yet tight spreads also mean little room for error. If growth slips or defaults tick up, credit markets could reprice rapidly. Historically, spreads in the top 5% of their tightest range have often preceded significant widening later on.[5]

That makes this phase of the cycle unusually delicate. Investors hoping that rate cuts alone will boost all bonds equally may be overlooking how fragile the high-yield market becomes when liquidity tightens and economic momentum fades. In those moments, Treasuries tend to shine precisely because everything else looks riskier.

For fixed-income investors, this is where an active and tactical approach begins to make sense. Falling rates may benefit bonds broadly, but they don’t help all bonds at once. A static portfolio that leans heavily on high-yield could struggle if the first wave of Fed cuts arrives alongside slowing growth. By contrast, investors who can rotate between credit and Treasuries as conditions evolve may find themselves better positioned.

That’s the premise behind my tactical bond ETF, the ATAC Credit Rotation ETF (JOJO). The fund takes a data-driven approach to navigating the shifting balance between risk-on and risk-off markets. JOJO rotates between high-yield bonds and Treasuries based on a tactical model designed to identify when risk appetite is fading.[6]. It does so by monitoring the performance of utility stocks relative to the broader market—a historically reliable leading indicator of volatility. Utilities tend to outperform when investors grow defensive. When that happens, JOJO shifts from high-yield to Treasuries, seeking to reduce exposure before volatility spikes.[6] When risk appetite returns and utilities lag, the fund rotates back into credit to capture income potential.

This systematic approach doesn’t try to predict the future—it reacts to changing market signals. The goal is to avoid being caught in the wrong part of the bond market when the cycle turns. If a recession unfolds, a rotation toward Treasuries could help buffer losses in riskier credit. If the Fed manages a soft landing, the model can pivot back to high-yield exposure to capture the upside.

Of course, no strategy can eliminate risk entirely. I believe if rate cuts prove mild and markets remain calm, a tactical approach might underperform a steady allocation. On the other hand, if credit stress returns—as it often does in the early months of an easing cycle—an active framework could make a meaningful difference. What matters is flexibility. The market’s history of reacting unevenly to Fed pivots suggests that a “set it and forget it” approach may not serve investors well in this environment.

The coming months could illustrate this divide vividly. Treasuries are positioned to benefit from falling yields if growth slows, while high-yield bonds may face renewed scrutiny over default risk. Investors who assume that easier policy equals universal gains risk learning a familiar lesson: rate cuts don’t help everyone at once. For those willing to adapt, the shifting dynamics of a Fed cutting cycle can be an opportunity rather than a setback.

History offers a simple guide. When the Fed changes direction, markets don’t move in unison. Treasuries often lead, credit lags, and active strategies that can pivot between them may stand out. In that sense, the logic behind JOJO is less about timing the market and more about staying aligned with its changing rhythm. After years of straightforward “buy the dip” thinking in credit markets, investors may find that the next phase of the cycle rewards those who stay nimble.

A rate cut might be good news for the bond market overall. Yet for investors in high-yield debt, the first wave of easing has often been a warning sign that stress is building beneath the surface. Tactical tools like JOJO offer one way to adapt—not by predicting what comes next, but by responding to it faster. In a world where the next Fed move could signal both relief and risk, being able to shift gears may be the most valuable advantage of all.

References

Lewis Krauskopf et al., “A cut — and then what? The Federal Reserve is set to cut U.S. interest rates for the first time since the pandemic. History shows the state of the economy will play a crucial role in how markets respond,” Reuters, Sept. 17, 2024, link.

Investing.com, “A Market Playbook to Prepare Your Portfolio for Fed Rate Cuts,” Investing.com Analysis, 2025, link.

Steven Oh, “This Rate-Cut Cycle Is Different: Why It Bodes Well for Leveraged Finance,” PineBridge Investments, Oct. 8, 2024, link.

VanEck, “How a Fed Rate Cut Impacts Investors and How to Prepare,” VanEck Insights (Emerging Markets Bonds), Oct. 2, 2025, link.

Brent Olson and Tom Ross, “High Yield Bonds: Can Tight Credit Spreads Persist?” Janus Henderson Investors, Oct. 3, 2025, link.

ATAC Funds, “ATAC Credit Rotation ETF (JOJO) – Fund Summary,” ATAC Funds, accessed Oct. 4, 2025, link.

Junk debt, also known as high-yield bonds or speculative-grade debt, refers to fixed-income securities issued by companies or governments with lower credit ratings, offering higher interest rates to compensate investors for the elevated risk of default.

The VIX index, often called the "fear gauge" of Wall Street, is a real-time market index that measures the market's expectation of 30-day forward-looking volatility derived from S&P 500 index options prices, serving as a key barometer of investor sentiment and market risk.

The ICE BofA BB US High Yield Index Option-Adjusted Spread measures the yield differential between BB-rated corporate bonds and a spot Treasury curve, quantifying the risk premium for below-investment-grade debt with a BB rating in the US market.

As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is new with a limited operating history. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund, and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV.

Because the Fund invests in Underlying ETFs an investor will indirectly bear the principal risks of the Underlying ETFs, including but not limited to, risks associated with investments in ETFs, equity securities, growth stocks, large and small capitalization companies, non-diversification, fixed income investments, derivatives and leverage. The prices of fixed income securities may be affected by changes in interest rates, the creditworthiness and financial strength of the issuer and other factors. An increase in prevailing interest rates typically causes the value of existing fixed income securities to fall and often has a greater impact on longer duration and/or higher quality fixed income securities. The Fund will bear its share of the fees and expenses of the underlying funds. Shareholders will pay higher expenses than would be the case if making direct investments in the underlying funds.

Because the Fund expects to change its exposure as frequently as each week based on short-term price performance information, (i) the Fund’s exposure may be affected by significant market movements at or near the end of such short-term periods that are not predictive of such asset’s performance for subsequent periods and (ii) changes to the Fund’s exposure may lag a significant change in an asset’s direction (up or down) if such changes first take effect at or near a weekend. Such lags between an asset’s performance and changes to the Fund’s exposure may result in significant underperformance relative to the broader equity or fixed income market. Because the Adviser determines the exposure for the Fund based on the price movements of gold and lumber, the Fund is exposed to the risk that such assets or their relative price movements fail to accurately predict future performance.

Past performance is no guarantee of future results.

The Fund’s investment objectives, risks, charges, expenses and other information are described in the statutory or summary prospectus, which must be read and considered carefully before investing. You may download the statutory or summary prospectus or obtain a hard copy by calling 855-ATACFUND or visiting www.atacfunds.com. Please read the Prospectuses carefully before you invest.

Investing involves risk including the possible loss of principal.

JOJO is distributed by Foreside Fund Services, LLC.

Learn more about $JOJO at https://atacfunds.com/jojo/ Lead-Lag Publishing, LLC is not an affiliate of Tidal/Toroso or ACA/Foreside.