JOJO: Worried About Market Whiplash? Here’s How To Take Advantage Of It

There Are No Gurus, Only Cycles

The bond market has been a wild place in 2025.

Guessing about where the Fed plans on taking interest rates has been one factor fueling some of the volatility. Then there’s the question of whether the U.S. economy is slowing enough to warrant real concern about a recession. Of course, the big fuel-soaked rag on the fire was Liberation Day, which added worries about spiraling inflation and crippling corporate costs to the equation.

All in all, it’s created an environment where conditions are changing repeatedly and no one bond asset class has led for too long. This has created a situation where volatility has taken over with little in the way of consistent returns for investors.

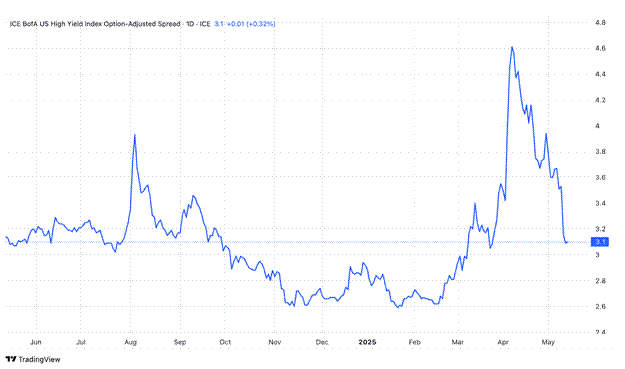

That dynamic is perhaps best demonstrated by high yield credit spreads over the past year.

Spreads, which are a measure of the amount of yield investors are demanding for a given level of risk taken, began moving higher ahead of Trump’s Liberation Day. Investors worried that rising import costs would damage the financial health of most companies and risk spiking inflation rates for consumers. Spreads spiked accordingly and peaked in early April at their highest level since mid-2023.

But then tariff fears started to peak. There were talks of trade deals and pauses on tariff implementations to allow for time to negotiate. The markets began to feel a little more optimistic that trade tensions could be more temporary than anything. This culminated in Trump’s announcement that the most aggressive tariffs on China would be suspended for 90 days.

All of this helped bring spreads nearly full circle in only around three months. Again, a lot of volatility just to get back to where we started.

In buy-and-hold strategies, that can be problematic. It can cause investors to panic when things swing a little too wildly for their liking and can result in them making emotional portfolio changes, ignoring their long-term plans. That’s where a lot of total return can be lost. Investors need to avoid falling victim to these behavioral biases.

That’s where risk rotation strategies can be vitally important. They can adjust risk levels based on specific signals tied to market risk. That way you’re accelerating when conditions look clear and hitting the brakes when there are storms on the horizon. It doesn’t guarantee that you won’t crash the car if it’s sunny or make it through fine during a storm. It can, however, tilt the odds in your favor.

The ATAC Credit Rotation ETF (JOJO) rotates between junk bonds and Treasuries, using the performance of the utilities sector relative to the S&P 500 as a trigger. When the traditionally more defensive utilities sector outperforms, it generally signals that risk-off conditions might be prevailing. In that case, the fund invests in Treasuries. The opposite is also true. When the S&P 500 outperforms, JOJO allocates to junk bonds.

This allows investors the opportunity to capture positive returns regardless of the market environment. Following the U.S.-China tariff pause, junk bonds outperformed and the speed of the trigger switching to risk-on in that event was critical to take advantage of that. But even if tariff tensions flare up again, JOJO creates a scenario where investors could benefit from the flight to safety trade if Treasuries begin to emerge.

Volatility doesn’t need to be feared. It can be taken advantage of. Fast moving markets, such as the one we’re in, can create whipsaws for investors. Risk rotation strategies may be able to manage some of that risk and deliver outsized returns at the same time.

Consider JOJO as part of your bond allocation strategy. Not because I developed the strategy and I’m the portfolio manager of the fund. Consider it because there are no gurus, only cycles. And the cycle may finally be here for it.

Michael A. Gayed, CFA

Junk debt, also known as high-yield bonds or speculative-grade debt, refers to fixed-income securities issued by companies or governments with lower credit ratings, offering higher interest rates to compensate investors for the elevated risk of default.

The VIX index, often called the "fear gauge" of Wall Street, is a real-time market index that measures the market's expectation of 30-day forward-looking volatility derived from S&P 500 index options prices, serving as a key barometer of investor sentiment and market risk.

The ICE BofA BB US High Yield Index Option-Adjusted Spread measures the yield differential between BB-rated corporate bonds and a spot Treasury curve, quantifying the risk premium for below-investment-grade debt with a BB rating in the US market.

As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is new with a limited operating history. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund, and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV.

Because the Fund invests in Underlying ETFs an investor will indirectly bear the principal risks of the Underlying ETFs, including but not limited to, risks associated with investments in ETFs, equity securities, growth stocks, large and small capitalization companies, non-diversification, fixed income investments, derivatives and leverage. The prices of fixed income securities may be affected by changes in interest rates, the creditworthiness and financial strength of the issuer and other factors. An increase in prevailing interest rates typically causes the value of existing fixed income securities to fall and often has a greater impact on longer duration and/or higher quality fixed income securities. The Fund will bear its share of the fees and expenses of the underlying funds. Shareholders will pay higher expenses than would be the case if making direct investments in the underlying funds.

Because the Fund expects to change its exposure as frequently as each week based on short-term price performance information, (i) the Fund’s exposure may be affected by significant market movements at or near the end of such short-term periods that are not predictive of such asset’s performance for subsequent periods and (ii) changes to the Fund’s exposure may lag a significant change in an asset’s direction (up or down) if such changes first take effect at or near a weekend. Such lags between an asset’s performance and changes to the Fund’s exposure may result in significant underperformance relative to the broader equity or fixed income market. Because the Adviser determines the exposure for the Fund based on the price movements of gold and lumber, the Fund is exposed to the risk that such assets or their relative price movements fail to accurately predict future performance.

Past performance is no guarantee of future results.

The Fund’s investment objectives, risks, charges, expenses and other information are described in the statutory or summary prospectus, which must be read and considered carefully before investing. You may download the statutory or summary prospectus or obtain a hard copy by calling 855-ATACFUND or visiting www.atacfunds.com. Please read the Prospectuses carefully before you invest.

Investing involves risk including the possible loss of principal.

JOJO is distributed by Foreside Fund Services, LLC.

Learn more about $JOJO at https://atacfunds.com/jojo/ Lead-Lag Publishing, LLC is not an affiliate of Tidal/Toroso or ACA/Foreside.