The Kurv Silver Enhanced Income ETF (KSLV) is a recently launched exchange-traded fund designed to provide investors with exposure to silver while generating monthly income. KSLV aims to outperform the price return of physical silver by combining silver-focused investments with income-producing strategies—a powerful proposition for income-oriented investors interested in precious metals.

Silver Exposure and Strategy

At least 80% of KSLV’s portfolio is dedicated to tracking silver’s price through exchange-traded products (ETPs), derivatives like options and futures, and physical silver held via a Cayman-based subsidiary.

Unlike most silver ETFs, which primarily hold only bullion, KSLV holds both ETFs and exchange-traded notes (ETNs) that are tied to the price of silver, in addition to forward contracts and options as vehicles for creating a synthetic exposure to silver. This frees up capital to be used for income generation strategies while still maintaining exposure to the commodity’s performance.

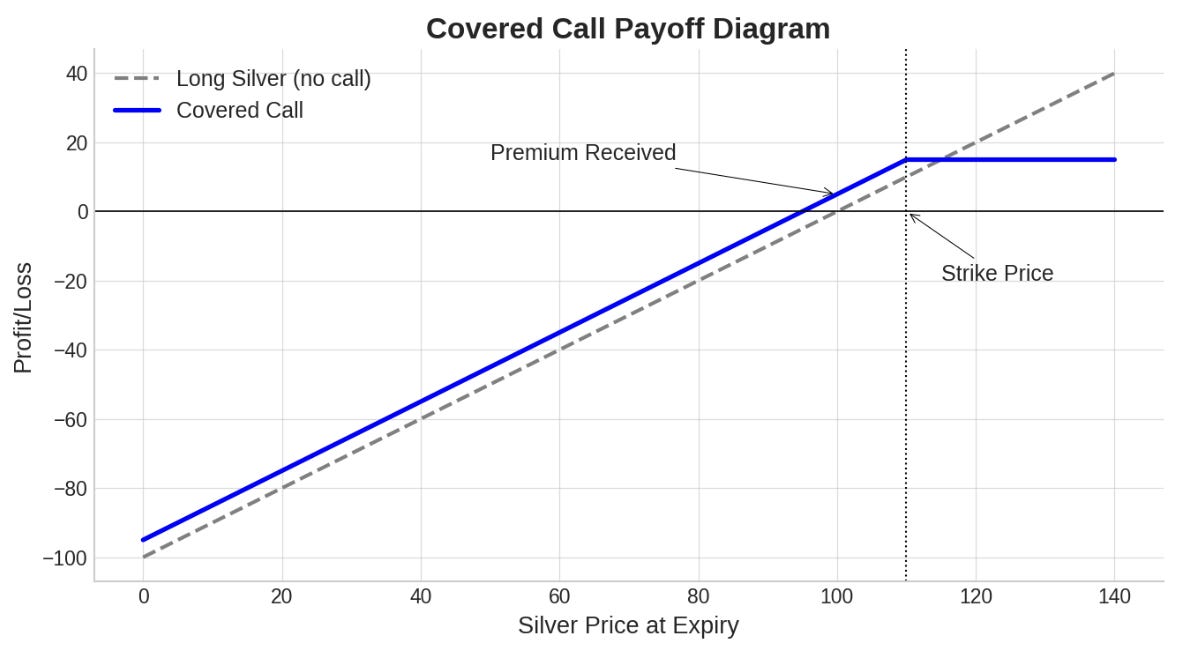

KSLV enhances return through options strategies, primarily writing covered calls. A covered call involves holding a long position in an asset (in this case, silver or silver ETPs) and selling call options on that asset to earn premiums. The trade-off is that upside potential is capped: if silver rises above the option’s strike price, KSLV forfeits some gains but retains the option premium as income. In flat or moderately rising silver markets, this strategy can outperform simply holding silver.

Income and Yield Potential

The fund aims to generate monthly income from two sources: premiums earned from selling options, and interest or dividends from fixed-income and preferred securities. This is a significant innovation for silver investing, as the metal itself offers no yield.

It is constructed to offer income-focused investors access to precious metals without sacrificing cash flow. The fund’s construction is well-suited for investors who think silver has upside but anticipate choppy or sideways price action in the near future — an environment where options tactics can prosper.

Why Silver Now?

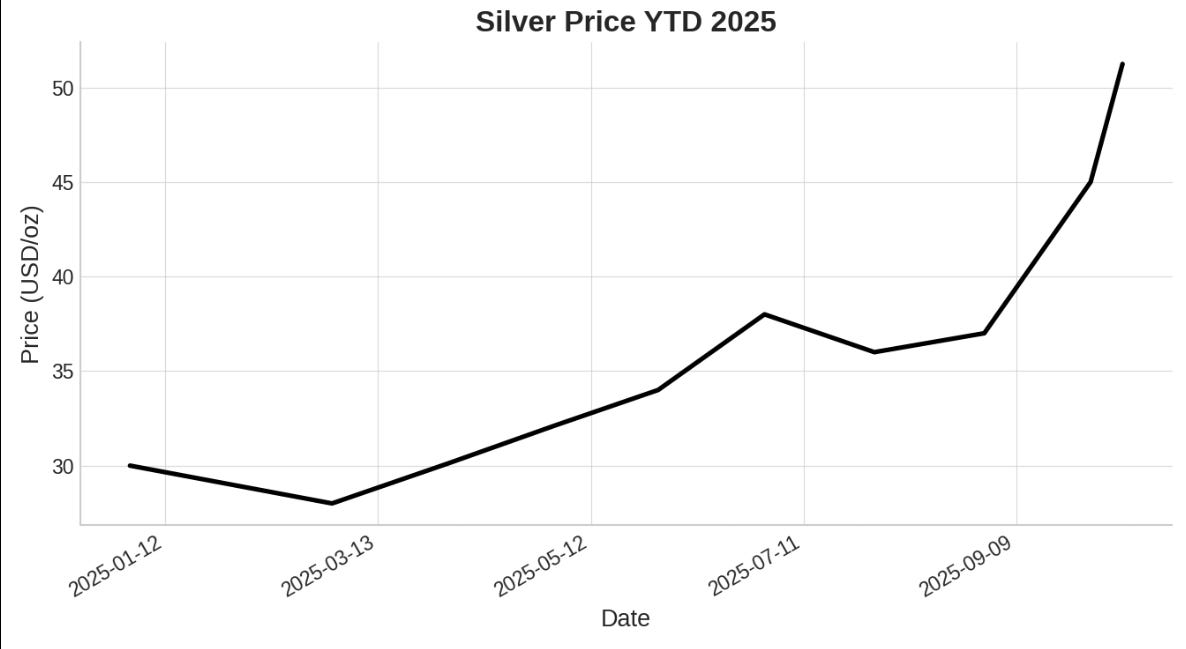

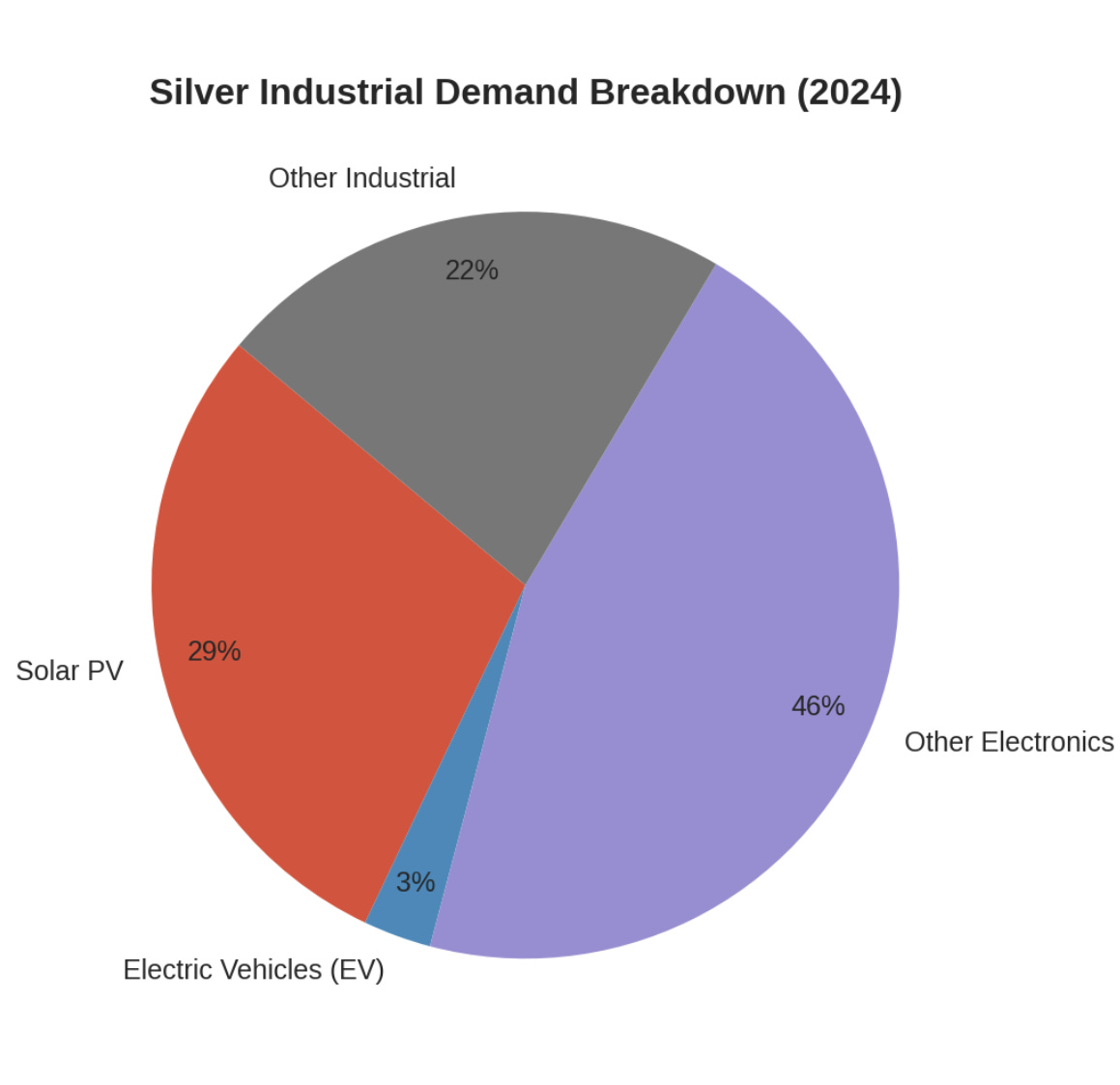

In 2025, silver prices surged to over $50/oz, driven by inflation concerns, geopolitical tensions, and a boom in industrial demand. Silver is widely used in solar panels, electric vehicles, and electronics, making it a critical material for the green economy.

The Silver Institute foresees increasing structural demand, particularly from clean energy uses. Physical supply of silver, however, has been tight with market deficits ensuing. These circumstances are all contributing to jolting prices higher, luring investor interest.