Every week, we’ll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

Convertibles are an interesting option for investors for several reasons. Their hybrid stock/bond structure can allow investors to potentially participate in gains in either asset class, but yields tend to be lower and they can be more volatile if viewed as a fixed income product.

Convertibles have served their purpose in 2025. They’ve been slightly above average as a fixed income product, but have demonstrated the ability to participate in some equity upside in the right conditions. In an environment where uncertainty seems to be king, a fund that has characteristics of both stocks & bonds can be valuable to manage the volatility.

The Calamos Convertible & High Income Fund (CHY) starts with a convertible core and uses other high yielding asset classes as satellite holdings. From a diversification standpoint, that’s a good thing and the evidence suggests that the managers have been able to mitigate portfolio risk using that. But the use of leverage is high and that could amplify downside risk, a particular concern considering where the economy might be headed.

Fund Background

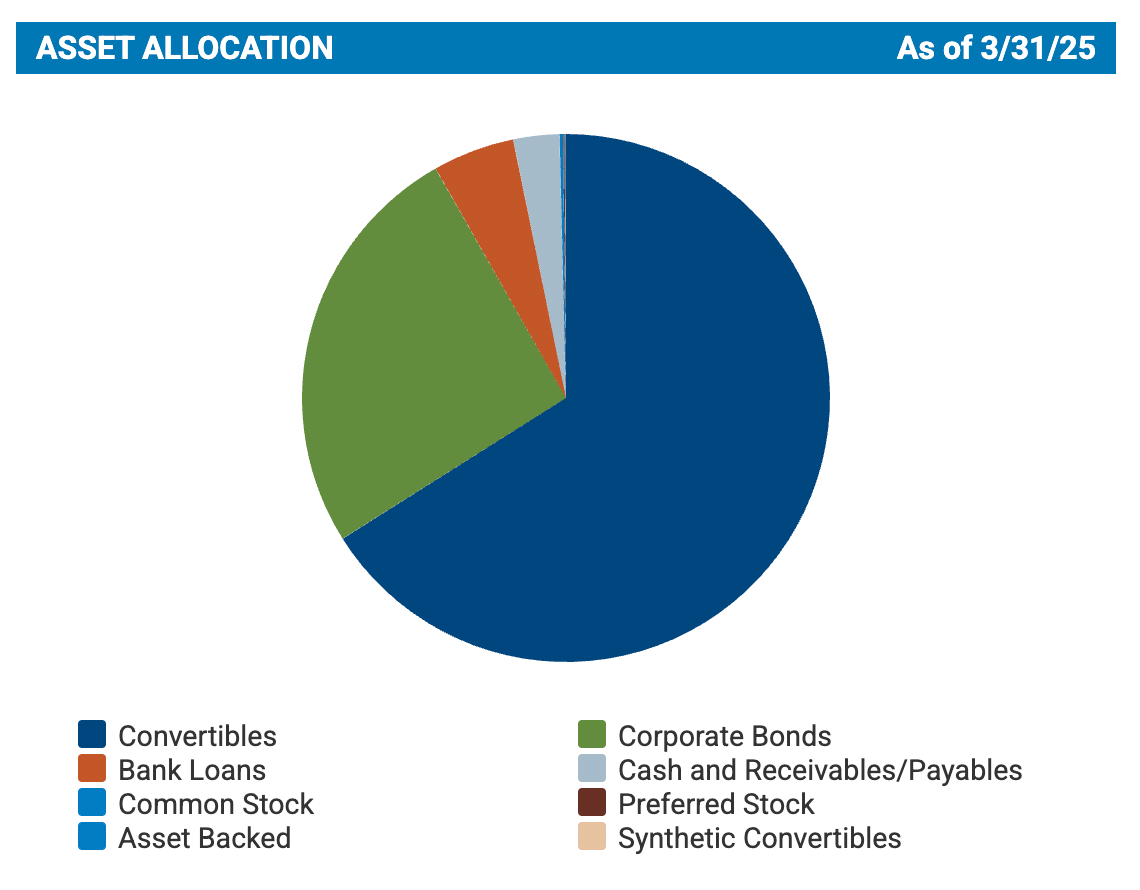

CHY’s primary objective is to seek total return through capital appreciation and current income by investing in a diversified portfolio of convertible securities and high-yield corporate bonds. The latter category could include traditional corporate bonds, senior loans or preferred securities. The fund also utilizes leverage in order to enhance yield and total return potential.

My immediate concern is that CHY currently has a nearly 40% leverage overlay. That’s really high and exposes shareholders to significant downside risk if conditions turn south (not to mention the cost of implementing that leverage right now). It helps push the yield into the double digits, which is probably the end goal, but total return could potentially be a problem shorter-term. The inclusion of senior loans and preferreds, however, could help balance out some of that risk.

Unfortunately, the allocation to senior loans and preferreds is minimal at best. About ⅔ of the portfolio is pure convertibles with most of the remainder going to corporate bonds. Convertibles will obviously be the driver of performance here, but there’s enough variety outside of that in the allocation that interest rate risk could become an issue.

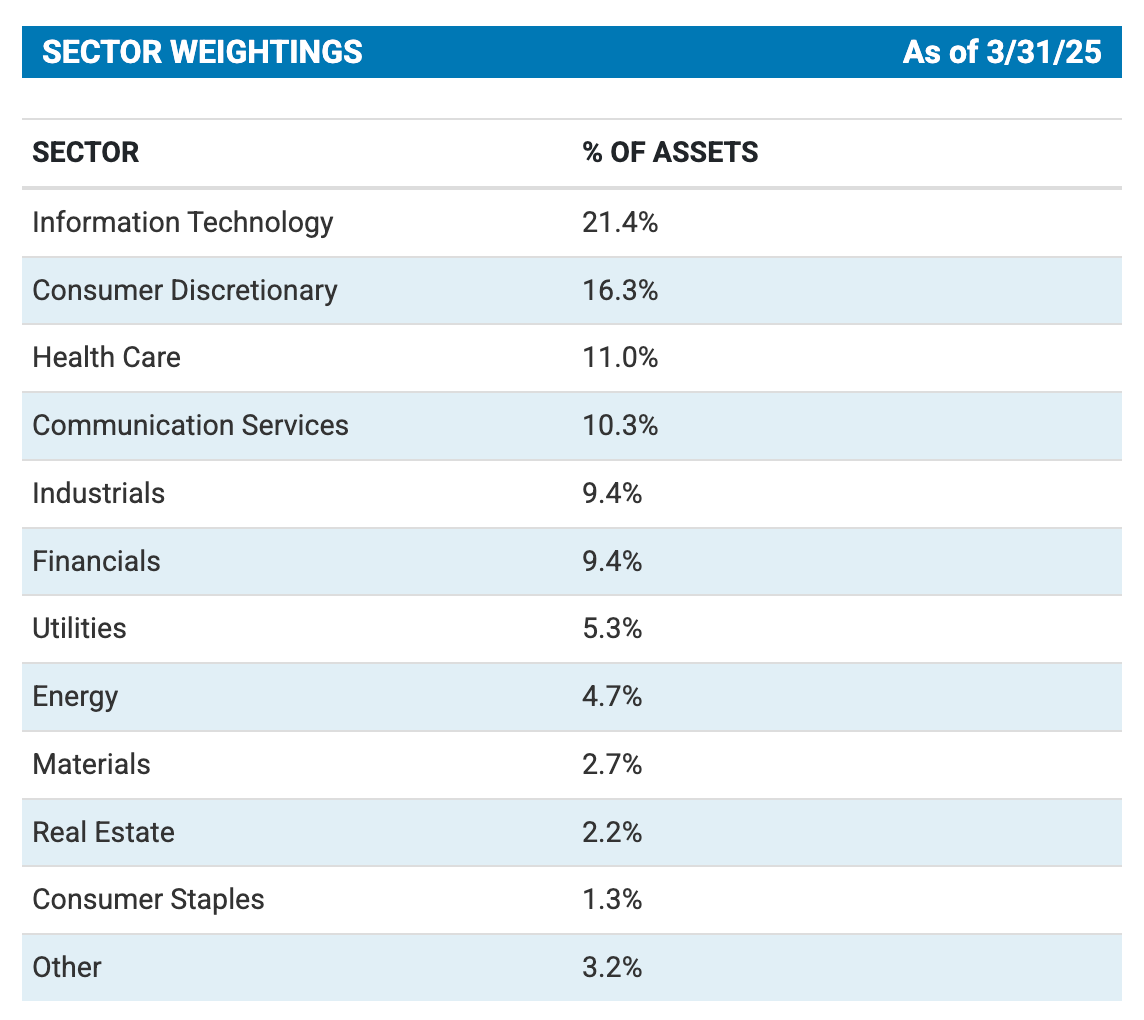

CHY has a sector allocation not all that dissimilar from that of the S&P 500, but there are some differences. It’s underweight tech & financials and overweight discretionary and some of the smaller sector allocations. Overall, it has more of a value lean sector-wise, but not so much that you have a meaningful deviation from the S&P 500.