Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: UTILITIES WAS RIGHT ON ALL ALONG

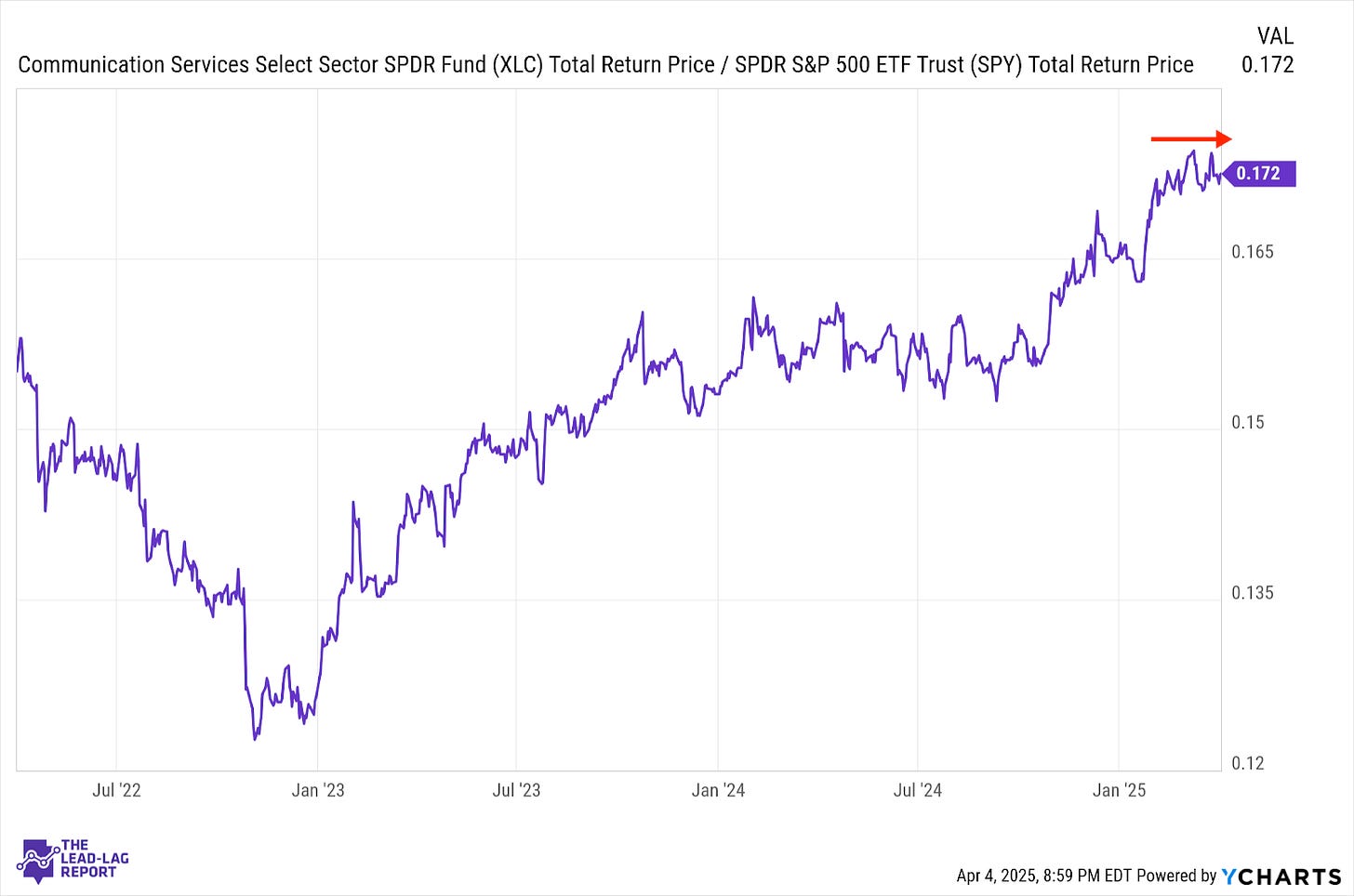

Communication Services (XLC) – Holding On, But Mag 7 Is An Anchor

Communication services stocks managed to hold serve overall thanks to the relatively better performance of the more defensive media and telecom names. The two big mag 7 positions, however, are both down around 30% from their peak, acting as an anchor, and that’s likely to continue with growth, tech and high beta continuing to lead on the way down.

Consumer Discretionary (XLY) – Uptrend Unlikely To Continue

Discretionary stocks are starting to outperform again even though this sector could seemingly get hit harder by the impact of tariffs. One possible explanation is that the futures market is now pricing in four cuts instead of two and looser monetary conditions tend to benefit sensitive sectors more. It feels unlikely that this trend could continue given how discretionary spending should, in theory, be among the first things to go if prices rise and inflation heats up.

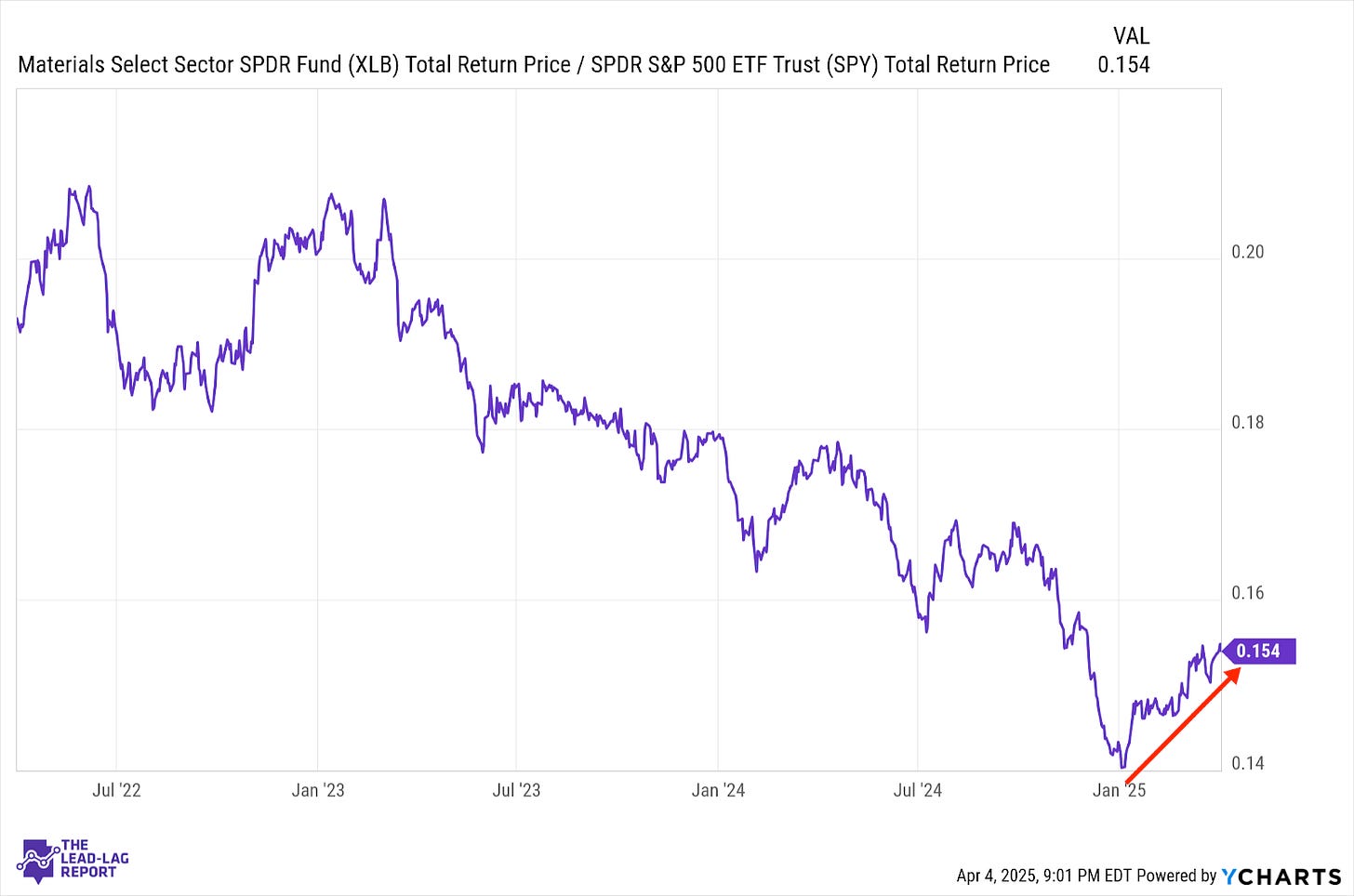

Materials (XLB) – Value Over Economics

Commodities are doing what they should be doing in this environment by providing some non-correlated diversification benefits. Even though the sector has become quite bifurcated with energy and metals doing particularly poorly, the value nature of this sector is helping to prop up the floor of what’s likely to be a very negatively tariff-impacted group.

Industrials (XLI) – OK For Now, But Tough Road Long-Term

Even though tariffs are likely to have a significantly negative impact on the global economy, industrial stocks are continuing to hold up relatively well here. The start and stop nature of tariffs by the Trump administration could mean that the market is pricing in a worst case scenario when one might not exist, but it’s tough to see this sector not taking a hit once the data starts rolling in.

Financials (XLF) – Loan Demand & Default Risks Are Troubling