Every week, we’ll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

On the surface, it seems like a smart strategy. If you’re worried that interest rates are going to rise (or you just don’t like the volatility in the bond market you’ve seen lately), it makes sense to take some duration risk off the table or pivot from longer-term bonds to shorter-term ones. In isolation, that seems logical, but investing in bonds is never about just one factor. Interest rate risk, credit quality and portfolio composition are all variables that one must consider.

In the case of the Eaton Vance Limited Duration Income Fund (EVV), there’s another issue to consider - leverage. EVV not only uses leverage, as do many closed-end funds, but it uses an incredibly high amount of it by comparison. The extra risk that investors may be avoiding via duration may actually be getting added back on and then some through the use of leverage. With recession on the horizon and a very uncertain geopolitical environment, risk management should be a primary concern.

Fund Background

EVV’s investment objective is to provide a high level of current income. The fund may, as a secondary objective, also seek capital appreciation to the extent consistent with its primary goal of high current income. EVV also uses leverage in order to enhance yield and total return potential.

In a fund with “limited duration” in its very name, I think the first consideration should be its duration profile. EVV’s profile indicates a current leverage-adjusted duration of 4.9 years, within the fund’s 0-5 year mandate. When measured against other high yield CEFs, that’s actually on the higher end of the range. In other words, “limited duration” may apply to the securities held within the portfolio, but the overall duration risk exposure with leverage included isn’t so limited duration after all. And that’s not even considering that the use of leverage is going to lift risk levels broadly.

Senior loans and generally floating rate and come with little if any duration risk, so we know that higher durations from the corporate/government bond sleeves are being used to create the overall profile. Senior loans actually present a fairly attractive yield/volatility profile, so there is an advantage to having roughly ⅓ of assets committed to this group, but there are risks being posed elsewhere in the allocation.

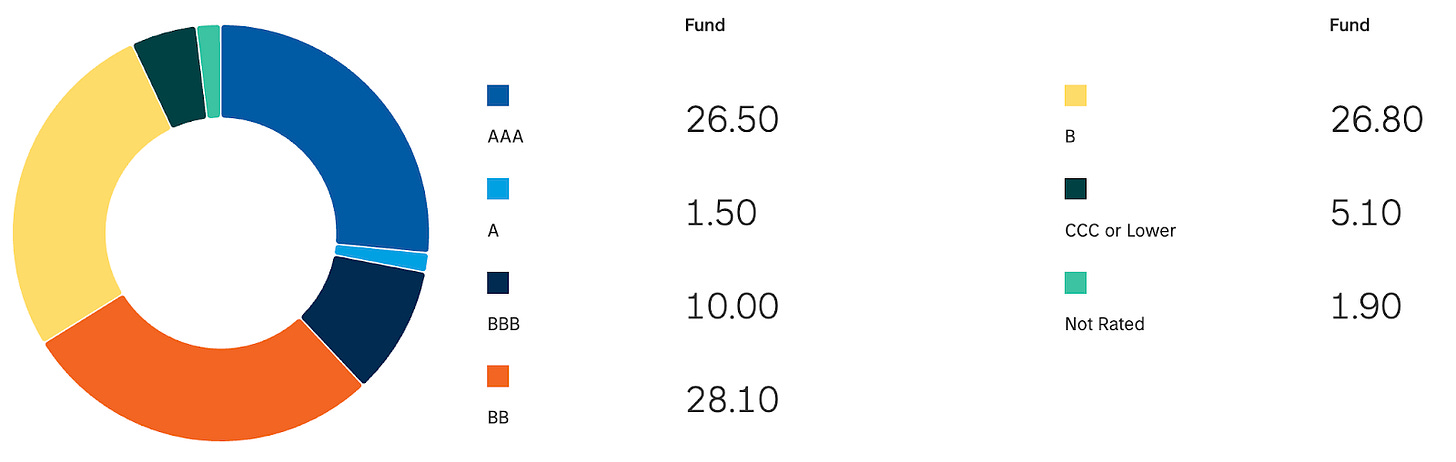

Overall, this is a relatively decent mix of credit qualities. The AAA-rated bucket is obviously the U.S. Treasury & mortgage-backed security holdings. The 10% allocation to BBB-rated securities is a bit unusual in that most fixed income funds choose to focus solely on the non-investment grade bucket. The BB-rated and B-rated holdings are largely to be expected, but the lack of major exposure to the CCC-rated and below category is a plus.

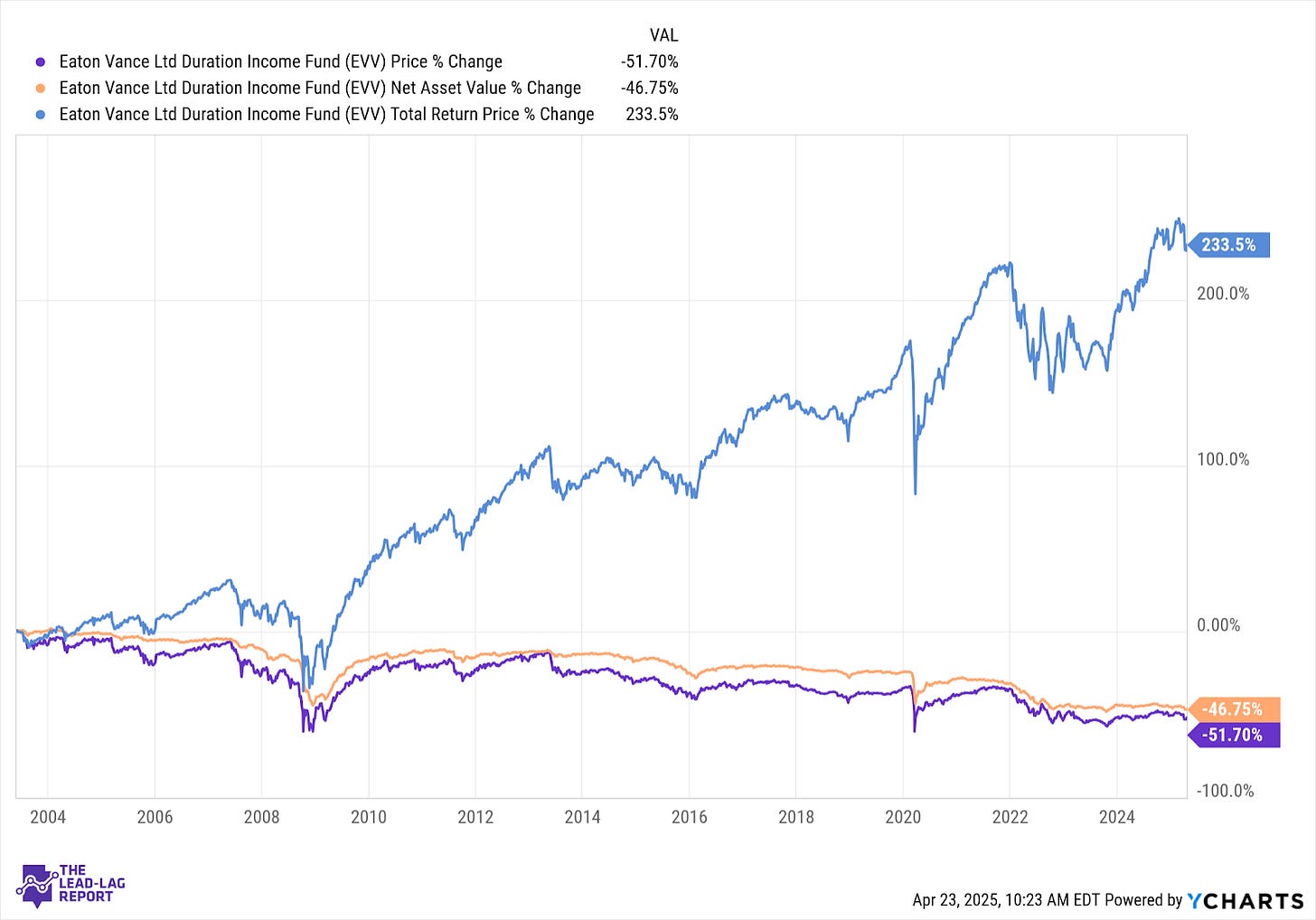

Since its inception in May 2003, BDJ has generated a total return of 233%. That translates to an average annual return of around 5.6%.