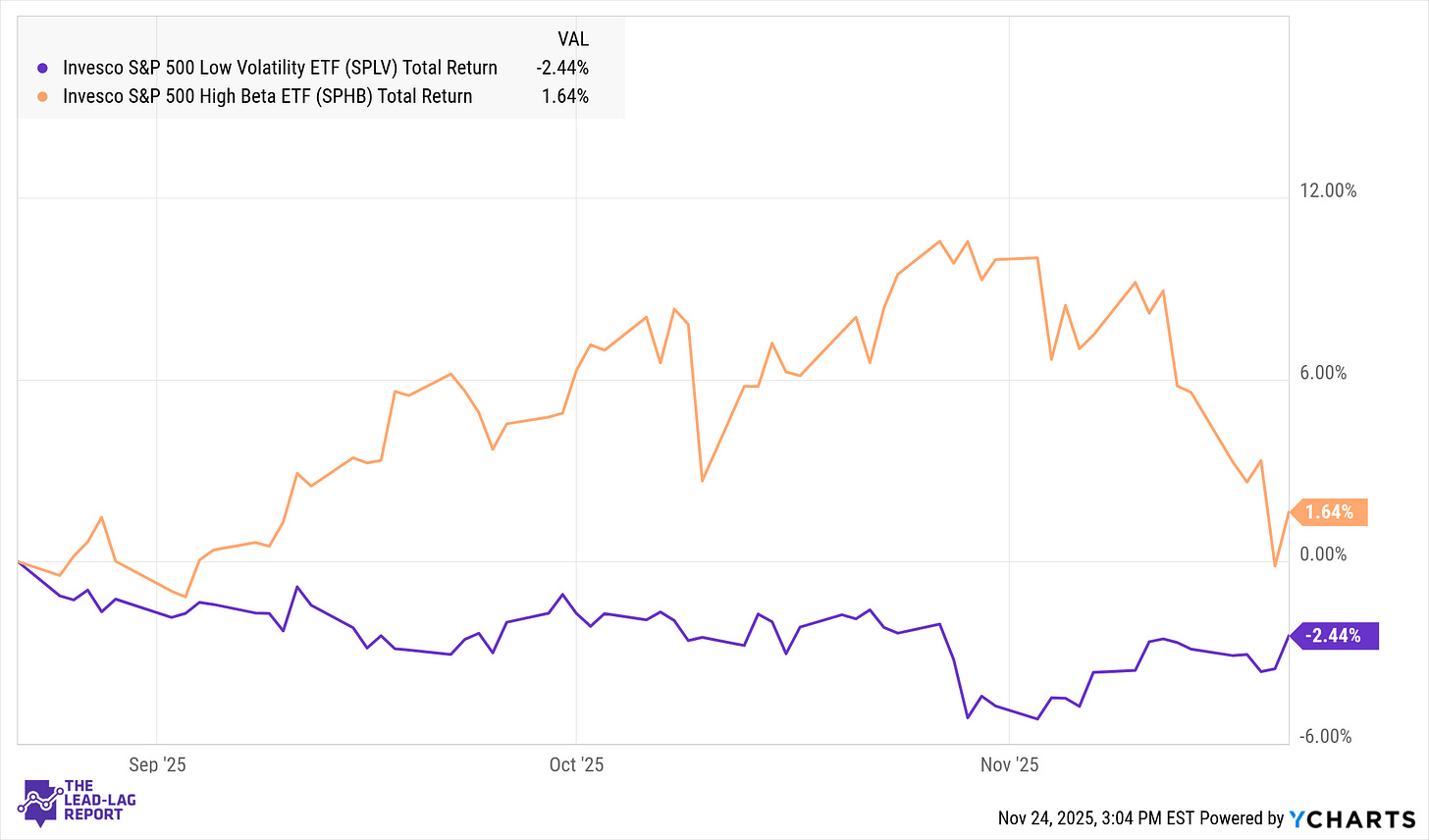

The market has spent most of 2025 celebrating its loudest winners — Big Tech, high-beta favorites, and the speculative trades that dominated the narrative. Yet beneath that noise, a quieter story is unfolding. Low-volatility stocks, ignored for much of the year, have begun to outperform. The shift is subtle, easy to overlook, and exactly the sort of early rotation that often hints at a deeper change in market character.

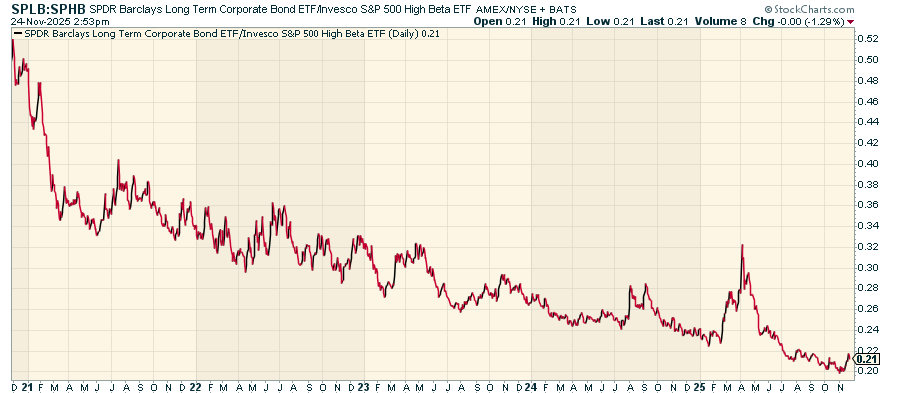

The SPLV:SPHB ratio — which compares low-volatility stocks (SPLV) with high-beta stocks (SPHB) — just bounced off a decade low and has turned higher. Historically, that kind of inflection has often marked the beginning of a rotation toward caution, even while headline indices continue rallying.

A Barometer for Risk Appetite

The logic behind this ratio is straightforward. SPHB represents the 100 most volatile stocks in the S&P 500 — the companies that swing the most on both upside and downside. SPLV holds the 100 least volatile stocks — utilities, staples, and other steady operators. When SPLV outperforms, investors are gravitating toward safety; when SPHB leads, the market is embracing risk.

For several years, the ratio pointed clearly toward aggressive sentiment. After a brief defensive surge during the 2020 pandemic shock, high-beta stocks dominated the recovery. Ample liquidity, stimulus, and a preference for growth pushed investors toward the riskiest parts of the market, and the SPLV:SPHB ratio drifted steadily lower.¹

High-beta names widened the performance gap across multiple periods, sending the ratio to its lowest level in roughly a decade.² That dominance created a long trend — one now showing early signs of reversing.

The First Break in the Trend

After years of pressure, the SPLV:SPHB ratio has begun to move higher. Low-volatility stocks have quietly outperformed, marking the first meaningful break in the multi-year downtrend.

The rotation has appeared across sector behavior as well. Capital has been drifting toward value, defensives, and lower-beta stocks. Some of the market’s most crowded high-beta positions — particularly among megacaps — have lost momentum. While the move isn’t dramatic, it has been persistent enough to suggest that investors may be becoming more selective and less willing to chase risk.

These transitions rarely begin with fireworks. They often start with a small but steady shift — low-volatility stocks outperforming on up days, defensive sectors rising while growth cools. These quiet turns frequently mark the early stages of a maturing cycle.

A Defensive Tone Beneath Strong Headlines

Even as the S&P 500 pushes to new highs, the market’s internals express growing caution. Research from October highlighted a “quiet rotation” into defensive areas while the index advanced.³ Utilities, healthcare, and consumer staples — sectors that had not meaningfully led since 2022 — suddenly became relative outperformers. Historically, these sector shifts carry weight.

Several forces contributed to this pivot. Valuations in high-beta areas stretched after months of strong performance. Economic data exposed uneven momentum beneath the surface. Credit pockets softened. And throughout early 2025, defensives repeatedly outperformed cyclicals whenever uncertainty re-emerged.⁴

Even in sectors fueling the year’s excitement — including AI — traders quietly trimmed winners and redistributed toward steadier holdings. When the market’s leaders falter despite strength in the index, it usually indicates that institutional money is preparing for a different environment.

Why Defensive Leadership Matters

Defensive leadership doesn’t guarantee a correction, yet history suggests it should not be dismissed. Utilities — a significant component of low-volatility strategies — have long functioned as an early warning indicator. When utility stocks begin outperforming broadly, higher volatility has often followed.⁵